The G7 countries – the U.S., U.K., Canada, France, Germany, Italy and Japan – have provisionally agreed to impose a price cap on Russian oil. The cap will apply to crude oil from December 5th and refined products from February 5th.

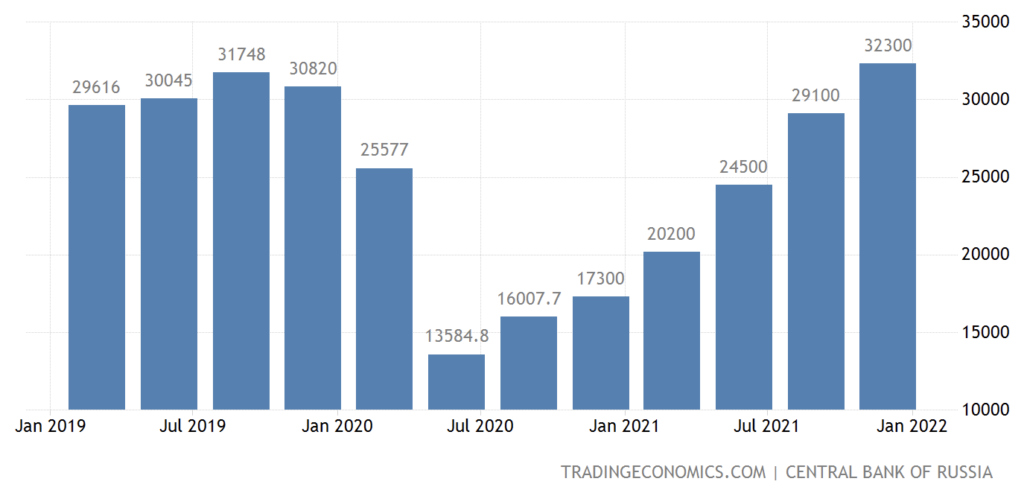

A major reason why Western sanctions haven’t turned the rouble to “rubble”, as Joe Biden said they would, is that Russia has been earning huge revenues in the oil and gas markets – thanks to elevated prices of those commodities. Western countries want to put a stop to this; hence the oil price cap.

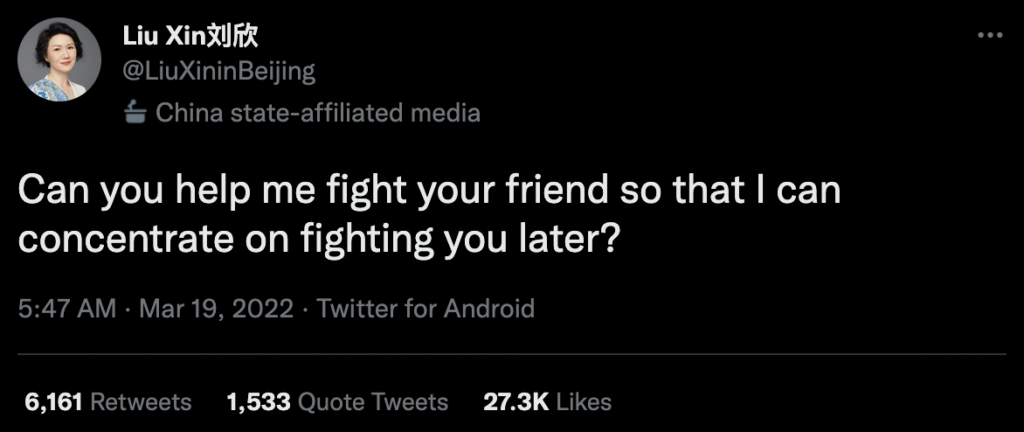

But why a price cap? Why not just threaten sanctions against any country that buys Russian oil? There are two reasons. First, other countries – especially China – wouldn’t stand for this. Second, Western countries don’t actually want Russian oil to leave the market. They want it to keep flowing – just at a lower price.

