COVID-19 is much less deadly in the non-elderly population than previously thought, a major new study of antibody prevalence surveys has concluded.

The study was led by Dr. John Ioannidis, Professor of Medicine and Epidemiology at Stanford University, who famously sounded an early warning on March 17th 2020 with a widely-read article in Stat News, presciently arguing that “we are making decisions without reliable data” and “with lockdowns of months, if not years, life largely stops, short-term and long-term consequences are entirely unknown, and billions, not just millions, of lives may be eventually at stake”.

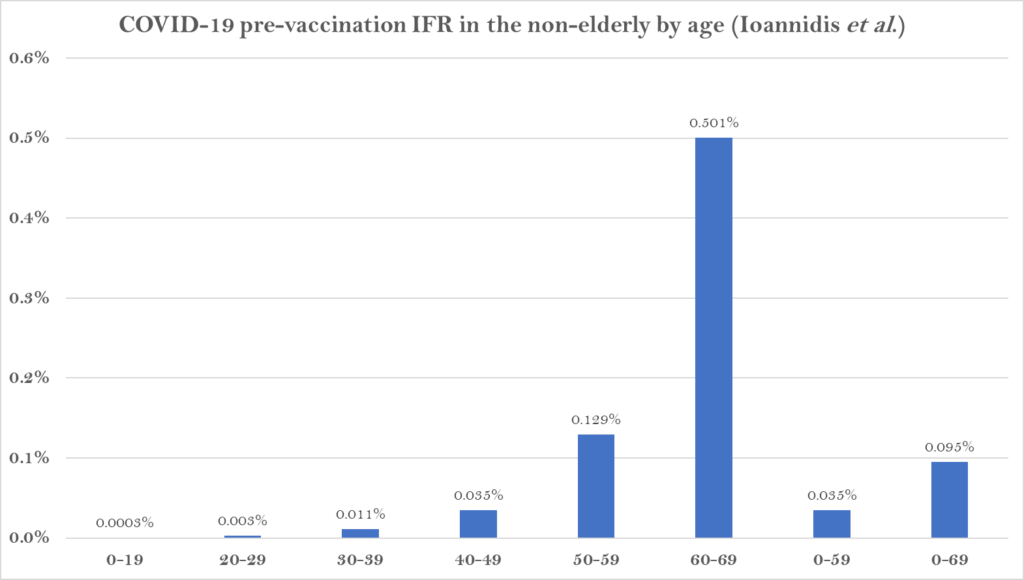

In the new study, which is currently undergoing peer-review, Prof. Ioannidis and colleagues found that across 31 national seroprevalence studies in the pre-vaccination era, the average (median) infection fatality rate of COVID-19 was estimated to be just 0.035% for people aged 0-59 years and 0.095% for those aged 0-69 years. A further breakdown by age group found that the average IFR was 0.0003% at 0-19 years, 0.003% at 20-29 years, 0.011% at 30-39 years, 0.035% at 40-49 years, 0.129% at 50-59 years, and 0.501% at 60-69 years.

The study states that it shows a “much lower pre-vaccination IFR in non-elderly populations than previously suggested”.

