I would start a petition, but someone got there first. Direct debits and standing orders need to be outlawed because they allow the Government to empty our bank accounts. And then there are the televisions. I have heard that the BBC restricts their size because if they were a bit bigger the edges of the image would reveal the studio and camera crew.

These are ridiculous examples, of course. But in my view they are scarcely more ridiculous than the scare stories being put out about Central Bank Digital Currencies (CBDCs), which will supposedly allow the Government to control all our money and monitor what we spend it on. As Laura Dodsworth recently wrote in the Daily Sceptic:

Digital money and particularly Central Bank Digital Currencies (CBDCs) offer the potential for the Government, through the central bank, to see every purchase and transfer you make, in real time. And not just see, but control.

I understand Laura’s concern, and if she was right about this then I too would be warning of the dangers of CBDCs. But the truth is that CBDCs are not the threat to liberty that Laura and others think they are. In fact, CBDCs’ critics get things upside down: CBDCs will, I believe, protect us against the overreach of private companies like PayPal, not make things worse.

To see why this is the case, it helps to know that most of the money in circulation these days, 80% in fact, does not come from or ever go anywhere near the central bank. It is what economists call private money. Of the remaining 20%, 17% are reserves held by commercial banks, moving back and forth between them and the Bank of England, so not used by us, the public. That means that only 3% of the circulating money in daily use by you and me has anything to do with the central bank. Your mortgage, loans, direct debits and standing orders, deposits, credit card balances are all private money, none of it controllable by central banks. Not now and not in future, with or without CBDCs.

If we want to know what really happens when a CBDC is introduced, we don’t have to speculate because it has already happened in the Bahamas where the so-called Sand Dollar was introduced in 2019. It hasn’t been the roaring success its central banker John Rolle had hoped for. Last year he said it was “still in the very early stages” two years after launch. Take-up was “modest”, with Bahamians only using it infrequently and for low value transactions. Getting merchants to accept it as payment is one challenge, getting it to move around inside the traditional banking and payment systems is another. Only one of six retail banks and one of five credit unions is even in the pilot. As of May 2022, a mere £263,000 of Sand Dollar was in circulation. Even the Government has had to be cajoled into using it with acceptance of payments for public-facing services still in the future. John Rolle can hardly be accused of exercising enormous power over Bahamian’s money.

The difficulty of getting CBDCs into use is not all that central bankers have to worry about. The IMF no less is concerned that “the biggest and immediate risk that CBDCs pose to monetary policy is deposit disintermediation”, which is jargon for a run on the banks if they became too popular. CBDCs don’t require a bank account, you see. Not surprising then that there has not been a rush of countries following the Bahamas.

But what about Sweden’s Do Black credit card that Laura highlights, launched in 2019 by Doconomy and which limits spending based on CO2 emissions? Not a popular product with Daily Sceptic readers I dare say. I admit this caught my attention because in my previous article I had said this kind of thing would not be possible, yet here it was. When electronic payments are made the payment systems do not know what is being paid for. So how can they make a judgement based on CO2 emissions of what you have bought? What the payment system does know is the merchant and, if the payment is being handled by Mastercard or Visa, the category it assigns to the merchant. If some eco-zealots then went to the bother of assigning merchants some kind of eco-virtue score, or in the majority of cases where they hadn’t got around to scoring a merchant then scoring the general category of the merchant instead, then you could attempt to make some kind of eco-assessment based not on what you bought but where you shopped. The people who have gone to that bother are S&P Global with its Trucost system, partnering with Doconomy via its Aland Index. While all the talk from the card provider to its eco-warrior customers was about “CO2 emissions caused by their consumption”, the reality was a strange rate-my-shop system which may or may not correlate with what your actual consumption was. When it comes to virtue signalling, validity and accuracy are not important, who knew? Despite Doconomy’s claims to have saved the world, the Swedish public were less enthusiastic and the card was withdrawn in 2022.

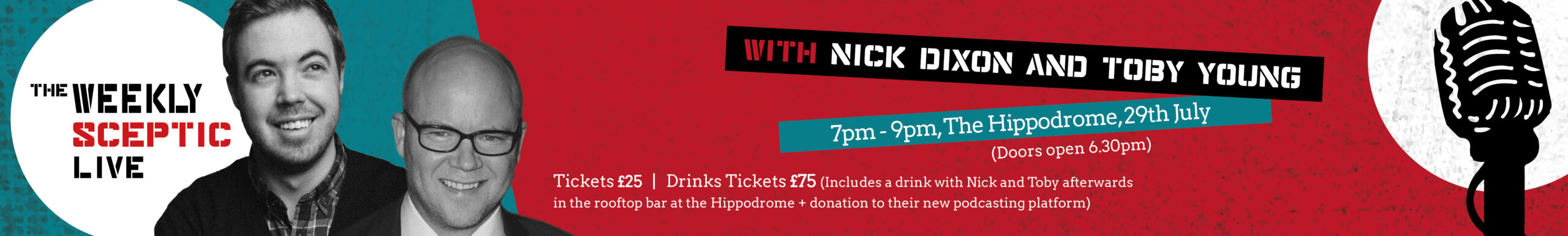

The point is not that schemes like this are launched on a burst of virtue-signalling enthusiasm which then falls flat, but that they are more likely to happen at all in the realm of private money. Further evidence is provided by our very own Toby Young and the FSU being debanked by PayPal and the Nigel Farage NatWest/Coutts scandal. Yes, CBDCs are problematic, as the IMF notes, though not for the reasons Laura gives, and private money is arguably more so and only getting worse.

This has not escaped the central bankers, and it is why we all need public money, just not necessarily in the form of cash. If you are still not convinced, then consider the plight of more than one million people in the U.K. who are completely unbanked. That means they rely entirely on public money – cash – and desperately need for it to remain relevant. In short, they need merchants to accept it. If the only form of public money is anachronistic, expensive to handle and vastly less convenient than its private money alternatives, it is increasingly at risk of becoming irrelevant, shunned and ultimately declined. Think: paying with a cheque at the supermarket checkout. Keeping cash alive with legislation does not address the root problem. As private sector innovation streaks ahead, cash becomes more and more archaic. It will be seen as a kind of Government food stamp, only held by the poor and marginalised and only exchangeable for a miserable basket of essentials at Government approved centres. The threat of being debanked will become even scarier, handing yet more power to the PayPals, Coutts and NatWests. The option of not using a bank or having something useful to withdraw if your bank is about to fail, or simply not wanting an intermediary between you and your counterparty, is always going to be needed. Public money, in the form of well-designed CBDCs will be the answer in the future, just as cash was in the past. Public money must keep up, for all our sakes.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.