On 5th December 2022 Western countries imposed a price cap of $60 per barrel on Russian crude oil. This was followed on 5th February 2023 with a price cap of $100 per barrel on premium-to-crude products (such as diesel) and a price cap of $45 per barrel on discount-to-crude products (such as fuel oil). One year on from its initial implementation, has the oil price cap been a success?

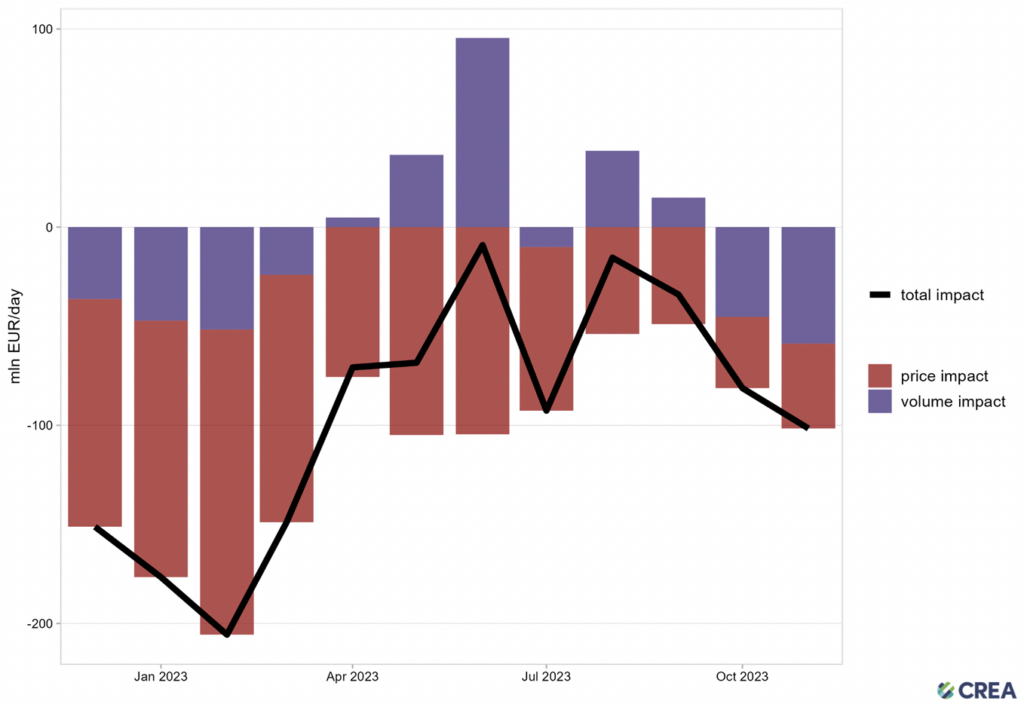

It appears not. According to a new report by Finnish thinktank CREA, the price cap has “failed to live up to its potential”. The report’s main finding is shown below:

The y-axis shows the change in Russia’s oil export revenues by month. As you can see, the price cap initially dented revenues quite considerably, up to a maximum of €200 million per day. However, the impact subsequently lessened, averaging around €80 million per day over the last six months.

Overall, the researchers calculate that Russia’s oil export revenues over the last year were 15% lower thanks to the price cap – not nothing but not enough to fundamentally shift the Kremlin’s calculus. In fact, from July to December, Russian Urals crude oil was consistently trading above $60 per barrel. And at the end September, it was trading above $80 per barrel.

Why has the price cap largely failed? For three main reasons, the researchers say.

The first is insufficient monitoring and enforcement. Recall that the price cap was meant to work by denying Western shipping and insurance services for any sale where the agreed price was above the price cap. Yet in October, when Urals was trading well above $60 per barrel, almost half of Russian oil shipments were carried on tankers owned or insured by Western countries – in clear violation of the price cap.

The second reason is the ‘refining loophole’, which I’ve discussed before. Countries like India, Turkey and Singapore have been buying up large quantities of discounted Russian crude, refining it, and then selling it on to Western countries at a profit.

The third reason is Russia’s increased use of ‘shadow’ tankers (those owned and insured in countries not imposing the price cap). Before the invasion of Ukraine, 13% of Russian oil was transported on such tankers. As of October 2023, the figure was more than half.

