There follows a guest post by an author, who wishes to remain anonymous, who is an experienced independent restructuring and turnaround professional with successful HMRC dealings going back over 20 years.

It was always the case that the Government’s rush to help businesses at the beginning of lockdowns would inevitably lead to some issues further down the line. In this article I argue that there is a disconnect between the broad policy agendas of the Treasury and HMRC. In particular, HMRC should not try to close businesses that have been adversely affected by COVID-19, provided the businesses can make a good case that they can recover over a reasonable time period. HMRC should not unilaterally apply a timescale for debt repayment that is unrealistic for a business.

The Treasury has always appreciated that COVID-19 affected businesses might not recover for several years. The introduction of the Business Recovery Loan Scheme, and its recent extension until June 2022, is evidence of this. The Business Recovery Loans are repayable over periods up to six years and are underwritten by Government guarantees of 70-80%.

There can be no doubt that the overall policy of the Treasury is to support COVID-19 affected businesses as long as reasonably necessary.

However, HMRC does not appear to have got the memo and is largely adopting the same approach to collecting overdue debt from businesses that it used pre-pandemic.

HMRC publishes its policy on collecting overdue debt online. The current version shows no evidence of any consideration of two key factors. Firstly, whether a business has genuinely been affected by COVID-19 and needs a certain amount of time to recover. Secondly, whether that business has Government guaranteed loans – either from the earlier CBILS and CLBILS loan schemes, or from the more recent Business Recovery Loan Scheme. The important fact to remember is that all of these loans were awarded on a loan-worthy basis. This was emergency funding directed at businesses that could demonstrate they’d been adversely affected by COVID-19 and had credible recovery plans.

HMRC is a serial closer of businesses that fall behind in tax payments. They have preferential treatment in the event of an insolvency, so their debt ranks above other unsecured creditors, and this leads them to take action earlier than other unsecured creditors who will often face disaster if the business in question fails. Other unsecured creditors and are more likely to try to support recovery, even if reluctantly. Job-secure HMRC staff are less concerned about the failure of businesses they call ‘customers’.

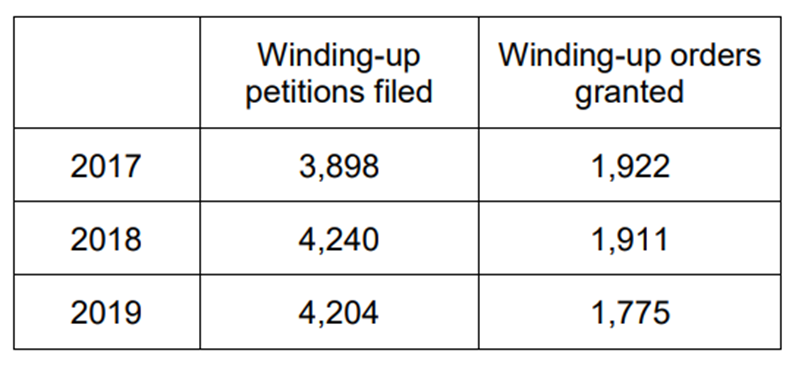

By way of evidence, Freedom of Information requests show that from 2017 to 2019 HMRC issued 12,342 Winding Up Petitions, of which roughly 45% caused the businesses to fail.

So, we now face the entirely likely and illogical situation whereby HMRC will attempt to close businesses – sorry, ‘customers’ – who may have a Government-backed loan. The collateral damage may mean that the cost to the taxpayer is higher than the actual debt itself.

However, we cannot have an HMRC process that applies different rules to businesses that have sought Government support than to those that haven’t. There are many businesses that have been affected by COVID-19 but didn’t take on additional debt.

Common sense dictates that HMRC should not be allowed take independent action to close businesses that can demonstrate that they have been adversely affected by the pandemic and are in the process of recovering. If HMRC has concerns about debts not being paid, it can always enlist the support of the many corporate recovery specialists who are generally better equipped than tax inspectors to judge the recovery prospects of a business.

