Yesterday, Gazprom announced that one of the two lines comprising the Nord Stream 2 pipeline may still be operational. (Which, incidentally, slightly raises the probability that Russia was behind the sabotage.) Although Line B’s capacity is only a quarter of the total, turning it on could make a tangible difference to European energy prices.

However, this doesn’t seem very likely to happen. Europe has been planning more sanctions on Russia, not fewer – since the latter formally annexed four regions of Ukraine last week. So even if Gazprom can get Line B up and running this winter, Europeans will probably just have to take the pain.

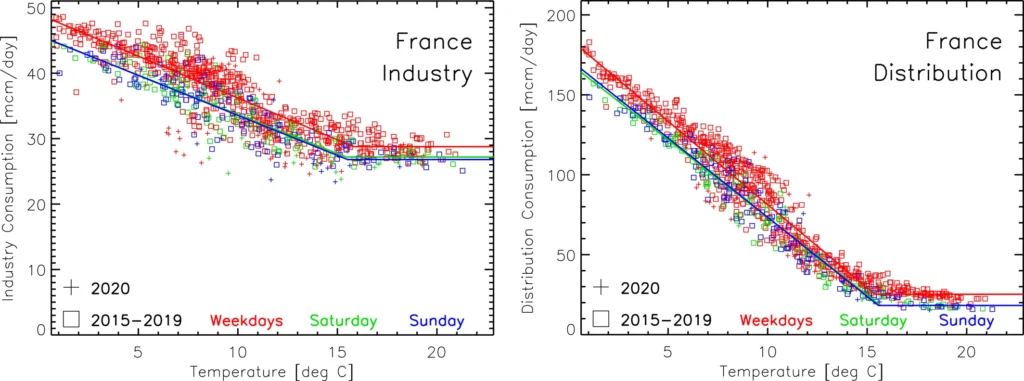

How much pain? For months, analysts have been saying that it all depends on weather. Gas consumption is closely related to temperature because gas is the main source of fuel for domestic heating. Here’s a chart showing the relationship in France, taken from a recent academic paper.

As you can see, the two are extremely closely related; the correlation is on the order of r = –.95. And France isn’t some weird outlier: it’s the same for Italy, Spain, Belgium, the Netherlands, Germany, Poland and the U.K. (Note: this only applies to distribution; the industry correlation is much lower in some of the other countries.)

“If we get a mild winter like last year,” Javier Blas noted back in August, “Europe may be able to weather the problem”. Though he added, “If it is cold in Japan, there is also trouble in Europe because it means that Europe is gonna have to compete with Japan for LNG supplies”.

So, will Europe get a mild winter? Unfortunately, it looks like we may not.

On Sunday, the FT reported that scientists at the ‘European Centre for Medium-Range Weather Forecasts’ are predicting a period of high pressure over Europe in November and December. This is likely not only to push down temperatures (increasing demand for gas), but also to bring less wind and rainfall (reducing supply from renewables).

As the Centre’s director Florence Rabier noted, “If we have this pattern then for the energy it is quite demanding”.

To add to Europe’s woes, gas demand actually rose during the continent’s first cold snap last week, which indicates that demand-reductions measures are not having their intended effect. Industrial consumption has declined, but that’s not due to voluntary demand reduction; it’s due to factories shutting down.

At this point, Europeans may simply have to hope the forecasters are wrong.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

its nothing to do with scariants – its all about vaccine coercion…

and it would be rude to wheel out the ‘boosters’ before everyone has been given the initial experimental gene therapy – and you will need the boosters to have your digital medical IDs updated – and receive your social points…. stay safe

Thank you for your clear presentation of the data & eloquent diagnosis of the sorry state in which we now live.

Yes, brilliant! Why can’t more people see this?

I find the hospitalisation of younger people a puzzle. Has the virus really changed its target population? Maybe, I suppose.

But an alternative explanation might be that there is a nod and a wink policy in operation whereby the NHS and the medical profession are conspiring to feed in as many hospital cases as possible. So, anyone with any sort of risk factor is now being hospitalised whereas six months they would have been told to stay at home and use ventolin, or whatever.

Another explanation of course might be that we are seeing the effects of vaccination, and that these younger people are now becoming vulnerable to the virus because of vaccination (give we know vaccination weakens the immune system for a couple of weeks).

