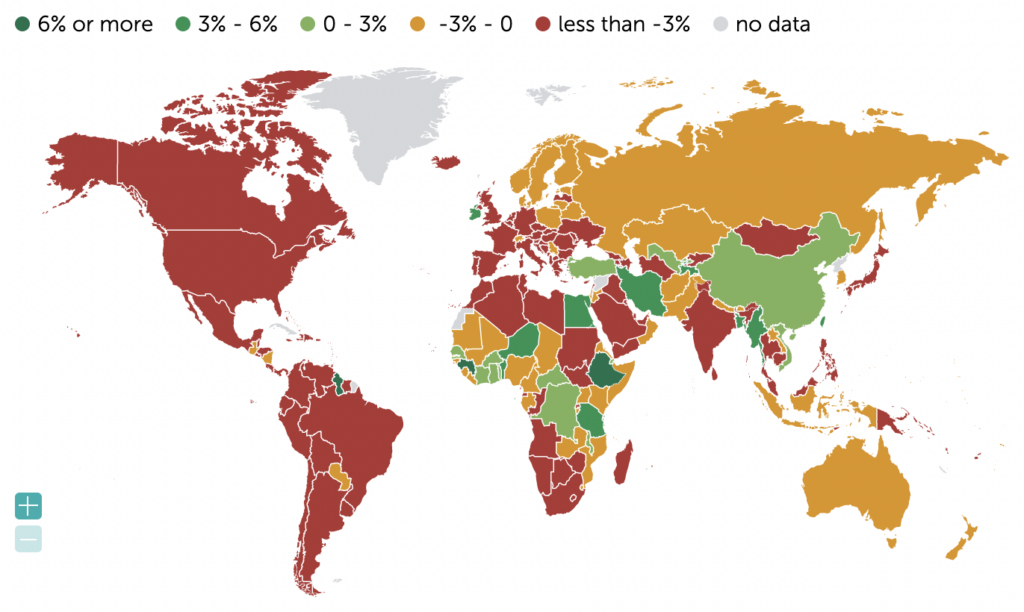

In 2020, the first year of the pandemic, almost every country in the world had a major recession. As this map from the IMF shows, most countries in Europe saw GDP decline by more than 3%, the only exception being Ireland (which in any case has an unusual way of counting GDP).

Despite this, unemployment in the EU only increased by a modest 1.2 percentage points, rising from 6.6% to 7.8% by the third quarter of 2020. One reason why unemployment didn’t rise more during months of lockdown is that governments spent unprecedented sums of money on furlough and other wage-support schemes.

In other words, they paid people to sit at home all day. For example, The U.K.’s Coronavirus Job Retention Scheme paid furloughed workers 80% of their previous salary, up to a cap of £2,500 a week.

While such wage-support schemes had the benefit of preventing large rises in unemployment, they had the cost of being extremely expensive. Data published by the ONS in January of this year show just how expensive.

