Government borrowing came in lower than estimated in May, but there is little else in the state of the country’s economy to be cheery about. Following more than a year of lockdowns and heavy borrowing, the national debt stands at £2.2 trillion and a former Chancellor has warned there is a big risk of inflation spiralling out of control. The MailOnline has the story.

The Government was in the red by £24.3 billion last month, down from £43.8 billion a year earlier at the height of the pandemic – and crucially below the Office for Budget Responsibility’s forecasts.

However, the figure was still the second highest on record for the month and £18.9 billion more than in May 2019 before the pandemic struck, while national debt now stands at a staggering £2.2 trillion.

The grim fiscal backdrop was highlighted as former Chancellor Ken Clarke warned that there is a “big risk” of inflation running out of control – and urged Mr Sunak to raise more revenue now to make the Government less vulnerable to a resulting spike in interest payments.

Responding to the figures, Mr Sunak reiterated his pledge to “get the public finances on a sustainable footing”.

“That’s why at the Budget in March I set out the difficult but necessary steps we are taking to keep debt under control in the years to come,” he added.

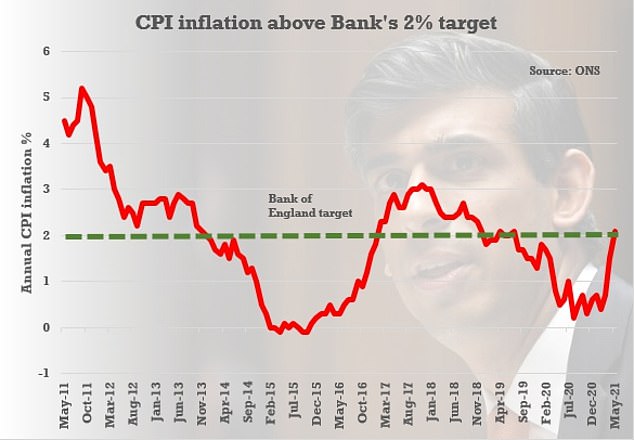

Concerns over the rebounding economy overheating and causing an inflation spike have been intensifying after the headline rate surged ahead of expectations to hit 2.1% last month.

In the U.S. it is also at worryingly high levels, as Joe Biden pours money into stimulating the economy.

