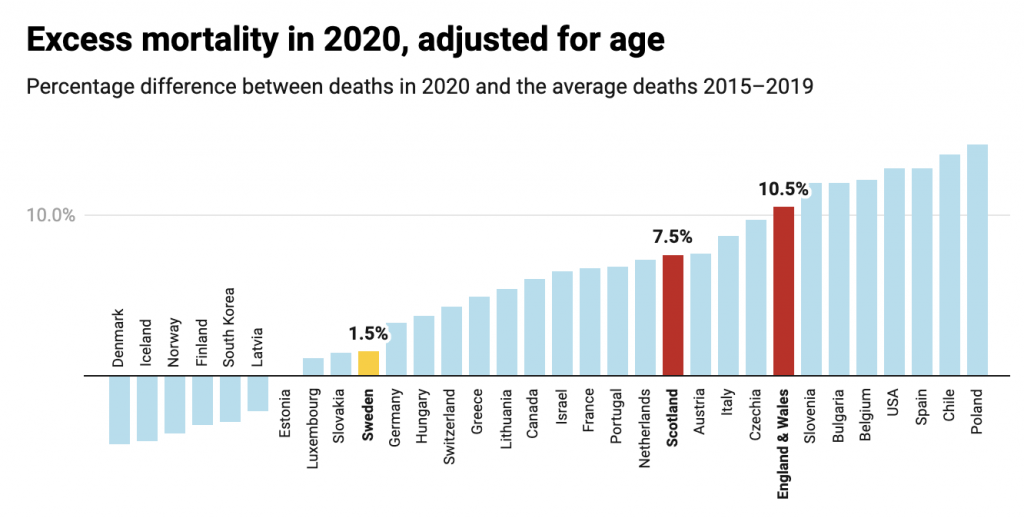

Having read Dominic Cummings’ twitter thread on the Government’s lack of preparedness for the pandemic – I had 10 hours to spare and thought, ‘Why not?’ – I began to suspect that Boris might be a lockdown sceptic. The central plank of Dom’s case against the PM in his thread is that he should have locked down earlier and the reason he didn’t is that he naively thought that a policy of shielding the elderly and vulnerable, and encouraging symptomatic people to quarantine at home, would mean ~60% of the population would become infected over the summer, thereby avoiding a second wave in the autumn/winter, when the NHS would have found it harder to cope due to the annual winter NHS crisis – the so-called ‘herd immunity’ strategy. Hmmm. Sounds pretty sensible to me – and to get an idea of how that would have worked out, we only have to look at Sweden, which avoided a hard lockdown throughout 2020 and had one of the lowest age-adjusted excess mortality rates in Europe.

Dom tries to swat this argument away in his thread, accusing “UK political pundits” of “spreading nonsense on Sweden/lockdowns”, and compares Sweden unfavourably with Denmark. A pretty feeble response, as we’ve pointed out numerous times on Lockdown Sceptics. (see Noah Carl’s piece on Monday for a comprehensive rebuttal of the “Yeah, but, Denmark” critique of Sweden’s approach.) No, the example of Sweden, which refused to lock down and whose health service never came close to being overwhelmed, remains a devastating riposte to the apocalyptic doom-mongering of people like Dom back in March of last year, who were screaming at the Prime Minister to lock everyone in their homes because… the NHS.

As I say, reading that thread, it seems pretty clear that Boris’s instincts were correct and the reason he switched tack in the week leading up to March 23rd was because he was surrounded by bed-wetting hysterics like Mr Cummings.

But today’s Daily Mail confirms it: Boris is a lockdown sceptic. I’ll let the Mail summarise the “explosive allegations”, which Dom has clearly leaked to them:

Boris Johnson referred to Covid as “Kung-Flu” and – before he was infected with the virus – offered to be injected with it live on TV to “show it’s nothing to be scared of”, Dominic Cummings will claim today.

They are among the explosive allegations that Mr Cummings, Mr Johnson’s former chief adviser, will make to MPs investigating the Government’s handling of the epidemic.

In an extraordinary claim, he will accuse the Prime Minister of being responsible for “thousands of deaths” by delaying a second lockdown when a second wave of the virus hit the U.K. in the winter. …

The Mail has learned that Mr Cummings will allege Mr Johnson:

* Argued against tough Covid curbs on the grounds that “it is only killing 80-year-olds”;

* Did say “no more f***ing lockdowns, let the bodies pile high in their thousands”.

* Said he regretted being “pushed” into ordering lockdowns because the “economic damage is more damaging than the loss of life”.

No doubt Boris could have expressed his scepticism more diplomatically – assuming Dom is telling the truth – but the substance of these points is correct: for those under 65 and with no underlying health conditions, the virus is nothing to be scared of; the average age of those who’ve died from COVID-19 in the UK is about 80; and the economic damage caused by the lockdowns will certainly outweigh the harms the lockdowns have prevented, if any.

Should anyone be in any doubt that Boris is a 64 carat lockdown sceptic, Dom has some more “devastating” points:

Mr Cummings will also say that before the decision, Mr Johnson vowed: “I’m going to be the mayor of Jaws, like I should have been in March (when the first lockdown was ordered).”

The Prime Minister has said that he regards the mayor in the Jaws movie – who refuses to close the resort’s beach even after a shark has killed tourists, for fear of damage to the local economy – as one of his “heroes”.

I must say, I take some comfort from this. Regular readers will know that until that fateful U-turn on March 23rd 2020 I was a huge fan of Boris’s and have struggled to reconcile the Rabelaisian, liberty-loving character I’ve known for the past 38 years with the furrowed-browed headmaster of the last 15 months. As I asked the journalist Quentin Letts in our recent Free Speech Union chat: How did Sid James become Hattie Jacques?