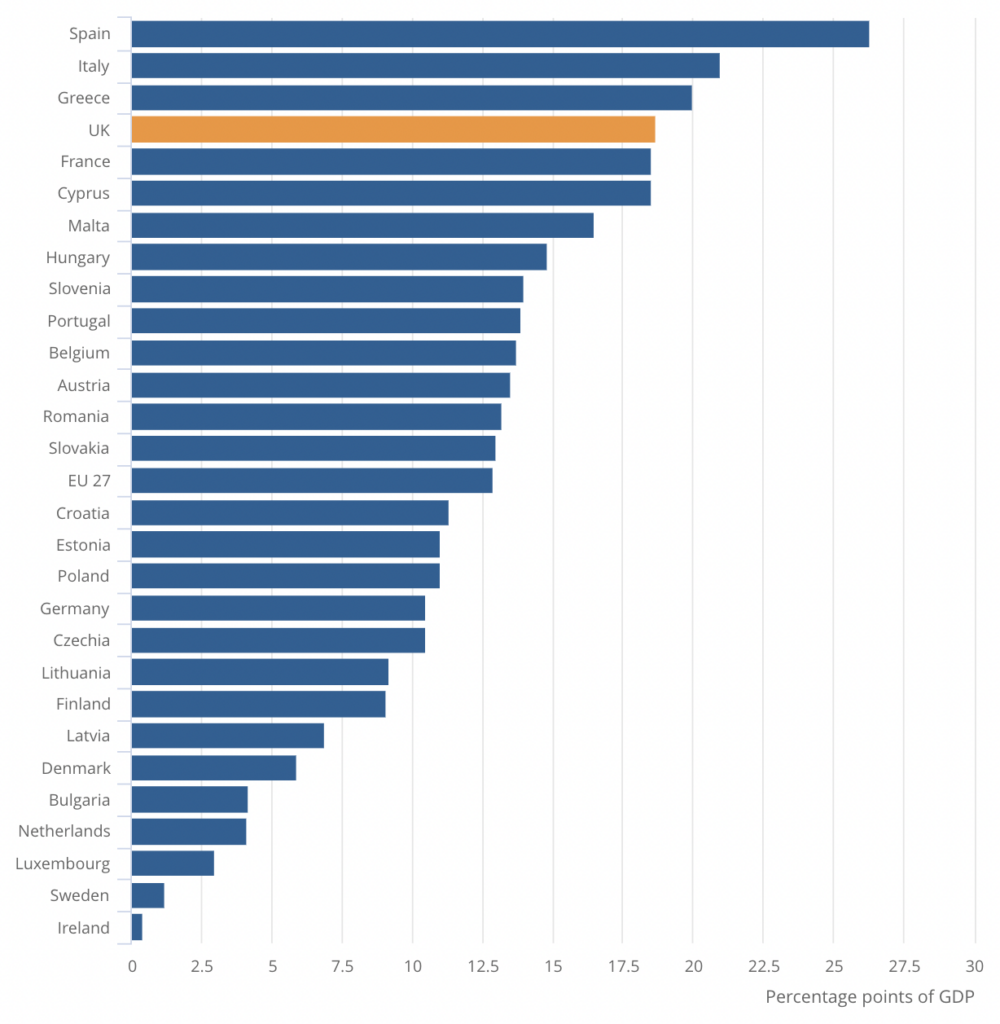

The chart below shows change in general government gross debt (as a percentage of GDP) in percentage points from the fourth quarter of 2019 to the third quarter of 2021:

Many countries saw absolutely huge increases in debt. Over just seven quarters, Spain’s debt grew by 26 percentage points, Italy’s by 21 percentage points, and Greece’s by 20 percentage points. The UK wasn’t far behind, logging an increase of 18.7 percentage points.

At the other end of the spectrum, Ireland’s debt grew by less than one percentage point, while Sweden’s grew by only 1.2 percentage points. Of course, Sweden’s strong performance comes as no surprise, given it was the only major European country that didn’t lock down in the spring.

As I noted previously, The Economist ranked Sweden third in a league table of 23 rich countries for overall economic performance during the pandemic. And we know this didn’t come at the cost of Swedish lives – the country actually saw negative excess mortality between January of 2020 and June of 2021.

