Is diversity our strength? Our leaders certainly seem to think so. And many multinational corporations are of the same mind. In a series of influential reports with cringeworthy titles like ‘Diversity Wins’, researchers at McKinsey have put forward the officious-sounding “business case for diversity”. In short, they claim that more ‘diverse’ management leads to better company performance.

As for proposed mechanisms, they list several: ‘diverse’ teams are more innovative, ‘diverse’ companies have a more positive global image, and employees in ‘diverse’ companies feel a greater sense of belonging.

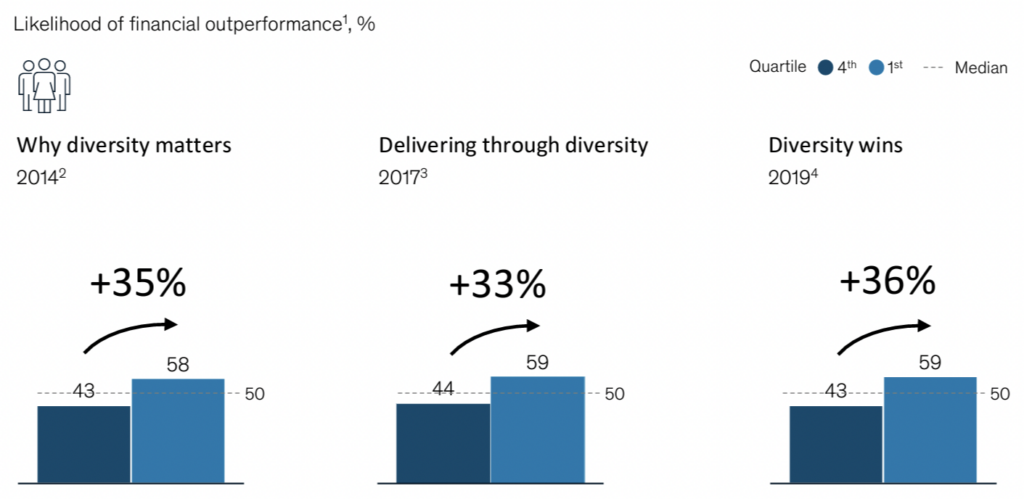

The image below details some of their findings. Each chart is a comparison between firms in the bottom 25% and top 25% for executive ‘diversity’, with the outcome being the likelihood of financial outperformance (a measure of company performance). So for example, the 2014 report ‘Diversity Matters’ found that firms in the top 25% for executive ‘diversity’ were 35% more likely to achieve financial outperformance than those in the bottom 25%.

The McKinsey researchers measured ‘diversity’ using something called the Herfindahl–Hirschman index. This sounds very complicated, but it just means squaring the proportions of different racial groups in the company’s management, and then adding up the results. For example, if a company’s management was 70% white and 30% black, the index would be (0.7*0.7) + (0.3*0.3) = 0.58.

Enter Jeremiah Green and John Hand – two U.S. economists who tried to replicate McKinsey’s findings. In a new paper published in Econ Journal Watch, they summarise what they found.

To begin with, McKinsey would not provide Green and Hand with their data. Nor would they even share the names of the relevant firms. (This is obviously bad scientific practice on McKinsey’s part.) Hence the authors decided to focus on public U.S. companies in the S&P 500 – a sample that likely overlaps substantially with the one used by McKinsey. They also used data from the same pre-Covid time window.

What did the authors find? McKinsey’s “business case for diversity” is built on sand.

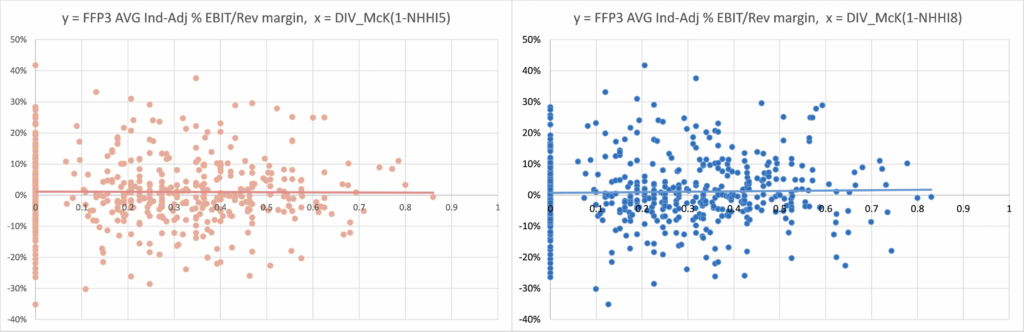

Their main finding is shown below. Each chart plots company performance from 2015–2019 on the y-axis against executive ‘diversity’ in 2020 on the x-axis. The left-hand chart uses eight racial categories to calculate diversity, while the right-hand chart uses five. In both cases, there is zero association between the two variables: companies with more executive ‘diversity’ do not perform better than those with less.