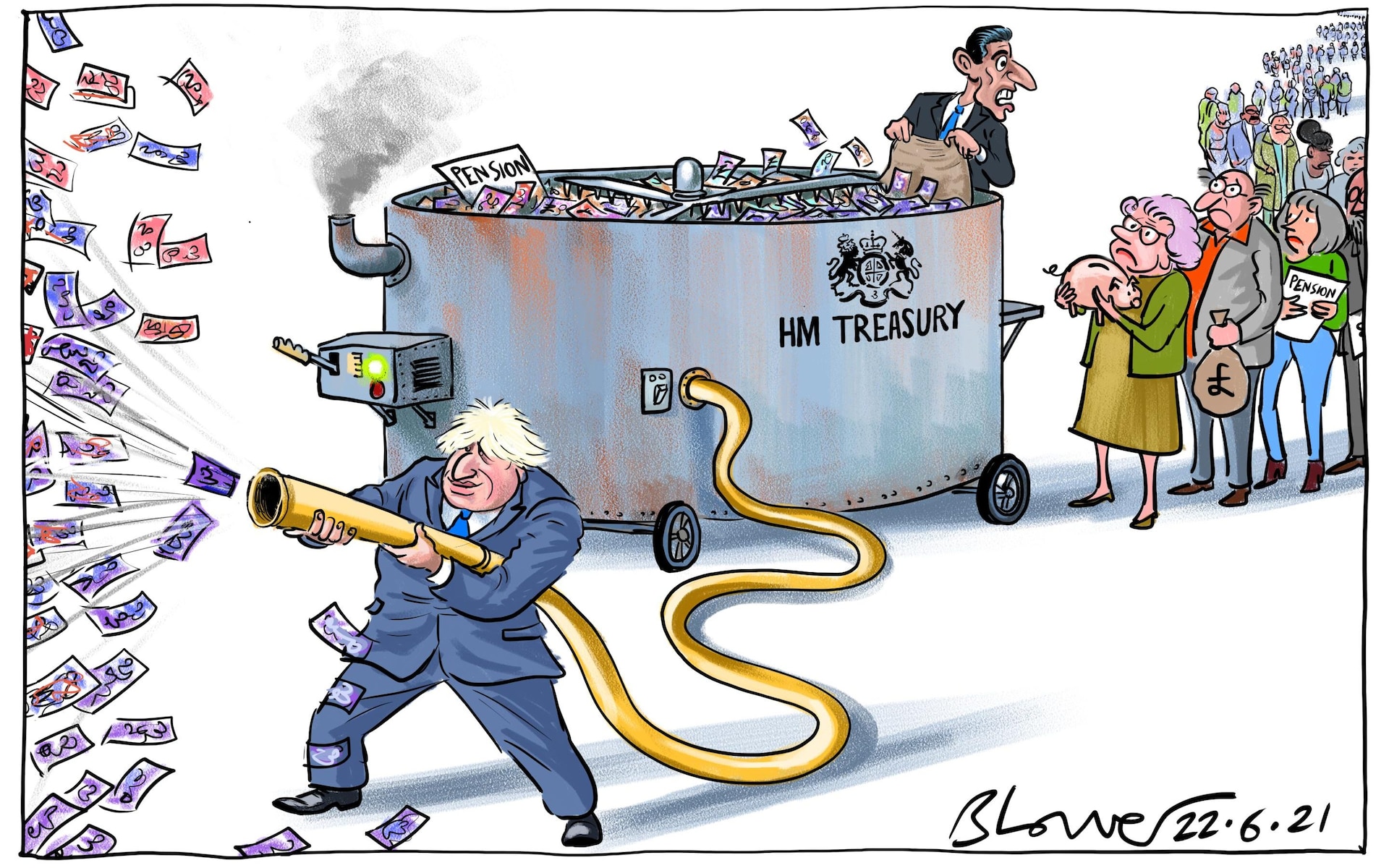

Mr Sunak has been wrestling with Boris Johnson over how to fund ambitious “levelling up” spending commitments and a new social care plan.

Downing Street has insisted that the “triple lock” on the state pension will stay in place, even though the warping effects of furlough could mean it rises by 6% this year.

Number 10 also says the manifesto commitment not to raise income tax, national insurance or VAT in this parliament stands – even though the respected IFS think-tank says that makes it “extremely difficult” for the Chancellor to find ways of raising money.

Worth reading in full.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Inflation doesn’t matter when your plan is to abolish money

and kill a few million people.

“Conservatives” still standing around whistling and pretending that the bomb they threw up into the air will never return to earth.

Mark, are you the old Mark of the original Mark-name fame? Why don’t you come join us on the reddit group?

I am the old Mark.

Always been a little wary of Reddit (as a platform), tbh.

I’ve always enjoyed your comments. (Everyone’s really!) I didn’t think you’d migrated because you have a rather distinct style and I didn’t see it.

reddit is a woke, groupthink cesspool of trolls and bots and you are right to be wary. But we have made ourselves a sanctuary there that’s really just folks from here on a new message board. Who knows how long we will be allowed there, but while we are, it’s been wonderful.

What is the name of this Reddit group, I have only ever found a Dutch anti-lockdown /r ….. all in Dutch ?

https://www.reddit.com/r/LockdownSceptics/

Bit of a tricky site to find your way around – look for today’s comments and Mabel Cow is a moderator, so if you see her name you’ll know it’s the right place. Perhaps better on a ‘table top’ computer rather than a mobile phone (?).

Public borrowing is fantastic news for the private global banking elite who make the rules and control our ‘democratically’ elected governments.

An endless gift from the taxpayer for generations to come.

All hail corporate fascism.

No problem. Big pharma will pay. No one else will have any money.

I started investing in November 2019, all time highs leading into a ‘pandemic’, it’s been a soul destroying ride. Finally back above water, believe inflation will be a big problem, not really sure what to do with my ISA… Stay in companies with pricing power, go to cash and wait, gold, pull it out build a camper and bugger off!?

Ride it out, keep investing, buy cheap when the inevitable correction materialises.

Dollar cost averaging and the compound investment rate will see you through good times and bad.

It’s time in the market that makes you money, not timing.

Equity income funds generally do well in the long-term regardless of the state of the economy. Since they invest in larger more stable (in theory) companies which earn cash and pay dividends.

But don’t invest what you can’t afford to lose. Investments may rise or fall in value. You may not get back what you invested. This does not constitute financial advice. If any doubt please consult an independent financial advisor. You won’t necessarily get a better outcome but it’s someone to blame if things go wrong.

