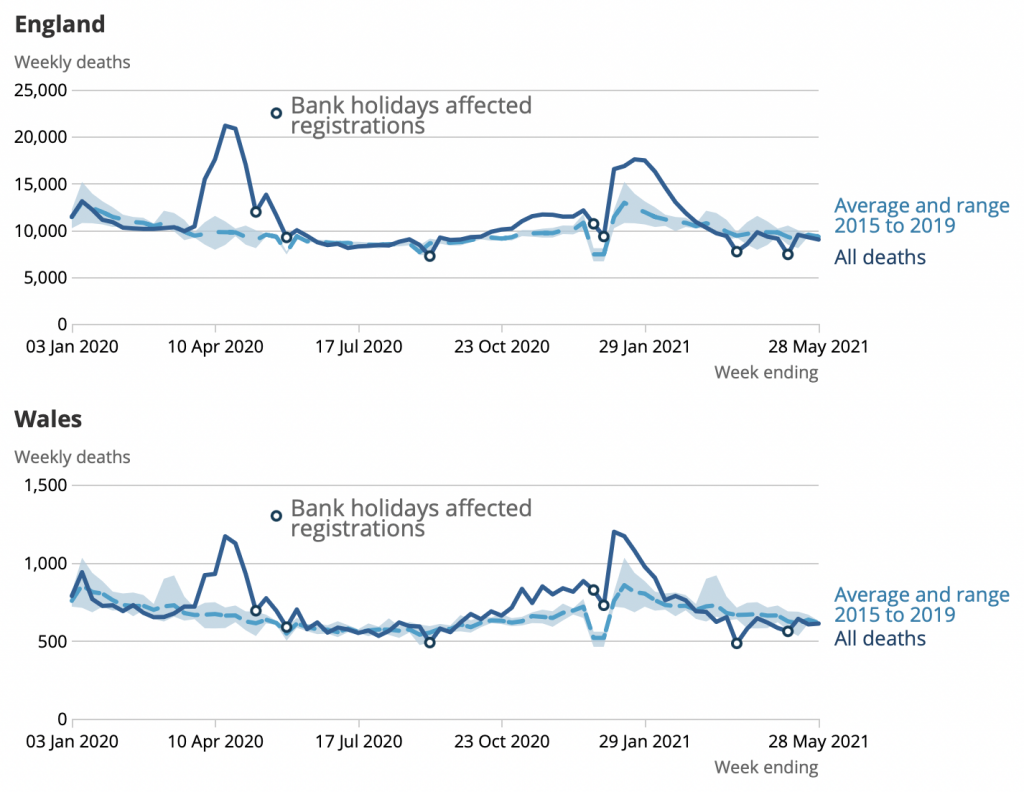

On Tuesday the ONS announced that there were 9,628 deaths in England and Wales in the week ending 28th May 2021. This is 232 fewer than the previous week, and 3.1% below the five-year average. Here’s the chart from the ONS:

Deaths in England and Wales have now been below the five-year average for 11 of the past 12 weeks. Over that time, there were 8,212 fewer deaths than you’d expect based on the average of the last five years. And note that, due to population ageing, the five-year average understates the expected number of deaths. So the true level of “negative excess mortality” is even greater.

The number of deaths registered in the week ending May 28th was below the five-year average in seven out of nine English regions. (Only the North East and North West saw positive excess deaths.) Compared to the five-year average, weekly deaths were 7.5% lower in the East of England, and 8.1% lower in the South West.

As I’ve noted before, the most likely explanation for persistent “negative excess mortality” in England and Wales is that deaths were “brought forward” by the pandemic.

Given these figures, and the fact that around 80% of adults now have COVID antibodies, it is difficult to see what possible grounds there could be to delay the full reopening. Indeed, the costs of remaining lockdown measures must be so vastly disproportionate to the benefits that the Government’s dithering – as Daniel Hannan has noted – is surely a function of status-quo bias.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Of course these ludicrous actions could also be explained as intentional policies attempting to blow up the errant British economy that voted for Brexit and has a sizeable population of antiAgenda pro freedom people.

All these policies also push us towards the Great Reset obvs. You can’t Build Back Better without Breaking us first.

Exactly ! The PTB sheep dogs are on their final round up of us towards the closing gate of the WEF Pen ! Surely the author can see it’s all part of their so called bbb agenda !!….

The lower paid working class are already dependent on the State for top-ups now they are in the process of extending that to the middle earners as well. I think you are right it’s all part of the plan to get as many as possible dependent on the State.

Hence the push towards UBI which was a spectacular failure in Finland

Not just Britain. It is all over the West, but I think Neil Oliver’s latest monologue is correct. This will pass, but we little people need to fight for that passage to be sooner.

These are not “errors” or “blunders”. They are all part of the deliberate plan of creating financial misery for the people, just like the energy and food deprivations in the name of “climate change” and the degrading of public health via the toxic injections. All so that they can pretend to make it all better by imposing their Great Reset.

