Last week, this correspondent brought you an article from Australia about how China has captured 80% of the world’s solar market, all powered along by its coal-fired economy.

Now, it seems, Europe is on the brink of losing the EV battery market to China, too. According to the Telegraph, Europe’s electric car market rebellion is claiming its biggest scalp. There’s no reason to gloat though. The vast sums of money poured into the Swedish-based firm Northvolt, which has now filed for bankruptcy protection, have come from “investors, bondholders, pension funds and European governments since it was founded in 2016”, to say nothing of ceding yet more market dominance and strategic autonomy to China.

The Daily Sceptic flagged up Northvolt’s precarious situation back in September.

Northvolt is now down to its last $30 million and the CEO Peter Carlsson has stood down:

Northvolt has blamed its downfall on foundering demand for electric vehicles (EVs) across Europe. Its “capital structure and business plan were premised on the assumption that the electric vehicle industry would continue its pattern of consistent growth”, said Scott Millar, a restructuring adviser at Teneo, in the company’s court pleading.

As investor fervour for EVs reached its peak during the pandemic, Northvolt expanded aggressively across Europe, the United States and Canada, with plans for a network of gigafactories, as the facilities that manufacture car batteries are known.

However, the bottom fell out of the global market for battery-powered cars in 2023 as inflation and hesitant consumer demand led to a slowdown – and, in some cases, a slump – in EV sales.

Analysts at Rho Motion pared back their predictions for EV sales by a quarter, to 8.3 million by 2030. In Europe, home to Northvolt’s biggest clients, demand has been particularly weak. Sales are down 3% so far this year, according to Rho Motion. In Germany, they have fallen by 18%.

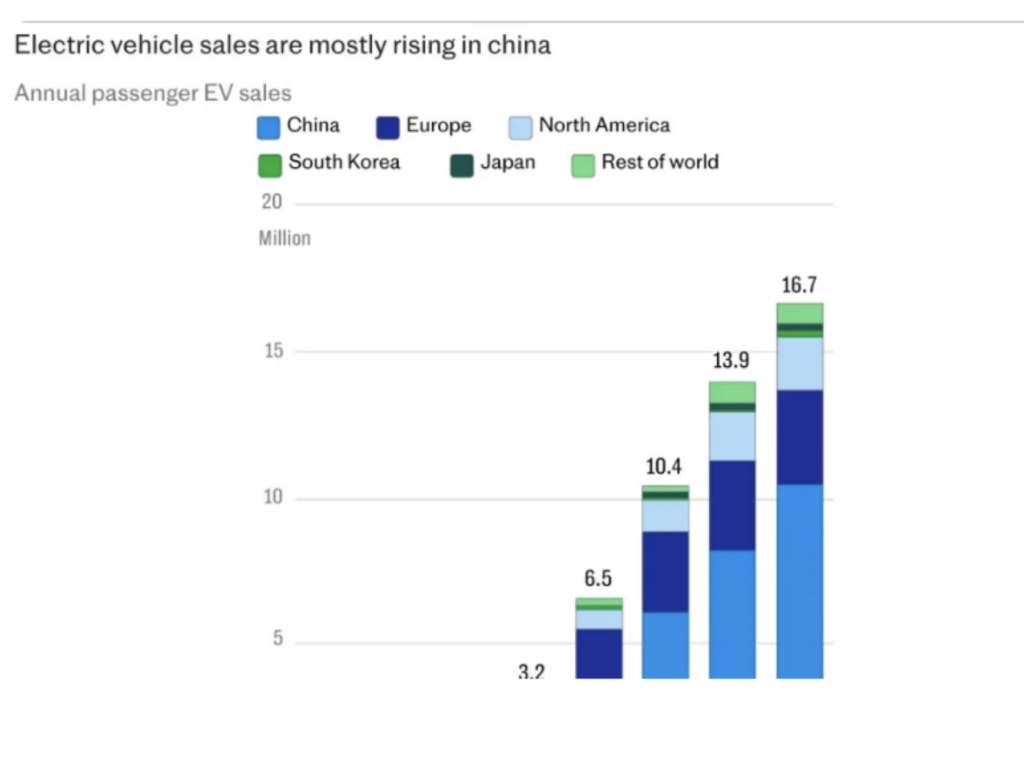

As this graph shows, the only real beneficiary of the EV market has been China:

Volkswagen, a major Northvolt customer and shareholder, last month announced plans to shut three factories in Germany, the first closures in its home market in its history.

