If you’re going to introduce a radical Education Tax that is transformational for some households, then even if it’s a good idea (which it’s not) then you need to consider timing and transitional effects. In other words, Government should be thoughtful not only about what they are doing but how they are doing it.

Before the election, the Labour Party were indicating Corbyn’s Tax would start in September 2025. Labour candidates briefed voters to expect September 2025. The aggressive January 2025 release, announced here on July 29th is already causing predictable carnage and distress for parents who will be, or might be, displaced, and we want Starmer, Phillipson and Reeves to take responsibility for the situation they are causing and announce a delay.

This post explains the transitional short term challenges of Corbyn’s Tax, which (like the reaction to “swamp the comp” which I covered here) illustrate the lack of capacity, and operational inability, of the state sector to respond in the way our Government promised. Two relevant asides (1) comparison with the Soft Drinks Levy and (2) an article on Starmer’s opening notes as an “illusion of seriousness”; then I’ll tell you just how badly this is already going.

Please (1) help the Education Not Taxation campaign by telling your MP what you think of Corbyn’s Tax and its implementation; you can use the guidance here. (2) Subscribe to the Economics with Mr Chips blog and share widely. Finally, (3) sign the petition, and tick to receive updates.

(1) Case Study: the Soft Drinks Levy

The Soft Drinks Levy raises 18p/24p per litre on drinks that are high/very high in sugar content. In today’s money, that’s 8-10% on a bulk carton of canned Coke at Tesco. It’s a higher rate (on price) for large bottles or own-brands; a lower rate at higher-priced outlets. Incidentally I learned that Fanta, whatever else it contains, comes in under the sugar threshold, and that many drinks have been reformulated to do the same. As of 2022, 85 countries tax sugary drinks.

Starting in June 2014, the Government spent two years considering options, consulting and gathering existing evidence (which was already pretty robust), gaining further input from national and international scientists and industry experts. The tax featured in the March 2016 Budget, and then took two more years to implement in April 2018. So four years in total.

I’m not going to opine on whether the Levy has been A Good Idea or whether it has worked as intended. I want to talk about the timeframe. It is worth briefly noting that revenues were “hypothecated” i.e. reserved for activities promoting healthy living, and that lasted about two years before revenues (shock horror) disappeared into general waste Paying for Marvellous Things for us all.