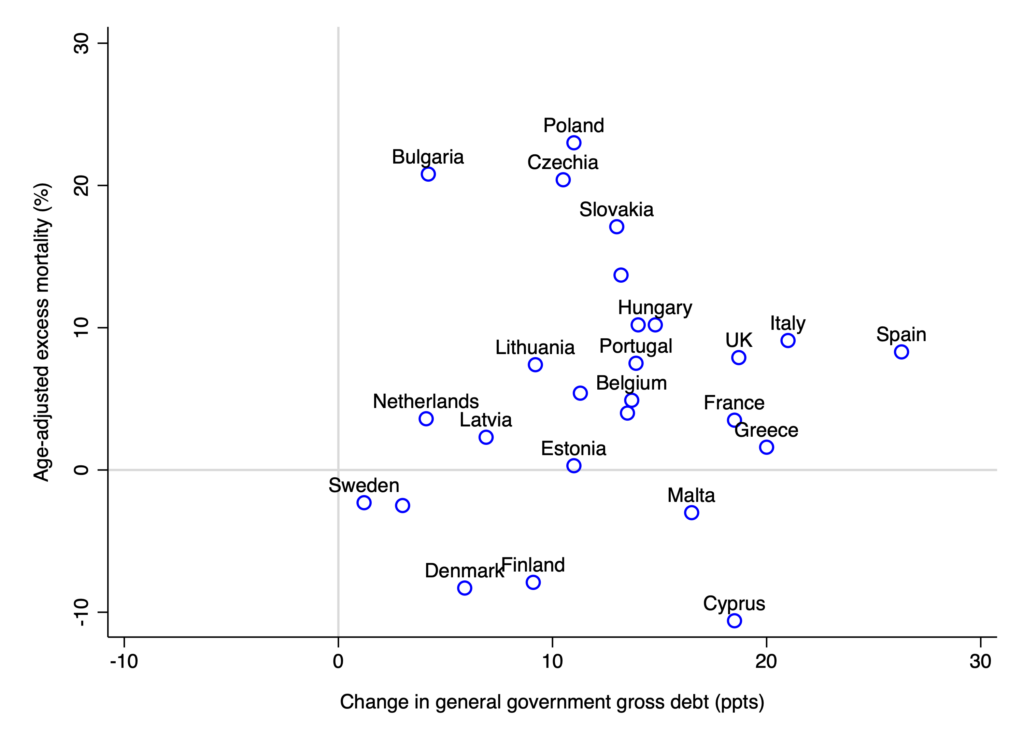

To compare European countries in a comprehensive way, I plotted change in general government gross debt against age-adjusted excess mortality. (Data were not available for Germany, Ireland, Norway and Switzerland.)

Taking into account both metrics, Sweden was one of the best overall performers in Europe, along with Luxembourg, Denmark and Finland. And it was by far the best performer among countries with a population over 10 million.

By contrast, Eastern European countries and large Western European countries – almost all of which had strict lockdowns – did poorly on both metrics. So lockdown was harmful to the public finances, with little corresponding benefit in terms of reduced mortality.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Glaringly missing is Israel damningly hauled in front of the International Court of Justice on genocide.

Of course it’s missing from most news headlines in the MSM. So remember if they don’t want you to hear about it guess what that generally means…

Opening argument: Genocidal intent

https://youtu.be/0or-RacPDiM?si=ep64wvwjWN_Z1z0w

Closing argument:

https://youtu.be/yhsWyBWGoCU?si=Hn00TXHbOwe8UHcl

In a well timed attempt to deflect attention from the disgrace of Israel, the US bombs the poorest country in the world and its capital city in Sana.

https://www.dailymail.co.uk/news/article-12954065/US-UK-launch-airstrikes-Iran-backed-rebels-Explosions-heard-Yemen-Houthis-reporting-enemy-raids-Sunak-said-no-defensive-options-left.html

When in doubt bomb the brown people.

When in doubt allow:

‘The General Assembly today adopted by consensus a resolution requesting an advisory opinion from the International Court of Justice on the obligations of States in respect of climate change’

‘Turning to the Court’s budget, she also informed the General Assembly the Court is experiencing one of the most dynamic periods of its history. “Members of the Court are honoured by the confidence that the international community continues to place in the Court,” she said. However, resources allocated to it do not match the significant docket increase, she reported, expressing hope appropriate adjustments will ensure adequate resources to continue to meet the growing needs of the international community.’

UN meetings coverage

Be very careful what you wish for…….

Believe me I’m not happy about any of this. It has been predicted and it fits well with globalist plans, that the US is supporting televised genocide as the final straw in the collapse of the unipolar system.

The actions of the US and Israel, the last trully ethnic supremacist and hence ultranationalist state will unite the world to reinforce globalist institutions to prevent this from ever happening again.

Thats not what I would want either. We lose in all scenarios.

It’s also worth noting that, as pointed out elsewhere, the number of people represented by the countries supporting SA’s suit is well over 1 billion, significantly more than the US/UK/EU combined. Worth thinking about.

https://ejmagnier.com/2024/01/11/south-africa-corners-the-judges-of-the-icj-to-stop-israels-war-on-gaza/

….South Africa’s decision has received considerable international support. The 22-member Arab League and the 65-nation Organisation of Islamic Cooperation back it. In addition, a diverse group of nations, including Belgium (vice Prime Minister), Colombia, Saudi Arabia, Pakistan, Brazil, Morocco, Nicaragua, Turkey, Jordan, Malaysia, Bolivia, Venezuela, the Maldives and Namibia, have also expressed their support for South Africa’s legal action. This broad support underlines the global concern over the situation in Gaza. It reflects a collective call for accountability and justice in the international arena. ….

In this context, South Africa’s case against Israel is profoundly significant. By legally challenging Israel’s actions in an international forum, South Africa is not only seeking accountability but also striking at the heart of Israel’s international image and legitimacy. The case symbolises a broader global dissatisfaction with Israel’s policies, particularly on the Palestinian issue.

