Bond yields are soaring to their highest levels in almost 30 years and sterling is sliding, but the Chancellor is nowhere to be seen. Where is Rachel Reeves and why won’t she address the markets her failed Budget has spooked, asks Matthew Lynn in the Spectator.

The Government’s economic strategy is facing its first real test, and where is the Chancellor? So far Rachel Reeves has been silent, preparing for a jaunt to China. At some point Reeves will have to address the markets – or risk turning a round of jitters into a full-blown crisis.

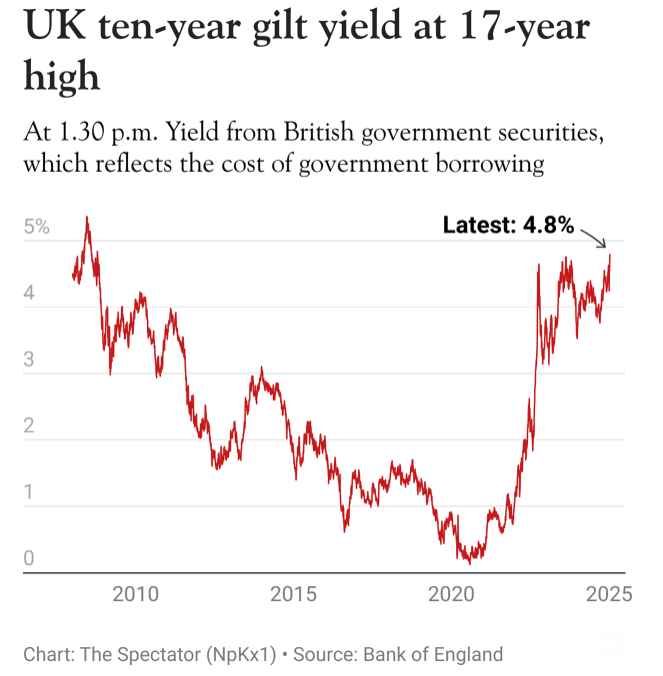

Over the last few days, the markets have turned decisively on the U.K. Yesterday, the yield on 10-year gilts hit its highest level since the financial crisis of 2008, while the yield on the 30-year gilt hit the highest level for 30 years. The U.K. is now paying more to service its debt than Greece, and very soon that will mean rising mortgage rates, and more companies going bankrupt. There is no mystery about what has happened. Investors have worked out that Reeves’s Budget, with its mix of big increases in borrowing, and higher company taxes, has failed, and will trap the economy in stagnation. The result? They are demanding more to lend money to the U.K.

Worth reading in full.

Meanwhile, Liz Truss has sent a cease and desist letter to Keir Starmer demanding that he stops claiming she crashed the economy, calling it “false and defamatory”. Her lawyers cite a report from economist Andrew Lilico, who tells the Telegraph that far from crashing the economy, “the thing that happened immediately following the mini-Budget was that the economy performed well”:

It’s not as though the economy was expected to go really fast and Liz Truss made it go a little bit slower than was expected. The thing that happened immediately following the mini-Budget was that the economy performed well. So it’s just preposterous to claim that she crashed the economy. Exactly the opposite happened. The economy did better than had been expected.

So Truss didn’t crash the economy, but Rachel from Accounts has.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Where is Rachel from accounts?

It’s 2nd Thursday in the month and on her to-do list today is filing last month’s invoices and printing the wage slips.

The Princess of Theeves is hiding in the Number 11 broom cupboard with a Do Not Disturb notice on the door.

Rayner is on a building site back in Adswood knocking up another council house to make some more ackers out of on the side.

Lammy is in the Caribbean hunting for any sugar plantations overlooked by Wilberforce and the Royal Navy two hundred years ago.

Phillipson is checking the VAT returns and getting all the whiteboards changed back to blackboards.

And last but not least, Sir Kia is in Islamabad canvassing for the voters of the future.

Drôle.

Ultimately in a capitalist economy, whether you like it or not, the markets will pass judgment on your competence. The signs are not good for Rachel from Accounts.

To be fair on her, and with compassion towards a fellow human being, it can’t be easy for her. She must know she is incompetent. She knows she sexed up her CV. She knows she is being hated by a lot of people. This must put a lot of psychological stress on her.

Downticked you, sorry, I have no compassion for her. I feel sorry for the people she is exposing to misery because of her incompetence!

That’s OK, you can disagree.

But despite everything, she is still a human being. Incompetent, hopeless, out of her depth. She should admit it and resign. But even if I had absolute power over her, I would only want her to resign. Nothing more than that. So that’s my compassion.

JOpenmind – I agree with you. I have plenty of sympathy for people in poorly paid jobs who are stressed as they struggle to pay day to day bills because of increased taxes and increased costs due to inflation.

I feel sympathy for stressed people in the lower layers of organisations with impossible workloads working for tyrannical managers.

I feel sympathy for stressed people juggling family responsibilities with work.

I have zero sympathy for Rachel Reeves and similar people who use ruthless determination to climb the greasy pole – and then find it stressful due to their own uselessness and incompetence. Entirely self inflicted.

My view is 100% science driven. For those who are OK with Anglo Saxon language – see dial here: https://tenor.com/view/dont-care-bs-whatever-stop-gif-22436087

Also no compassion. If her mendacity is now causing her stress as she realises that she is not up to the job, the solution is simple – resign.