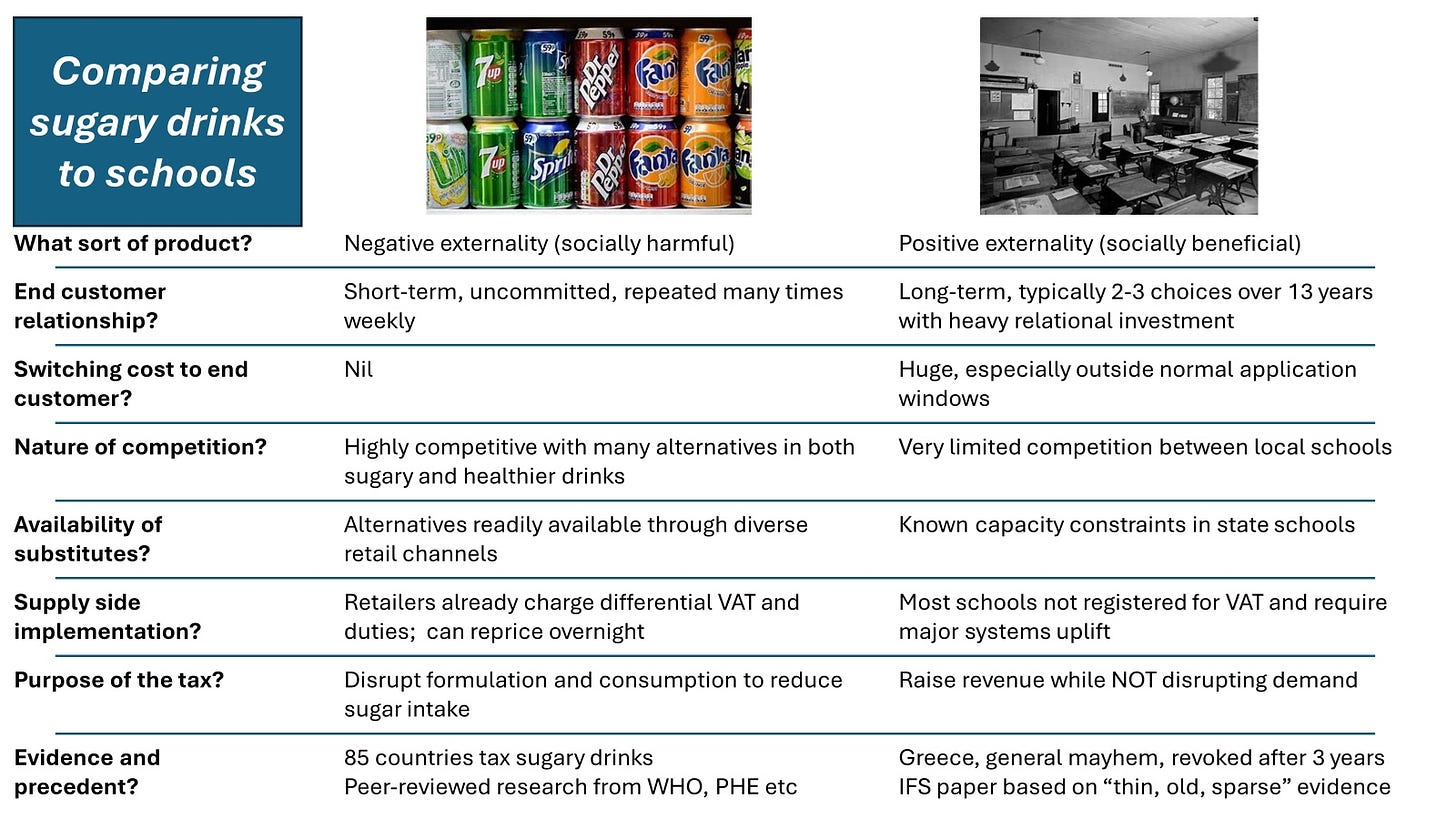

Let’s do a side-by-side comparison between the Soft Drinks Levy and Corbyn’s Education Tax.

So on every economic dimension, these two goods/services are at opposite ends of the scale:

- The last government took four years to tax at 8-10pc something we don’t want with the explicit objective of there being less of it, in a fast-moving market with heaps of competition and highly-responsive demand and supply, where supply chain can adapt easily consisting mainly of large corporates with vast IT budgets, and with a robust evidence-base including 85 countries regarded as success stories

- This government is taking four weeks to tax, at 20pc, something we’d ideally like more of with the explicit objective of raising revenue (thus not harming quantity) in a market where switching brings huge cost, competition is weak and slow, alternatives are scarce and burdensome on the state, and neither demand nor supply are able to respond with speed or ease, causing a major implementation challenge to small and medium schools that are unlikely to have resources on-tap, based on one pathetic paper from a domestic think-tank, and with the sole international example of Greece and general mayhem

Who on earth thinks sugary drinks deserved an approach of “act with caution, do no harm, allow time to adjust” while for the Education Tax, disrupting kids’ lives, it’s a case of “just do it yesterday, never mind the cost?” What could go wrong?

(2) The Illusion of Seriousness

I liked this article in The Spectator which contrasted the theatre of Starmer’s victory speech…

As always, you have to work out what Starmer actually means – or wants you to think he means – with his current tack. “Unburdened by doctrine” is his phrase du jour, one that is just begging fate to make highly ironic. It fits very neatly with his head shaking, disappointed-in-you, you’ve let the school down, you’ve let yourself down 2024 persona. “Dear dear, here I come, everyone deserves respect and dignity and we must behave very nicely and everybody needs to calm down because look how reasonable I’m being.”

This is passive aggression elevated to an art form, pure vibes.

…with the people he entrusts with high office. Lammy, who compared the European Research Group of Tory MPs to “Nazis”. Dodds, who doesn’t know what a woman is. Nandy who thinks convicted male rapists should be allowed to sign up for women’s prisons. Serious? Grown-up? Competence-not-chaos?

“The adults are back in the room” is the bum-clenchingly awful cliché of this vibe. But what does this actually mean? As long as the aesthetic of sensibleness, competence, ‘seriousness’ is there, you don’t have to actually be any of those things – just look as if you are.

We’re being taken for fools – or rather, we are fools, if we fall for Starmer’s soppy-eyebrowed, mellow tones. Remember folks, as I wrote here, this is Starmer the barrister at work. Barristers are required to have an “interesting” relationship with the truth in order to serve the cause of justice. Bringing adversarial sham to the office of Prime Minister isn’t so great for the cause of UK plc.

If everything looks right, and everybody is behaving reasonably on the surface, a government can get away with pretty much anything. The correct tone – the illusion of sweet reason – is all that you need, as you tear the place apart.

Implementing Corbyn’s Tax at any cost

Now to the point.

Labour have promised all independent school parents a “welcome at a brilliant state school”. It doesn’t matter, goes the tale, if loads of families are unable or unwilling to afford the fees + VAT, because there’s heaps of space in state schools. The state sector will serve you all with a smile.

(Of course it matters, because if loads of families switch then the tax raises zero or negative net revenue, but stop the awkward remarks, pay attention or you’ll be sent into the corridor, see?)

The Swamp-the-Comp saga already proved that Labour are scratchy about capacity issues. The “illusion of seriousness” is that independent school families are being purely selfish and snooty, and they aren’t handing state schools a saving of £8-12k per child because state school places actually exist. There is, physically, an empty chair in a school, near you, reserved, if only you’d be gracious enough to put your child in it.

