The Low Carbon Contract Company (LCCC) manages the Contracts for Difference (CfD) subsidy scheme and publishes data to show how much it costs us. The data is usually published about 10 days in arrears and sometimes is adjusted. Now, we have the full data for August 2024, and it has settled down enough for some reasonable analysis.

Overall Subsidy Levels Rising

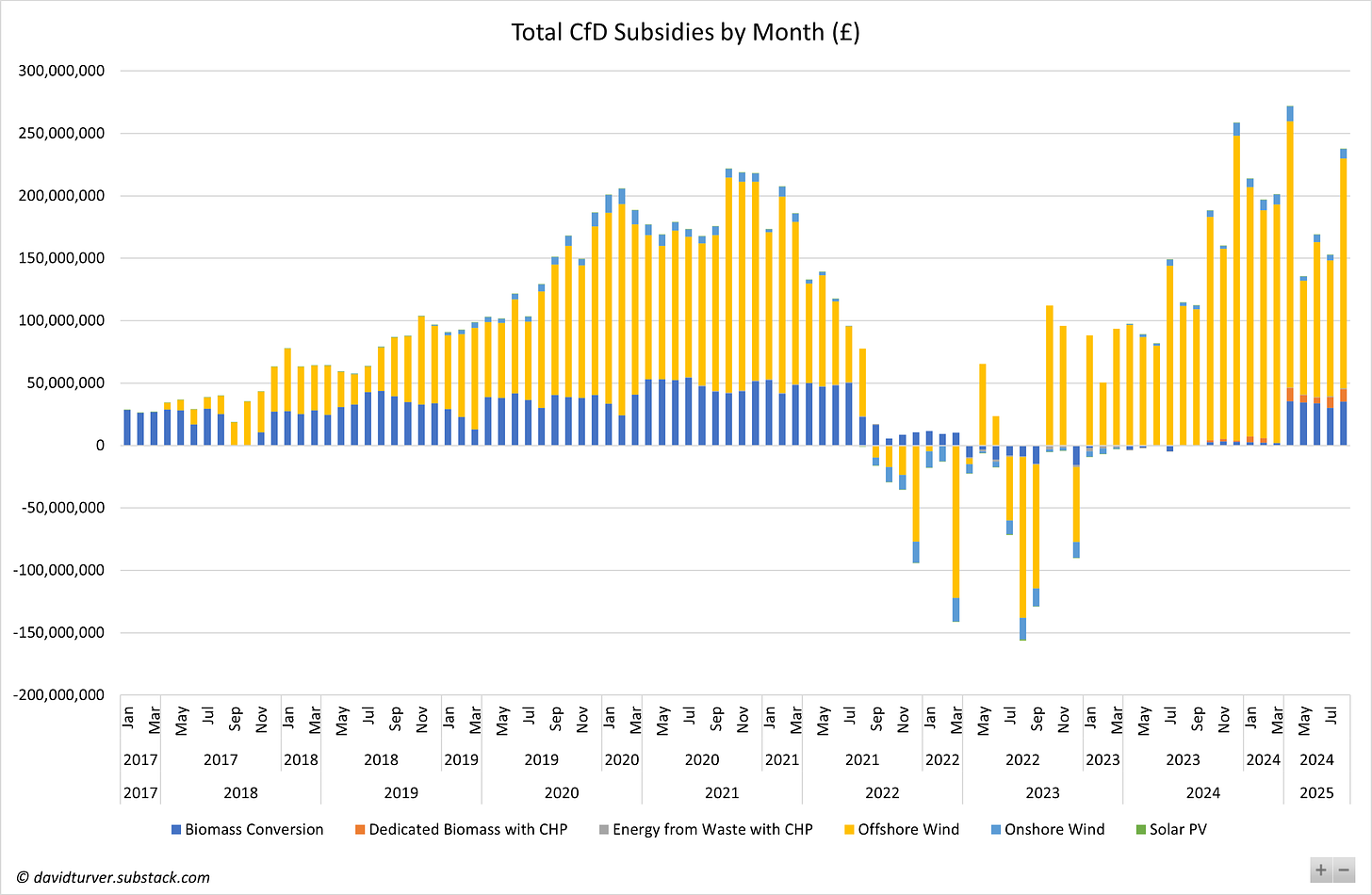

The headline is that overall CfD subsidies rose sharply in August 2024, recing a total of £237 million – the third highest total on record and by far the highest level for the month of August (see Figure 1).