At the same time, Chinese carmakers have been undercutting their European rivals by flooding the market with cheaper EVs that run on Chinese batteries. This piled pressure on Northvolt, which had aimed to set itself apart from rivals by developing clean batteries with renewable hydropower.

Even though it was producing 60,000 batteries per week and had $50 billion in future orders, some of Northvolt’s customers, such as BMW, reduced investments in the company as demand slowed. Government investors, meanwhile, withdrew billions in planned funding after Northvolt scaled back its plans for new factories.

The bankruptcy filing buys Northvolt time to salvage its business. Scania, a core customer owned by Volkswagen, has provided $100 million in debt-in-possession financing, a kind of emergency loan, while it has also unlocked $145 million in cash collateral.

“Northvolt’s liquidity picture has become dire,” Millar said in a court filing. It has debts of nearly $6 billion and has already wound down or pulled the plug on several divisions. Investors such as Baillie Gifford, BMW and Goldman Sachs all face having their stakes wiped out by its bankruptcy.

At least the CEO has had the dignity to stand down, admitting “we were overambitious”. But the problems run deeper:

While Northvolt has blamed its demise on the disintegration of EV demand, industry experts argue that mismanagement, inflated expectations and a lack of government investment in electrification are also to blame.

Reports have also suggested an over-reliance on Chinese machinery and engineers meant Northvolt lacked in-house expertise.

Andy Palmer, the former Aston Martin Chief Executive, says: “The biggest issue is that batteries are not easy to make and Northvolt haven’t satisfied the supply demands of their customers – that is a management issue.” James Frith, Europe head at investment firm Volta Energy Technologies, says: “Europe needs to rethink how it supports a nascent sector before China eats up the entire value chain.”

If Northvolt cannot be revived, Europe will cede what little gains it had made against China in building up its own battery supply chain. While EV demand has stalled, mandates to sell more green cars mean demand for batteries will grow. If they are not made in factories in Europe, the bloc will be perilously exposed to China.

“Europe needs battery capacity,” says Simon Moores, Chief Executive of Benchmark Mineral Intelligence. “The pendulum of industrial battery power has just swung east towards China.”

Yahoo! News has more.

There’s more on the story from Reuters, which includes this devastating observation:

“The biggest issue is that batteries are not easy to make and Northvolt haven’t satisfied the supply demands of their customers – that is a management issue,” said Andy Palmer, founder of consultancy Palmer Automotive said.

“The Chinese are technologically 10 years ahead of the West in batteries. That’s a fact,” he said.

At least eight companies have postponed or abandoned EV battery projects in Europe this year, including China’s Svolt and joint venture ACC, led by Stellantis and Mercedes-Benz.

In modern-day technological terms, 10 years might as well be 100 years.

Regardless of your views on EVs, the outlook is grim, and the strategic implications for Europe and Britain potentially catastrophic as they prematurely run down and outlaw older technologies, sacrificing it all on the altar of the Green Dream.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

There is only one face on that gallery of criminals that I suggest might be worth a punt on and that is Esther McVey. The rest are treasonous gallows fodder.

A complete wipe-out of one of the main parties would be good for the soul of this country. There is no doubt an incoming Labour Party will be as bad or worse but that might be the price we have to pay before the sheeple awake from their stupor. Nevertheless, as I keep posting:

Our salvation will not arrive via the ballot box.

You beat me to it. ——-I just scanned the faces and I could not see a tory, (McVey maybe but she is untested). So it is not Tories that face electoral oblivion is it? —-It is Labour Lite.

They are all globalists to me!

She has just been brought to heel by Sunak.

https://www.cheshire-live.co.uk/news/chester-cheshire-news/cheshire-mp-esther-mcvey-appointed-28100000#

She like all others are all bought and paid for.

Quite. But too many people on this side of the argument still can’t get their heads around that. Where’s Oliver Cromwell when you need him?

The Tories deserve to be wiped out by the people who put them in but what fails me is how can the same people vote for Labour instead ! It will make no difference !!!

