It’s well known that some countries and jurisdictions offer very low tax rates for wealthy individuals or multinational corporations. But how much impact do they have in terms of global profit-shifting? And who are the biggest losers?

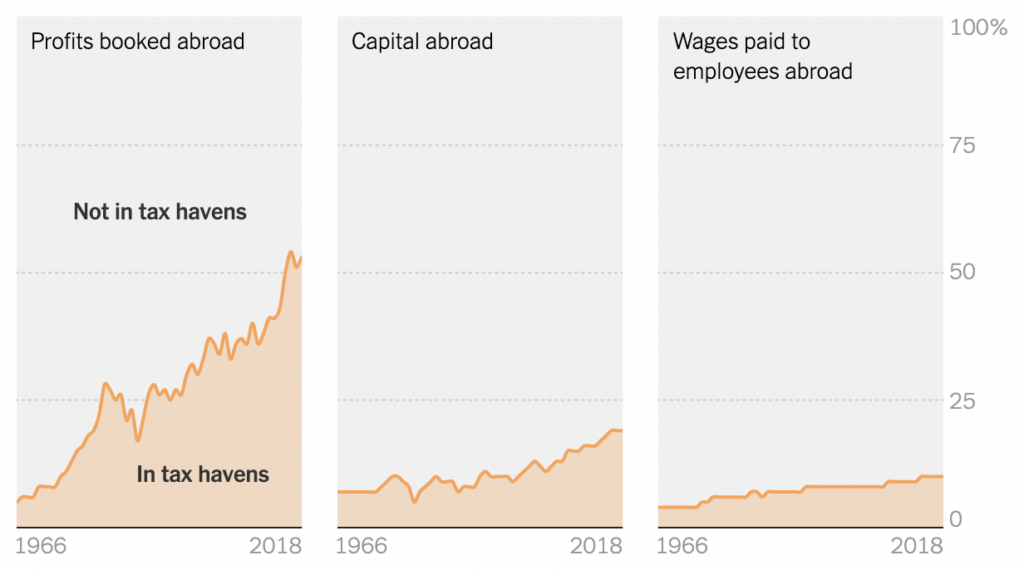

According to economist Gabriel Zucman, a leading researcher in this area, use of tax havens has grown substantially over the last half century. The graphic below shows trends for US multinationals.

The left-hand chart indicates that companies have been reporting an increasing share of their overseas profits in tax havens – rising to more than half in 2018. Meanwhile, the share of their capital and wages allocated to tax havens has only risen slightly – as seen in the other two charts. This is essentially a smoking gun for profit-shifting. Companies are recording more and more of their profits in tax havens without doing much more actual business there.

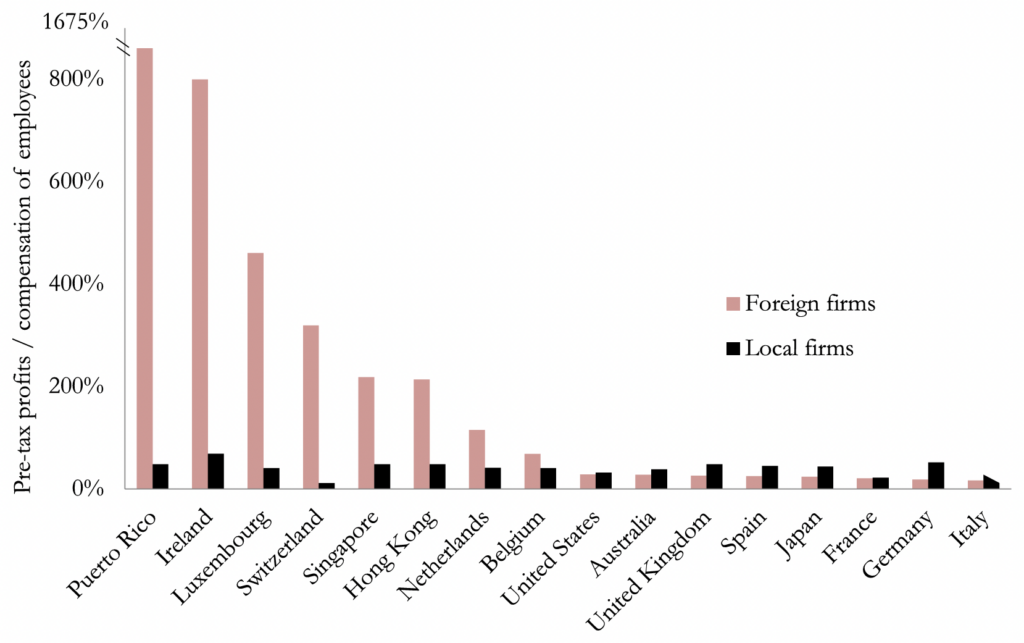

So where are the biggest tax havens? Different researchers have compiled their own lists of the ‘top 10’, but they turn out to be more or less identical, with the same countries cropping up again and again: Ireland, Switzerland, Luxembourg, Puerto Rico, Singapore etc. Yes, the Celtic Tiger is now among the world’s biggest tax havens.