It was clear during the pandemic that HMRC wasn’t given policy guidance to complement the various support packages put in place for businesses by the Treasury. When the Government guaranteed £80bn of loans to get businesses through the pandemic, it did so on the understanding that recovery would not be immediate for many businesses. Why, then, should HMRC try to close down businesses that can’t repay debts quickly enough?

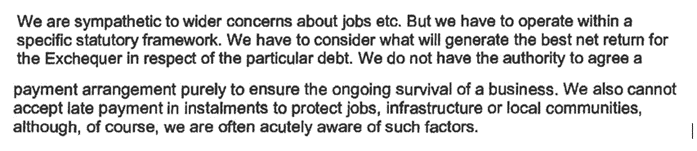

It seems HMRC remains a law unto itself. Calling taxpayers ‘customers’ is a good example of how HMRC confusingly positions itself. It is a branch of the Civil Service, not a supplier. A client of mine received this chilling comment last year when pleading for leniency.

Surely jobs, infrastructure and communities should be at the heart of HMRC’s priorities? The comment is, though, clear that HMRC should look at the best Net Return to the Exchequer.

It is time for Rishi Sunak to get to grips with this threat to the survival of thousands of businesses, which is hardly in the national interest. I’m not suggesting that businesses which are inevitably going to fail should be protected from market forces. But HMRC must take a much longer, more pragmatic view.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Wake up, and smell the Great Reset. You will own Nothing, and be happy.

Except that some people will not-own more than others.

That deserves a classic Orwell quote…

“All animals are equal, but some animals are more equal than others.”

Get everybody dependent upon the State appears to be the plan.

Getting everyone dependent on the State was all part of New Labours Universal Credit.

Tax peoples income away then give it back by way of UC.

Now we have the the Tories lending everyone £250 for their energy bill (whether you want it or not) and expanding the welfare state even further.

Klaus Schwab seems to be becoming a de facto president of the world these days, I wrote a short satirical science fiction imagining what the future may look like (if we’re not careful):

“Welcome To Schwabia”

http://participator.online/articles/2022/02/welcome_to_schwabia_20220226.php

The year is 2070, all the formerly independent nations of the world are now joined together in a single unified nation called Schwabia …

Don’t say that. The despotic old fart might just get off on it.

He bragged that Putin was one of the WEF’s young leaders, which leads us to ask some interesting questions about the current conflict I think.

https://www.youtube.com/watch?v=0v1pB8l6pQc

He speaks of “penetrating the cabinets” of many governments..

Putin was also a KGB Senior Operative – he knows exactly what Psycho Schwab is about!

The likes of Schwab want Russia balkanised and reduced to a collection of resource extraction colonies. Putin stands for the antithesis of this – a strong unified Russia for all of its ethnic groups.

Schwabia! Yes a cross between planet of the Apes and Nazi Germany!

You will own nothing …but Johnson and Sunak will own you …and they will be both richer and “happy”!

We will be zero!

I run a small biz

Since the pandemic started all hmrc staff have been working from home

It is impossible to get thru to them and when you do they frequently cut you off when they can’t answer your query. This is no word of a lie

They fined my business for an issue with a tax return. It was a cock up on their side but it is impossible to get thru to the right person to explain in detail why this is the case. They are utterly inept.

As a consequence our accountant has now said just take them to court about the fine. We will win 100 pc, Hmrc will pay all costs.

He said he has has done this with several clients already.

All because these bone idle civil servants can’t be arsed to go into the office and do their fucking job properly.

and the costs for you having to take these parasites to court, well its no skin off their nose, nobody will lose their jobs, they will just reach into the pot of money collected from us the tax payers to cover their mistake. Perhaps if the fine had to be paid from the HMRC teams own pockets they might be incentivised to actually do their jobs properly. Wheras now whats the downside for them.

Yep sounds about right.