Why would they vote for Labour or indeed any establishment party?

It does not really matter which WEF leader we vote for, as the policy will not change no matter the party spin that is applied. the “Parties” are trying to out do each other in the degree of “NetZero” to apply – without the consent of the electorate.

Wholly agree.

Bullet box ..

McVey, like Redwood, Patel, Braverman, Anderson et al talk the talk but at the end of the day it is Tory Plc that pays their bills and they cling to that reassurance. Tories who posit themselves as centre Right haven’t had the slightest effect in steering this stinking hulk of a party on its leftwards drift over the last 30 years. These characters need bouncing out too in 2024 as they are not genuine conservatives, if they were they would not be in the fake Conservative Party.

A fair point.

Your last line says it all, The ballot box is a medium to let the pleb vote for the representatives who will rubber stamp what the blob dictate. They do not really need us but condescendingly offer us a vain hope that we might have a voice, or indeed, make a difference

Thank you.

Good. I hope the Party is completely obliterated ….. and never recovers.

Isn’t there a saying – science hates a vaccuum?

Perhaps a complete wipe-out will provide the opportunity for a properly new political party.

The thought of 300 Kneels backed up by 300 Vicky Pollards – that’s Ranting by the way – is decidedly depressing.

“Look at my face, am I bothered? Am I though? ”

”

Sorry hux, getting my vicky pollards mixed up with my Lauren Coopers!

Still, both are perfect candidates for the labour party!

Understood Dinger.

Exactly! And thus disenfranchising it’s own ‘conservative’ supporters who now find themselves politically homeless.

“The Tories Face Electoral Oblivion”

Good! Lee, kemi, etc ,leave now!

Better still ,join reform!

They deserve it though why so many people think we’d be better off with a continuation of woke socialism with Labour is beyond me

The only sense in which we will be better off is that people stand a chance of realising we’ve swapped one bunch of traitorous no-hopers for another.

Well I suspect we’ll have maybe two terms of Labour and then people will get fed up with them and we’ll go back to Tories who don’t seem to show much sign of waking up.

Aren’t Gove and Hunt just the face of pure unalloyed evil and greed, having clearly been paid for by Soros/Gates etc. Starmer is a crazy Mugabe style Marxist so can’t wait for the next 5 years, gonna be fun, he’ll chuck ppl inside for mis-gendering.

He’ll chuck ppl under the burning ev bus!

To Starmer the burning bus is like the burning bush

They’ll be so many people under the bus the wheels won’t touch the ground.

Great image for my rifle range, that! Though I’m not entirely sure where I’d put the highest points…..

May I suggest a bullseye in the the middle of each of their foreheads!

in the the middle of each of their foreheads!

And don’t skimp on the hollow points!

Did this with my own cartoon drawings of Bunter, Vallance and Witty during lockdowns became an instant marksman.

As far as I recall – although I could be wrong – every single MP supported the Coronavirus 2020 Act. The lot should be duly wiped out! They are not fit for any purpose whatsoever, other than self-serving ambitions.

Some parts of the Act are still in force – why? In abeyance to manipulate / force the people to conform to whatever horrors ‘They’ next plan to impose on the people.

By a yet unknown disease x that maybe a dead cert in the near future!?

The Coronavirus Bill 2020 was passed ‘without division’ in both houses of parliament. No MP called for it to be put to a vote.

The Scottish Parliament gave immediate ‘Consent’ without significant debate as the Bill was an incursion on devolved powers.

It was enacted – given Royal Assent – 6 days after the bill was introduced to parliament. Jeremy Corbyn was on record asking to be involved in the drafting of the bill to try to avoid any debate and amendment in parliament.

That is a shame, his brother Piers is a tireless campaigner against Lockdown’s.

That’s surprised me about Jeremy Corbyn. I can’t remember if he was still Labour then or an Independent but he was clearly conforming to the Labour hunger for longer, harder lockdowns. Turncoat

Stabbed with the real junk not the special Westminster saline batch.

How many of the cowards are quitting their seats and declared they are not standing in the next election? Worried about the impact of their voting for government policies against the interests of the people? Rats, the lot of ‘em’.

Sigh….

Who cares. Team A, Team B.

They don’t make policy, they sell it. To the useful idiots who turn up every 4 years to play the western democracy game. Pick a name and pretend that you are expressing your will.