And as Green and Hand point out, there’s an additional problem with McKinsey’s argument. Even if company performance was associated with executive ‘diversity’, that wouldn’t prove the latter causes the former. After all, it could be the other around: perhaps companies that perform better can afford the luxury of greater executive diversity.

In a separate paper co-authored with Sekou Bermiss, the economists show that nine measures of executive ‘diversity’ do not predict any of six measures of company performance in the next financial year. So their null result appears to be very consistent.

Green and Hand have not conclusively falsified the claim that more ‘diverse’ management leads to better company performance; that would require studies that can get around the problem of reverse-causality mentioned above. Nonetheless, they have shown that evidence supporting the “business case for diversity” in fact does no such thing.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Australia.

California.

Canada.

The land of Zeus and Odysseus.

Forest fires all starting at once and in defined areas.

I see a pattern. I am not the science and too stupid to understand it. But I think it means something. Ot maybe the plant food has organised a coordinated assault on these locales directed by Thunturd and Al Whore. So nuanced.

It’s the best psyop since covid

Wait for a heat wave

Get the useful idiot “environmentalists” to light strategic fires

Authorities over react and blame it all on climate change

Make sure MSM is on hand to spread scare stories

How many hotels have actually burned down?

Arsonists funded by… I wonder who? Something about oil, perhaps?

About “stopping oil”?

JUST STOP OIL!

My fiver will be on a green eco-terrorist who is angry at being ignored by normal people.

Wildfires in Greece are nothing new.

Must have been fake news. And anyway, TheScience™ has changed, sor.

Gladiator 2 is on the cards! Comes out next year, Marcus Aurelius isn’t in it, neither is maximus but, lucius is, and his mother..just thought you should know Marcus Aurelius!

Not if the strike continutes, it won’t.

No doubt some fires like that occur naturally, and sometimes they are caused by the stupid. Arson is probably rare. No shortage of opportunism by the usual suspects.

Sometimes better land management in various regions can reduce the risk as well, as mentioned by soundofreason. A fairly recent example is that I can remember times when it was common practice in some parts of agriculture to burn off stubble deliberately, after harvesting wheat and other crops. Not done now, but sometimes it caused a fair bit of disruption, if it resulted in fire damage spreading across the land boundary, like onto a railway line.

A couple of hundred people were charged after the Australian fires.

That’s almost as rare as Covid vaccine complications.

Let’s assume for a moment that it is true that the planet is warming and that more natural fires are occuring as a result.

But the question, as ever, would remain: WHY is the planet warming?! Because it sure isn’t down to anything us paltry little humans do.

The bigger question is why does higher temperatures start fires considering the temperature needed for spontaneous combustion. I can see that a warmer and dryer climate will result in more dry material to support fires but how does nature start them except by lightening strikes?

“None of this is to say that climate change is not increasing the risk of fires in certain locations at certain times of year…” – what on earth does that mean? There are no indicators from observational evidence that anything is happening to increase the risk of fires, and the climate always changes.

Well it’s a double negative, that doesn’t necessarily make a positive: “NONE of this is to say that climate change is NOT increasing the risk…” Very ambiguous. Is he implying that he believes it is? More likely he cleverly got around the hurdle of not being allowed to stray too far from the orthodoxy, by hiding behind some ambiguity… “None of this is to say that climate change IS increasing the risk” is also implicit from the same statement.

At least it’s good to see a small amount of healthy scepticism creeping into the mainstream publications these days. Once a pioneering few have put their heads above the parapet and voiced their human-induced-climate-change scepticism and other until-recently seemingly taboo subjects, others will follow, one can only hope!

Till my tongue stiffens! Oxygen, fuel, ignition !!

Spontaneous combustion does not exist!

Best way to get catastrophe attention! Start a fire🔥

The BBC describes the fires as a ‘biblical catastrophe’, not realising that a real biblical catastrophe – the coronal mass ejection of Rev 8:7, when all the world’s grass is burned up – is just round the corner.

