Government borrowing last month came in £5 billion higher than was expected and was the second highest figure for August on record, pushing the national debt up to £2.2 trillion. The Times has the story.

Public sector net borrowing was £20.5 billion in August, down £5.5 billion on last year, the Office for National Statistics said, but above the £15.6 billion that economists had expected. …

At 97.6% of GDP, the debt is now at its highest since March 1963.

A sharper fall in borrowing had been expected as the economy opened up, more workers came off furlough and tax receipts recovered. Rising inflation ended those hopes, as debt interest payments increased by £2.9 billion to £6.3 billion, the highest ever for August.

For the first five months of the year, debt servicing costs rose by a total of £10.7 billion to £27.6 billion and the ONS warned that worse was to come. “The recent high levels in debt interest payments are largely a result of movements in the retail prices index to which index-linked gilts are pegged,” it said.

RPI inflation jumped in August to 4.8%, a decade high, but the monthly debt servicing cost was based on the average of RPI between May and June, when it was lower. Economists expect RPI to reach about 5.5% by the end of the year.

Samuel Tombs, U.K. economist at Pantheon Macroeconomics, said debt interest costs are likely to be £13.5 billion higher than the Office for Budget Responsibility, the Government’s fiscal watchdog, predicted in March.

Despite the sharp rise in debt servicing costs, the public finances were stronger for the first five months of the year than the OBR forecast at the March budget. For the financial year-to-date, borrowing was £93.8 billion, £31.8 billion below forecast.

The better-than-expected receipts reflect stronger income tax, VAT and corporation tax revenues and a big reduction in pandemic support schemes. Furlough and self-employed support cost £4.5 billion in August, compared with the same month the previous year, and £34 billion less in the year to date.

The OBR will update its projections on October 27th, when the Chancellor will set out his departmental spending plans and unveil new budget measures. The fiscal watchdog is likely to reduce its £234 billion forecast for borrowing for the year to March 2022.

Worth reading in full.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

A “Conservative” government….

These are clearly not Conservatives

How radicals are RUINING our economy to TAKE DOWN the west

https://www.youtube.com/watch?v=Oec2HXSGTzo

Upcoming peaceful stands other anti lockdown events – and we mean peaceful

Saturday 2nd October 2pm

GRAND STAND IN THE PARK BERKSHIRE

– with a couple of guest speakers and a stroll thought the town centre at the end

Reading River Promenade

Reading RG4 8BX

Saturday 16th October 1pm

Combined Berks/Bucks/Oxon/Surrey MEGA Yellow Board-Hold the Line

Stafferton Way

Maidenhead

SL6 1AY

Stand in the Park Make friends – keep sane – talk freedom and have a laugh

Reading River Promenade Sundays 10am

Join our Telegram group https://t.me/standindparkreading

Bracknell South Hill Park Sundays 10am & Wednesdays 2pm

Join our Telegram group http://t.me/astandintheparkbracknell

“Than expected”

What would you expect when those in power are asset stripping the country in preparation for the financial collapse and reset?

I was reading Machiavelli’s THE PRINCE recently. He notes that a ruler can survive if his government is corrupt or if it is incompetent, but not if it is both – as ours is, and bone-lazy to boot! Roll on its collapse.

If only were just the collapse of a government that we were contemplating. But it’s far worse than that.

Despite the best efforts of Thatcher and Reagan, western countries are up to their neck in socialism. The public demands ever more from the state. People either don’t want to take care of themselves or the opportunities to do so are shrinking because the state encroaches ever more into every aspect of economic life.

Paying people not to work, encouraging less efficient work from home, giving the lazy every opportunity to skive off is just a recipe for disaster. It’s a giant socialist leap forward.

Smothered under a mountain of debt and with no realistic prospect of paying any of it back, every western state is on the verge of collapsing.

In many areas the state is cutting back on its spending and involvement – e.g. the repeated cuts to local authority services.

But they are doing the opposite in other areas – principally in ridiculous attempts to ‘control’ an airborne virus, which is impossible and they have no business to be trying (or pretending to try) do do this.

It’s interesting to look at how much various Local Authorities are spending out of their income on debt repayment – the cuts to services generally intended to make up shortfalls.

A billion here a billion there.

Who cares at this stage. They system is irredeemably broken. They’re barely keeping up the pretence that they are managing the finances.