You know what they call people who stand for office and actually intend on setting policy and representing people’s wishes? They call them populist extremists.

When you think about it, it’s comical and pathetic.

Exactly.

On all the policies that matter, that affect our wealth freedom and futures, the globalists have infiltrated all sides of fake left right.

What we do get to choose are whether boys can be girls, statues are racist, abortion at birth or a week after conception…

Meanwhile both parties have settled science, open borders, money printing, digital identities, etc

Surely these millions of New Britons should be grateful enough to the Tory Party to vote for them?

What’s behind the invasion of Western Europe and the US with migrants?

Chris Martinson of Peak Prosperity offers his views on Rumble

https://rumble.com/v49hbb0-exposed-the-hidden-agenda-behind-mass-migration-in-the-western-world.html?mref=6zof&mc=dgip3&utm_source=newsletter&utm_medium=email&utm_campaign=Peak+Prosperity&ep=2

Did the pollsters really ask people about UKIP but not about Reform UK?

Perhaps some of them know there won’t be an election if the plan is to go to war before Jan 2025? It would explain why they have been so incredibly complacent.

“there won’t be an election if the plan is to go to war”

This is certainly a point of view that has crossed my mind. It’s as if the Tories are committing wilful suicide.

But Labour would not be on board with that when they are ahead in the polls.

There’s plenty of reasons to hate the Tories e.g. net zero, immigration etc. but people always reject the governing party, whoever it is, when things are tough for them financially.

When the Tories printed £500 billion of funny money during covid high inflation and a cost of living crisis was inevitable. Given that the economy would probably be in an even worse state if they’d locked down without furlough and all the other spending their electoral fate was sealed when they decided on lockdown.

Until they accept that lockdown was a choice not a necessity they aren’t going to learn the correct lessons and will be happy to do it all again.

You are discussing cock-up theory Matt and that has been demolished.

Agenda 2030. It has all been planned.

At least you refer to it by its actual name…Most just call it Net 0.

Inflation wasn’t caused by planting magic money tree’s during the Lockdowns it was Russia invading the Ukraine. Come on now, the BBC told me (trusted news initiative) everything else is right wing conspiracy theories Marianna said so.

Sadly that’s what a lot of the population believe, just as they don’t realise that high energy prices are in a large part due to the obscene subsidies given to renewables.

It isn’t in their interest to reduce migration and I’m sure I don’t need to explain why this is the case. Why would you expect them to do things that are in direct opposition to their interests? This isn’t arcane knowledge or hard to deduce just a quick glance at supply and demand dynamics will do the trick. It’s implicit in everything they say and so of course they will indulge their predatory and parasitic proclivities. Saying that the lunatics are in charge of the asylum is putting it way too mildly.

Was speaking to eldest daughter today (will be eligible to vote in a year) explained the party system ie uniparty with top down orders from the WEF . The only difference between the Tories and labour is, the conservative party will destroy the country labour will do it quicker. Spoiled my last vote plan to do the same this time around they are all treasonous next Tuesday’s.

In a sense they do have us by the balls because we reject the political class and yet all of our lives in complex societies rely upon the stability of systems that if we were to severely disrupt them would leave us in a difficult situation. How genuinely self-sufficient could we possibly be. And given our reliance on the status quo, how do we ever change it without wrecking everything that our lives depend on? This can lead to despair but i do believe that there are forces operating beyond our kenning. You will not be able to cogitate on our malaise and come up with a solution. Rudolf Steiner was asked by his more eager acolytes, how do we attain knowledge of higher worlds? He said that to start with you should go down to the local old people’s home and take a few of the residents out for a walk. That the only way to higher worlds is through the heart.

True….Just seen some Alfred Hitchcock Presents half hour thrillers today. It is a good throw back watching old films, the attitudes, decor etc. Skills for living off the land were once passed down from generation, something that has been in decline and we’re only just realising this while the Globalists plan to control all food production, and will there even be enough.

It seemed obvious from the start that Sunak was put in to deliberately lose the election to usher in Sir Kier Stalin.

Sir Kier Stalin has supported every Government policy from the Fake Brexit to Lockdowns, Jabs, Net Zero, Ukraine …

Kemi for PM!