The potential impact of this trial goes beyond its immediate legal implications. It represents a significant moment in international relations, highlighting the growing willingness of nations to confront and challenge powerful states through legal and diplomatic channels. This shift reflects a changing dynamic in international politics, where public opinion and moral considerations are increasingly influential.

It also serves as a reminder of the importance of respecting international law and norms. It underlines the principle that no nation is above the law regardless of its power or alliances. The outcome of this case could have far-reaching implications not only for Israel and its allies but also for the international legal system and the enforcement of global justice.

Unfortunately, the carnage in Palestine will just be used to highlight the problems of superpower politics and reinforce globalist models of governance.

The best move would be for the US to stop Israel from committing genocide by ending its supply of weapons and aid.

All this would stop, but instead they choose to widen the conflict. That kind of irrational and irresponsible behaviour can only be explained by elements in the deep state intentionally wanting to commit international pariah status.

Or maybe it’s just a mega cock-up.

You are right, that would stop the fighting. Jews in the area would be exterminated and the problem, for the middle east, would have been resolved.

What Hamas and Iran would then do to Egypt, Jordan and the other neighbouring countries can be imagined from what has happened to Lebanon, once a lovely and multi religious nation.

Fantastical arguments used to maintain an infected wound on global relations.

What happened to Lebanon can be directly traced to Israeli policies from the 1967 war onwards.

Agreed, and there has been much discussion on various geopolitical forums on exactly this and other related issues. What the SA suit has done, however, is for the first time (and IMHO most comprehensively) question the special status and exceptionalism of Israel in the international arena. No one dared before because of the weaponisation of the usual slurs – which have lost power in recent years because of the utterly indiscriminate way they gave been applied. Regardless of outcome (and I’m not hopeful of justice prevailing) the idea is now out there in the zeitgeist. If the US-led ‘rules based order’ (their rules, their order) of international law and global justice fails here, multiple countries will shift their allegiances elsewhere, to the significant political, economic and reputational loss of the West.

Back in April 2020, government adviser Robert Dingwall said much the same as Fauci in relation to social distancing accompanied by “conjured out of nowhere”.

Yes, it’s ‘back of the fag packet’ stuff, like so much of the guff that comes from our interfering government. six feet distance for covid, only drink so may units a week, five veggies a day, or is it ten now? There must be more.

Leave us alone, for heaven’s sake.

Common sense surely dictates that we ignore government announcements intended to modify our personal lives.

I will not comply.

Brownstone Institute did a good article a while back on the Wharton Business School tech bros who felt the enormous sense of entitlement to come up with back of an envelope rules for millions of people:

https://childrenshealthdefense.org/defender/america-covid-pandemic-lockdown-jared-kushner/

Although the AfD in Germany are riding high in the polls I’m a bit cynical about this latest claim. I think what one wants to happen and what is possible in reality are two entirely different things most of the time. But wouldn’t ”remigration” of the riff raff by the million be awesome?

”The AfD has been promoting its policy on “remigration” as of late, but focusing primarily on migrants convicted of crimes, whom Germany has been unable to remove. However, although there are hundreds of thousands of migrants who are “tolerated” in Germany, the figure of millions presented by Springer would represent a far loftier goal in terms of deportations.

In a statement earlier this week, the AfD detailed a long list of offenses involving migrants during New Year’s celebrations, including the case of three migrants knocking a doctor unconscious on video in a Berlin hospital, a 20-year-old Somali beating a woman with a fire extinguisher on a train near Schwetzingen, and a Ukrainian migrant hitting a 46-year-old with a bottle in Bad Lippspringe.

“Everyday life in the ‘colorful republic,’ Such everyday conditions are shocking and make it clear: 2024 must be the year of remigration! Anyone who vandalizes restaurants and train stations, attacks doctors, or riots on trains has no place here and must be deported immediately. Action must finally be taken,” wrote the AfD in its statement.

Springer’s message on deportation comes at a time when the AfD just hit a record high of 24 percent in a new national poll from YouGov, a poll result once thought unthinkable by most just a year ago.

Some X users have taken a victory lap over AfD’s surging poll numbers.