The chart below, taken from a paper by Zucman, shows the ratio of profits to wages for foreign and domestic firms in various countries around the world. For large Western countries like the UK and France, the two bars are roughly equal in height: foreign firms are about as profitable as domestic firms. But for the jurisdictions mentioned above, foreign firms are vastly more profitable. This, again, is unmistakable evidence of profit shifting.

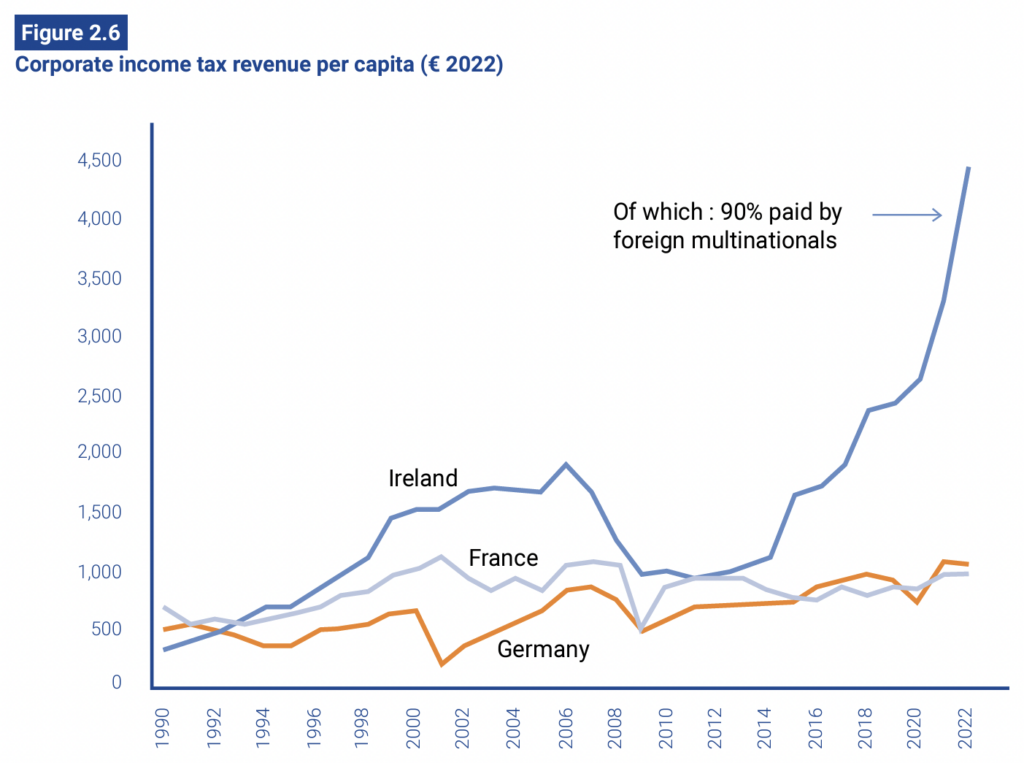

A major consequence is that those few jurisdictions collect vastly more tax revenue than they otherwise would. The next chart shows corporation tax revenue per capita in Ireland, France and Germany from 1990 to 2022. Since Ireland ‘reorganised its affairs’ in the early 2010s, there’s been a huge divergence, and the country now collects more than four times more corporation tax revenue per capita than France or Germany.

Zucman and his colleagues estimate that 36% of multinationals’ profits were shifted to tax havens in 2015 – the latest year for which data were available. And where were these profits shifted from? Who, in other words, are the biggest losers? In short, it’s high-tax European countries like the UK. According to Zucman and his colleagues, Britain’s corporation tax revenues are 18% lower than they would be in the absence of profit shifting.

Now, this profit shifting is basically a zero-sum game. Places like Ireland are essentially stealing tax revenue from their neighbours. Productive activity that generates profits takes place in the UK, France or Germany, and then the profits get taxed in Ireland. The Irish government ends up with more money to spend on public services, while those other countries have less.

Why don’t those other countries put a stop to this by applying some pressure? The answer is not entirely clear. One possibility is that elites within losing countries have an interest in the continued existence of tax havens, since they’re more likely to be shareholders in multinational corporations, and/or the corporations themselves lobby governments not to take action.

Another possibility is that it’s an arms race: as soon as you close one loophole, another one opens up. While this may be true to an extent, it has a hard time explaining how places like Luxembourg and Switzerland have managed to remain tax havens for decades without much being done.

What is clear is that tax havens’ impact is far from trivial. Major European governments are losing billions of dollars in revenue to them every year, and will continue losing revenue unless they take action.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Perhaps the larger countries could try taxing firms less?

That is categorically incorrect. In several ways.

Taxation is transfer activity and so has a cost but produces nothing. It simply takes property (money) from one party to give it to another. And as it employs resources doing so, taxation can be seen as negative production. It costs something and produces nothing.