This isn’t always true anymore. Stocks are going up on fresh air and low volume at the mo- there’s little fundamental basis for lots of it and the tech sector looks way overvalued. The US stock market is currently valued at around 200% of GDP, whereas back in ’08 it was around 60%- this can’t continue indefinitely. How many more subscribers can the likes of Netflix gain for example. We’ve been here before- people were saying similar things in 99/2000, then the bubble burst and the FTSE took almost 20 years to get back to where it was on New Year’s Eve 1999.

Why is Ken Clarke’s remedy to increase taxes when the obvious solution is to cut spending to a more sustainable level.

Scraping the furlough scheme and the constant testing / moonshot would go some way to improving things.

.

…

I think the triple lock should go – to be honest, I wouldn’t be sad to see the demise of the state pension (obviously in some means tested way – i.e. doesn’t go to anyone who has a private pot over x amount) to trade off the inevitable higher taxes levelled on my generation and demographic. If as expected the retirement age keeps going up the chances of me receiving any are looking slimmer and slimmer. I’ve given up enough to fund this bloody nonsense.

I’m 72 and always have thought that the triple lock was unfair but assumed that it was the tories looking after us oldies who are more likely to vote Conservative, not me, I add.

No shit! Anyone who didn’t see this over a year ago wasn’t paying attention….

This gave me some hope this morning –

DR. PETER MCCULLOUGH ON WITH REINER FUELMICH JUNE 11, 2021

https://www.bitchute.com/video/rKP61hruGxIt/

I remember thinking last year that if this is still going on by St Swithin’s day we’ll get worse than 40 days of rain. And here we are with them continuing this shambles beyond the next St Swithin’s day. We can be sure that changes will be coming, and likely some quite disastrous developments. And then they’re going to continue with hs2 because we’re not racking up enough debt from furlough etc. Utter madness. And to think people voted for the pm for economic reasons!

I’m very interested to see how Wishy Washy plans to reduce the debt from the money printing when there are less tax receipts coming in. Many small businesses, that is those who pay UK corporation tax and UK rates wishy, have been destroyed.

Is he going to make FB and Amazon pay more in tax? Good luck.

How is he going to square Net Zero costs that taxpayers will face to pay for the subsidies for bird chopping wind turbines in the North Sea and solar panels made at zero cost in concentration camps in Uighur region of China.

Does he or those technocrats in Whitehall know us commoners pay utility bills? I see its not included in the ONS CPI inflation web garble.

Speaking to friends in America where they have printed 25% of all the physical money supply within the last 12 months. Quarter of US are now “earning” more than wen they had a job. What’s holding the inflation running up, so far, I reckon is the velocity of money is low. People are buying online and not on the high street. So Bezos just gets it. Not the butcher, then the grocery store and so on.

“I’m very interested to see how Wishy Washy plans to reduce the debt from the money printing when there are less tax receipts coming in.”

Very simple. Sterling Debt is somebody’s Sterling savings. You have less tax coming in because unsurprisingly ‘not spending’ stops tax being raised.

When people finally decide to spend those savings then that ‘increases spending’, which ‘increases taxes’ by precisely the same amount. (My spending is your income less tax, your spending is my income less tax. Add that up and you’ll find that all spending ends up as tax eventually).

So in aggregate the ‘debt’ is actually a store of taxation that will precisely pay off that ‘debt’ once whoever holds the matching ‘savings’ spends them to destruction.

And that works for any positive tax rate.

In other words, stop worrying and trust in the accounting. It always all sums to zero and they don’t use Sterling anywhere else.

I didnt think there could be someone more out of touch with the real world via spreadsheets than a COVID modeller, MMT faith managers that.

I’m very in touch with the real world.

If you want to explain precisely where what I say is incorrect, then please do so.

Otherwise it is not me that has a faith problem.

Plus they’ll get you in the end no matter what you do- tax on earning, spending, saving, pensions going in, pensions paid out, driving, eating, drinking, housing, then they’ll take your assets to pay for your care and then when you die if there’s enough left there’s Inheritance tax. What wonderful way to encourage enterprise!

I uded to read the late great Christopher Booker on wind turbines, I don’t know how far the economics pf it have changed since then, however, i rather suspect that when the crunch comes, we’ll end up grubbing about for any coal we can find, same as has happened in the Ukraine.

Most of the world’s central banks are desperate for a bit of inflation to inflate away all the debts. They have been trying to engineer some for years. With plenty of success in physical assets, but now it is spreading into the wider economy.

Inflation, for those who still remember it, is a disaster for those on low and middle incomes with no assets and for those on fixed incomes like pensioners. But of course the elites are largely untouched by it.