The promise, the welcome, the brilliance, the place, the chair are all supposed to remain purely theoretical, a rhetorical device to prove what ain’t so. “Yes I know we promised you the place that you already pay for, but we didn’t think you’d actually WANT one. Shut up, stay where you are, and pay up.”

Now to the actual implementation, which started (for families) when Corbyn’s Tax became government policy on 19th July, with the King’s Speech, and the January 2025 timeline was announced only on 29th July. And no, we do not remotely agree that “we were warned” and all that rubbish, since Corbyn’s tax has been around since its election-losing inclusion, twice, in that Communist’s Manifesto. To the extent we were “warned”, we had several Labour candidates insisting that rollout would be in September 2025, presumably in order to swerve the sort of impossible questions I’m raising in this article.

I know who really has no excuse for issues caused in the implementation of Labour’s Education Tax….and that’s Labour. Read on.

How can families possibly respond?

Here’s a few issues facing parents wishing to switch:

- Independent schools typically need a term’s notice to get out of paying fees. So parents unable or unwilling to avoid paying fees+VAT from January must give notice now before the autumn term starts, with just six weeks’ warning from the KS and four weeks from the timeline announcement. Nobody’s wriggling out of September’s fees, those are already committed.

- Parents don’t know how schools will respond (and vice-versa). Some schools are committing to absorb the VAT by cost-cutting; that’s not necessarily sustainable and could be recognition they are in cut-throat survival mode; if this brings a few families across from St Custard’s to St Trinian’s, perhaps the former dies first? It’s all very well for Labour to talk of “cutting cloth” but we are talking a 15-20pc cost-cutting exercise in three months, in an industry that Labour say (with some justification) has no track record of cost discipline. A handful of schools indicating absorbing the tax absolutely does not prove that all schools are able to do so sustainably.

- State schools and local authorities are barely functioning, being “closed for the holidays”. You might get the office to tell you have a place, or you might get fobbed off until September. If you want to meet the Head or pay a visit, forget it. Bournemouth is one of dozens of examples: “After you submit your application, we will send your request to the schools. Please note however that as they have now closed for the summer break, some schools may not respond until they reopen in September 2024.”

- Other local authorities have their systems down whether for planned (believe it or not) maintenance or unplanned outages.

- Other schools are refusing to offer places for January 2025. If you get offered a place at a state school for September, jolly well take it now. If that means you’ve lost the £££££ for September’s fees, tough. You’re a millionaire, remember, “one of the richest in society” according to Bridget Phillipson.

- There is clear and consistent advice against mid-year and particularly mid-exam cycle moves. This is Somerset. Pretty much all local authorities publish similar advice:

- “The attainment of pupils who make in-year moves is markedly lower than their peers, and lower among pupils who make multiple in-year moves. Only 27 percent of pupils who move schools three times or more during their secondary school career achieve 5 A* to C GCSEs, compared to the national average of 60 percent. Results in English and maths for children at Key Stage 2 dropped 12 percent following one in year move, 17 percent for two moves and 25 percent for three moves (2013 RSA – Royal Society for the Encouragement of Arts, Manufacturers and Commerce report on in year admissions).”

- “If your child is at a critical stage of their education (in year 10 or 11) it is likely that the school you wish to transfer your child to will not use the same exam boards as your child’s current school. If this is the case, any work your child has already done towards their GCSEs may not be able to be used. This could have a seriously damaging effect on your child’s exam results.”

- There is particular jeopardy to around 100,000 non-EHCP SEN children (children with special needs who don’t have an Education Health Care Plan stating their independent school) for example where there is particular harm to children with autism and ADHD in moving them from schools where they are settled and comfortable. It’s all “in the greater good” see.Subscribe

It’s a car crash

The Education Not Taxation campaign argues that a serious approach to improving state schools would #FindABetterWay than taxing schools that (1) generate large and wide-ranging social benefit (2) save the state system £8-12k per child per year with (3) substantial risks to the economy via feepayers’ labour supply and jobs.

Aside from that, the implementation of Corbyn’s Tax is a car-crash. Even if it was a good idea it should be phased in (like the Soft Drinks Levy) over some sensible period to (1) ensure children’s exams weren’t being trashed against government advice, (2) to give schools in both state and independent sectors a chance to adapt and (3) to give parents and kids an actual choice and an opportunity to move schools at an appropriate time.

It’s “as though” the Government is

- ensuring the maximal harm to children

- gouging parents unable to pay the tax in the knowledge they probably can’t / won’t switch schools mid-year

- setting themselves up for a tawdry claim of success “look, nobody moved, like we said”

Either that or, more probably, they simply haven’t thought it through and are out of their depth. Which is crackers. “Parents have had years of warning” they say, we should have planned ahead for Corbyn’s Tax while Labour were in opposition. I don’t agree, but I do think THEY should have planned ahead.

The issues listed above aren’t exactly a surprise. They are issues of Government, a Government that didn’t plan ahead for a self-inflicted car-crash. The illusion of competence-not-chaos is shattered.

Mr. Chips is a pseudonym for an employee of a private school. He writes on Substack.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.