The total is up £84.2 million from July’s total. The main driver of the increase is offshore wind, which is up £74.5 million from a month ago. This August’s total is also up £123.8 million from August 2023. Since August last year, offshore wind subsidies are up £72.3 million, biomass conversion £35 million, biomass with CHP up £10.2 million and onshore wind £5.1 million.

There are several factors driving the increase in subsidy since last year. First and most obviously, more wind farms have now activated their CfDs since last year. Moray East and Hornsea Project 2 offshore projects came online earlier this year, as did the Sneddon onshore wind farm. Moreover, the CfD part of Drax biomass plant was not used at all last August, but it attracted £25.6 million in subsidies in August 2024.

Load Factors

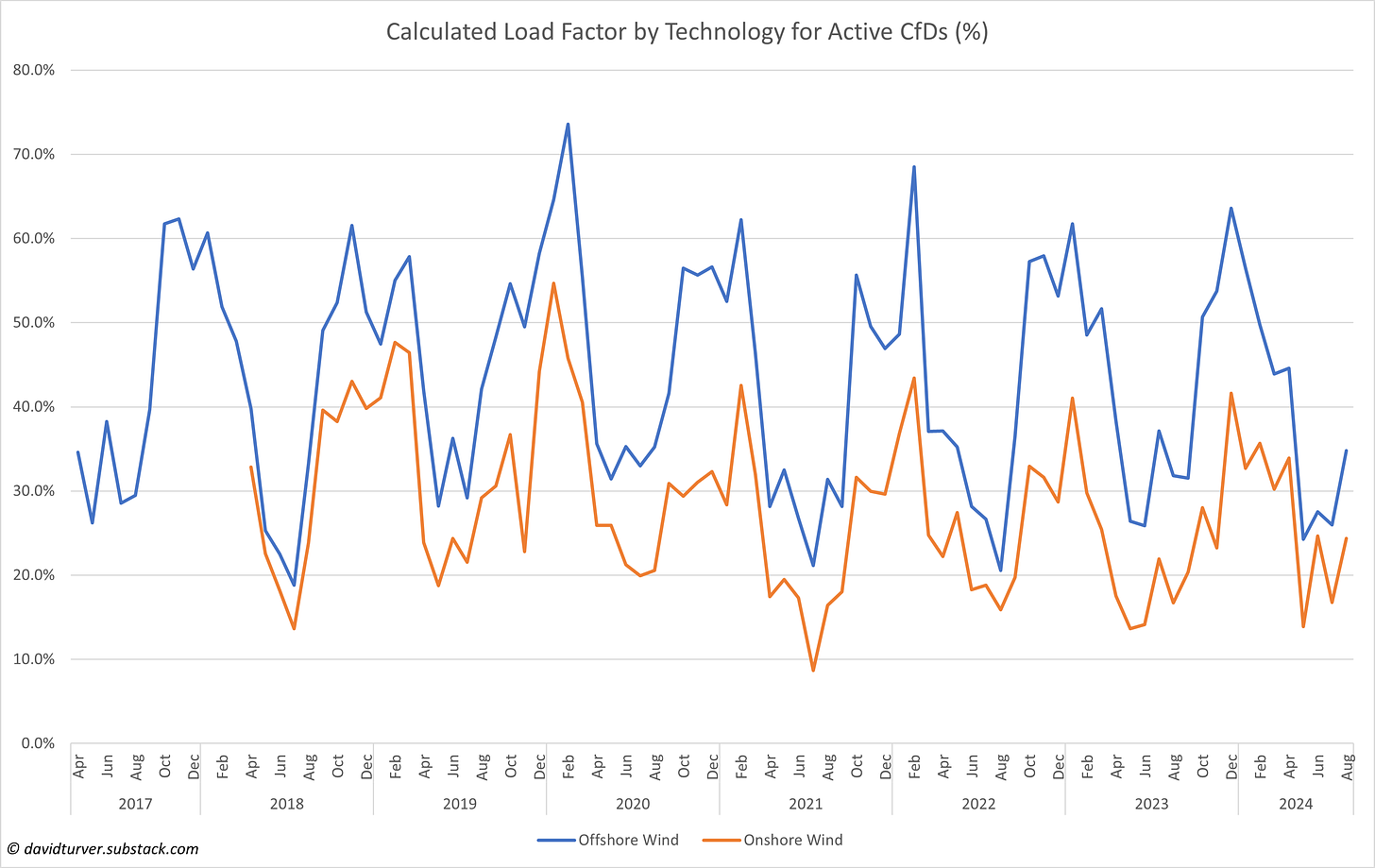

However, the number of turbines claiming subsidy is not the only driver of increased subsidy. Load factors are also up. This means that both onshore and offshore wind farms produced closer to their theoretical maximum during the month (see Figure 2).

Using the nameplate capacity recorded by LCCC for each installation, we can calculate the load factor for each project and aggregate it by technology. In August 2024, CfD-funded offshore windfarms achieved a load factor of 34.7%, the third highest August on record, the highest since August 2020 and up three percentage points since last year. Onshore wind achieved 24.9%, the second highest August load factor on record and up from 16.7% last year.

More wind means more generation and, other things being equal, more generation means more subsidy.