Conservatives could once be relied upon to at least WANT to manage the country’s finances responsibly. But now that they have become soft Labour we have one party that wants to spend like mad and another that wants to spend like crazy.

There’s a democratic choice for you.

It’s obviously untenable and going to implode at some point.

“Deaths with” yesterday, 203. “Deaths with last September 21st, eleven.

Best. Vaxxine. Evah.

203 is probably registered deaths on 21st Sept. It’s certainly not the number who died on 21st.

We’ve barely broken 100 deaths a day (date of actual death) the last few weeks. I keep tabs on the data and graph it to prevent falling for the hyperbole like your 203 number.

Here’s where we are currently

I know the figures are shite, but they’re condemned out of their own mouth with their ridiculous numbers.

Yeah, too lazy to look for themselves, too easy to parrot any old number and the bigger the better !

To put the current ‘situation’ in context, here’s another deaths porn graph lol

Lovely booster to look forward to as well!

“WITH” speaks volumes!!

We are in deep **** and for some reason they think that taxpayers will cover it. Its the Blairite way

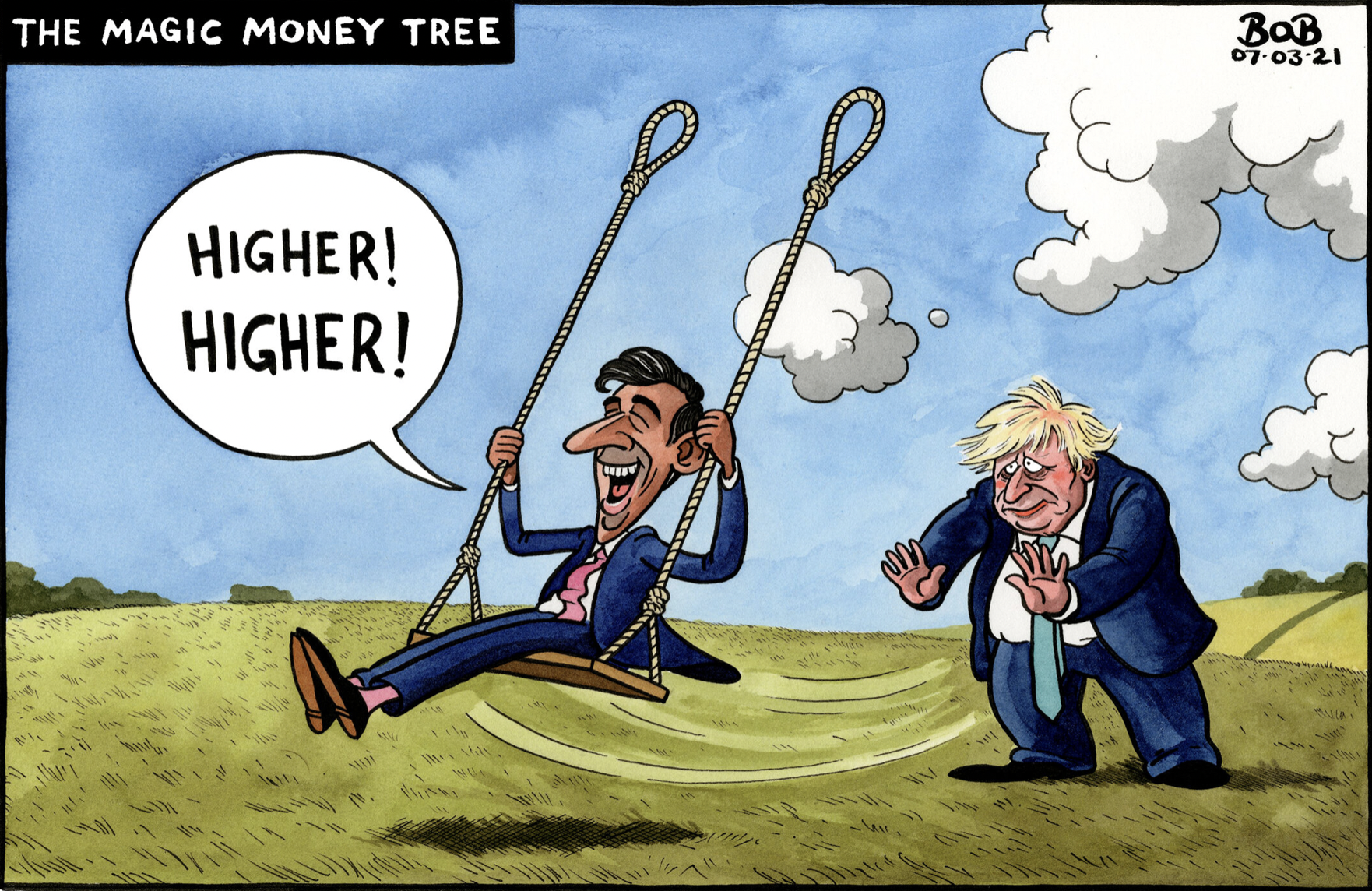

I know what’s coming, even greater tax rises to pay for Johnson and Sunak’s largesse with tax-payers money. I think maybe it’s time to withdraw support for the existing system and go truly independent. I don’t see why I should pay for their malfeasance and incompetence.

Increase VAT so we all suffer ‘fairly’

VAT is just another income tax.

Who’s adding the value that’s being taxed.

No one. The currency is dead meat the moment anyone runs the numbers properly.

Gotta love the additional reporting about “stronger income from VAT”. In any article where some major fuckup is reported nowadays there is some a “buuuut, we’re fucking up less than we could” side note to keep the spirits high.

Alternative headlines for the same story might be:

Public sector net borrowing in August drops £5.5 billion on last year

Public finances for the first five months of the year stronger than forecast. Borrowing 25% below forecast.

MTF going ATM with Rishi Sunak’s calculator now. Humour me, which Secretary of State lasts longest?

Kinda sums up where we are

All going to plan. Bravo BJ!

https://txti.es/covid-pass/images?fbclid=IwAR2um1RVFE0-XhC2ExBLIma7BHDmXdDmlejNFFGaP_EFx70GjU_BxqJ9OOI

“Government borrowing last month came in £5 billion higher than was expected and was the second highest figure for August on record, pushing the national debt up to £2.2 trillion. ”

So people are saving more than expected (One person’s debt is another person’s savings. Basic accounting). Given the supply shortages that is hardly surprising, as there isn’t much to spend your money on.