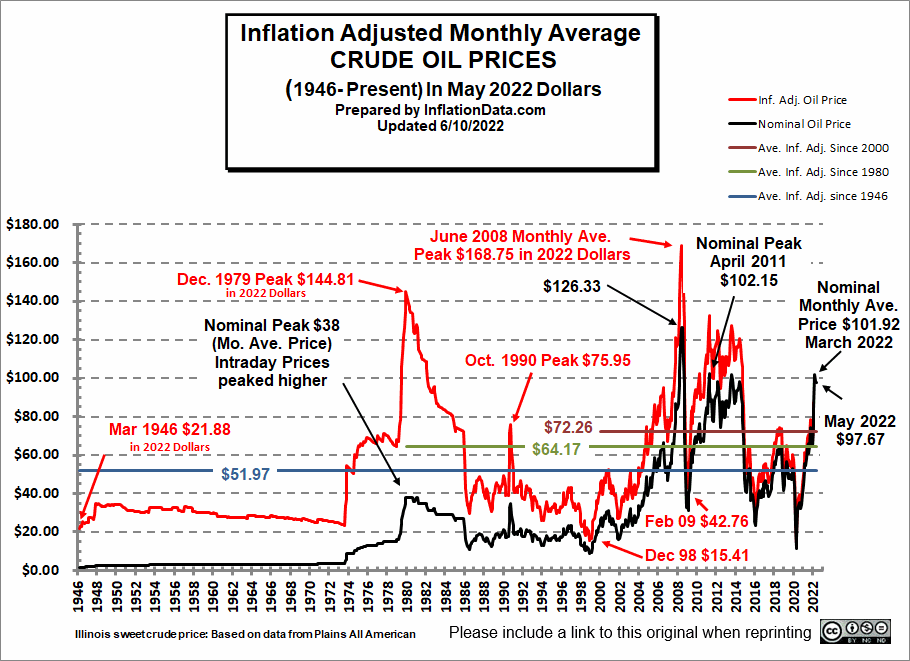

Why is that? If Russian oil left the market, the price of oil would skyrocket. Since the end of the Second World War, the inflation-adjusted oil price has never exceeded $170 per barrel. But if Russian oil was no longer available, it could reach more than twice that level – bringing the world economy to a standstill.

The logic behind the price cap is that the oil price remains relatively stable, but Russia ceases to earn outsize profits. So how will it work?

Western countries actually do have some leverage over Russia when it comes to oil. Much of the shipping and insurance services that facilitate the distribution of Russian oil is based in Europe (shipping in Greece; insurance in London). The plan is to announce that such services will only be available for shipments where the agreed price is below the price cap.

Suppose the market price is $100, and the price cap is set at $50. India proposes to buy a shipment of oil from Russia. Western shipping and insurance services will only be available if India agrees to pay $50 per barrel or less.

Russia has already warned it won’t sell oil to any country that imposes a price cap. But the West is hoping Russia will be forced to comply. After all, shutting down oil wells is expensive and risks scuppering future production.

Now, Russia did manage to cut production during Covid when demand for oil cratered. But proponents of the price cap say it won’t be so easy this time, as Western oil companies have gone and taken their expertise with them. Sceptics, however, say that Russia knows how to manage its own oil industry.

Successfully cutting production would presumably hurt Russia, but by less than you might think. Remember there’s a quantity effect and a price effect. Russia would be selling less oil, but would be earning more money per barrel.

Another possibility is that major buyers like China and India refuse to go along with the price cap. So far, India’s petroleum minister has said he will “look carefully” at the proposal, while noting he has “moral duty” to Indian consumers – not the West. Meanwhile, China’s Foreign Ministry has called for “dialogue and consultation”, which has been taken as lack of support. (That China would oppose the price cap is hardly surprising.)

So how will Russia’s customers get their oil if Western shipping and insurances services aren’t available? Some people claim that tankers can be rerouted from elsewhere, and that Russian or Asian companies can provide insurance. Others claim there’s no enforcement mechanism. What’s to stop a customer paying the price cap, and then making up the difference with a side payment?

Indeed, if the price cap falls well below the market price – which is the whole point – won’t every buyer in the market want Russian oil? Why pay $100 per barrel for Saudi oil, when you can get Russian oil for $50? Buyers will then bid up side payments until the ‘true’ price of Russian oil is close to the market price.

The best-case scenario for the West is that Russia complies with the price cap and side-payments are small.

What seems more likely, though, is some combination of production cuts and alternative distribution channels – which will hurt both Russia and the West. Russia will earn less revenue, and Westerners will pay more for their oil (at a time when Europeans are paying vastly more for their gas).

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Sorry Toby, the Top heads of Israel knew that Hamas was going to attack. Just as many wars of the past had leadership allow first strikes so they could wield “just war” propaganda.

Try being a little skeptical. It will give this site more validity.

Heres a list of some:

Fort Sumpter Lincoln’s Civil War

Lusitania: Wilson’s War

Pearl Harbour: The Pacific War against Japan

Gulf of Tonkin: Vietnam

on and on…

Agree. I used to take so much history at face value but in the last few years I’ve learned not to want to understand events as black and white, good vs evil. That’s what being sceptical and free-thinking is all about. I know the majority of people on this site would like to be sceptical but seem to have become lazy or jaded by the onslaught of reality. You can’t pick and choose and should apply the same sceptical standards to all events otherwise you lose credibility and respect.