Hospitalisation has fallen dramatically in the younger (<54) age groups as well, just a bit less relative to the older age groups. Overall mortality is much more seasonal in the older age groups, and a lot of that seasonal overall mortality is driven by respiratory infections, so the observed shift in the proportions of the (now far smaller) number of deaths in each age group is not too much of a surprise.

for “deaths” in the above read “hospitalisations”

Younger people who needed treatment for other serious conditions were also sidelined for the covid obsession.

It is also explained by considering the Not in Employment, Education or Training (NEETs). These are people who hve been at their parents’ homes for a large part of the lockdown, not having anywhere to go out to. And then the pubs opened and larger groups could gather, and Bob’s your uncle, all these unvaccinated and formerly isolated people meet up, hang out and share their infections around.

If you look at more nuanced age related statistic the highest infection group is 19 to 25. NEETs are 16 to 24.

Agreed, they WANT admissions to be high since there are so few deaths (and not just “from covid”, overall deaths have tanked for weeks)

Are we going to get less propaganda and more real news from GB News which begins this evening.

I live in hope, but will probably be disappointed

I hope too, they are more experienced reporters unlike the programmed ones we have now.

With Tom Harwood on the staff, I have very low expectations – I hope they are low enough that I will not be too disappointed!

The immediate signs are not promising, with BBC, ITV, and Sky apparently trying to throttle their news output by refusing GBN access to pooled news resources. We can all see what’s likely to happen next – access to the pooled facilities will be dependent on GBN agreeing not to rock the boat.

Seriously doubt it. Fully onboard with Covid forever I reckon.

Can I refer you to the NHS website and cancer treatment waiting time breaches from April 20 -21

thats 159310 thousand cases who were not treated within the basic NHS parametres, and most common failures are in Breast Cancer and Gyny Cancers, Way to go Boris you dont see those figures pasted up every day do you

Good post, thanks.

Now what was that Boris was saying the other day, something about society becoming more feminine? You need live females for that, not dead ones.

Anecdotally a friend said she knows an oncologist who specialises in breast cancer. He’s been twiddling his thumbs for the past 14 months. Like you say factor this into you stats fat man.

There can be no doubt, no doubt at all – that is a deliberate part of the whole scam.

If it is a scam then who is behind it? It could be the government, or it could be SAGE, big pharma, Bill Gates etc. (take your pick), and Boris and co. are too spineless/scared/stupid to stand up yo them.

A very good piece.

Welcome to our club.

This piece is vaccine propaganda, pure and simple.

I thought it was reaffirmation of the constant barrage of lies that we have been subjected to over the past 18 months. If it is propaganda to get me to be injected with an untested drug then it has failed miserably.

If it is propaganda to get me to be injected with an untested drug then it has failed miserably.

Yes it’s propaganda and I am glad it’s not working on you. Most doctors are so brainwashed concerning vaccines that it could even be unintentional, but still unlikely.

Looking at my down vote score I must congratulate 77th Brigade for working on Sundays, without pay I hope.

I think you miswrote your first posting which is why people down-voted you. Your second posting about doctors being brainwashed concerning vaccines implies you agreed with the article.

https://www.telegraph.co.uk/global-health/science-and-disease/face-third-wave-covid-19-die-may-already-have-cast/

The DT’s resident zero Covid advocate and vaccine pusher stirs up the readership to ask for more restrictions for longer….

My take on this is the following:

The share of the unvaccinated being infrcted is higher because the criteria have been changed for the vaccinated only, we are as a result now comparing apples to pears here and miss the vast part of infections amongst the vaxxed.

The vaccines have created the variants, mass vaccination is a huge mistake, the focus should always have been and be on treatment and prophylaxe and on focused protection.

Testing is useless, certainly as long as tests aren’t standardized.

Face masks and SD are not just useless but harmful torture, and the only thing needed to catch the asymptomatically infected (if transmission by them really exists, which is still highly doubtful contrary to the author’s claim and much more likely at the vaxxed now) temperature measurement, which is of course not done anymore but worked just fine last summer.

No test, no mask, no gene therapy for me, thanks. I’d rather get infected deliberately with the delta or any other variant.

Obesity is the driving factor for serious outcomes, not not being vaccinated, see swprs.org latest.

https://swprs.org/obesity-and-the-pandemic-new-insights/

And the absolute risk of death is still tiny and hardly reduced by the vaccines anyway- see all data and trial results.