Turns out, Boris’s Jamesian side wasn’t entirely abandoned; it was just just kept in check by the Jacquists in 10 Downing Street.

Presumably, one reason Boris allowed himself to be pushed around by these chin-wobblers is because he was worried they’d accuse him of needlessly killing thousands of people if he didn’t do what they said. In which case, Dom’s suicide bomber routine is actually quite helpful. Boris allowed Dom to browbeat him into following his lockdown strategy and the disloyal bastard is still accusing him of being a mass murderer. So Boris has little to lose from ignoring these Cassandras from now on. They’ll turn on him whatever he does so there’s no point in trying to keep them on side.

It’s time to assert yourself, Prime Minister. At the next meeting of the Cabinet, announce that you’re going to reopen on June 21st come hell or high water and anyone who thinks that’s a bad idea should resign now or forever hold their peace. Thereafter, if the usual suspects start briefing against stage 4 of the Roadmap, including those snakes on SAGE, he should sack the bloody lot of them.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

It is bizarre reading all of this. It is like someone criticising Hannibal for his tactics at the Battle of Cannae.

Idiot.

Twat

It won’t take fifteen years at the rate Johnson and his minions are proceeding.

He still can’t be excused. Advisors advise, Ministers decide. And as Prime Minister, Johnson is ultimately responsible for this calamity. If he instinctively felt that the advice he was receiving was wrong then why didn’t he change his advisers, or at the very least seek broader counsel from the authors of The Great Barrington declaration for example? In fact, it makes the whole thing even more reprehensible if he knew it was wrong but did it anyway. He cannot and should not be forgiven, not least by the libertarian conservatives whose principles he has betrayed.

The British Establishment are now trying to save the only sellable product they have . Lawyers around the world are now presenting their Crimes against Humanity to International Criminal Courts. Those people are WHO, PHE, CDC, GAVI. Whitty, Valance, Fauci, Hancock, Johnson, Sedwill, are also being prosecuted personally along with members of CIA, MI5. All those who knew this was coming and facilitated it. Including the destruction of a legally elected President who wanted CCP investigated for gain of function and wanted HCQ with zinc available free to all who did contract this purposefully released flu virus, in order to bring down Western Governments and destroy certain populations. People need to join the dots.

Thank goodness it may not do the damage they were hoping for. Too many folk are now wise to the real purpose of creating hysteria in order to provide a deadly solution. Too many are now refusing to be injected. Too many are quietly turning away from the violence unleashed to intimidate us.

Eventually the Parliamentary Army tired of the “King’s evil counsellors” excuse and cut off the King’s head. And what, by the way, is Boris’s excuse for the mass death, I mean, vaccination programme?

Some members of The Great Barrington declaration did see Johnson which no difference to this panic stricken SNAFU

That was just a PR gesture on Boris’ part to try to shut the CRG up.

and it is hard to separate out “covid blunders”, if that is how they are to be viewed, (not by me I hasten to add) from the Great Reset agenda which the Toby cannot argue the PM is not fully behind and the two go hand in hand as one creates the conditions for the route march to the other – his government, his agenda.

I think you are correct.

Remember him trying to get the school kids to go back? He was met with a furore of protests from Unions and Parents despite the clear facts that children are safest from Covid.

And of course the polarisation of the ‘press …

Maybe this ridiculous delay in opening up is to squash the lockdowners once and for all…

This assumes he has no backbone. He is the PM, it’s not a personality contest, he has to make the tough choices. Bumbling Boris routine doesn’t wash. What the Government has done, with him at the helm, is criminal.

Boris is a lockdown sceptic?

The pig dictator?

The fat f..k?

The worst prime minister in history?.

The leader of the worst government in British history?

The destroyer of freedom, of happiness, of hope, of youth, of everything that makes life worth living?

The creature that presided while old people were tortured and murdered, and children incarcerated and crushed?

The lying, whoring, posturing, soulless, conscienceless blob of putrid grease?

Is. one. of. us?

Obviously I haven’t woken up yet. I’m dreaming somebody said Boris was a ….

Alas he is all of that and more.

And DC is showing that book smart doesn’t always convert into real world smart.

It’s the only way Cummings can throw him under the bus. Hancock too. To be replaced by who? Gove? I don’t believe a word of it, Boris is a dangerous tit. So is Cummings. So are the rest of them, Has anyone heard from the CRG recently?

Don’t be daft, he actually joins a long line of incompetents we have been enduring since WW2, everyone as bad as the one before!

Not a fan then, Annie !

Not exactly, no.

I knew TY would get no support for those thoughts, and with a smile I pressed “comments”. Thanks Annie

Toby , c’mon this is getting silly.

You know that this country is a signatory to the WHO IHR.

You know that means this country is legally bound to follow the direction from the WHO and implement the national ppp when the WHO declares a “pandemic “

You know that the ppp is already a certified and approved (by WHO) process way before the “pandemic” is declared.

so what’s all this garbage about “good ole Boris “ being recycled for again ??

For you, and people around you, and people you care about and even people you don’t know,

I urge you to watch this video of “the 5 Doctors” it’s from a few days ago.

it’s only an hour or so long.

https://rumble.com/vhiltf-follow-up-to-the-5-doctors-discussion-of-the-covid-shots-as-bioweapons.html

watch it , do your own research, but in the dark of the night know this, you are in a position to share real truth to people .

You know Boris is a fraud, you must have serious misgivings about what is going on.

are you going to stand for real truth or just peddle the lines you’re told.

Time is running out.

Yes, the vaccine is the reason for the lockdowns and not the other way round.

