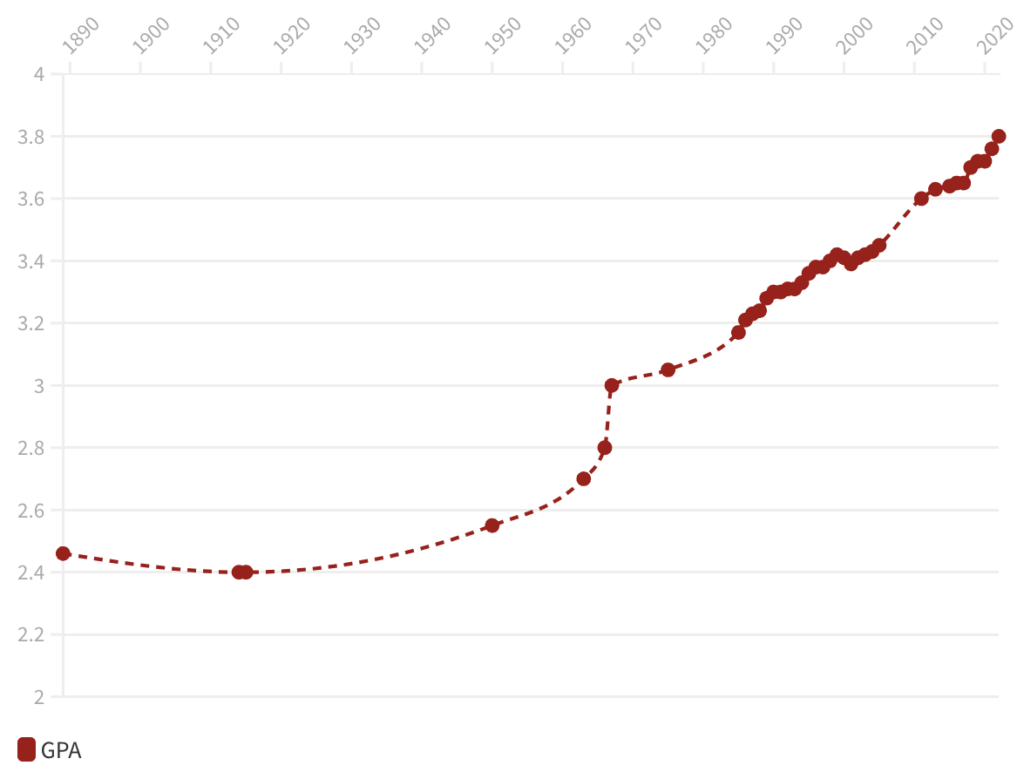

The chart below, first published in the Harvard Crimson student newspaper last October, recently came to my attention. It shows the average grade-point average of Harvard students between 1899 and 2022.

As you can see, there’s been a dramatic rise in average GPA, which began in the mid 20th century. In 1950, Harvard students had an average GPA of 2.55. As of 2022, their average is 3.8 – not far shy of the maximum GPA of 4.0.

It’s truly impressive how much better at teaching Harvard has become. I guess that’s why it’s said to be the best university in the world! Except that’s not what’s going on…

No one can seriously believe the dramatic rise in average GPA reflects a real increase in the quality of teaching. While the early rise might partly reflect admissions becoming more meritocratic, the main factor here is simply grade inflation – students being awarded higher grades for the same calibre of work.