In a similar vein for two years in March I’ve been trying to buy a flat which was repossessed by a government department in 2019. They repossessed it for an unpaid 4 figure ( almost 5 figure ) debt

Thanks to our oh-so-efficient civil servants

binge watching Netflixworking from home… They never answer the phone or answer emails ( conveyancing lawyers tearing their hair out ) so the chance of the govt recovering this debt is now zero as the mortgage against the flat has racked up so much interest.The

stupid fuckersvaliant government staff even publicly trumpeted this repossession against the debt as a triumph in one of their departmental magazines.I particularly admire their brazen online chat system. It tells you that you are in the queue and that there is no need to refresh the web page. However, it is clear that there are no scripts running on the page and I have twice been “in the queue” for eight hours with no change. To summarize, they have created a totally fake call centre queue, just to fob you off, with no hope of ever getting through.

All tax is theft – and they’re getting greedier and better at it every year.

At last. A fellow traveller. It is theft. Shocking that so few people will consider zero tax or at least local taxes only.

It’s not really Taxes that are the problem. It’s the administration of those Taxes which is so objectionable.

A number of places in the world are ‘Tax free’, Monaco and Bermuda spring immediately to mind, but having personal experience of Bermuda, Taxes are levied by means other than Income Tax. The administration of those Taxes are no less objectionable than ours.

Then there’s the political coercion associated with Taxes. Frankly, they are used by politicians to bribe the public.

It’s a subject that can run and run. Is Taxation theft? Not so much theft as extortion in my opinion. A government run Protection scheme no less onerous than a Mafia Protection racket. Except it probably doesn’t work as well and often it’s more destructive.

http://www.libertarianprepper.com/taxation-is-a-protection-racket/

They are installing Global “Catch Twenty Two” – they can do anything they like to you and you can do nothing about it!

The Globalist Banks and Black Rock and Vanguard Asset Holders are ultimately responsible and all the politicians are merely their useful stooges!!

Yep- amazes me that pretty much everyone thinks that it’s OK to just take 50%+ of someone’s earnings and that these people should do so willingly because they have to ‘do their bit’- as if taking risks, starting businesses, investing in the local economy and employing people don’t actually amount to ‘doing their bit’. A woman near us has spent years on benefits but recently started working after her youngest left school and she’s horrified by how much she’s having to pay in tax- and how much things like council tax have gone up now she’s paying the full whack. She very quickly became outraged by the unfairness of it all and what ‘her’ taxes were paying for…

I think the answer may be Common Law.

Much the same in the private banking sector where everyone is also STILL ‘working from home’, I’m afraid.

I was happily self-employed for 30+ years with minimal but satisfactory contact with the Public Sector (taxman mainly) before coming seriously ill 12 months ago.

The illness’ symptoms includes short and long-term memory loss, made worse by the medication and a pre-existing condition.

After 5-6 weeks in hospitaI I found that “DHSS” (they come in vavious guisses but ‘DHSS’ can cover all) had been very efficient. Various due monies had been paid into my two bank accounts, sufficient to cover bills paid out or on the way. I don’t remember giving anyone information about outgoing requirements but they happened !

Not smoking or drinking plus three cooked meals a day saves £200.00+ per week so no short-term financial worries.

Then things started to go wrong.

It’s not just me, digital chats revealed that the following Public and Private Sector wrongdoings are commonplace.

All of my bank and digital details are on my computer at home where I can’t go and without my Pass I can’t use the hospital cash machine.

No point going into lengthy detail but bank website

“I’ve forgotten my username/password”

link does not work. I can’t find a way to contact either of my banks or ‘DHSS’ by phone to ask for help ‘manually’.

I can’t do anything Digital that requires a password, happily Amazon and Mycare (NHS information/progress) are on my phone but not my bank details.

After considerable exploration (phone only, computer with details at home) someone at the bank finally answered their phone.

“Sorry, this is a Compliance office”

I’m the one with the thick head and memory loss. Sometimes have to ask who I’m talking to !

Opening my major Bank A app, “Homepage” link does not work so I can’t even check my balance let alone requests an email statement or transfer money as is now required.

Opening minor Bank B app just tells me my current balance, not how much got paid in nore where it’s gone.

Phone numbers lead only to irrelevant answer machines. I put it down to Office Workerd insisting on ‘working from home’.

Happily today is Sunday so I don’t have to think about actually talking to someone who can’t give me an answer.