Also there’s rarely mention that fewer mature trees are being cut down at the behest of environmentalists, meaning more old and dead trees in woods and forests than there used to be, providing lots of fuel. The old burnbacks have also been discontinued, meaning there’s more tinder. The ecoloons are making things worse.

Last summer, when it was warm, our local council didn’t cut back any weeds or grass in my area. The same as last year, there was brown grass three feet high that could have been set off by a carelessly tossed cigarette. This year, the council finally turned up and cut some of the grass about a month ago. It’s growing again, but I’ve been cutting it back 20 feet on the land adjacent to our house to keep some sort of buffer area for safety. And the council have the nerve to increase our council tax! They used to cut all the grass and weeds regularly. Now everywhere looks unkempt.

Many moons ago when I was in Zakynthos there was an enormous burned out area on the hillside. My friend who lived there said it had been started deliberately so that as it was no longer a natural forest houses etc could now be built there. Don’t know if this applies to the rest of the Greek island but it does make you think?

Also i know a firefighter who worked in California. He and many others in that service were complaining about the ‘dead wood’ in the forests. This ‘deadwood’ was not allowed to be cleared by the locals as use for firewood ‘cos it would damage the eco-system’ Talk about the dry tinder effect.

This is as well as the ancient aboriginal tribes in Australia used to practice controlled burning of areas which encouraged new growth. I do believe that this practice has now restarted in some areas.

Surely a fire can have an immediate cause of arson but climate chnage sets the conditions which make the arson more likely to succeed and the consequences more severe. No one is suggesting that climate change provides the spark or the match that sets the thing going.

Except that, as someone posted direct from the latest IPCC report on another topic (which the software won’t let me cut and paste) “a signal of climate change has not yet emerged … for… droughts of all types… and heatwaves” (amongst all other extreme weather phenomena). It goes on to say that such a signal is not expected to emerge, even under the extreme RCP8.5 scenario, by 2100 – with the possible exception of heavy rain.

On that basis, the last week’s weather in Britain might be a very early harbinger of climate change, but nothing that’s happened in Europe is.

So it seems you expect us not to believe our lying eyes, and not to believe even the technical report of the IPCC, but to believe politicians, broadcasters and meteorologists who know better. This appeal to authority I do not understand.

I’ll take the IPCC over the press. I was only disputing the argument “it was arsonists therefore it wasn’t climate change”. It would be interesting to read the relevant section of the IPCC report but no one seems to link to it. Whatever it says, it would obviously be looking back a few years not at current events.

I heard it first in a long-form interview with someone who is almost unique in having read the whole report of however many thousand pages. If I remember he was a former IPCC editor. The thing is constructed in layers, an initial scientific working-group report by scientific referees being based on selected research (which is itself, of course, only funded by IPCC if in line with its mission statement to demonstrate the adverse effects of anthropogenic climate change).

That report then gets edited by political appointees at IPCC (so it’s not uncommon to find conclusions that are contradicted by the cited sources, sometimes on the same page).

That in turn gets condensed as the report for policy makers, entirely by political types, so that this time, for example, the hockey stick diagram that was abandoned in previous reports because discredited is included again, though nothing in the “deeper layers” justifies it.

The politicians for the most part don’t even read that summary, but presumably a further precis made by their own civil servants with an eye to previous government policies. And the journalists rely on press released based on those, I guess.

In the case of the statement on extreme weather events (no trend) it’s right there in the final version of the working group report, but not, of course, in the summary for policy-makers. I had nor reason to remember the citation or its page number when I heard the discussion, but I saw it at the time and it’s there OK.

But even without wading through IPCC reports, the data on individual extreme weather types is easily found. For example, sourced information on US wildfire trends is here.

Which working group?

If I remembered that after several months I’d search out the reference for you myself, being ever helpful. I only record references for things I’m actually researching.

Fair enough. I just thought you might remember – after all there are only three to choose from. I tried searching the full report for WG1 but it is such a big document and I wasn’t certain I was using the right words I gave up. I guess we will never be certain what the IPCC actually wrote.

Is anyone looking into the poisonous chemicals falling from the chem trails being a reason things are more flamable at certain temperatures?

I don’t know about Europe; but fire season is big business in the USA. Starting about 25 years ago, our governments, US and states, have gone all in on fire-fighting infrastructure: command centers, very large budgets, equipment purchases, aircraft. Forest firefighters can make easily six-figure salaries in good year.

“…but southern Europe’s extended heatwave has helped create the dry conditions that make it easier for flames to take hold and spread,”

Where did the flames come from? Do they just appear when it’s hot?