Why were we mucking about for months while these jabs were being developed, in that case? I agree with you to the extent that TPTB appear fixated on getting the needle into anything that breathes.

Is it your argument that the snake oil was there all the time and enough deaths had to happen/be made to LOOK as though they happened, to conjure up a perceived need?

And they are coming for your children with the gene treatment. Twelve year-olds. What its the justification for this crime?

And Boris is just a duffer?

Absolutely spot on! All this Cummings bollocks is part of the propaganda being peddled to confuse the public and gain sympathy for the devil!

“Lockdown is President Obama’s Responsibility

I have previously called for some investigation into the decision by President Obama to use PDD2 (Presidential Decision Directive no.2) to transfer massive power to WHO just 4 days before President Trump won the election in 2016. I have also, by mistake, previously believed and propagated a lie published by The ECDC in Sweden, as it is found on their website, falsely explaining the background to their conference proceedings of 2017. These were the first ECDC conference proceedings where a new protocol of “social distancing” was introduced, pre-determining from that point on that any future WHO declaration of any pandemic would make it European policy to lockdown.

The ECDC lie states these new protocols, as found on the website in their introduction to the publication of their conference proceedings, were the result of WHO’s response to The Ebola crisis in Africa 2014-2016. The truth is, for which further investigation is required, and should be assumed from the precise timing of President Obama’s decision to transfer such big powers 4 days before a pro-Brexit American president Trump was elected, that the thinking behind them is nothing to do with Ebola. I propose that investigators will be able to find evidence that both pro-EU leaders and The EU leadership itself were involved in bringing influence upon President Obama to make use of PDD2 so.

Those allied to The EU leadership swore to deliver “hell on earth for Brexiteers” and I propose deliberately primed WHO health protocols to be ready as a future political weapon under the management of Sciensano in Brussels and The ECDC in Sweden. Sciensano in Brussels is tasked with the central role of interfacing with the variant database of UN/WHO viral definitions for the whole world. In some respects, given the aforementioned insight into how these important political decisions were made, Coronavirus can be seen as a complex bio-weapon prepared as an active counter-measure against The UK’s decision to leave The EU. It was the concern of President Obama that Donald Trump would be likely to assist.

President Obama’s support of The EU’s political status quo is already well known and documented. The question investigators must unearth are answers on how PDD2 came to be signed? What are the names of everyone who brought their influence to bear upon President Obama to prepare and sign PDD2, to transfer power and resources to WHO shortly before Trump won? Whatever the outcome of a novel experiment in medical ethics, as lockdown is and for which no historical precedent exists, investigators should be tasked with providing a list of names who may be liable, if a crime against humanity is later deemed to have been committed, to be prosecuted.”

Useful to know, so we have to cease being signatories to the WHO IHR. Step one.

Well Sandra, this is old news unfortunately no one wants to talk about it

To examine the reason they don’t talk about any of this please research the TNI “trusted news initiative”

Most people need to wake up, and soon, to the fact that this country like all countries has no autonomy of action, it’s all “Hollywood”.

The World has been systematically manoeuvred into a central control agenda without anyone bothering to explain it to the people.

People like Boris may or may not be “libertarians”, the problem is that they have ALL be co-opted into the grand global govt scheme either by coercion or ideology sympathy.

There is a grand vision for the coming changes and the end result is painted as a fantastic Utopia, unfortunately we have to get from here to there and some of the populations just aren’t going to make the cut.

This generation of world leaders, everyone from Boris, Macron, Castro’s son over in Canada, Jacinda, Morrison Modi etc etc are fully determined to “build back better”, they are hand picked and placed to carry out the agendas.

This is a joke, it isn’t a muddled misunderstanding,it isn’t going to sort itself out once fatso finally does the “right thing” , he and all the others believe there is no alternative.

I can only urge anyone of the few people who bother to read these columns to do their own research and see for themselves what is really going on.

In the USA , the duly elected president, like him or not, is playing golf while a junta sits behind a fortified enclave in their capital issuing executive orders on behalf of their paymasters.

If they can get away with that, what ever garbage story Cummings or Boris peddle is totally irrelevant.

Hard to swallow, Toby. See your point, but as the formula goes, if it sounds like a cretinous fanatical lockdowner, looks like a cretinous fanatical lockdowner and walks like a cretinous… you get my drift.

Toby isn’t the brightest button on the beach…. either that or he just can’t shake his shackles.

Boris MAY have been a lockdown sceptic in the beginning. But even that I doubt. Too much other evidence e.g. Hanock’s earlier meetings with Klaus Schwab. But also.. this:

Boris’ Greenwich speech in early February where he talked about how a wholly disproportionate response to a virus could create global order.

https://www.gov.uk/government/speeches/pm-speech-in-greenwich-3-february-2020

And in that context, we are starting to hear some bizarre autarkic rhetoric, when barriers are going up, and when there is a risk that new diseases such as coronavirus will trigger a panic and a desire for market segregation that go beyond what is medically rational to the point of doing real and unnecessary economic damage, then at that moment humanity needs some government somewhere that is willing at least to make the case powerfully for freedom of exchange, some country ready to take off its Clark Kent spectacles and leap into the phone booth and emerge with its cloak flowing as the supercharged champion, of the right of the populations of the earth to buy and sell freely among each other.

And here in Greenwich in the first week of February 2020, I can tell you in all humility that the UK is ready for that role.

Hi Chaos – If Toby is not one of the brightest buttons on the beach, then I’m completely invisible. So feel free to disregard this comment. But doesn’t your quote here from Boris’s speech at Greenwich make Toby’s point for him? Here is Boris in full borisflow talking about opening up trade and taking up our seat at the WTO etc and resisting the panic that coronavirus may trigger and resisting going beyond what is medically rational? I agree he caved in a month or so later, but what could he have done with the cabinet, the public sector, the msm all hysterically demanding that “something must be done”? We don’t have a presidential system in this country – and I don’t want one.