And perhaps some of the downtickers would explain why they disagree?

I’d take the down-tickers as a badge of honour. I get a fair few from time to time for breaking the party line, water off a ducks back etc….

Anyway, I agree with your point. I do find its only a short distance between being sceptical, ie. going further into the details to see if the face and the guts come from the same creature, and seeing *everything* as a fabrication or part of some hideous scheme. I do think there is a hideous scheme in play, btw, but when the ‘rabbit-holers’ disappear down their particular favourite (chem trails and nano-bots as examples…) you can leave me out. Just keep asking ‘Why they are telling us this, and who benefits from it.?’

“You can’t pick and choose and should apply the same sceptical standards to all events otherwise you lose credibility and respect.”

I would like to challenge this.

I am not sure it is healthy or desirable to be sceptical about everything one hears. Through experience and intuition, we naturally trust some sources and people more than others, and the corollary of that surely is that one is more sceptical of some sources and people than others. For example, we have learnt definitely not to trust The Trusted News Initiative and its founder, the BBC, whereas we are much more likely to trust people like Peter McCullough and Brett Weinstein.

I do think it healthy and desirable to question everything one is told and do one’s own research as much as possible. However, I agree that one can’t be on top of everything all the time. We have to make judgements on particular issues in order to function but we should always try to be open-minded and able to change our opinions when new facts become apparent to us. I’m not inclined to trust anyone or institution that suggests it knows best. Interesting you mention Peter McCullough and Bret Weinstein. I think they have their limits in questioning the narrative, especially concerning the “novel virus that caused a pandemic and killed millions of people”. JJ Couey has an interesting take on this because so few will question whether it was a viral pandemic rather than a man-made pathogen (bioweapon which could be any toxic substance) that was distributed to cause respiratory illness and then it was the protocols (from ventilators to Remdesivir) that killed people. (See his presentations to MD4CE on Charles Kovess’s rumble channel.)

Today’s leaflet Climate Change Conference Cops And Robbers

latest leaflet to print at home and deliver to neighbours or forward to politicians, media, friends online.

“Reform U.K.’s surging support could cost Tories up to 35 seats”

It’s going to be a great deal worse than that.

“Despite her flaws, Liz Truss was ahead of her time”

‘All the right notes, not necessarily in the right order’

“Prince Harry loses latest legal challenge against Mail on Sunday”

‘The thickest man in England’

This is good news but Hamas are still holding hostages, which means they have leverage, so what’s to stop them demanding the release of more Palestinian terrorists? Unless these newly arrested men can give info to the IDF on where the hostages are being held it surely is looking increasingly doubtful the remaining captives will get out of this alive. This is why it’s unrealistic and naive to say Hamas will ever be destroyed. As long as the ideology is there ( and shedloads of prisoners being released ) Hamas will always be an entity, no matter who you kill or imprison.

”Photos and videos shared by Israeli journalists on social media show scores of men surrendering to the Israel Defense Forces (IDF) in the neighborhoods of Jabaliya and Shejaiya in Gaza.

Some videos from correspondents in the region reportedly showed the IDF arresting dozens of men who surrendered and were being checked to determine if they were operatives for Hamas or Islamic Jihad, both Palestinian terror groups operating out of Gaza.

“Jabaliya and Shejaiya are ‘centers of gravity’… for terrorists, and we are fighting them,” said IDF Spokesman Rear Adm. Daniel Hagari. “They are hiding underground and come out and we fight them. Whoever is left in those areas, they come out from tunnel shafts, and some from buildings, and we investigate who is linked to Hamas, and who isn’t. We arrest them all and interrogate them,” Hagari says in response to a question at a press conference.

“Hamas fighters surrendering here in seemingly large numbers,” wrote defense analyst Jonathan Schanzer on X/Twitter. “This is a good sign, if the trend continues. Questioning them will also lead to more intelligence that could also help bring a speedier end to this phase of the war.”

https://www.algemeiner.com/2023/12/07/hamas-terrorists-surrendering-large-numbers-israeli-forces-reports/

The Hamas prisoners may have been released to buy back hostages, but I don’t think any of them should plan a long retirement. No-one said that the IDF couldn’t shoot them another time….

Germany continues to be the architect of its own slow demise. All of those more suitable countries between Pakistan and Europe but they must be admitted into Germany apparently, and how many are actual extremists or terrorists?

”The first flight of 188 Afghan migrants expelled from Pakistan for living in the country illegally has arrived in Leipzig as the German federal government vows to accept vulnerable Afghans who don’t wish to return to their Taliban-governed homeland.