Even more happily I am able to report that (despite numberless press complaints) the care I have been receiving for various conditions by numerous NHS staff of all degree has been wonderful and superb despite my being somewhat grumpy to say the least.

Sorry that this report is messy and overlong; blame iron the conditions and medications.

I hate to seem critical, but why are you still keeping information on a computer at home?

Over the last 30 years or so numerous organisations have developed secure online storage which is accessible anywhere from almost any device.

Microsoft’s One Drive is an example, Apple has it’s own system and there are numerous independent organisations. They take minutes to set up and are just a storage extension of your PC. No need for big hard drives any longer. My last laptop had a 500Gb drive that I eventually never used. I now have a MacBook with 128Gb of memory and I still don’t use that because everything is in ‘the cloud’.

I also run a home NAS (Network Attached Storage) where I keep movies and music. Even that can be accessed by a laptop or smartphone from almost anywhere in the world.

App’s such as ‘LastPass’ securely store passwords for you, individual to every site you ever subscribe to. These can also be accessed from a smartphone.

You could lie in a hospital bed and run your entire life through a smartphone.

Not my downtick.

By all means be critical, in a position way as you are RedS.

Call me old fashioned but I’ve never trusted ‘3rd parties’ like The Cloud, preferring to rely on hard drives and discs ( same accessibility problems of course).

It’s not as though I have any secrets to hide; just stuff downloaded from YouTube and, more recentl, ‘private’ medical information that I don’t care who knows about.

Time to change my views on that perhaps so your information will be a usefull start and currently I have all the time in the world to sort it out !

I seem to have One Drive app on my recently upgraded* Android so I’ll give it a go this afternoon. Thanks again for your advice.

*Upgraded but not all in a Good Way.

The Electoral Commission are exactly the same. Absolutely useless.

Not “useless” …try corrupt!

The base-line “Project” is the “Take Down of West” – accept that and it all makes sense!

It’s ok, all large WEF partner businesses will thrive.

But isn’t that part of the plan? Destroy the middle classes, the independent traders etc etc, all for the benefit of Globocap…

Also known as “leanness”, addressing the issue of “too many chiefs”, and “the Asian model”.

Yes of course it is!

Globocap maintained by Globocop – the ultimate tyranny we are being dream walked into by Spaffer Johnson an his Gang!

Where are Johnson’s 20,000 extra police ..or are they Militarised Robocops currently in Training?

Ought we to be worried? Yes!

Yes it it is. See what an ex-Wall Street big shot has to say and what’s in the pipeline. https://thehighwire.com/videos/financial-insider-exposes-covid-fraud/

It’s time that HMRC was placed under proper Government control with a senior minister having direct responsibility for it and encouraged to rein in what at times appear to be the department’s powers to make up the rules independent of Parliament as it goes along.

And do away with the role in the tax system of the lord lieutenants of the county? Not likely!

HMRC is a major government department. How much more government control are you imagining?

Until you accept government itself is the problem you won’t get far.

Most of government is a bureaucracy. The bit we see on TV is the showbiz component for the masses; a fat controller with a trademark messy blond haircut is the current court jester. The next one will be more clean cut to make it look different. Then they’ll appoint an ethnic minority, another woman, an ethnic minority woman and no doubt eventually a mentally-disturbed transgender woman of colour in a wheelchair to get the full set.

But the hidden part of government is a misanthropic machine that has a life of its own. It cannot be reformed, only dismantled.

Next PM – ‘clean cut’ and ‘dishy’! Swoon!

I used to argue this about New Labour- put a grinning moron in front centre and get him to tell everyone how different it will be, meanwhile it’s business as usual behind the scenes with as many new or stealth taxes as they thought they could get away with. So, you earn money and it’s taxed, then you spend some and it’s taxed, you save some and the profits are taxed, you take an income from it and that’s taxed, you die and then whatever’s left is taxed. Your original earnings aren’t worth much by the time you’ve finished ‘doing your bit for the country’.

