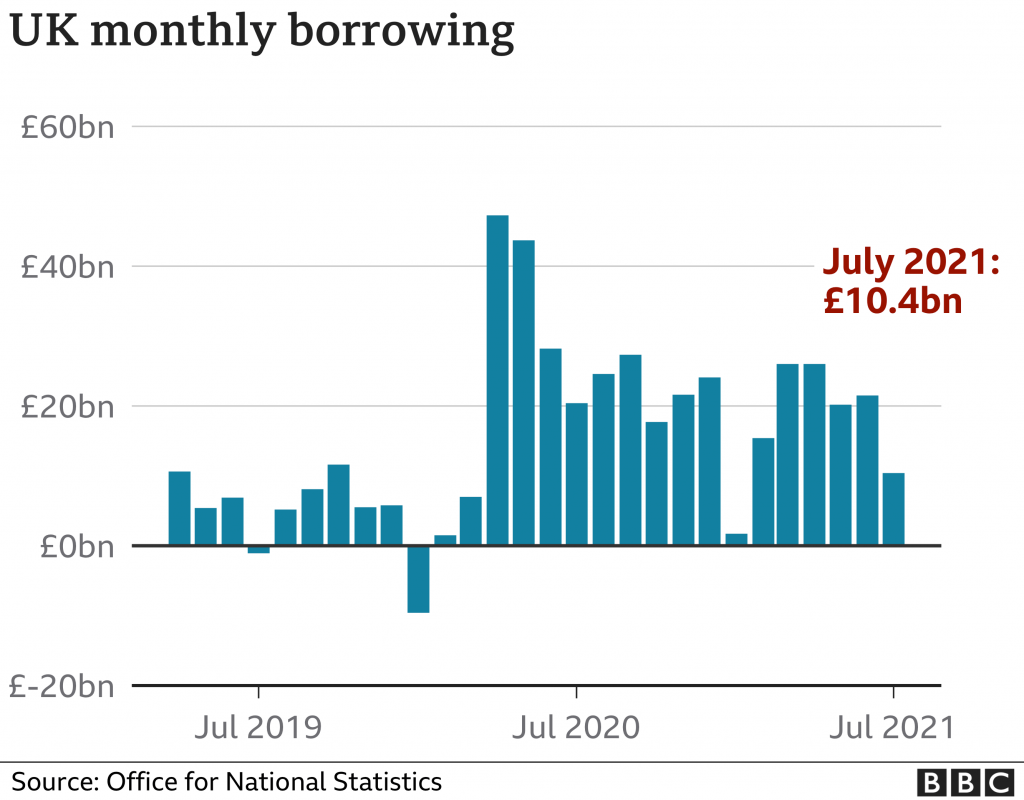

“Government borrowing shrinks in July,” reads today’s headlines – but the figure is still the second-highest for July since records began. Borrowing over the past year of lockdowns has pushed the national debt up to more than £2.2 trillion (about 98.8% of GDP).

BBC News has the story.

Borrowing – the difference between spending and tax income – was £10.4 billion, official figures show, which was £10.1 billion lower than July last year.

However, the figure was the second-highest for July since records began.

Borrowing has been hitting record levels, with billions being spent on measures such as furlough payments. …

The Office for National Statistics (ONS) now estimates that the Government borrowed a total of £298 billion in the financial year to March.

That amounted to 14.2% of GDP, the highest level since the end of World War Two.

The ONS said the cost of measures to support individuals and businesses during the pandemic meant that day-to-day spending by the Government rose by £204.3 billion to £942.7 billion last year.

Interest payments on central Government debt were £3.4 billion in July.

That was £1.1 billion more than in July 2020, but far lower than the monthly record of £8.7 billion in June 2021.

Worth reading in full.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.