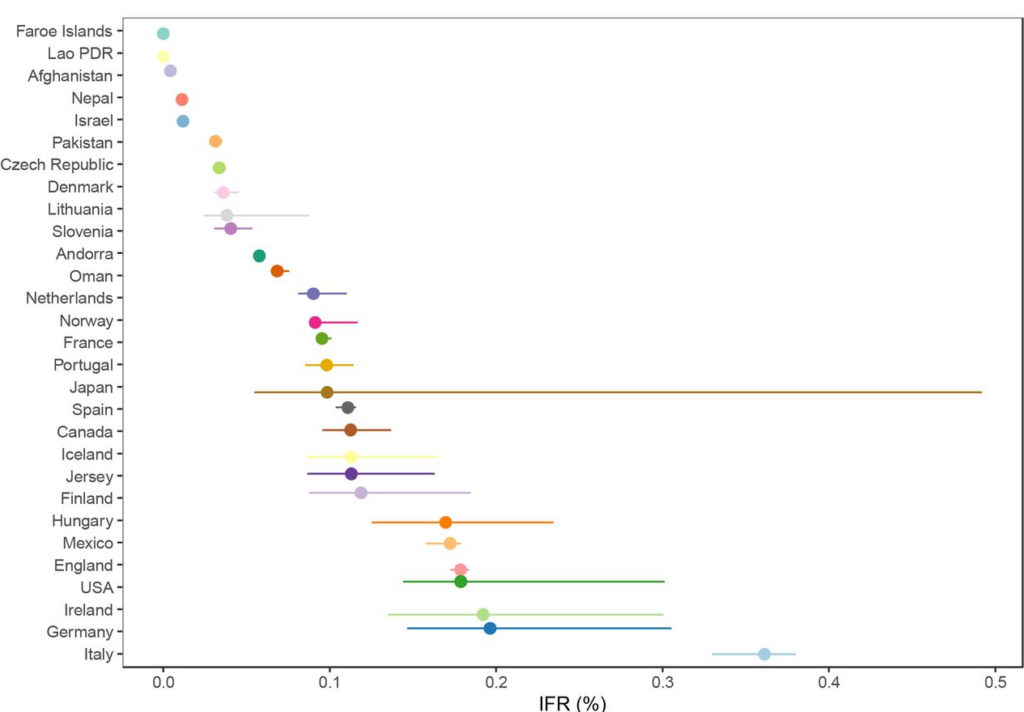

A breakdown by country reveals the wide range of IFR values across different populations.

The significantly higher values for the top seven suggest some of the difference may be an artefact of, for example, the way Covid deaths are counted, particularly where excess death levels are similar. Note also that the antibody studies date from various points during the first year of the pandemic, most of them prior to the large winter wave of 2020-21, when levels of spread and numbers of deaths were more varied than later in the pandemic as subsequent waves caused countries to converge.

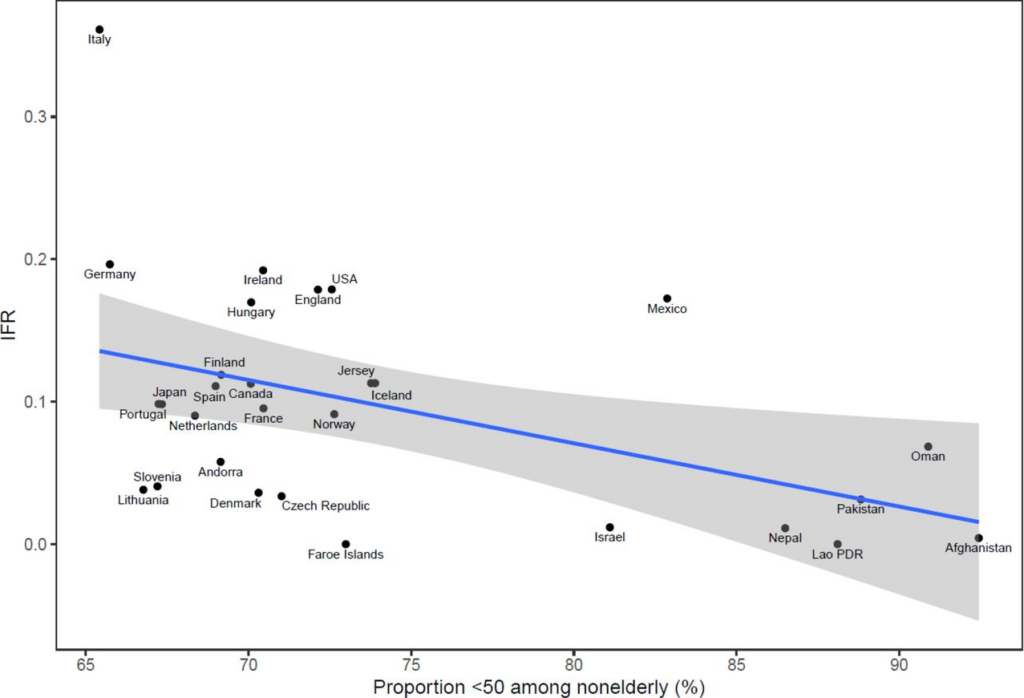

The reason some countries had much lower values and some much higher is not completely clear. The authors suggest that “much of the diversity in IFR across countries is explained by differences in age structure”, as per the plot below.