“New Forsa surveys! AfD Saxony: 37%, AfD Thuringia: 36%, AfD Brandenburg: 32%. Do you finally understand it, dear old parties and old media? It doesn’t bother us that the AfD wants #Remigration. On the contrary, we – and more and more Germans – are voting for the AfD BECAUSE they want remigration!” wrote one user.”

https://rmx.news/trending/we-will-return-foreigners-to-their-homeland-by-the-millions-afd-politician-vows-mass-deportations-as-his-party-reaches-record-polling-high/

Covid Con Great Care Home Cull

latest leaflet to print at home and deliver to neighbours or forward to politicians, media, friends online.

The man’s a fool. Everyone knows it should have been 2 metres. The extra 17cm were crucial.

But blimey, I had no idea Bret Weinstein ever had this stance regarding the face muzzles. The 180 that some ( inc the learned and respected ) folk have done… 😮

https://twitter.com/LawHealthTech/status/1745706660822384716

Apparently he supported lockdowns initially.

Yes, and metric is science, innit?

‘Hours before the U.S. and British strikes in Yemen, the U.S. military said the Houthis fired an anti-ship ballistic missile into international shipping lanes in the Gulf of Aden’

At last….some resolute action.

‘”This strike was two months overdue, but it is a good first step toward restoring deterrence in the Red Sea,” U.S. Senator Roger Wicker, the top Republican on the Senate Armed Services Committee, said in a statement.

In December, more than 20 countries agreed to participate in a defensive U.S.-led coalition, known as Operation Prosperity Guardian, safeguarding commercial traffic in the Red Sea.’

Reuters 12 Jan 2024

The very people who will complain about this action will also have been complaining about a rise in the cost of living

As a consequence of Houthi interdiction of commercial shipping in the Red Sea, longer shipping times, higher freight costs and an energy price shock all contribute to a rise in the cost of living.

If you wish for peace, then prepare for war.

Useful observation piece by Larry C Johnson on US/UK direct action against Yemen:

https://sonar21.com/will-crossing-the-rubicon-in-yemen-expose-u-s-and-u-k-weakness/

This bombing is unlikely to achieve any meaningful degrading of Yemeni missile and drone capabilities, but it will rally more of the global Arab and muslim street to the side of the Houthis. It also raises the risk that the Houthis, who up until now had only targeted ships linked to Israel, will expand targets to include U.S. and U.K. vessels. Important to remember that the U.S. and U.K. ships can only spend a limited time in the Red Sea before they have to set sail for a port, such as Dubai, where the destroyers can replace the empty VLS missile tubes.

I think it also is likely that U.S. and U.K. embassies, consulates will be attacked and that commercial enterprises viewed as U.S. or U.K. will be targeted. Nabil Khoury, a former deputy chief of the US mission in Yemen, appeared on Al Jazeera and observed, “the attacks on Yemen are a “failure of American diplomacy.” He also noted that as a result of these actions:

Yes that is a far better action then restraining your rabid killer dog nation Israel.

If it had been your country, your people, how would you have wanted your government to respond to an attack exactly similar to that of October 7th on Israel?

How should the Israeli government have responded, in your view?

“How Lord Arbuthnot became Post Office victims’ most trusted voice”

Why has Andrew Bridgen been airbrushed out of the script along with the former PO executive who now works for ITV.

Just asking.

My thoughts exactly.

What the WHO proposals are really about and why our elites really love and want them:

https://brownstone.org/articles/the-whos-managerial-gambit/

“Technocrats learned a lot from Covid. Not how to avoid policy mistakes, but how to exercise control.

These proposals will make next time worse. Not because they override sovereignty, but because they will protect domestic authorities from responsibility. States will still have their powers. The WHO plan will shield them from the scrutiny of their own people.

The WHO proposals are a shell game. The scheme will provide cover to domestic public health authorities. Power will be ubiquitous but no one will be accountable.

The WHO proposals would not replace or define the meaning of constitutional rights. But they would not be irrelevant either.

The WHO is not undermining democracy. Countries have done that over time by themselves.

The WHO proposals will protect power from accountability. National governments will be in on the plan. The people are the problem they seek to manage. The new regime will not override sovereignty but that is small comfort. Sovereignty provides no protection from your own authoritarian state.”

The German professor who correctly calculated an over 200x larger QALY loss than benefit of lockdowns has now calculated that the current migration leads to a €5.8trillion higher net cost instead of a benefit in Germany.

https://jungefreiheit.de/politik/deutschland/2024/raffelhueschen-zuwanderung-kostet-58-billionen-euro/