If that is your intepretation, fine. Just isn’t logical. This speech was made well before lockdown. It reads like a plan. Because it was the plan. He wasn’t talking about resisting it.. here I could suspect you are just 77th. How could you possibly reach that conclusion?

Perhaps like most people you also think John Lennon’s Imagine is about a lovely world where everyone loves one another.. no possessions, no borders.. and no-one owns anything but is happy (sound familiar?). Lennon essentially put the communist manifesto to music. Intentionally sugar coated it.

Was it well known at the time that marxism had killed 100 million?

Boris should’ve made may-day a day to remember the victims of marxism.

I just don’t get this – Boris is saying there is talk of corona virus and countries closing borders etc and he is saying he will stand up against it. He didn’t of course, but that’s another matter.

Resigned.

He definitely appears to be signalling the introduction of the ‘4th Industrial Revolution’ in that speech, it’s almost like the WEF wrote his script!

If Johnson is a secret Lockdown Sceptic, then shouldn’t we ask why, how and by whom he was made to inflict Lockdown on us?

I humbly suggest that crying ‘it was Cummings’ isn’t good enough. There are too many players with vested interests who’ve influenced the PM. Just look at the ‘big earners’ from this “pandemic’ …

and if the PM REALLY was a secret Lockdown Sceptic then he could at any time he wanted have changed course and done Sweden

If Johnson really is a sceptic, he would have no use for vaccine passports. Instead he puts Gove on the case.

If he is or was a secret sceptic, he’s an especially cowardly one, apt to bend to others l rather quickly on important matters – these qualities are not really what you want or expect from a PM with a massive majority and 5 years left on your term.

Also doing what you know is wrong is more reprehensible in some ways than doing what you think is right.

Let’s for a moment suppose he is a sceptic, surrounded by zealots. He has had umpteen chances to get us out of this, to dial down the fear, the nonsense, the propaganda, the testing, the last of which has been the cover afforded by having a jab rolled out to the vulnerable. Even if he didn’t feel he could come out and say it was all bollocks, he could have steered things slowly but surely towards a bit more normality a bit sooner – that’s what politicians do.

For the use of the SPI-B alone he deserves unqualified condemnation.

“For the use of the SPI-B alone he deserves unqualified condemnation”

Nail on the head.

Yes. Go back a generation or so. Think Attlee and Churchill – either side of a real political spectrum, whatever your personal views. Both can sustain the charge of being wrong at various times – but co-operated in running a country with a much more severe situation to face.

But would either of them have needed this sort of cringing defense and ‘cowardice’ as an excuse? Would either have acted like Johnson (and Starmer)?

I would never have been of Johnson’s political persuasion – but his unsuitability for any significant office is nothing to do with any alleged ‘view’ that he might take (according to wind direction in relation to his own short-term interests).

Absolutely not, Toby. This man chose to be Prime Minister. He takes the ultimate decision and the responsibility. And he has ruined the country for an exagerrated virus…and he is still so doing. Johnson even deserves no praise if he releases us from incarceration because he was the PM who signed off this totalitarian disaster.

Toby, clearly the pain of being wrong about your old Oxford mucker being a cad is too much for you. You are in denial. The answer you want is that Boris is good underneath and was misled, so you desperately work your way from from that axiom to construct your own truth.

To be fair, Toby Young has been heroic since the beginning. The guy is very short of sleep as a result.

Long story short. If Boris had any Churchillian qualities at all, he would have taken control of the situation and said NO. He would have bought in a variety of scientists and he would have refused to work with a modelling failure known to have caused misery and heartache since 2003. In short he would have supported the real Churchillian leader, President Trump.

WOW what a combination that would have been for the successful future of the West and indeed Brexit,

I did laugh at your piece, MP’s ‘investigating ‘ , the useless nodding dogs have not the brains to put two and two together.

Boris is a useless, self-interest c*nt! He and his “team” should all be in front of a Nuremburg style inquiry. This “good old Boris” line makes me want to puke.

Bring back Albert and his noose.

Boris Johnson a lockdown sceptic?

Lockdown sceptic, my arse!!

What a great piece.

So Boris is a libertarian but without the backbone to stand up for his beliefs! Not the sort of person to be leading a once great country.

After 14 months of lockdown and other restrictions, I think it can be safely said that Johnson is either a) NOT a lockdown sceptic, or b) a lockdown scpetic without the courage of his convictions and thus a liar and a coward who is prepared to sacrifice people’s lives and livelihood for appearance sake. Also, is it not more likely that Johnson will look to continue some restrictions from 21st June in an effort to counter Cummings’ narrative?

Possibly to counter Cummings’ narrative but more likely to keep us subjugated, confused and in fear, pressurising us to submit to vaccines and therefore vaccine passports (and thus control) as that seems to be the ultimate agenda in which Bumbling Boris is playing a role.

Cummings loyal to the end (or like a dog returning to his vomit) trying to paint Johnson in a not quite so bad light.

Ha – interesting take!

Toby may well be correct here. Johnson may well be a Lockdown sceptic at heart. I say that as a vociferous critic of Johnson over the last year.

Trouble is, being Prime Minister means taking responsibility. And for a Prime Minister taking responsibility means acting against those who you think are giving you wrong advice. It can be sustained by taking advice from wider circles, to include voices sympathetic with your views.