However, the age breakdown by country suggests that the IFR differed for each age group in each country, casting doubt on that suggestion. (In the chart below, note the logarithmic scale, and ignore the zig-zag lines, which are due to small countries having low numbers of deaths.)

Why are countries seeing differing IFRs even for the same age groups? The authors suggest a number of explanations, including data artefacts (e.g. if the number of deaths or seroprevalence are not accurately measured), presence and severity of comorbidities (for example, obesity affects 42% of the U.S. population, but the proportion of obese adults is only 2% in Vietnam, 4% in India and under 10% in most African countries, though it affects almost 40% of South African women), the presence of frail individuals in nursing homes and differences in management, healthcare, overall societal support and levels of drug problems.

Prof. Ioannidis has previously published a number of papers estimating COVID-19’s IFR using seroprevalence surveys. He and his team conclude that their new estimates provide a baseline from which to assess further IFR declines following the widespread use of vaccination, prior infections and evolution of new variants such as Omicron.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Lucky the public sector is amazingly productive and these pensions are so well earned.

I was thinking it is good they retire so soon in order to limit their damage.

Then the only damage they do is financial…

Public sector pensions are no different to state pensions in that they have always been unfunded. Successive governments have continued to kick this can down the road hence the mess we are now in. It is inconceivable that the Prime Ministers of the last twenty odd years or so have not been aware of this looming disaster so the question is why go so public on this now? It’s enough to make a conspiracy realist believe that the grand sale of UK PLC is not far off and we are simply being prepared for it.

Yes, all forms of state pension are Ponzi schemes.

Theywere bad enough when the working age population greatly exceeded the retired population but with baby boomers now retired there are nowhere near enough earners to fund state pensions. The triple lock was a disgusting and cynical electoral ruse but any politician principled enough to abolish it will suffer the electoral wrath of the baby boomers.

I’m sure all politicians have been aware but continued to kick the can because it suited all sides.

I’d suggest 2 things have/are changing though,

1. It’s becoming harder to kick the can. In some areas more than 20% of council tax goes on pensions and it’s only going to get worse.

2. We’re facing a change in government so why not draw attention to it to force them to deal with it (and take the political hit) rather than allow the status quo to continue

Actually, I forgot to state the obvious – no Prime Minister and certainly not MP’s are going to push for the reigning in of State pensions when for most of them it’s the reason they sought election in the first place

Exactly, Politicians do things to promote themselves and to stay elected regardless of cost. Comfortable in the knowledge in that what they started will be paid for by someone else, and that someone else will carry the can for their decisions. Consider for a moment, the source of most of the problems of today, and the origins.

The scale of public sector pension liabilities is another illustration of the importance of economic growth. Annual average economic growth in excess of 2% is essential and eminently achievable if the right policies are adopted.

Liz Truss grasped this but lacked the political skills to implement a pro-growth agenda. Her successor pursues anti-growth policies as did her predecessors back to Blair.

The size and scope of the state need to be reduced radically with cuts in state spending, taxation, and regulation. Cheap and reliable energy is also essential along with incentives to save and invest rather than borrow and spend.

The state is far too large, far too powerful and headcount must be cut (either figuratively, or literally – I’m open to persuasion). Let these parasites find a real job in the real world where people (mostly) progress by competence rather than long-service.

Also, growth isn’t simply a case of ramping up GDP as most of our so-called leaders appear to believe. If GDP per-capita is falling (as it is currently) then we have a mirage.