Subsidy per MWh

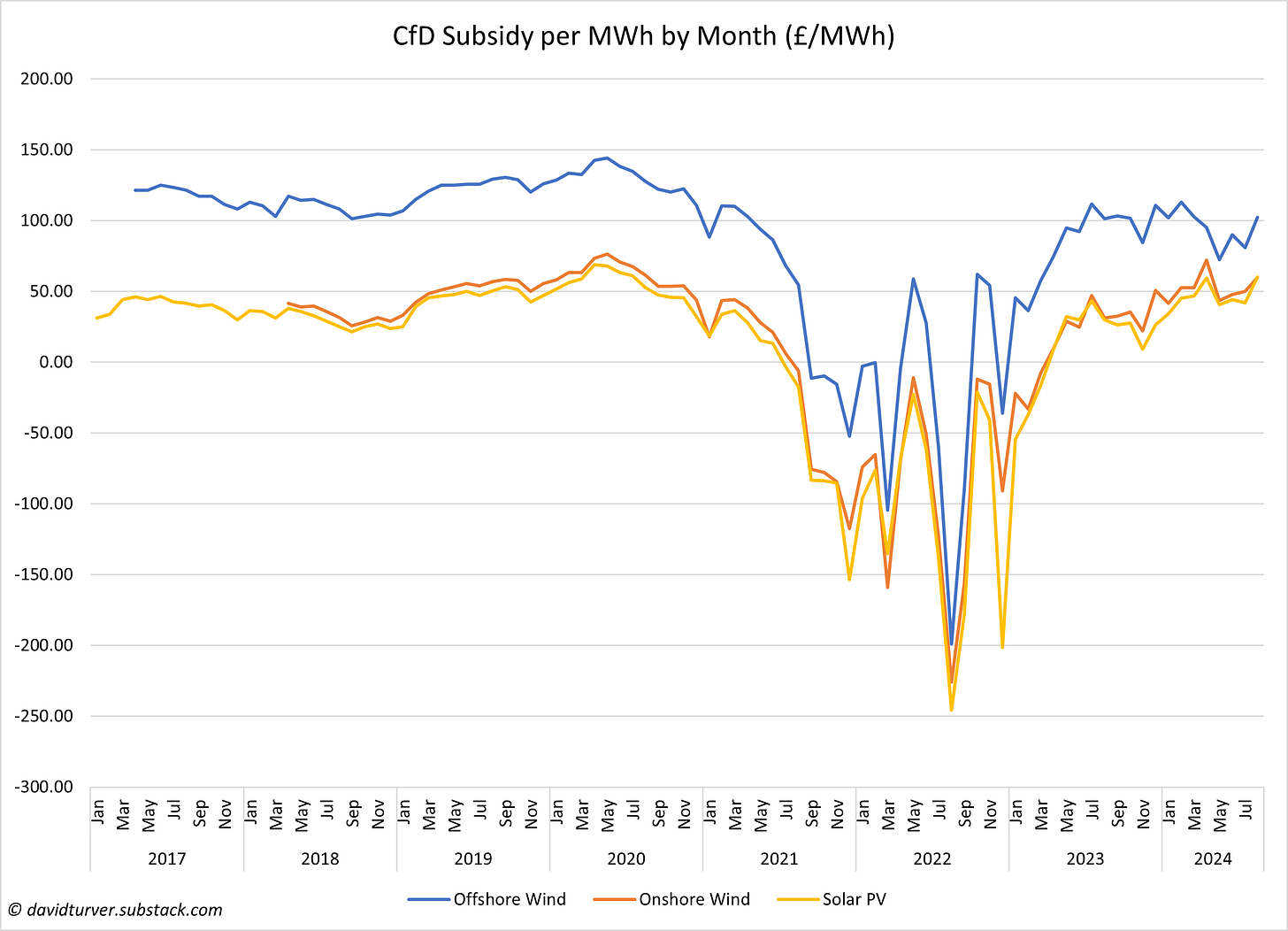

The other things that drive the levels of subsidy are the CfD strike prices and the reference price used to calculate the subsidy level. For offshore wind, the weighted average strike price has fallen by £23/MWh from about £178/MWh in August 2023 to £155/MWh this year. This is because of the aforementioned addition of Moray East and Hornsea Project 2, which both have lower strike prices than the earlier offshore wind farms. The strike prices for onshore wind are up a few pounds from last year to £113/MWh, and solar is up £4 to £110/MWh.

However, the Intermittent Market Reference Price (IMRP), which is used as the baseline for the price that renewable electricity was sold for in the market, is down significantly on last year. The average IMRP, weighted by generation, has fallen about £25/MWh from £76/MWh in August 2023 to about £51/MWh in August 2024.

The subsidy per MWh is calculated as the difference between the strike price and the IMRP. The upshot is that the subsidy per MWh for offshore wind is up a bit since last year and is up sharply for onshore wind and for solar power (see Figure 3).

Gas prices are lower this year than they were last, so that explains some of the reduction in IMRP, because gas often sets the market rate of electricity. However, adding more uncontrolled renewable generation can also affect the IMRP. There were two days in August when the weighted IMRP for offshore wind fell below £20/MWh and three occasions when the weighted IMRP for solar fell below £10/MWh. Provided the price stays positive, this does not matter to the generators; they just make up the difference with extra subsidies. If the price goes negative for a time, then some wind farms are not paid curtailment fees.

Conclusion

The addition of the newer, cheaper offshore wind farms has not had a significant impact on the subsidy per MWh. The reduction in average strike price has been overwhelmed by a combination of the indexation upwards in April and cheaper gas prices since last year. Even if gas prices stay at the current elevated levels, we are unlikely to see a significant reduction in the subsidy per MWh because increased generation from renewables pushes down the IMRP, thus increasing subsidies. For the generators it is heads they win, tails the consumer loses. We can expect more record subsidies between now and February 2025 as the seasonal load factors creep back up and Drax is kept running to replace our last remaining coal plant, which shuts shortly.

David Turver writes the Eigen Values Substack page, where this article first appeared.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Read the article earlier. Of course Shriver is right, but she neglects to give us a suggestion about how we counter this menace, unless she just thinks that each mania will blow itself out, and eventually the behaviour of the maniacs will soften and come back to reality..?

That’s obviously her idea of it.