Johnson appears to have done none of this. And let it not be forgotten, he appears to have been a supporter of vaccine passports. If he wanted to stop this abhorrent policy, as well as the evil of vaccinating children, he could do so at the blink of an eye.

But the remains silent. Sorry Toby, much as you want it otherwise, Johnson is fully culpable for this shitshow, and continues to be the architect of an even worse one.

Agreed. What the débacle demonstrates is how awful the Government is, and has failed to provide proper services to us. While it’s not unusual (to some of us who’ve been around for a while) to come across a degree of bureaucratic over reaction to major incidents – not just health issues – what is on display now is how bad that lot can be to lots of us. Intelligent politicians need to be sceptical to the likes of Vallance and make their own mind up to some extent; we’ll see what happens later on, no doubt.

Hi TJN – If Boris is a sceptic then he didn’t have sufficient authority / personality / brains whatever to keep us out of lockdown. Fair enough. But we don’t know what was said at cabinet when the msm was in full flow, people were talking as though the horses of the apocalypse were at the door. I suspect, Boris was simply outvoted as many of the cabinet would not have wanted to be on the wrong side of this, had it really been a major killer and they had done nothing. I suspect Boris was met with 20 or more threats of cabinet resignations. I disagree with lockdown of course, but could I have stood up to all that? I doubt it.

Whether you could have stood up to that is not the point. You didn’t set out to be PM. If the scenario you suggest is true, he could either have attempted to impose his will point blank, or resigned, denouncing the madness, or carried on but steered a more sane course than has been done. He did none of those things so is unfit to be leader.

Resign and you are history with no way of averting the madness. Then people would have criticised him for running away when the going got tough.

All I’m saying is we just don’t know – hopefully the truth will out.

Well he could have stayed and fought and called their bluff publicly and refused to resign, and forced them to push him out, and been a spokesman for sceptics.

Or he could have stayed and kept quiet but steered a more sensible course.

He did neither, and neither did he avert the madness.

I think it’s a stretch to use the “only following orders” defence for a PM with a massive majority and 5 years to run on his term.

And the use of the SPI-B, the propaganda, the lies, the doubling down, the gaslighting, cannot be excused.

“running away when the going got tough”

Well – according to the Toby Young’s revisionist theory – that’s precisely what he did do!

Quelle surprise.

He’s not a Lockdown Sceptic, he’s a very naughty boy.

Rubbish, Kim Jong Johnson is a lockdown enthusiast, judging by his policies and pronouncements.

So if Johnson was swayed by the people around him…who swayed them? I seem to recall that the first I heard of the mass hysteria was in the media – not from our leaders. And they claimed to be reflecting the public mood – but were they? From what I remember, Boris told us to stay home if we could – so we did. And then sensible people tried to maintain their physical and mental health by walking and meeting outside (which by any measure of common sense was risk free) and the papers went mental – printing all these inflammatory stories with misleading photos to attempt to shame these poor people. The hysteria went media > public > politicians.

The book by Laura Dodsworth, The State of Fear, analyses this very well.

It is excellent, depressing but excellent!!

“Is Boris a Lockdown Sceptic?”

No

He’s a quivering, easily manipulated lump of lard.

I suspect that Johnson is typical of his class of people in that he has the view that life must go on. A view also common in so-called lower classes, too- it’s only the middle classes who believe life should be hung on to even IF everything else goes to hell with their religious fanaticism for safety above all.

SO, yes, I can believe he didn’t want lockdown.

BUT…he has a fatal weakness in that he likes to be popular and will be swayed by this.

So that means he is simply not trustworthy.

No balls, no testicles. He’s had a year to rid the cabinet of the hysterical morons and yet they’re all still in place. A weak prime minister is no prime minister at all.

His balls are in Princess Nut Nits purse next to her biodegradable tampons

Feeling TY is gaslighting us now.

I don’t think that’s his style. I think he either truly believes this, or wants to, or maybe he thinks the PM reads this, or will hear about it, and wants to offer encouragement.

I disagree with what TY is saying, but don’t doubt his (in this case misplaced) good faith.

Maybe he just wanted to start a bit of a fire…

I think it’s more hope and desperation – if you’ve had some faith in some of the political class, and politics/political journalism is your business, it must be devastating to see that faith was evidently misplaced. I know quite a few sceptics who go for the “poor old Boris, he had no choice” line.

… or to be liked by his erstwhile dodgy friends.

hard to avoid thinking TY just trying to curry favour – “I have my little LDS site but really, I do my very best to stick up for you when I can”

“it takes a strong fish to swim against the tide. Even a dead one can float with it”

John Crowe

Johnson is a minnow.

https://vimeo.com/179639133 in which Toby plays Maxwell Smart to Boris’s Simon the Likeable.

If Boris is a lockdown sceptic he’s a pretty weak one.

I think it’s more likely he’s a political opportunist and saw there was no way he could stick with the correct policy and survive politically and so he took the expedient option and fell into line.

Which might be ok if he showed any determination to destroy the entire bedwetting public health, media, civil service, SAGE and NHS lobby with a nuke from space when all of this is over – but there is no sign of that.

I think the truth is he’s just a rather weak and disengaged leader.

So why did he say that lockdown, not vaccines, were responsible for getting the virus under control?

Brain fart? Pity he had his mouth engaged at the time.

Correct. Kim Jong-Johnson has been defending lockdown.

and the proof of the pudding will most certainly be in the eating – say in September when the UK gets locked down again “for its own good”

Seems like a convoluted way for Boris to be on both sides of history. A calculating cunt if ever there was one.

What is this pish??

No

He is not

or else there would have been no lockdowns

number 4 incoming

Oh puleeeeaaase. We have had this discussion in so many disguises over the months. Fact is not what his natural instincts may be, our current PM has acted in a way they would give the lie to that. We are where we at because the people in charge, and he is where the buck stops, have taken certain actions.