According to Zeit Online, the charter flight that touched down in Germany this week from Islamabad was the first of its kind since the Pakistani government announced in October that it was adopting a mass deportation program for an estimated 1.7 million Afghan illegal migrants from the country citing national security.

The move was announced after new data revealed a majority of suicide bombings in Pakistan this year were carried out by Afghan nationals.

“There are no two opinions that we are attacked from within Afghanistan and Afghan nationals are involved in attacks on us. We have evidence,” Pakistan’s Interior Minister Sarfraz Bugti said in October.

Germany, however, seems intent on offering safe passage to Europe for a number of those at risk of deportation.

Under its federal admission program, Berlin identified 44,000 Afghans who face possible persecution by the Taliban, as well as their eligible family members, who they want to bring to Germany.

At the end of November, around 11,500 Afghans were still waiting for admission to Germany, including 3,000 currently living in Pakistan.”

https://rmx.news/migration/pakistan-is-deporting-illegal-afghan-migrants-en-masse-and-germany-is-taking-them-in/

Supporting evidence to demonstrate how stupid Germany are and how the government evidently despise the people. Wonder if Germany are doing that bone test to see how many ‘minors’ are actually adults….

”Asylum claims made in Germany this year surpassed 300,000 in November, representing a 60 percent increase on last year’s figure with one month still to go.

Data published by the Federal Office for Migration and Refugees (BAMF) showed that 35,316 initial applications were submitted last month, taking the total for 2023 to 304,581 first-time applicants which rises to 325,801 when accounting for follow-up applications.

The figure does not include Ukrainian refugees of which over 1 million have arrived in Germany since the Russian invasion of Ukraine’s eastern territories in February last year.

The asylum crisis has deteriorated significantly this year with applications soaring by 60.3 percent from the 189,998 claims made in 2022.

Of the tens of thousands to arrive last month, 61 percent were Syrian or Turkish citizens. Asylum claims from Turkey have surpassed those from Afghanistan despite the number of Afghan claims increasing by 53 percent.

The BAMF figures revealed the consistent demographic trend of over 80 percent of asylum applicants being males over the age of 16.”

https://rmx.news/migration/asylum-crisis-in-germany-worsens-as-over-300000-new-claims-made-in-2023-so-far/

A subcomitee hearing in USA about twitter censorship:-

https://www.youtube.com/watch?v=FNj_asppG98

Not sure why you’ve been downvoted. As always, it seems like US mainstream politics and media on the political right are much more awake to what’s going on in the world than we are here.

Could be anybody. Including somebody from you know who (brigade 77 that sort of thing). Anybody in the world can down/up vote, not just registered voters.

The video shows the levels of U.S government and government agencies interference and control of social media posts. There’s little doubt that the U.S mainstream media is similarly controlled by the same agencies in terms of which stories are reported (and buried) and what “the official line is”.

Thank God that we can trust the impartial and transparent reporting of the British media – particularly the BBC.

Senator Rand Paul about war and debates about war (or lack of them):-

https://www.youtube.com/watch?v=TyqoKZ99WcI

He’s a star. He invoked this: War Powers Resolution – Wikipedia to enable him to speak about it. Reading the history of that resolution, it seems like Congress has repeatedly tried to stop Presidents involving the US Military in conflicts around the world, and Presidents have repeatedly ignored them.

“We didn’t just close down our coal-fired power stations, we blew them up”

Hitchens is far too clever for the audience and for Moonbat in particular. They cling to their crusade desperately ignoring that 70% of the world doesn’t believe any of this Climate nonsense. When a volcano can issue forth more CO2* in a few weeks than man is supposed to have produced in 200 years, where is their case that anything we do will have the slightest influence on anything.

*The central premise that CO2 is a poison gas is the most stupid part of the biggest lie.

I am starting to think that they invented this as the most absurd narrative they could think about and then wanted to see whether it would be believed.

If so, anything would henceforth go and could be exploited.

They were right.

“A Labour win will be a disaster. Too many Tories don’t care”

Lord Frost has a point.

Take education. Labour’s idea of reform..let’s reform the bits that still work, grammar schools and private schools….and then make sure all pupils can only attend ‘bog standard’ comprehensives:

‘All the international evidence suggests (Bollocks. Have a look at India.) that the most successful systems, those that do break the class ceiling by reducing the gaps in achievement linked to family background, don’t segregate children into different types of schools. Labour should pledge to phase out the 11-plus test, tighten up the admissions code to end flagrant social selection and ensure that no school can achieve the best Ofsted grade, or whatever alternative Labour brings in to judge schools, unless its intake is representative of its local community.’