If you are under the age of 70 and reasonable healthy, your risk of dying from the virus is as high as dying of any other cause unexpectedly, see Prof. Luckhaus, Germany’s top mathematician.

https://politikstube.com/professor-dr-stephan-luckhaus-zu-seinem-austritt-aus-der-leopoldina/

Stop the fearmongering and get a life!

Paul Nuki: purveyor of shite masquerading as science

Re the comment on obesity, I can’t help remembering that when BoJo was a patient on account of his alleged infection (I’ll set aside the issue as to whether it was true or not), someone released his body mass index; not good – albeit a good advert for whatever tailor he uses!

We all know Boris is a buffoon and a Liar. Neither of those precludes him from doing a good job as Prime Minister. His overarching character flawthough is that he is a COWARD.

Recent months? They were tossed away last March along with everything else we knew about medicine.

“A lot more dangerous than any virus”

Indeed. I think many of us reached that conclusion well over a year ago.

On hospital admissions : as a frequent visitor, it is obvious to me that hospitals are now opening up and trying to cope with the back-log generated by their politically-driven desk-jockeys. Activity has increased immensely compared with a year ago.

This will push up general admissions significantly, and, of course, in parallel,a rising number will be labelled ‘Covid admissions’ on the basis of false PCR-detected debris

The government`s Net Zero madness is going to require either coercion or psychology to implement, and Covid has given them some useful clues…

I attempted to post the following on order-order this morning and free speech was naturally prevented.

If anyone finds this too offensive well do let me know:

Its very easy.

Look at ourworldindata and compare the Vindaflu ‘cases’ in India with the UK.

Then move the line for the UK forward to match the Indian graph and you can see we are where they were back in April, 4 weeks before Vindaflu proved to be a damp squib, I mean peaked.

That’s where the experts are hoping we’ll be in 4 weeks time at the peak of the Vindaflu wave and then it’d obviously be impossible to relax anything and we would in fact need harsher lockdowns – as they’ve been so effective so far.

Obviously this does require you to ignore:

a. The two massive spikes (which we had and India didn’t) as that will mean a lot of people have natural immunity to Vindaflu and the highly profitable experimental prophylactic treatment and any positive effects it may have.

b. The naughty Indians have half a hospital bed/1000 people (UK 2/1000 last 2017 data) generally poor healthcare and sanitation yet have done surprisingly well by using WHO banned treatments like Ivermectin.

c. That Ponzi schemes exist and supposedly smart people keep falling for them.

No idea why this would be censored in a country of free speech

These days it is difficult to find a country of free speech. Do you know of any?

To continue Project Fear the govt issued to following propaganda poster

If anything starts with the word “Government”, don’t waste your time reading it!

Brave words, correct data. Having been a statistician and modeler for business years ago I have tracked the data relentlessly. I agree Covid is deadly, to a narrow corridor of people. I agree long Covid exists, as it does with seasonal flu and other viral diseases (reminder, one symptom that puts you in this category is depression…enough said).

But words like “exponential growth” are pure fear mongering. Yes we went from 2k to 4K, but we did not go to 16k this time. Or 256k. If they wants to use 3k as the baseline we would have to have 9k new cases.

We have bee surge testing in hotspot communities. Beyond the fact this is driven by the overstated fear of asymptomatic infections, it makes sample comparison. If you reduce testing elsewhere and test a hotspot you cannot compare last week’s 3k to this week’s 7k. I appreciate the work of Tim Spector, and I agree cases have gone up. In hotspots. In Oxford we had 13 positives yesterday. Our local trust has 3 Covid patients. 3 of the 1089 patients. Or .6% of capacity.

It is past time for this government to provide firm data and firm targets for the ending of masks, social distancing and the rest. If it is cases, they must justify why these pose a threat when the numbers are small and have had a small increase (.55 to .60 of capacity). Tell us on Boris what data (not date) will you base your decision on. We deserve that after 15 months of your abuse of our natural rights!

Safe means never!

Why surge test the bees, and for what? Of course, they’ve manipulated the meaning of safety and risk, and the accuracy and tolerance of any tools in use, largely to promote their own position.

Of course, they’ve manipulated the meaning of safety and risk, and the accuracy and tolerance of any tools in use, largely to promote their own position.

Awkward from the BBC “And of 42 deaths in people with Delta variant infections, 23 were unvaccinated and seven had received only one dose. The other 12 had received two doses more than two weeks before.”

19 vaccinated deaths and 23 unvaccinated. Not that much in it.