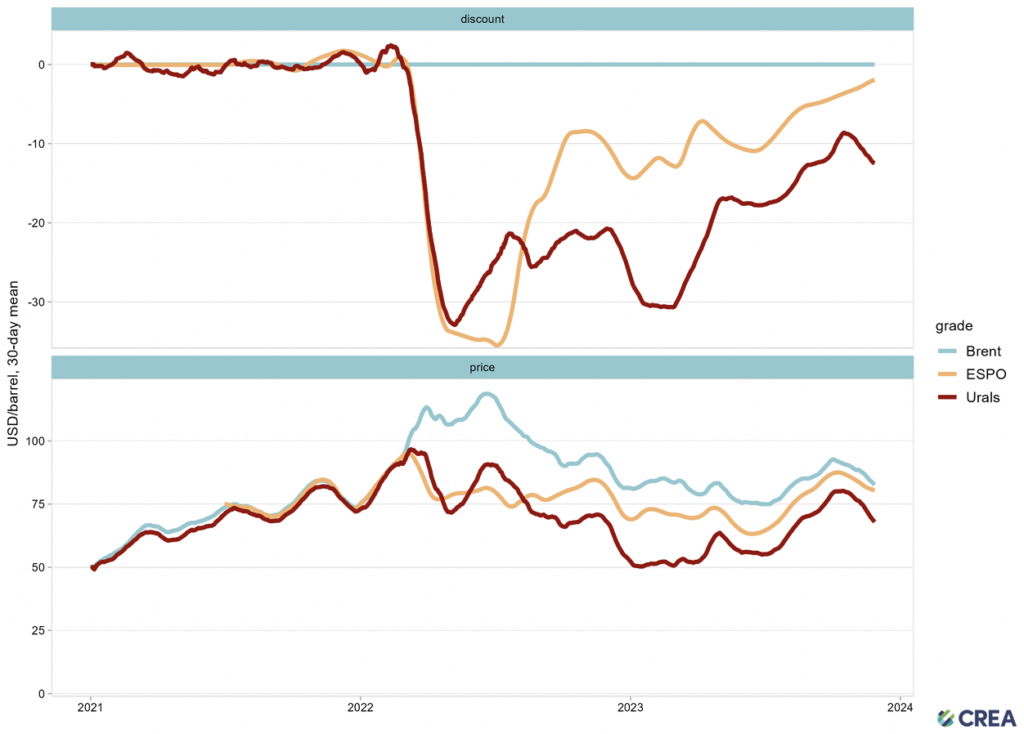

CREA’s report contains another interesting graphic, comparing the prices of Russian Urals and Russian ESPO crude oil to the price of Brent crude oil. (The top chart shows the difference between the blue line and the red and orange lines on the bottom chart.)

Interestingly, by far the largest fall in the relative price of Russian crude occurs around the time of Russia’s invasion and the announcement of Western sanctions. The impact of the oil price cap (the second dip in the red line on the top chart) is comparatively small. In fact, both Urals and ESPO have been increasing in price relative to Brent since February/March of 2022.

This suggests that the main reason Russia’s oil export revenues have suffered since the invasion began is loss of bargaining power due to the Western embargo, with the price cap itself having had relatively little effect.

Of course, just as Russia’s bargaining power fell when it lost its biggest buyer, Europe’s bargaining power fell when it lost its biggest seller. In the oil market, Russia has to sell at a discount because buyers know it has fewer outside options. And by the same logic, Europe has to buy at a premium.

Although Western sanctions have hurt Russia’s oil sector, the oil price cap has not had a major effect above and beyond the measures that were announced back in February/March of 2022. This may change if Western countries decide to increase monitoring and enforcement – at the risk of spiking oil prices.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Price caps have never worked. They will never work. Oil price caps or other measures have been used since the 70s in various countries and the result is the same – massive price shocks and systemic crippling costs and a reduction in the supply chains to that country or region retarding future oil flows and consumption, not to mention investment.

Prices caps are bloody stupid, which is why governments pursue them – to be seen ‘doing something’.

Oil price cap worked, blowing up Nordstream pipeline worked, sanctions worked. Europe is ever closer to deindustrialization having lost all independence from the overseas puppet master.

We were told it would help Ukraine, but it hadn’t been designed to do so.

One of the observable things is the reducing retail price of fuel at present. A couple of hours ago, I paid 138.7p per litre of E10 petrol, compared with189.7p 18 months ago.

Motor fuel prices have more to do with refinery output, demand – which may vary with region – competition, availability of refined fuels.

It is not just how much oil is available, but the grades of oil available, as refineries are configured for certain types.

Oil is bought largely on future prices, so a spot market increase/decrease does not immediately affect pump prices although people believe it does if oil prices go up, or should if they go down.

It failed because the Govts in the West, particularly the US, didn’t realise they don’t actually rule the World – I think the message is getting through.

Also, politicians and bureaucrats have no understanding of market economics, and evidently their advisors who supposedly do, either don’t, or only tell their paymasters what they want to hear…. like ‘scientists’.

There is also a firmly held belief among the political goon-squad, that people are blocks of wood incapable of acting in any way other than what is expected/demanded of them, and can’t push back.

Actually the Fracking Revolution in the USA created more oil in the world and reduced the global price. But despite these economic benefits, there is still a war on hydrocarbons, mainly from environmental groups and leftist politicians concerned (irrationally) about global warming and any other excuses they can find like the alleged poisoning of water tables and earthquakes etc.—Europe is perfect for fracking but there are still moratoriums everywhere preventing fracking including here in the UK.—-Europe seems to be content to import 75% of it’s petroleum, and 65% of it’s gas from outside of Europe. Instead of using oil and gas Europe has decided to transition to unreliable, risky and expensive renewables.—-The energy crisis episodes are directly connected to green policies to adopt wind and sun and are and will cause serious economic damage and lowering of living standards.

This whole sanctioning regime urgently needs to come to an end as it’s demonstrably pointless. Russia has been sanctioned in one way or another since 2014. That doesn’t seem to have caused Putin to adopt a policy that’s more palatable to the people who put these sanctions in place.

There is talk of Saudoi Arabia pumping more oil to lower the proce, as it did a fw years ago, in an attempt to drive other producers out of business and to discipline other OPEC and OPEC+ members. That would be interesting. If westen governments had any brain they would use that to top up reserves. Ditto gas if only we had storage facilities.

I have just read an article which showed that the main import by the UAE from Russia now was and is diamonds, to the tune of $7bln p.a..

Another currently unsellable item here which is picked up enthusiastically at a discount by smart people elsewhere, at our cost.

And in a few years, those diamonds will also surely again be marketable in the West.

In short: we are just id****.