Add in unprecedented sickness levels and staff shortages due to a loss of work ethics thanks to lockdowns, miseducation et.al., plus far too long too easy money followed by an ill-timed and misguided policy of increasing interest rates, which only drives costs and inflation up further when done in such situations, see Paul Craig Roberts on that.

As with any government and civil service policy action over the last 30 years, doing the opposite of what they did would have been and will remain the correct course of action, the one in the national and the normal citizens interest.

I’m not sure why the dig at tax cuts at the end? Sunak and Hunt’s plan to raise corporation tax is not exactly going to stimulate business out of recession is it, it will hit SME’s harder than the big corp’s so my guess is they are just playing to the lobbyists but whatever the reason it seem ill conceived to me.

“although Australia went without one for 30 years”.

Only by sticking to a Ponzi scheme of mass immigration to inflate the country’s income and keep driving demand, as well as good luck on commodity prices when it mattered.

No structural reform.

Ah, I see, it was all poor management that brought us to this place, piss poor planning. A more careful study will reveal that we are where we are as a result of very careful planning. Extremely evil planning but as it turned out well executed.

Until we accept the extreme evils we are up against a concerted fight back cannot begin, not least because cock-up theory provides the gateway for the “amnesty,” and some people will do anything to avoid confronting horrific reality.

It is time to be honest with ourselves and forget salvation via the ballot box, that route was closed in March 2020. Only naiivety and stupidity, or perhaps a combination of both keeps this myth alive.

We all need to be a lot more candid and face a brutal fact – our executive, acting on the orders of God knows who, but the Davos Deviants will do, are seeking a massive cull of our population, the demolition of Britain as a nation and a country and enslavement of those that survive the onslaught between now and 2030.

So let’s drop the damned excuses and start treating our situation for what it is – the greatest crime against humanity ever inflicted on this planet.

The problem with this story is that it is based on a BoE forecast. If they were any good at it action would have been taken before now to control inflatioin, for example.

That’s a fair point.

Politicians burn our money future and dreams

Yellow Freedom Boards – next event

Monday 14th November 11am to 12pm

Yellow Boards

Junction A332 Kings Ride &

Swinley Rd, Winkfield Row,

Ascot SL5 8BP

Stand in the Park Sundays 10.30am to 11.30am – make friends & keep sane

Wokingham

Howard Palmer Gardens Sturges Rd RG40 2HD

Bracknell

South Hill Park, Rear Lawn, RG12 7PA

Yellow Freedom Boards – next event

Monday 14th November 11am to 12pm

Yellow Boards

Junction A332 Kings Ride &

Swinley Rd, Winkfield Row,

Ascot SL5 8BP

It’s a mistake to focus on the technical definition of a recession. For some of the reasons set out, we have and are witnessing a significant attack on the living standards of people in the West, by the actions of our political class. That’s the larger story here.

I have an issue with the narrative ‘money printing during lockdown is causing inflation’. It actually already did, during lockdown. If you pay something for nothing, when you used to pay something for something, that’s infinite inflation.

For example, paying that waiter a salary, to stay at home not waiting table, that’s inflation. That it doesn’t show up in CPI numbers is besides the point. This is sometimes known as ‘shrinkflation’, i.e. the chocolate bar staying the same price but the content reduces.

We may now be experiencing a second wave of inflation due to lockdown spending, as people start spending the money that they saved during lockdown, and also as people are slow to return to the labour force.

With regards to taxing and spending – Liz Truss should have stood her ground. The mistake was to not announce spending cuts at the same time as the tax reductions. The story of how Truss caused the gilt market crisis is deeply unfair.

(What happened was that yields had been rising through the year. I bet some pension funds just let the leverage in their investments drift up during that period. That then poised the market for what happened, a death spiral of fire selling leading to prices falling leading to further fire selling. The phrase for this is a ‘long squeeze’. It must also be added that the Bank of England responded too slowly and very ineptly. Enough for one to almost wonder if there was an agenda.

The contents of the mini budget had been very well flagged prior to the announcement so it’s disingenuous to suggest it took the market by surprise. It seems like the timing was unfortunate, as it was made into a period over a couple of weeks when the market had been a bit weaker than average.)

With regard to taxes, all that matters is that they don’t disincentivise work, or skew work towards unproductive areas. The truly conservative thing to do is to cut government spending. It is the level of government spending and regulation of the economy (spending in another name as regulation just means the government ordering you to spend it in a way that they see fit), rather than the level of taxation that is the true measure of the economic oppression suffered at the hands of government. I would much rather have the money I pay in tax be put on fire than spent on the government’s priorties.

As for a recession – there is no real need for economic activity to fall in any period, although it can of course happen by accident. If the government stayed bullish (Trump style) and the Bank of England kept its mouth shut, then there would be no recession.

Inflation can be self supporting once people realise how fast the value of cash in hand is reducing. Forget about the idea of waiting for the price to fall when considering to buy something, e.g. You won’t get a discount while waiting for one.

The other side of the coin is deflation, which is why the BoE likes some inflation, rather then negative values. In that scenarios, firms go bust while most of the prospective customers wait for the price to fall.

