Earlier this week, the price on gas contracts in Europe went briefly negative. It was obvious this was a bubble, and a dive into the justifications for negative prices shows the whole thing was based on market speculation. I wrote an article for UnHerd noting that false signals like these were extremely dangerous because they breed complacency about the energy crisis.

Right on cue, articles are coming out telling us the crisis is over. The Financial Times journalist Chris Giles is ahead of the pack with a piece titled ‘The End of Europe’s Energy Crisis is in Sight’. When I read the title I groaned and expected Giles to make the case that the negative price in the market earlier in the week was a real market signal and not a wanton speculative excess.

Thankfully, he does not go in this direction. Instead, he claims that “it occurred because liquefied natural gas supplies keep arriving in Europe when storage facilities are effectively full”. What he fails to mention is that our lack of capacity to process massive amounts of LNG puts our energy supply at risk this winter, but no matter.

Giles goes on to mention the sabotage of the Nord Stream pipeline, noting that analysts expected this to harm European energy markets: many, he claims, thought it would cause the price of gas to shoot up. This is untrue – at least for serious analysts. When Nord Stream was sabotaged, it was operating at basically zero capacity. Low gas supply was already ‘priced in’.

Giles then waxes lyrical that the German economy has not yet collapsed, as many predicted. But of course, those predicting negative outcomes for German industry foresaw them coming by the end of winter, not the middle of autumn. According to my calendar, winter does not start for another two months.

Then Giles introduces an argument with some substance. He cites what he calls a consultancy – but which is actually a green energy lobbying group called Ember – and makes the case that renewables have been used in place of gas for electricity generation.

Dirty coal and clean renewables have been used to substitute for gas in electricity generation. Analysis by Ember, a consultancy, has found that there was a record year-on-year increase in solar and wind electricity generation across the EU between March and September.

Okay, this is a substantial claim. If wind and solar can be brought online quickly enough to replace large amounts of Russian gas, then Giles may be onto something. The Ember briefing paper makes specific quantitative claims in this regard:

Based on the average EU benchmark TTF Day Ahead gas price for March to September 2022, this additional gas would have cost the EU €99 billion. The year-on-year increase in wind and solar generation resulted in 8 bcm of gas savings, making up €11 bn in avoided gas costs.

Here we go: the increase in renewables apparently produced 8bcm (billion cubic meters) in gas savings. Let’s take this at face value. How much Russian gas did it replace?

Bruegel data tells us that Russian gas supply from March to September 2021 was around 80bcm. This fell to around 42bcm in 2022, a shortfall of around 38.5bcm. If Ember are correct, renewables managed to replace nearly 21% of this in 2022. And if we continue to shut off Russian gas next year, they’ll replace around 10% of the shortfall. These numbers are not to be sniffed at, but they’re not the gamechangers Ember or Giles make them out to be. If this is substitution, it is modest substitution.

But are the Ember numbers correct? Any statistician should look at them with suspicion. Why? Electricity generation fluctuates from year to year. Just because it increased between 2021 and 2022 does not mean that some revolution took place. The fluctuation could have been random. This is where Giles’s claim – based on Ember’s paper – comes in. He writes about a “record year-on-year increase”. Specifically, Ember cites a 13% year-on-year increase as being one for the record books:

In total, wind (192 TWh) and solar (153 TWh) generated 345 TWh of electricity across the EU from March to September this year — a record year-on-year increase of 39 TWh or 13%.

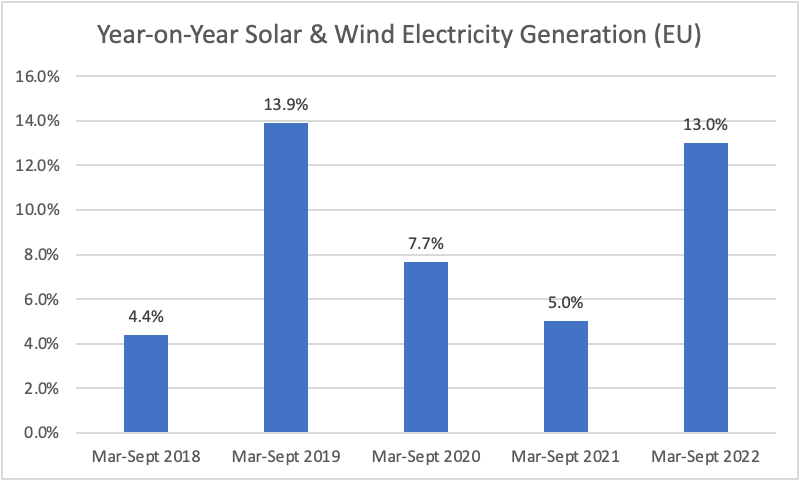

Well, we can check this because Eurostat publishes the numbers. Here are the year-on-year increases in renewables (wind and solar) usage in EU electricity generation.