Fixing the latter is far harder than pretending to fix the former, especially when inflation is eroding the value of money.

“Our” public services.

LOL

The country is divided into two: the private sector, mostly small businesses who pay the taxes; and the public sector administrative state that lives off it. They dictate the rules that maintain their supremacy over the entrepreneurs,and will never willingly yield this power.

The private sector now works up to half a year to pay for it. Time for change.

The blob is parasitic and ‘progressively’ killing the host. There is no symbiosis.

No doubt that this is a preliminary to discussion of assisted dying, completely voluntary of course. Has its appeal but I would avoid it given the ghouls that we have in charge. I heard an estimate that human productivity globally is less than one percent of what it could be if we didn’t have the parasite on our back. There would easily be enough abundance to care for the old in their dotage. Tha parasite sucks more and more and gets you used to it gradually so that they normalize the unthinkable and make you forget that you ever thought otherwise.

Ideally they don’t need to be cared for because they’ve set enough aside to take care of themselves.

Yes that would be far better. But the reality is very different. I read something recently that said that the average Brit doesn’t even have a few hundred pounds put away for a low level emergency like buying a new washing machine for example.

The Labour Party is campaigning on the basis of it ‘has a plan to get your future back’. They don’t have a plan and even if they did it would be doomed to fail. This time that we are moving into has nothing to do with getting your future back, quite the contrary. It will be a time when you will have no familiar foundations, no retrospective glories to appeal to. Essentially as new and alien as stepping onto another planet. In terms of politics you will already see that. The important thing is that the people see that there is no restoration or renewal of the old. What comes next hasn’t been forged yet but it has nothing to do with those power structures. They know that they are dying and so they engage in last gasps attempts. Where we go from here is going to look entirely different to anything that went before.

We talk about how difficult it is to financialize care work. Perhaps we shouldn’t be financializing. Like the editor of the FT said, financialisation is like a species of parasitic wasp which lays its eggs in the body of a host and then takes it over and destroys it. Anyone with any nous can see the doleful future that awaits if financialization isn’t recognised. I don’t even like saying it because it behoves a people to understand it.

There is a real battle up ahead and I don’t know if this is a conscious avoidance mechanism or genuine naivete. Just be are of the situation.

There is a lot of confusion here. Describing the pension liability as a “bill” is incredibly misleading. The best way of thinking of it is how much the government would have to pay a bank to take responsibility for meeting pension commitments under current arrangements. These commitments stretch many decades into the future so it is not as though the government has to pay them now or even in the short term. Comparing it to GDP is comparing capital liability with a single year’s income. It is dramatic but fundamentally irrelevant.

It is also worth noting:

I should add:

I have never worked for the public sector and therefore my pension is private sector.

I do think we will have to reduce government pension payouts .

I don’t suppose it helped when Labour’s Gordon Brown and the Cons George Osborne raided the pension pots.

Not to mention some private sector company ‘raiders’ like the Mirror Group and Marconi – these stole millions from many thousands of people just to prop up share prices.

We’ll get rid of the Conservative Party this election but unfortunately it’ll be 5 years of depression until we get rid of Labour. New beginning in 2029. But will it all be too late. God help us

In the absence of any government savings on the behalf of the public sector employees who ‘contributed’ to their pensions all their working lives; these pensions can’t even be ‘cashed out’. They depend on tax income from those currently in employment.

The UK Government is therefore running a Ponzi scheme.

China, Russia, Norway, Saudi Arabia all have sovereign wealth funds to invest on behalf of their citizens.

Montenegro also has a sovereign wealth fund.

And the Tories have increased the size of thePublic sector over that of Labour (no fan of either being politically marooned).Whilst we in the Private sector had our pensions ruinedand plundered by Tony Blair and Gordon Brown, and the Tories continue the theft, the parasitic politicians and the civil servants, DEI workers in public sector get to continue the leeching whilst they work from home and produce NOTHING which grows the economy.

And they wonder why people have lost all faith in so called “democracy”