In addition, companies put their profits to work or give them to shareholders who then consume them or put them to work. Companies and individuals do all of that more efficiently than the state and so even if taxation cost nothing, which it doesn’t, it would still result in an overall loss.

So shifting profits to avoid taxation is not a zero sum game. It’s a productive activity.

The problem we have, is the notion of private property Rights is no more. The collective ownership of property has become firmly entrenched in the minds of the ruling elite and a large section of the Great Unwashed who have been conditioned since 1945 to believe they have a Right to other people’s money to be used for their benefit.

Profit – either individual as wages, or institutional as return on investment – belongs to collective via the State, and those running decide from time to time how much the private owner can keep.

We often hear that people should pay their fair share of tax. As Thomas Sowell (I think) put it, What do you consider your fair share of somebody else’s money is?

The notion that Ireland is stealing tax revenue from higher tax countries always drives me nuts.

these companies can be assumed to obey the law in each of the countries in which they operate.

Therefore France say if she doesn’t like the fact that her most innovative dynamic countries book their earnings in Luxemburg then there are two possibilities:

I suspect the truth is that the movers and shakers in France and elsewhere don’t change the rules because they use them to line their own pockets, and bollocks to the long suffering tax-paying classes.

Tim Worstall used to be very good on this but I haven’t been to his blog for a bit.

It is also the case that whilst corporations pay corporation tax on their consolidated accounts in the jurisdiction in which their corporate seat is located, it is also the case they pay tax in-Country on profits of subsidiaries if their activities directly contribute to sales within the jurisdiction in which they reside.

Amazon UK pays no tax on sales in the UK because it does not make those sales, receives no revenue from them and therefore makes no profit on them. That is because Amazon UK is basically a warehouse operation. It pays UK tax on profits from selling its logistics service to the parent in Luxembourg where Amazon EU is responsible for selling and receiving sales revenue and thus profit – taxed in Luxembourg.

Global corporations use tax havens to aggregate their global post-taxed (in various jurisdictions) profits rather than repatriating them where taxation is high.

Apple, for example, amassed huge taxed profits off-shore to avoid the high taxes due if they repatriated them into the US. OrangeMan (Boo! Hiss!) when he was in Office introduced a 15% (I think) one time tax on repatriated funds, which encouraged Apple and others to bring funds into the US.

“Who Are the Biggest Losers From Tax Havens?”That’s easy. The biggest losers are those governments who tax too much, and spend too much and waste too much. If tax havens did not exist, their taxing and spending and wasting would be even greater. I think it follows that tax havens are a benefit to the entire world.

Bingo.

Avoiding tax makes you smart.

Ireland is clearly an example that the Labour government isn’t going to follow.

Best of luck in the pursuit of jam tomorrow, Keir.

Perhaps France should get Ireland kicked out of the EU if it’s not playing by the rules?

Ah. The Rules.

There have been attempts to sanction Ireland and prohibit it from not doing the decent thing – France particularly upset.

Tax havens are competition. Without them there would be no restraint on National Governments’ addiction to high taxes.

Profits repatriated are then taxed. Profits distributed as dividends are taxed according to the rules in the jurisdictions where the shareholders reside.

“Places like Ireland are essentially stealing tax revenue from their neighbours. Productive activity that generates profits takes place in the UK, France or Germany, and then the profits get taxed in Ireland. The Irish government ends up with more money to spend on public services, while those other countries have less.”

The neighbours meanwhile have the benefit of wealth being created within their Countries by that productive activity through the increased goods/services for consumers and also jobs. That is what productive activity is for, not to provide tax plunder for slimeball politicians to pizz away.

Public services consume wealth, they generate none. Ireland is not better off because whilst it gets tax revenue, it does not get any increased economic activity and wealth generation and the benefits that brings. No Country gets rich on taxes, just the hucksters who collect it.

That’s why until recently, there has been net population outflow with Ireland exporting its best and brightest. Now it’s replacing them with the dregs of Humanity.

There is no “stealing” of anything. Each country is free (well, not exactly because of the horrific GMT) to set whatever corporate tax rate it wishes – just like every country is able to set an entire range of taxes and laws within its jurisdiction in order to make itself more or less business friendly.

Some countries (of course, it is the ones that are supposedly “losing” tax revenue) have massive natural resource advantages that they fully exploit – they also (mostly) happen to have the most developed economies. To protect themselves from legitimate competition, they shamelessly introduce GMT in order to take away a legitimate method for other countries (without those natural resources or developed economies) to attract business. It is cronyism on a global scale and utterly disgraceful.

Tax competition is legitimate competition. Regions WITHIN borders engage in it all the time (example: all 50 states in the US are in competition with each other – would the writer suggest that all the companies relocating to Texas from California should be prohibited from doing so or that Texas must remove its tax policy differences?). To decry it is to be anti Capitalist.

You would almost think from this discourse that giving more money to government’s will result in some useful purpose. Government’s are already massively oversized and destructive. You have to be particularly naive to think that removing money from private industry and business and giving more to politicians will result in anything useful.