“Inflation, for those who still remember it, is a disaster for those on low and middle incomes with no assets and for those on fixed incomes like pensioners.”

That isn’t the case is it. Inflation – in economic terms – just means that wages and prices rise in lockstep. Otherwise it isn’t an inflation – it’s a reallocation of resources via the price mechanism, which what we are currently going through. Things that were excessively cheap due to cheap immigrant labour are being repriced to their correct levels. Prices are rising to encourage investment, employment and increase in supply.

Capitalism is doing its job.

In an actual inflation wages rise, profits rise and state pensions rise. People’s mortgages shrink. Only those who are debt owners get left behind – and they are called ‘bankers’.

That only works as long as wages keep up with prices.

Look to what happened in Weimar Germany, Zimbabwe, Argentina, to see what happens with hyperinflation.

It wipes out savings, people’s wealth is destroyed.

“Following more than a year of lockdowns and heavy borrowing, the national debt stands at £2.2 trillion and a former Chancellor has warned there is a big risk of inflation spiralling out of control. ”

The national debt is in Gilts, which means there are £2.2 trillion of Gilts held as savings somewhere. Whose savings would you like to confiscate to eliminate them?

I’d suggest we start with those who complain about it. That way they may learn how the accountancy works. If you want savings, then you have an equal amount of debt – as a matter of accounting.

If you have a hot tub and you turn the pump on higher, would you expect the water to run out?

“Whose savings would you like to confiscate to eliminate them?”

If I were inclined towards revolutionary justice:

I’d start with every member of Parliament who has not voted against every stage of this nonsense

I’d proceed to every newspaper and media owner, editor, journalist and opiner who has promoted it

I’d carry on with every policeman and court official who has enabled and protected it

I’d finish by confiscatory nationalisation and resale of all the pharma and big tech companies involved, with heavy regulation to break them up and prevent big corporate accumulations.

We addressed the worst excesses of big state socialism in the 1980s, and although we missed a lot we did deal with some of it. Now we need to deal with the rest, along with the globalist corporate problem that was always present but has grown beyond all reason in the past few decades.

I’m not inclined towards revolution, but we need societies that control both state power and big corporate power, that actively protect and promote the heart of any civilisation – the small businesses and families, independent schools and doctors and churches and charities, alongside the workers, that foster strength and independence of mind and spirit.

Small state, small business, conservative nation states should be the goal. That’s what we’ve been crushing out of our societies for the past century and more, and we are paying the price for it, moving inexorably towards the unified world nanny society, whether mediated by gigantic bureaucracies or gigantic corporations or a mix of both, that will be the fabled boot stamping on a human face forever, with nowhere outside to provide an alternative example or to escape to, and nowhere to hide.

Can you think of any examples of such nation states, from history? Would you consider the US one of those, at least in its early years?

Yes, up to a point. As with other such theoretical ideals, in reality it’s about emphasis, not any completely ideal society. The UK was in much better balance in the late C19th/early C20th, but the world wars kiboshed that and ensured the long triumph of socialism.

You could see most modern countries, once the church declined, as a shifting mix of these broad forces, state, big business, small enterprises, family, and labour.

I don’t follow – if you have savings why must you have an equal amount of debt? I have savings in the bank but do not hold an amount of debt equal to those savings. When I add to those savings I don’t then take on an equal amount of debt. What you are saying makes no sense.

“I have savings in the bank but do not hold an amount of debt equal to those savings.”

Are you in credit at the bank? “Credit” is the accounting term for “debt”. The bank owes you – therefore the bank owes a liability to you of the amount of your savings. It accounts for that in its own books as a debt.

Similarly if you own a Gilt which is your saving, then HM Treasury owes a debt to you. That ‘national debt’ is your savings. To eliminate the ‘national debt’, your saving has to be eliminated too – because they are one and the same thing.

Your black ink is their red ink. In accounting everything has to sum to zero.

It all makes perfect sense once you understand the accounting.

yep. And once they create a new money system they will push all their inflated assets there and leave their liabilities in the old system, using COVID as an excuse to write it all down. This is the start of a major change of control and in my opinion an attempt to create a new world reserve currency. The biggest wealth transfer from the middle class to public-private corporations is happening right before our very eyes.