Karma. When she gets a bit more experience in life she’ll learn about balance and how the universe cannot abide a credit without an equal and opposite credit. Tell a lie and bad things have a habit of coming back to bite you.

Human? I dispute that.

I have no compassion for failed Lefties ever. I hope their life is totally miserable.

At least she knows what a woman is!

Good! If one is too arrogant and/or deluded to pay heed to the judgment of others then they deserve all the opprobrium heading their way.

Here is a list of things I find ridiculous.

— Rachel Reeves

— People who think that the UK economy depends on what Rachel Reeves does.

— People who think that the price of UK debt depends largely on what Rachel Reeves does or says.

I couldn’t rank them though. Quite how ridiculous they esch seem depends a bit on my mood.

While I agree that macro economics across the world impact on national economies in a way that Governments admit when things are going badly and deny when times are good, I disagree with you on two of your points. If Rachel from accounts decides to tax jobs, employment will be affected, everything else being equal and likewise, if she borrows more, again everything else being equal, the cost of that debt will increase. In the days when you could walk in to see your bank manager, if he perceived you to be a low risk, you paid a lower rate of interest than if he thought you to be a marginal or high risk and so it is on capital markets. With her budget, she has shown herself to be a high risk, so in a time of static or increasing rates, the price of our Government borrowing is having an even higher margin applied

Your points are logical. Except that if she tanks the general economy (likely) and company profits take a nose dive (likely), there will also be a huge demand for safety and liquidity and moderate inflation protection in government bonds. Quantifying the magnitude of that demand is tough, to say the least.

Yes, I understand the theory as well.

Now apply the theory and make some specific predictions of the level of any of these standard economic indicators based on different actions by Rachel Reeves (or anyone in the British government for that matter).

The problem is you can’t. Nor can anyone. Too many other variables the net effect of which overwhelms anything that Rachel Reeves may or may not do.

I have yet to encounter anyone anywhere that can make reliable economic predictions. All so called economic experts do is construct narratives about what happened, drawing attention to the bits they (randomly) got right and giving plausible explanations for the bits they (randomly) got wrong.

Put in a different way, I could get a monkey to throw darts at a board with plausible economic indicator predictions and then afterwards construct a coherent analysis of the difference with the actual data (which is also BS btw), explaining what was accurate with appropriate references to economic and giving plausible sounding reasons for deviations.

In fact, it would make for a great comedy skit.

Economics. The dismal science! Short term micro-economic predictions have some value, but beyond that it gets so complex… But governments think the reverse, claiming they know the picture for the next ten years and can model the effects of tax increases with certainty. Shocking that so many folk fall for it.

Well I agree it’s not a cause and effect science, but broad brush she believes in and is trying to implement a more centrally planned economy, higher taxes, higher government spending. We know from history that the more you go in this direction, the poorer you get. Scandinavia has highish tax rates but they have (or had) better human capital on average than we do, and a lower welfare budget supporting unproductive people, and we now have on top of all this a mad “energy policy” and I think you could draw some nice graphs correlating energy prices with prosperity and growth or the lack of it.

I’m sure one could draw all sorts of graphs.

But we’ve been on a NetZero war path for over a decade and promoted by every government’s during that time. And while that has remained constant, the 10 year rate has fluctuated. So…

Truss wanted to cut taxes and gilt yields went up. Reeves wants to raise taxes and gilt yields go up. Go figure.

The idea that these people have buttons that actually create predictable outcomes is just an illusion.

Buttons no, but they can certainly over time get in the way of human endeavour

I wouldn’t look at bond yields as a measure of anything useful

But these long term policies aren’t decided by politicians. Nothing major changes from election to election. It’s all pretty much pre-detwrmined.

Bond yields are very real and tangible. They go up and if you hold the debt, your wealth goes down and vice versa. That’s very real.

And for a country that is broke and needs to borrow money, yields better.

But Reeves doesn’t really affect any of that (which is what the article is about)

Politicians have the power to change course, usually not the will though.

It’s true that it’s not good if borrowing costs go up, I am just sceptical about the short term wisdom of the bond markets.

Reeves pushed the button that increased job taxation for employers. It was obvious that it would discourage recruitment and pay rises, and that’s exactly what has happened.

Yep. Some good points. UK 10 year gilt tracks US 10 year pretty neatly. And what drives the price of the US 10 year is v v complex. The US dollar is much more than just a currency these days. It is, at least in part, a payment network nicknamed “Eurodollar”. Anyone who can tell you with confidence where the US 10 year note will be in 3 months is a liar. … But – my guess is down, along with the UK 10 year. Check out the general direction of 10 year rates across the West…

‘Preparing for a jaunt to China …’

No jaunt. Just like Starmer and Lammy, as a committed communist she’s there to get her orders.

Notice how everything this government does benefits the CCP.

Whither Rachel – perhaps out searching for the ubiquitous yet invisible Far Right?

The trouble with the Student Union is who is there that is remotely competent? It is really scary that the vacant Anneliese Dodds was her predecessor.

Busy polishing up her CV for the next job she is not competent to hold?

I really wonder what she will achieve for the UK with her China ‘mission’? They will smile politely and send her back!

Rachel from Accounts is indeed pretty useless.

But take another look at that gilt yields graph. The big increase in gilt yields happened in 2023, under the Fake Conservatives. Rachel has just carried on with their policies.

The Telegraph’s attempt to paint this picture of Labour rapidly wrecking the economy is pathetic. Their own Conservatives were and are every bit as bad.

The Uniparty as we’ve said for a while…