Here we immediately see that the Ember claim is false. In March-September 2019, wind and solar usage increased around 14% – higher than the 13% increase it cites this year. Note that this is with only five years of data – a miniscule sample – making its grandiose claims even more difficult to take seriously. But even if it hadn’t flubbed the numbers, 13% just isn’t that much. The average growth rate between 2018 and 2021 was 7.7%. A 13% increase is high, but not stunningly so. To see real substitution at work we would probably wanted to have seen a 50% increase or something in that ballpark.

Finally, Giles says the market will sort out the rest of the problem by ramping up LNG capacity. He cites no data in this regard – the market just does things like that, or something. I have explained what would be required of the LNG market to replace Russian gas in a Twitter thread here, so readers can refer to that. In summary: LNG is almost certainly not going to replace Russian gas anytime soon. This is obvious if you take a serious look at the numbers.

We all know what is going on here. Since the war started in February, many journalists have seen their role as cheerleaders. They have strong feelings about the war and so they want to minimise the potential downsides. Many predicted sanctions would crush the Russian economy. They didn’t. Instead, we got a serious energy crisis in Europe. Now the game is to ‘prove’ that this crisis does not exist. Or, at the very least, to try to downplay its severity and map out a path forward.

Let me try to appeal to these people’s own interests. If we continue to get policy in Europe wrong, Europe will become weaker relative to Russia. It will become poorer and unable to send arms to Ukraine. This is obvious. So if you are in a position to influence economic policy, your wartime duty, as it were, is to ensure that policymakers and businesspeople have a solid grasp of the actual problems – so they can deal with them effectively. If journalists try to find the best ‘spin’ to put on the problems, rather than helping us face them head on, they will weaken Europe and strengthen Russia.

I have no idea why people cannot grasp these obvious points. Although I suspect it has something to do with the dark powers wielded over them by the little blue bird.

Philip Pilkington is a macroeconomist and investment professional. You can follow him on Twitter here and subscribe to his Substack newsletter here.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

‘has found that there was a record year-on-year increase in solar and wind electricity generation across the EU..’

For how long? Wind/solar generation from installations dotted around the land/sea scape for a few hours or days in a week give a misleading aggregate amount. They cannot provide continuous supply, no matter how many, so cannot maintain a stable grid, nor be reliably called on to meet increased demand.

Germany started its ‘energiewende’ over twenty years ago, has spent hundreds of billions of €uro, installed 30 000 windmills.

So why is it so reliant on Russian – or any – gas, running 30 coal-fired stations and opening more?

There are no equivalent alternatives to fossil fuels to provide transportation, heat, light, cooking and to power industry.

When will these people stop lying?

Their biggest lie is the word “renewables”. The truthful word is “unreliables”.

One of the follies of it: https://www.climatedepot.com/2022/10/21/goldman-sachs-jeff-currie-3-8-trillion-of-investment-in-renewables-moved-fossil-fuels-from-82-to-81-of-overall-energy-consumption-in-10-years/

The difference between Germany and the UK: 40% coal vs 2%, 15% gas vs 40%.

https://www.achgut.com/artikel/was_die_briten_wirklich_ruiniert

Bird choppers and solar panels are not green friendly and produce little energy relative to our needs. Max they can claim might be 8% and this is after 30 years of endless tax monies used as ‘investments’. All of this nonsense is subsidised by me, the raped taxpayer. A £Trillion industry gorges itself on this debacle. The faux science and faker models are propaganda. Fossil fuels are nothing of the sort (a Rockefeller lie). Gas is the 2nd most plenteous liquid on the plant and self generating. It is clean. So is nuclear. Plant food has 0 to do with climate (falls out of climate processes). Gaia emits 95% of plant food. Kill her to save her. Climate fascism is just that. Another brain dead cult equalled in its audacious stupidity and totalitarianism by Rona. The 2 are the twin bastards of the NWO.

https://www.conservativewoman.co.uk/the-climate-scaremongers-the-electric-car-nirvana/

Tucker Carlson on Fox News saying that the USA has 25 days of diesel left…!

Europe is also short of diesel…..what do you think is going to happen?

It’s utter clown world. The West is in the very very deepest shit, and yet just keeps pretending they are not….

If I had no responsibilities and wasn’t and old git, I’d be heading to the global south…Thailand possibly, as fast as my feet would take me.

Total collapse imminent….