I, like may here, find myself at odds with many of my nearest and dearest. I love them so need to keep contact but they are so scared and brainwashed, even the well educated scientists, that some of them want to keep exercising precautions even when double jabbed.

The government, led by the current PM, has caused this fear and rift in families. The virus didn’t do it.

Bang on.

‘led by the current PM’ exactly WasSteph.

If he had wanted to do it differently – as PM does he not have the power to make it happen (although didn’t Obama say in despair that even as President he couldn’t actually do anything?).

If you are excusing the PM but just saying he was too scared or too influenced by the mad group around him (whatever their own devious agenda’s) simply is not good enough. Mind you, can anyone here think of another person in the current political masses that are any good? ie have balls and brains and are prepared to be unpopular?

My family think there are only 2 things that worries the PM – not being liked – and himself. He’s got his 5 years in the limelight sown up. What else matters?

Reading a viewpoint about the past that overlooks the dimensions of the crisis is to understate or overstate what we faced early in 2020. I was getting my info direct from China in January 2020 and in the months that followed. I knew what was coming and from my perspective Boris completely failed in the job he was supposed to do. The levers of Government are immense in a crisis and in the weeks that Boris ignored the virus’s potential plans could not have been put together when, after all, there was time for this. Data from China, Italy and the laboratories could have led to a coherent plan. This could have been to go for herd immunity, taking total control of care for the elderly and stopping agency workers going into different Homes, and, identifying the vulnerable in the community who needed isolation and support. It would have been hard to achieve but instead of a cross party consensus he went for the narrow thinking of right wing ideology. Boris basically messed up. Dom Cumming’s revelations today are an irrelevance in my book. Time has moved on and we are left with a Government of questionable quality, ability and integrity. More waves of the virus are coming, some of them are likely to be deadlier. Looking forward not backward is the need is now.

The Cummings-Johnson polarity feels like a cleverly-scripted piece of distraction theatre.

If he is, he’s a funny way of showing it. He is the Boss, the buck stops with him; he has the final say. Seems total bullshit to me by Cummings. Another unelected c*nt that wielded massive power over the people and who was to blame for that; Boris.

What you think is totally irrelevant Toby. It’s what you DO that marks you as a leader. If this was against what you believed why did he not resign? Why carry on doing something? Do you not understand Toby this is ALL bullshit designed to catch the attention of the review board and stop them asking. Why lockdown? Who decided to abandon 50 years of pandemic advice on something never done before?. Why put sick people back into care homes effectively condemning them to death? Why not reopen when it became obvious it was not a serious illness and the nhs was not being overwhelmed? Why close down schools when no children were ill? Why masks after the pandemic was over? Why keep air travel open when it was known the disease came from China? Why take advise from Ferguson when his models were absolutely shit and overstating 11 times the actual number of fatalities. Who decided to stop autopsies allowing many deaths to be misdiagnosed? And many others, feel free to jump on this thread and add any I might have missed. The fat pig dictator and handjob are fucking useless and have terrified the population without any justification and you Toby are a fucking idiot for believing it!

Well said!

I agree with Toby. Michael O’Bernicia says all the evidence in his case points to Hancock and the advisors as the culprits and Boris’ hands are tied. I personally think Gove is in on it too. The media are also driving the agenda rather than simply reporting it. Boris can’t just sack them without the support of the party. Plus they probably have so much dirt on him that they can force a resignation if he acts out of line. I suspect he is being held to ransom and is waiting to find a way to out manoeuvre them. The recent leaks about interior design and paid for holidays were warning signals to him. I feel it is only the public who can save us now by refusing the vaccine passport and holding out until the lawyers can break ground on their cases.

I don’t think the Nuremberg Defence is applicable to arguably one of the most popular PMs in history.

“waiting to find a way to out manoeuvre them” How long is he going to wait? Until 100% of the population has been injected with an “emergency” experimental vaccine?

Given Gove’s previous history of loyalty to Bozo I would guess he’s the one doing the Brutus bit, with Wancock on a promise of Foreign Secretary when Gove takes over. Why on earth did Gove get back into Government after his previous knifing of Bozo?? Trust is like virginity, once it’s gone, it’s gone

“Boris can’t just sack them without the support of the party”

Of course he can. But a self-seeking egomaniac wouldn’t.

I am more inclined to think that Johnson is the useful idiot. A puppet on the string of his real masters.

His image is carefully crafted by them, primarily as a hedge.

At the very least, he has no balls.

Indeed, and leadership requires balls.

yep!

Clearly you don’t think that the plan from day one was exactly what we’ve ended up with.

The ENDGAME is the Global ID linked to digital cash and a health passport.

You seem to think that the Lockdown (might as well call it LockSTEP) strategy is just a big cock-up, not something running to a co-ordinated agenda worldwide.

Have you considered that there is considerable evidence of a global synchronisation in the Official Narrative, Toby?

Poor old Toby – bereft at the loss of his idiot erstwhile friend. The misanthropic, self-seeking idiocy is long established. This is just a revelation of it.

W’ve all had to come to terms with this syndrome – but excuses don’t do it.

I dare say in the next few months and in particular when you meet up with relatives at Christmas you will hear a familiar refrain “of course, I was always a lockdown sceptic”

Well, we all knew Boris’s weaknesses. They’ve been documented often enough. He doesn’t like to do the hard work, he wants to be liked and he’s easily pushed around. He often seems to me to be like Bishop Proudie in Barchester Towers. Gove as the Archdeacon – the man who thinks he should have had the job, Cummings as Slope – the schemer manipulating things in the background and of course Carrie as Mrs Proudie – the one who really makes all the decisions.