No, she seems to be suggesting that one mania follows rapidly on the heels of another.

Stuff like this has happened in the past: for example Tulip Mania in the 17th century when men ruined themselves to buy overpriced bulbs; and the South Sea Bubble in the 18thC when so many piled on the dodgy investment. Common sense, prudence and rational thinking were all ditched.

But those manias were largely about making money and one didn’t follow the other with such rapidity. There was no mass communication.

Beatlemania came along with mass media and TV.

In the last few decades, the internet has spread IDEAS (memes) across continents in a matter of hours and most humans are conditioned to be groupthinkers, copying each other’s behaviour.

Although I appreciate Shriver’s broad arguments, I can’t agree with her sweeping statement that ‘EVERYONE’ thinks, talks of, believes in and promotes the latest mania.

As someone who has rejected climate change, transgenderism, covidia, BLM, and me-tooism, I hope there are many, many more of us who are sceptical on a daily basis and eschew the herd mentality.

But manias today are like buses – there’ll be another one along in a minute.

The global boiling crescendo is the same people who brought us COVID — The Virus Strike Back! continuing to use their newly learnt rethoric and other tricks, especially the substitution of facts with ever more hysterical lying, for their other hobby horse. Deadly heatwave season, with weather forecast maps all in RED!!!, has apparently already been started in Germany despite real temperatures remaining in the lower 20s, coming hot after a string of Hottest ever! months, starting with (I kid you not) unusually warm snow in winter.

“all white people are genetically racist”…..Why would that then exclude black racism towards white people?

These manias as she calls them often come at a time when something else big is happening in the world and is handy to keep the plebs looking the other way.

I’ve found some mania. Not that anybody can escape maniacs and mentalists these days so it’s not exactly a challenge. Look what these entitled, narcissistic little scrotes have just done today. They’re not even bothering to hide their identities. What do you think happened to them as a result of their actions? No doubt the parents will fit the bill and say ”well done!”

”BREAKING: We Painted @UKLabour HQ Red

Labour has blood on their hands. They are complicit in the murder of Palestinians, and millions of people around the world, as they continue to drive genocide.”

https://twitter.com/Wayward_sestra/status/1777380981432861020

Climate Catastrophism has been around a while now – since the ’70s at least. It has had various episodes, such as The Coming Ice Age, The Ozone Hole, Global Warming, Climate Disruption, etc.

I think Climate Alarmism is more of a money-driven scam by an elite rather than a mania of the masses. The Blob has found it a useful way of extracting extra tax from the populace and is keeping it going. It will lbe up to the populace to stamp it out, and there are signs (not least on the Daily Sceptic) that this is starting to happen.

I wonder if the next trend will be identifying as a different colour and ethnicity. We might all go Michael Jackson in order to get the jobs and sports scholarships allocated for those people.

Trans men are simply oddball gays or

paedos using it as cover and protection. Trans women are likewise. Gay people are often very narcissistic so being trans plays to this internal desire to be adulated

There’s a third option: They get paid for playacting something in public.

And the Putin threat mania? Once he is finished in Ukraine, he will first take Europe and then the rest of the world. Everyone to arms!

The herd is easily stampeded. It has always been this way. Just look at the toilet roll mania at the beginning of the covid scam or I can go back 60 years to bread strikes. I can also talk to the power of advertising. People of my age will remember The Golden Wonder peanut advert with the strap line “their jungle fresh”. People were coming into our shop asking for “Jungle Fresh” not simply peanuts.

But now with global connections and social media, nearly all the world goes mad together.

2016 also brought in the crazy clowns craze. Also going back a few centuries was the dancing craze.

I hope you are not referring to Brexit. The only crazy clowns between 2013, when the Referendum was announced, and 2016 when LEAVE won, were the Remainiacs. Idiots who predicted, like Chicken Licken, that the sky would fall down if we left the EU.

Crucial point: All of these manias conform to the agenda of the fashionable ruling elite. The institutions in power have every incentive to promote, support, and reward those who advance the progress of each of these trends.