Hardly anything to get excited about. It should be obvious by now that there isn’t a limit to how much savings people can have, any more than there are limits on how many goals can be scored in the Premier league in a season.

We can of course tax away the financial savings of those who find this upsetting, which will bring it down. And that is the the only way you can actually bring it down as a matter of accounting – either by confiscating the savings, or by making those savings flow through the economy so they pass taxation points or repay loans.

I never understand why some people get so excited about the level of savings in the country. Saving is generally considered a good thing to be doing.

It’s almost as though they don’t realise that debt and saving are two sides of the same coin and you can’t have one without the other.

Hyper inflation here we come – unsteady as she goes with collapsing Every grande property developer, collapsing Green energy companies… financial crisis and BOOM – central banks step in and we are all proverbially fucked. Go cash, gold and Bitcoin et al. Now.

Have checked my account but they don’t appear to have paid it to me by mistake.

The bastards!

Just print more money, where’s the problem? Oh, massive inflation. Doesn’t matter, the serfs will have to suffer that.

https://odysee.com/@en:a5/PK_Tot-durch-Impfung_english:a

This is a special conference led by Vivaine Fisher from the Corona Committee.

It goes into proper medical detail on what is in these “vaccines” There are slides which show metallic objects moving in the “vaccines” It suggests to me that the “mad” theories about transhumanism could have merit, as some of these objects are clearly engineered nanobot type objects.

The part on the vaccine contents starts at about 1.19.

There is a good presentation from a German surgeon who is working with a group of international doctors to investigate and publicise this.

Much of the conference is hard to follow because of the translation, which is hurried out, due to the importance and urgency of getting this information out as soon as possible, given the need to protect children from being experimented on with these deadly injections.

£2.2tn means that every tax payer owes ~£73k each…

If I pay my debt unfortunately that’ll leave another ten who can’t pay. Maybe the debt is better written as £730K for each solvent person?

All you need to know (source slides)

High level view. This deck summarizes the case for you: the vaccines kill more people than they save for all age groups. They’d have to be >100X safer to be practical. We should focus on early treatment. Uttar Pradesh is now COVID-free and they did it all with early treatment; almost no one is vaccinated. By contrast, Israel, one one of the most heavily vaccinated countries on earth, the cases are at an all-time high.