I believe Toby is essentially right on this matter. Johnson is a libertarian by instinct, but he ran scared of certain leading members of SAGE and their friends in the broadcast media. It might have helped if Johnson had a scientific background – that at least might have enabled him to ask the right sorts of questions and to insist on a cost-benefit analysis of any lockdown measures. As it was, he was simply the wrong man at the wrong hour.

I don’t have a scientific background, but I managed to work out just from “official” information that the whole thing is bollocks. My mother in law never made it to secondary school but knows it’s bollocks.

Sorry, the Nuremberg Defence is not applicable to leaders.

Aye..it takes time though, the lizards kept BigBozza too busy to think for himself….

It’s worth noting, that I know from personal experience, the higher ups in PHE and the security services pride themselves on manipulating politicians to achieve their long term goals…I do suspect BigBozza was bounced… and probably did put up the salty resistance quoted…

Kim Jong Johnson is a great fat communist fraud.

Interesting stuff coming out of Cummings’s mouth. “The PM’s view was that the real danger was not the disease but the measures we take against the disease and the economic consequences”

Well who’d have thought it?

I am in complete agreement with the last paragraph of this piece, Toby.

Yup…though I can think of more far more painful retribution to be vested on ‘The snakes on SAGE’… probs involving hot pokers…

No more appeasement Toby.

”The era of procrastination, of half-measures of soothing and baffling expedients, of delays is coming to its close. In its place we are entering a period of consequences.”

W. Churchill.

Toby is still avoiding the issue. Cummings says a September LD would have averted the ‘new-variant’ death-surge at Christmas and New Year, a surge that followed a nationwide vertical take-off 2 weeks earlier in PCR-positives which itself exactly tracked the vaccine rollout. And was nefariously blamed on a rampant new variant of the virus.

Hancock ordered an embargo on Lighthouse Lab test results. To this day, we have no visibility of the various positive rates of the labs, or of the correlation of test-positives with vaccination status.

At Christmas, frail elderly and already very sick people, prioritised for jabbing, began dropping dead all over the country. In care homes in England alone, an extra 4,000 deaths occurred in the following 8 weeks, and an extra 20,000 occurred in the country at large. These were deaths of the very people – the only people, in fact – at any risk of death from the virus. Hancock ordered vax-status omitted as a data entry from death-certificates (so the ONS would not pick up the connection), pulled the Pfizer1 jab, substituting the Oxford, and ordered a cover up, knowing that the truth would kill his jab-‘em-all plan dead in the water. His yellow-card system continued to rely on the deceased to self-report their vaccine side-effects. Hancock’s cover up of this crime had been astonishingly effective. No information is available – FOIs to the NHS, to PHE, and ONS are just blanked – on the vax status of the excess-deceased since the jabbing started. None. 25,000 people have effectively been put up death, and millions of others, who were at zero risk from the virus, induced to accept a novel jab, licensed only under emergency waivers, with a potentially dangerous experimental mechanism. This is turpitude of Eichmanesque proportions.

Quite. And all this is being covered up by hundreds of MSM journos who smile at us and tell us they are honest reporters.

Tobes – stop calling him Dom. Call him Creep Cummings or the Whitehall Weirdo or something else – even Mr Cummings. I know he’s probably your mate but, well, that is part of the problem really isn’t it?

And if Johnson is-were a lockdown sceptic, then that makes everything worse. That means a Digital ID sceptic and a Lockdown Sceptic is taking us into a horrendous dystopia even though he doesn’t believe in the principles of the new dispensation. That’s really appalling

I can’t help feeling todays Cummings show is all a massive distraction designed to rehabilitate Boris with libertarian leaning conservatives (and the apparent Cummings/BoJo fallout is about as real as Goves apparent backstabbing of BoJo when the Brexit winds were uncertain ) , and prevent anyone asking the real questions, ie is Covid19 a massive NATO hoax to neuter populist Trump and populist Brexit, using the scientific/financial ‘elite’ to effect this…. Call me a suspicious sod….

“Lockdown is President Obama’s Responsibility

I have previously called for some investigation into the decision by President Obama to use PDD2 (Presidential Decision Directive no.2) to transfer massive power to WHO just 4 days before President Trump won the election in 2016. I have also, by mistake, previously believed and propagated a lie published by The ECDC in Sweden, as it is found on their website, falsely explaining the background to their conference proceedings of 2017. These were the first ECDC conference proceedings where a new protocol of “social distancing” was introduced, pre-determining from that point on that any future WHO declaration of any pandemic would make it European policy to lockdown.

The ECDC lie states these new protocols, as found on the website in their introduction to the publication of their conference proceedings, were the result of WHO’s response to The Ebola crisis in Africa 2014-2016. The truth is, for which further investigation is required, and should be assumed from the precise timing of President Obama’s decision to transfer such big powers 4 days before a pro-Brexit American president Trump was elected, that the thinking behind them is nothing to do with Ebola. I propose that investigators will be able to find evidence that both pro-EU leaders and The EU leadership itself were involved in bringing influence upon President Obama to make use of PDD2 so.

Those allied to The EU leadership swore to deliver “hell on earth for Brexiteers” and I propose deliberately primed WHO health protocols to be ready as a future political weapon under the management of Sciensano in Brussels and The ECDC in Sweden. Sciensano in Brussels is tasked with the central role of interfacing with the variant database of UN/WHO viral definitions for the whole world. In some respects, given the aforementioned insight into how these important political decisions were made, Coronavirus can be seen as a complex bio-weapon prepared as an active counter-measure against The UK’s decision to leave The EU. It was the concern of President Obama that Donald Trump would be likely to assist.