Welcome aboard !

LONDON

Mon, 14 June, 12 noon till late

Downing St, London

MONDAY https://gab.com/emoji/1f511.svghttps://gab.com/emoji/1f510.svghttps://gab.com/emoji/1f513.svghttps://gab.com/emoji/1f929.svg

JUNE 14TH , BE THERE

1O DOWNING STREET

12 PM

EXERCISE YOUR RIGHT TO PEACEFULLY GATHER.

All the acceptance of authoritarianism … Seems to me that the CCP has more control over the west than our leaders would have us believe, will the white elephant aircraft carriers stop the soft engagement with useful idiots like Blair and help us get our freedom back?

Methinks not.

Perhaps what we are seeing is fulfilment of Lord Acton’s dictum: “Power corrupts and absolute power tends to corrupt absolutely.”

As a chum of mine said to me – “Even Hitler didn’t mange to close Britain’s pubs.” It’s some power to be able to do that.

Blooming well said sir!

Absolutely fabulous piece.

A perfect summation, thank you very much. I’ve forwarded it to my MP. I know he’ll be able to do nothing; he’s a newbie MP and thus will only do what he’s told. But it will embarrass the servile plonker when I keep on reminding him of his craven attitude on a regular basis – up until he loses his seat on the gravy train at the next election. Hopefully.

Good idea, and I will forward it my (completely useless) MP, who ALWAYS, in spite of being (because?) in the CRG votes FOR the government every single time. My contempt for:

Politicians, Civil Servants, quangocrats

Bishops, a large number of the clergy

the BBC, most national newspapers

is boundless.

Your comment about the smoking technique is half way there. The theory of wearing ‘face coverings’ is supposedly to reduce risk to third parties. They are absolutely useless to the wearer, most of the time in this context (not writing about proper industrial masks etc). A minor tweak might be: A café man is happy to exhale known toxic compounds to the general public.

The last two sentences are spot on, though.

It was never about Covid or public health,it was always about getting as many people as possible jabbed. We can only speculate as to what will happen as a result but it won’t be good.

Wow! What a great article. Many thanks for that.

This piece is a cracker, which I have forwarded to both my Twitter and Facebook pages.

The key bit that resonated with me was this:

Generally speaking, I’m an adherent to the ‘cock-up’ school of disaster rationalisation – but the last few months have changed my mind.

That’s just it. Even the most conspiracy averse of us – in which I include myself – are now being forced by events to conclude that there is indeed “something rotten” going on.

I guess that Power corrupts, and…

Julian Jessop (retired doctor)

Couldn’t agree more. What has really bothered me during this whole episode is the total refusal of government and the DoH in particular to engage with real scientists and clinicians. When clinical medicine is determined by statisticians, epidemiologists, public health doctors, physicists etc it is a betrayal of medicine. Like the writer I am a retired NHS consultant, one who actually has experience of managing the syndrome that causes Covid-19 – the cytokine storm. I have read the definitive textbook on the subject. I have offered my help and advice. I have had no acknowledgement and, indeed, as the Sceptics website reported a while back, it is apparent that any communications from outside the system were simply binned. So it’s not only not medicine, it’s not even science.

Do I detect some difficulty on the author’s part in keeping one’s temper? Yes I do. I am in the same boat!

Thank you for making an effort.

It is very obvious that they do not want ‘outsiders’ to their narrative being involved, or to participate in sharing better or good practice – or even consider that there is an alternative viewpoint.

Can I ask why you and others such as the author of this piece have not taken and are not taking this up with the GMC and the Royal Colleges? Complaints from persons such as you would be treated with far more seriousness than those from the general public. It seems to me that if individuals such as Michie or Vallance thought they might be at risk of striking off/expulsion for misconduct they might start withdrawing their objections to lifting lockdown.

A great article.

My only argument is with graph 3 which is what the doomsters use to show that it’s more dangerous for the young. This would be better using actual numbers rather than percentages to show the decline across the older age groups with little (if any) change for the younger groups.

Really excellent article that poses all the key questions. First time I have commented here in well over a year of being registered with the site. Thank the writer!

“or why vaccinated people are prevented from foreign travel,” Why can’t those unvaccinated travel surely if you had the jab and are “protected” you don’t need to worry about other people’s medical history? And if the “vaccine” doesn’t work then it doesn’t matter whether you’re “vaccinated” or not ! It all totally illogical.