News Round-Up

26 July 2024

Government Has Just Declared War on Free Speech

26 July 2024

by Toby Young

Keir Starmer says he will never withdraw from the ECHR because there is "no need" and Rishi Sunak did not disagree, despite it being the reason he failed to stop the boats. Nigel Farage says it's time to ask the people.

As he left Downing Street, Rishi Sunak apologised for the Conservatives' record in Government. Mark Ellse imagines what he might have said had he apologised for lockdowns and Net Zero.

Illegal immigrants in northern France have celebrated Labour's landslide victory and said they will cross the Channel at the "first chance" they get.

Labour is set to win a landslide with a majority of 170 for Starmer on 410 seats, the exit poll shows. Conservatives slump to 131, Reform on 13 and the Lib Dems on 61. A new Labour era dawns. God help us all.

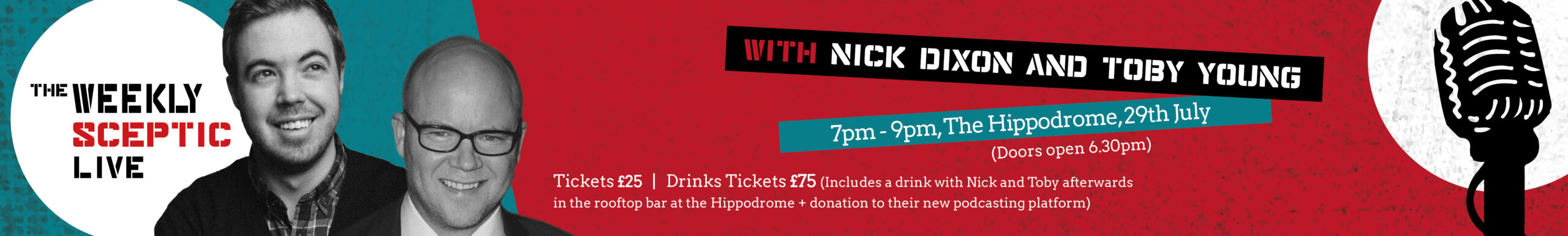

In the latest episode of the Weekly Sceptic, the talking points are whether the Tories really are facing wipe out, Channel 4's dodgy exposé of Reform and Macron's humiliation.

Rishi Sunak will likely hand over to Keir Starmer on Friday. But how much difference will it really make, asks Steven Tucker. We'll still get Net Zero, mass immigration, high taxes, trans madness etc. etc.

Isn't it a bit odd that we're halfway through a General Election and yet the political parties have not sought to discuss their or their opponents' record during the pandemic, asks Brian Monteith.

Rishi Sunak and Keir Starmer appear to have an understanding not to mention the costs of Covid measures, says Dr Tom Jefferson. And no wonder, as leaders of the lockdown and lockthemdownharder parties.

In the latest episode of the Weekly Sceptic, the talking points are Rishi's D-Day disaster, the LIb Dems Loony Left manifesto and the populist insurgency in the European elections.

The Tories have barely confronted the ‘Diversity and Inclusion’ racket. On the main government jobs website, and you will find dozens of listings for jobs like ‘Diversity & Inclusion Lead’. Why do they let this happen?

© Skeptics Ltd.