That’s an odd article as everything criticized in it has an obvious technocratic solution, namely, do it the other way round. It’s especially true for the point about refineries: Private companies, especially publically traded private companies owned by investors, don’t care if their commerical enterprises provide a necessary infrastructure service, only if a profit can be made by doing so. Hence, they’ll gladly cause long-term damage to avoid short-term losses, counting (as usual) on the state, that is, the taxpayer eventually being forced to pick up the tab.

It is a focus of companies to make a profit, as without a profit they cease to exist. Infrastructure is only built by private enterprise if the political and economical environment is perceived to be stable enough to warrant the investments with a long term view of a potential return.

In an environment where governments have knee gerk reactions, and issue edicts for a quick fix to a perceived problem, then a company has chioces to make, and bottom line becomes shall I stay or shall I go, or if you prefer, can I make a profit and stay in business or not.

The tax payer does not pick up the bill for failed business, but for failed policies that incurred the business closures.

One of the big problems we have in the UK is that too many people are disconnected from the fundamental ‘wealth generating’ part of the economy. We’re now in a position where the non-productive part of the economy is ruling-the-roost, and believes that they are more important than the productive — we’ll end up with the productive being increasingly beaten up (economically) while the unproductive call for even more cash to support their needs.

Cripes, I did not know this! Apologies, not related to the above article;

“The word is now out. The Democrats sent tens of billions to Ukraine and then laundered this money back to Democrat pockets and funds in the US. Now the company is bankrupt and the funds are nowhere to be found.” Why am I not surprised?

https://www.thegatewaypundit.com/2022/11/breaking-exclusive-tens-billions-transferred-ukraine-using-ftx-crypto-currency-laundered-back-democrats-us/

I wonder why digital ID advocate Tony Blair and Bill Clinton were at a FTX conference? That strengthens my opinion that anyone encouraging the use of cryptocurrencies is not to be trusted. I think these currencies are being used as a stepping stone to the introduction of Central Bank Digital Currencies using blockchain technology and all the opportunities for totalitarian control that will create.

Yes my thoughts exactly. And Blair and Clinton are both shady as hell.

“Shady?”

Are you not rather downplaying the evil of these two somewhat Mogs?

It’s deliberate. You can only aim to “Build Back Better” ……. ie gain control of entire populations …… if you first destroy their economies including energy and food security.

Anyone who votes for one of the Establishment Parties is endorsing the deliberate destruction.

Let me see if I have this right.

(1) Massive government deficit set to soar further because of tanking revenues in the next 2 years.

(2) No option to raise interest rates to check surging inflation because mortgagees will default en masse and become homeless.

(3) No option to keep interest rates low, because sterling holders will dump, crash the exchange rate, and send costs of imports, and therefore inflation, soaring even further.

Sounds to me like we’re shafted.

For some time it’s been a mystery what we in the UK do for a living, apart from retailing imports, holding meetings, engaging in miscellaneous bureaucracy,…

We seem to have a leisure economy that depends on disposable income. Question: Suppose, after paying for food, energy and housing, there is no disposable income left. What happens to a leisure economy?

The writer of this article misses the bigger picture. Our economic problems are caused by Keynesian economic policies which are utterly corrupt and rob the people of their money by inflating the monetary supply – creating money out of nothing then lending it out on interest – causing inflation. We need to go back to sound money and a gold standard so that governments and central banks are not able to print money and spend as much as they the like.

A fair comment, I would suggest at the moment the markets and governments are concerned about all that money they created assisting financial expansion, will inevitably implode into a vacuum where money has no further value.

I can’t help feeling that the crypto currencies have evolved in an attempt to have some means of trade exchange if and when it all goes TU. Its only pit fall is that it is not tangible. For anything like Crypto to work, first they have to make everything cashless. You then have to ask yourself. If the governments can’t use tangible currency effectively, are they going to be any better with Crypto?

I think we know the answer to that.

Our journey back to sound money is called the Great Reset

It requires the world’s central banks to take back control of the issuance and spending of money by digital means – the so-called central bank digital currencies.

So by ‘expiring’ or ‘programming’ money its value can be geared to, i.e.in step with, economic acivity.

In other words money equals a stake in an economy’s wealth – and not its debt.

Nice idea.

But a short step away from totalitarianism and serfdom with a rampant black market.

Poverty all round.

While what has been said is true and the result of cras stupidity by our government how come we have the chancellor who caused most of this stupidity now as PM. The biggest problem for my business and many others in the UK is that this idiot Sunak has intoduced punative corporation tax levels(twice those of the Irish republic) which will ensure no business will want to invest in the UK and those that are already investing will go elsewhere. My business and others rely on companies building offices, distribution resources and retail outlets, which also provide employment. Who would, while this anti business twit is in charge? Of course as a supporter of the Chinese communist party Hunt will love it when we fail thanks to his actions. It is no good trying to increase Tax income based on short term gains if it means our country will fail miserably in the longer term. The idiots in our current government have set us on this course of long term failure and the hedge fund spiv that Sunak is will probably gain from it.