The HMRC and its employees are like the rest of the Government in the belief that they somehow are in charge of a business, and that their job is to make as much money off its “customers” as they can, whether this be by fair means or foul, there is a disconnect in understanding that people’s jobs and businesses is what pays their wages and that they are supposed to be public servants, and not business people. During the past 2 years Government and the Public sector has swollen its ranks, again further evidence of profligacy. Unfortunately both main parties are touched with the same belief that they are running a corporation even though barely anyone in Labour ot the Conservatives has ever operated a business in their lives. I am sure that the loss of middle class and working class jobs is nothing to them because their friends in Amazon, Google, and the rest of the WEF will ensure that they are kept in the manner to which they are accustiomed, whereas the rest of us, well we will own nothing and be happy won’t we,

A naive article. The purpose of government is to increase dependency on government. Small businesses represent the very antithesis of this mentality. They are by nature independent and run by the independently-minded. All of that is anathema to a large centralized bureaucracy.

HMRC are doing exactly what needs to be done. This crisis, ostensibly not caused by HMRC, is a golden opportunity to further their plans. More control, less opportunity for tax dodging (as they imagine it).

The government is your enemy. When enemies fight there are flashpoints, some more visible than others. One of the most visible is the treatment of the self-employed who are by and large treated as tax dodgers not paying “their fair share” despite most of them employing chartered accountants and rigidly staying within the rules.

But that is not the point. The people behind HMRC are maddened by the freedom. They can’t easily take their cut from the source as they do with PAYE. They have to wait until accounts are submitted then retrospectively trawl through all that data to find the villains. That doesn’t work for the top-down central control brigade. It reminds them they aren’t fully in control. And this is all about control.

The above article illustrates the problem, government itself.

The “Making Tax Digital” push is just another way of the Government and its departments forcing people to do the work for them, ante up the money in short order, get the taxpayer to pay for HMRC mistakes, and avoid any necessity to explain themselves.

It’s a pity that HMRC “sweetheart deals” are available only to oligarchs, plutocrats and kleptocrats , after a bit of essential wining, dining and free ticketing, and not to Joe Taxpayer.

To pluck but one example out of the many, the burgeoning growth in pages of Tolley’s Tax Guide just goes to show that the entire tax system is now so labyrinthine that the people adding to it and supposedly running it can have, in many cases, no real notion of how it applies “by the book”, let alone to the realities of life and business for many.

https://www.taxpayersalliance.com/far_too_taxing_why_it_s_time_to_simplify_self_assessment

The tax code is a disaster. Except for them. If you run a chip shop you are intentionally baffled. If you are Amazon you get a buffet of loopholes that only cost a few millions to exploit.

Completely unreformable, despite what people think.

OR are we talking about the ‘cash in hand’ ‘non registered’ kind of employment which illegal migration thrives on. Getting rid of cash and forcing ID would answer those ‘problems’

I have no doubt that will be used as a rationale. The black market etc.

That’s a tricky one as the government generally avoids any examination of illegal immigration because of its scale and the many polls indicating a solid 60-80% routinely oppose mass immigration of any sort.

HMRC are a law unto themselves. In no way do they serve the interests of small businesses. The digital tax malarky is just one example. The .Gov website alone is a vortex of pain. But they don’t care.

If you are advocating getting rid of our government altogether, what is going to protect us from other governments? Are you hoping for all the people of the world to simultaneously reject governments?

Hear hear!

If this idea is true, then why not take it to its full extent: stop bankrupting ALL businesses through taxation?

Think about it, with great care. This is an apolitical question.

I agree. Never tax productive endeavour. It is self-defeating. Only people can pay taxes. So if we must have tax then an income tax and nothing more, including sales taxes.

Our Rishi burned money and now, in typical government form, expects Regular Joe to pick up the tab. Twas ever thus, sadly.

The HMRC have no soul. They actively lie and manipulate to reach their targets as do any unscrupulous Sales Managers.

This Johnson Government and their “Covid Great Reset Deep State Civil Service” have no soul – it appears that they despise and detest the British people and wish only to reduce and enslave them to serve the Globalists deranged Power Grab agenda!