Fiona Millar

We know that doesn’t work:

https://www.spectator.co.uk/article/when-it-comes-to-education-scotland-is-an-example-of-what-not-to-do/

In Finland, where education is as good (if not better) as any worldwide?

‘There are private schools in Finland, but they offer the same education based on the national education plan, just like public schools. Private schools get funding from the state and cannot charge fees’ AACRAO 11 March 2022

So, essentially, vouchers (in fact proposed by Labour, opposed by Ms Millar)

Of for heavens sake!

Not any more. Look East for proper education

https://www.euractiv.com/section/politics/news/finnish-education-system-fails-to-improve-performance/

‘Finland’s immigrant kids had the lowest reading scores in the Organisation for Economic Co-operation and Development.’

Crawford Kilian 30 Jan 2023

That’ll do it…….

‘“I am convinced that Finland is still the ‘best’ national school system, along with Estonia — best-trained teachers, fairly distributed resources, highest learning return for hours spent studying, free school meals and health support. But I am not surprised that learning outcomes are dropping.’

‘Helsinki schools that give first graders their own iPads “to learn Finnish at home.” In upper grades, “most everything is digital,” even though education and health authorities say kids should be limited to two hours of screen time daily.

“The unlimited and uncritical proliferation of 24-7 digital access down to very low ages has, in my opinion, contributed to the collapse of reading, especially among boys, the elimination of movement at recess, and an avalanche of classroom distractions, compounded by laptops handed out by schools at ages 12 or 13 with no filters or limits, laptops that are often being used as entertainment devices during class time without teachers knowing (screens face away),”

“All of this hurts learning and displaces physical activity. It is rarely talked about here, despite a tidal wave of global research associating excessive screen time and excessive social media use among young people with a wide range of risks to mental health, physical health and lower academic achievement.”

‘1. Stop spending money on unnecessary and unproven K-12 classroom technology, which means most of it. And minimize classroom and recess digital distractions.

2. Take the huge amount of money you’ll save and launch a national campaign to encourage young people (and parents) to read paper books from age seven, and to apply healthy limits to screen time.

3. Hire many more special education teachers.

4. Hire many more physical education teachers. Make physical education classes three or four times per week instead of one or two. Unlike technology, physical activity is an intervention with solid evidence for improving academic achievement, well-being and mental and physical health.’

https://thetyee.ca/Analysis/2023/01/30/Shine-Off-Of-Finnish-Education/

Now there’s a thought……..

P.S. I wonder if private schools are a bit stricter on use of iphones/IT in this country?

Clue: yes, they are….

So kneel wants to make them even more expensive.

What a total no hoper……..

Education in the UK is based on ‘The Prussian Model’ developed in the late 1700’s and early 1800’s by Prussia to provide an ‘appropriately’ educated hoi poloi who could fight Napoleon. It teaches basic skills but also encourages love of country and disciplined subservience to the state through a top down imposed curriculum. Nothing has really changed across western europe since. School has nothing to do with learning, nothing outside of what the government wants you to know for their benefit. If we taught people how to learn and educate themselves in what the citizen wanted to know (The trivium) , no-one would get taken in by our insipid, corrupt politicians again.

I would add that not too long ago, we had an excellent three tier higher education system.

CFE/Technical colleges for trades

Polys for jibs that could be complex, but did not require degrees – e.g. Architecture.

Uni for the brightest.

Indeed, West Germany adopted and has retained that approach since WWII. Until recently; we dumped it for Uni for all. And it shows.

Children will be segregated into different types of schools regardless, because some state schools are quite good, usually in well off areas (or should we call them “economically less diverse” areas now, who knows?), and some state schools are quite sh*t, usually in less “posh” parts of the town/country. I used to live in St Albans, and the go getting tiger parents would move there from London to give their children private-quality schooling without the fees. Of course they were still paying the “fees” in the form of insane house prices and enormous mortgages (not to mention the pressure of finding a house in the ever-decreasing catchment areas), but presumably Sir Keir will be putting an end to that kind of thing as well?

Climate video:-

https://www.youtube.com/watch?v=tqcDyHdbYd4

Maybe not to everybodies taste, but interesting non the less.

“A Labour win will be a disaster. Too many Tories don’t care”

Lazy assumption from Lord Frost. Everyone in the centre and right gave Boris a tremendous mandate to do stuff to make our country better. They were not ‘Tories’ but people who can see the destruction of our nation before our eyes and wanted the government to pursue altogether different policies. The opportunity was right there, in his hands, but it has been squandered.The Blue Socialists have been a disaster and have turned people, perhaps in perpetuity against the Tories.