President Obama’s support of The EU’s political status quo is already well known and documented. The question investigators must unearth are answers on how PDD2 came to be signed? What are the names of everyone who brought their influence to bear upon President Obama to prepare and sign PDD2, to transfer power and resources to WHO shortly before Trump won? Whatever the outcome of a novel experiment in medical ethics, as lockdown is and for which no historical precedent exists, investigators should be tasked with providing a list of names who may be liable, if a crime against humanity is later deemed to have been committed, to be prosecuted.”

Very interesting. I hadn’t heard this.

To my mind the whole Cummings Show is a diversionary tactic to distract the enquiry from asking the real questions, i.e. How real a threat was Cov19, how proportionate was the insane response, and who was responsible for this chimera…

Only vaccinated people allowed….

The thing is, Cummings was right, spot on, from a political point of view, which is all they care about. At the start, Johnson could have got rid of a couple of bedwetters and Sage and the rest would have fallen into line to go for herd immunity and the Swedish approach. But then they’d have had to try and influence the MSM not to sensationalise and exaggerate the death count – a near-impossible task. They’d already started. I’ve said right from the beginning that the MSM is to blame for all this. Along with weak politicians.

Agree about the weak politicians. A weak politican in a time of crisis who knowing does the wrong thing is worse than useless.

As for blaming the media, sorry, that won’t wash. They have been dreadful, but a lot of that has been following the government lead, and with government money.

If you’re the PM of the UK with a huge majority and a 5 year term, the “a big boy made me do it” argument doesn’t wash.

“a near-impossible task” Well some leaders managed it. The PM did not attempt it, in fact did the opposite.

The Govt allowed Cheltenham to go ahead, and a Liverpool-Atletico Madrid match too. They were getting a lot of flak for that, from all sides, from all media, and from Labour. But I’m not trying to exculpate Johnson at all. He was weak.

I think the Govt was following the media, rather than the other way round. They didn’t pay the media so as to hype and exaggerate the death toll. There was no need – they were going to do it anyway, in fact were already doing it. They paid them and gave them ‘Guidance’ so as to exclude any criticism of the lockdown and restrictions and keep the public totally unaware that there was any opposition.

Since March 2020 the government, led by the PM, has doubled down on the insane narrative at every opportunity and made no attempt to return to rationality, despite having many chances to do so. Point to a single action of the government or any of its agencies that is indicative of scepticism, love of truth, genuine concern for public health, respect for democracy, desire for genuine. “weak” does not cover it, sorry. They are wicked, vain, arrogant, dishonest.

MSM was getting big money whole way through pandemic for the advertising campaign they ran for the government – govt was effectively funding many of the print media via that ad revenue – therefore media was bought and had no option but to stick with govt narrative – SPI-B drafted it and media published it

and he is still doing it

No. Boris like Trudeau, Sturgeon, Macron, Biden etc. is a compromised puppet leader and local executor (whether willingly or through bribery/coercion) of a globalist power grab.

In latest news.. Toby believes every accusation that Dominic Cummings is making makes total sense. There defininitely isn’t some kind of strange manouverings going on.

In other Toby News.. Bill Gates is a nice man and Epstein didn’t kill himself. Nor did that nuclear inspector chappy.

Newsflash

Boris’ former employer (and recipient of over £3 million of Bill Gates’ money in the last couple of years) The Daily Telegraph concludes that Boris is a great bloke and definitely never does anything wrong. He might even be an angel they said. Perhaps even god himself. Or Jesus.

End of Newsflash.

There can be no redemption for Johnson. He and his cartel of conspiring cronies are in Tony Blair territory, the latter has had far too much interference in all of this as well.

A jail cell would be far too kind for these disgusting evil people.

“I must say, I take some comfort from this. Regular readers will know that until that fateful U-turn on March 23rd 2020 I was a huge fan of Boris’s and have struggled to reconcile the Rabelaisian, liberty-loving character I’ve known for the past 38 years with the furrowed-browed headmaster of the last 15 months. As I asked the journalist Quentin Letts in our recent Free Speech Union chat: How did Sid James become Hattie Jacques?

Turns out, Boris’s Jamesian side wasn’t entirely abandoned; it was just just kept in check by the Jacquists in 10 Downing Street.”

I think this tells us everything we need to know about the editorial policy of LDS, ATL at least. Worries me somewhat.

No. He is not a lockdown sceptic. No real sceptic would ever say that it was ‘really important that everyone understands that lockdowns caused the reduction in hospitalisations and deaths’ as the pig dictator did. A real sceptic would have sidelined the zealots, embraced the sceptics and held out against the media pressure whilst steering the narrative his way (see Governors DeSantis and Noem). Tyrant Johnson is a spineless tumour with no morals, beliefs or principles who would say or do anything for a whiff of popularity.

Correct. Kim Jong Johnson’s pronouncements are great, fat, communist and fraudulent.

However enjoyable it is to see the show of Cummings attacking Hancock; today promoted Lockdowns, in advance of future lockdowns.

We know more is coming. Let’s not buy Boris as a Lockdownsceptic. He’s a puppet at bet. Judge these people by their actions not their spin.

I voted for him but he was too weak to get rid of the obviously failing sage, the disaster that is Neil Ferguson. He is overseeing the coercing of the young into into taking an experimental jab that has not finished its trials .. He is allowing that fanatic Gove to push for vaccine passports. The embarrassment Hancock still has a job – his fake crying alone should have got him the sack….No, sadly Boris Johnson has been and continues to be disaster. He needs to find some guts and some backbone He must take control and stop this whole fiasco NOW…