Sunak is from the Christopher Holm stable and does what he is told, hence the lovey dovey headlines in the system press.

The 666 policy was to destroy small independent and collapse their economy. They had to do it stages otherwise it would look nefarious. Years 3 & 4 will see a great die-off (extrapolated to be greater than WW2) in the USA, UK (Ref) and Germany (Ref) hence a financial reset, which one is up to the individual.

My thinking is they have to create a dominant news cycle during winter with the excess deaths. A new wave and lockdowns again, who knows?

I have plenty of direct experience of this from when I was working. The approach of HMRC is a very blinkered one. They are a revenue collecting department first and last, and their ethos is therefore, first and last, to collect revenue. If they can’t get their dues in full, they have little patience with the taxpayer and prefer to close its business down and grab whatever crumbs might be left from the wreckage. There is also that ghastly trait that runs through all levels of government: the concrete-hard inhumanity that allows decision makers and minor operatives alike to inflict endless misery without any accountability or acceptance of any responsibility for the collateral damage. They are always just obeying orders and doing their jobs. It is the machine that is crushing you; not the myriad of cogs within the machine, that really have nothing to do with the unfortunate outcomes as you are ground down and spat out.

You see it again in that message: “We are sympathetic to wider concerns about jobs etc…” We all know they are just empty words, a glib lie designed to ease the conscience of the writer and provide a fig leaf of protection against any charge of indifference.

Our Government seems to hate small business owners. They seem to hate the idea of citizens who are not dependent on the State or the big conglomerates like Amazon.

Not just the small business – they just want ti steal their assets- in fact they hate the whole British population

(.But they just love Bill Gates!)

Yep – no back-handers on offer from SMEs: scratch the back of mega-businesses and many goodies will fall into one’s hands!

Quelle suprise! You could almost believe that it looks like a plan.

Little Rishi Sunak, like Sajid Javid, is one of Klaus Schwab’s prize poodles. Rishi and Javid are actually nothing more than corporate spokesmen.

A main goal of the plandemic was to close down the High Street and force all consumers to get their goods online from the likes of Amazon. Having people do their shopping online goes towards forcing a digital ID on them, track what a person spends their money on, and you’ll know quite a lot about them.

People get taken in by the likes of Sajid Javid because he held a relatively high position in the banking sector. As they perceive him to have been successful in banking, they therefore assume he’s very qualified for politics.

Another school of thought, though, is that Klaus Schwab sources the son or grandson of a respected Elder in a minority community. Then, if necessary, Schwab has the power to get this chosen person grade-inflated through school and university.

Then Schwab and his cronies have the wealth and power to bequeath this chosen person a high-ranking position in the corporate banking sector. It doesn’t matter if this chosen person is an imbecile that sits at his desk twiddling his thumbs and watching YouTube all day every day – the bank can afford it in order to achieve Schwab’s ultimate aim.

The ultimate aim is that this chosen person’s ascendancy to astronomical heights in the business world will give him almost royal status in his highly tribal ethnic community. Then this chosen person is shoved into politics and assured of perpetual re-election.

And it will be all the better for Schwab if this chosen person is a bit of an imbecile, or low-born like the son of a bus driver. People like this that are elevated to great heights will be very pleased with their status in life and with the royal treatment they get when they return to their ethnic communities; mundane things like policies will be lost on them and be found boring and distracting.

So, all Schwab has to do is send around a minion each morning and give him a script to read from. (Check out Sajid Javid’s body language in news footage and you’ll see that this man is much more a kebab takeaway manager than a politician.)

Schwab’s little Rishi Sunak will not be doing what the people want, he’ll be doing as ordered to by the scripts he is regularly given.

From Boris Johnson down, they are all corporate spokespeople – and a few of them actually aren’t even fit to be spokespeople.

Absolutely 100% bloody spot on.

Sunak hates small business, he’s already done much to try and destroy it and the self-employed.

He loves only Billionaires – that’s why he married one!

I’ve sent this article to my MP with a request to pass it on to the Chancellor and endorse the author’s opinion. Suggest everyone who agrees with it does the same.