First you crash the economy with a fake pandemic, declaring all those businesses that are not in their camp as non-essential. Then you offer these poor folk a “lifeline” through subsidies. Recipients of subsidies will have to do what they’re told (this includes entire developing nations who rely on the dollar as their reserve ccy as they receive billions in IMF “aid”). Meanwhile, insiders receive stimulus and cheap central bank money to buy up everyone else’s assets as they struggle to pay their debt (land, real estate, businesses). You create permanent debt entrapment (a bit like the EURO and Greece.)

Correct.

The Lucan chap is possibly a 77 brigade idiot and best ignored.

What is a 77 Brigade idiot? I’ve never heard of this.

I got this from Laura Dodsworth’s book, State of Fear:

“The 77th Brigade is an army unit which combines former media operations and psychological operations, specialising in ‘non-lethal’ forms of psychological warfare. It works with social media companies to counter disinformation. Would you believe that Twitter’s head of Editorial in Europe, the Middle East, and Africa also served as a part time officer for the 77th Brigade and the Ministry of Defence would not reveal his current rank when asked by Middle East Eye?”

I highly recommend the book, goes into all the other shady governmental groups that are waging war with us online.

I have been saying to people for many years that this is why I dont pay any more money into my pension than is necessary. Of course I didnt predict COVID but its clear the financial system is unsustainable and it is only a matter of time before private pensions are raided. Yes there are tax benefits to putting money into your pension but it means nothing if you cant touch your money anyway. Scumbags

Private pensions were raided years ago by Gordon Brown- the tax benefits are nothing compared to what they were before he got his paws on them. Don’t forget- he also sold off our gold AND announced his intention to do so! Public Sector pensions are just tickety boo and are paid for by private enterprise- there is no other source of funding for them. Also, as more and more members of my family are finding out, providing for your old age is largely counter productive, since the benefits system punishes you, (and your spouse after you croak), and rewards the feckless with pension credits, Attendance Allowance, help with rent, care costs- you name it. It really is pointless unless you’re mega-rich- if you own a property they’ll come for it, if you live in a council house/ flat and don’t have a pension they’ll throw money at you.

Oh dear, not all people who wind up with just a state pension are actually ‘feckless’. There is no money being ‘thrown’ at those less fortunate for whatever reason….there may be some of working age who indeed see living on benefits as a way of life but I would suggest they are in the minority. If you have been fortunate throughout your life to be able to contribute to a private pension and now own your own home, then instead of pointing the finger at others just be glad you are able to fund your life going forward without having to go through the degrading process of asking for help with such things as rent because you literally have no choice……

True, not all are. Please know that I give a significant amount of my income to charities and when in town I buy food and drinks for homeless people and always encourage my children to do the same, (my son has actually convinced his cousin to do the same), so I am no heartless monster, but sadly there are plenty that are feckless in my experience and I am tired of being taxed on everything and anything to pay for it. Incidentally, I don’t have a private pension- I’m still working and intend to be until I drop. As for working age people who see living on benefits as a way of life being in the minority, I’m afraid not. Where I live they easily equal or outnumber those who work full time. Some of it may not be out of choice, but a lot is and not one of them thinks there’s anything wrong with lockdowns- why would they? Sorry if I sound bitter and angry but I am- my wife’s firm can’t get staff either full or part time, and yet at the same time the local food bank talks of ‘bone crushing’ poverty. Show me one of these people that doesn’t have a decent smart phone or flat screen TV, yet they can’t afford bread and soap? Yes, I’ve been fortunate and I count my blessings every day- but no one has given me anything- I start work at 4am so I can look after my son and then work in the evenings. I’ve worked in bars or cleaned houses and offices at weekends. The same opportunities are there for everyone, but some would sooner find an excuse not to take them.

File under: Duh!

The blessed Biden is saving America by printing money and spraying it around. That will debase the dollar which will, in turn, affect the pound. Our own twerps are throwing petrol on the yankee fire.

This was entirely predictable as is the damage coming our way from the mad decarbonising hysteria.

I am guessing this is one of the main reasons they can’t end furlough as it will result in stagflation.

As a student I always thought this was named after a male deer but 20 years later I finally realised it’s just a portmanteau of inflation and stagnation! Silly me

but 20 years later I finally realised it’s just a portmanteau of inflation and stagnation! Silly me

Rishi needn’t worry too much about the pension triple lock, he and his mates did a grand job earlier in killing more than a fair few seniors off

what will save us?

rejoining the EU is their plan. the EU. with compulsory ‘vaccines’ euthanasia.. and chinese style digital ID…

I do hope the tory opposition unseats PM Stanley Johnson soon.

So, Mr Sunak moans about the amount spent, but he is the chancellor and is personally responsible for spending it.