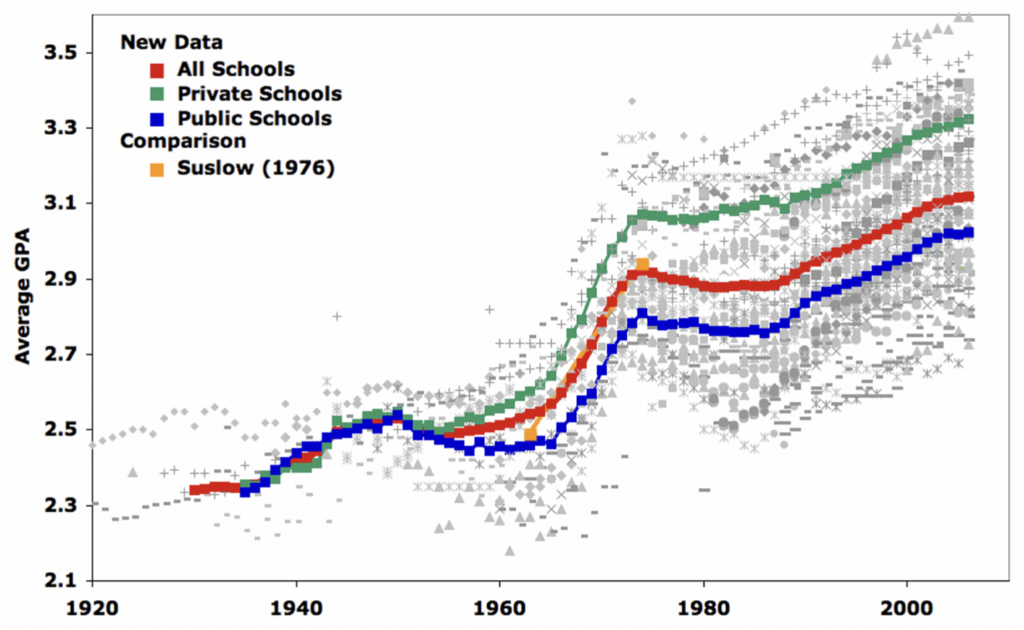

Of course, Harvard is far from alone in having witnessed rampant grade inflation over the last half century. The economist Stuart Rojstaczer has compiled a wealth of data on average GPA at U.S. colleges, and finds that it’s a pretty-much universal phenomenon. Here’s a chart from a paper he co-authored with a colleague in 2010.

And it’s not just a U.S. phenomenon. British universities too have seen grades climb continuously over the last few decades. As the left-hand chart indicates: between 1994 and 2015, the percentage of firsts awarded rose from about 7% to around 23%. And it has since risen further, reaching 33% in 2021.

The right-hand chart confirms that the pattern holds for Britain’s most prestigious universities. In each case, the percentage of firsts awarded rose by around 20 percentage points between 1998 and 2018.

Why are academics grading more leniently now than they were in the past? Rojstaczer argues that the sharp rise seen in the U.S. in the 1960s was attributable to the Vietnam War. Full-time male college students were exempt from the military draft, so professors refrained from awarding the lowest grades to ensure those students didn’t flunk out and get drafted.

As for the rise since the 1980s (which afflicts both Britain and the U.S.) Rojstaczer attributes it to the establishment of a “consumer-based approach to teaching” in which academics’ pay and promotion, as well as their freedom from complaints, are tied to “student-based course evaluations”. Basically: if they’re too stingy with their grades, they’ll receive lousy evaluations, and in addition to the stress of dealing with irate students, they’ll be less likely to advance in their careers.

This sounds right to me. Today’s students are the ‘participation medal’ generation, and until something’s done to rescue academic standards their grades will become increasingly meaningless.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

You think that people don’t know that being fat is unhealthy? It amazes me that someone can be in a profession that advises fat people all day and has an understanding of Western nutrition and just thinks that “SHOUTING ABOUT THIS FROM THE ROOFTOPS?!?” is the correct way to go about it.

If done regularly in a way that makes it as unacceptable as drink-driving, then, yes, I believe a change could be effected. Admittedly most people know, theoretically, that it is very unhealthy, but they need to be made to feel it viscerally!

“as unacceptable as drink-driving”

Because every day really fat people topple over and crush toddlers to death.

Obesity is selfishness personified. It costs the NHS billions which could much be better spent. As an ex nurse I can also tell you that many back injuries to staff are caused by lifting obese people. Try moving someone who is so fat that it takes two people to lift a leg.

What rubbish! Patients are not ‘lifted’ by nurses any longer and haven’t been for many years. Patient’s unable to move/ requiring assistance are hoisted mechanically. Any nurse who attempts to move a patient with mobility/or other issues such as weight is contributing to their own back injury. Any good practitioner would assess the patient prior to moving and handling. Stop spreading bad practice and misinformation claiming that nurses still lift.

Nevertheless nurses are still getting injured, Raquel.

All those slips during tik-tok dance rehearsals, probably.

Assessment is all very well, but patients don’t magically roll themselves on to sliding mats or hoists, neither do they all sit themselves forward as needed, eg to take medication. Undertaking a medicine round can mean lifting and manouvring many patients; stopping to position a hoist or pat slide for each one would mean the medicine round could take a ridiculous amount of time. This is where reality bites over the theory.

The problem is that the so called obesity paradox is that the most expensive patients are those that live longest, which is the overweight.

“However, is obesity always bad when it comes to health?

Certainly, obesity is a significant risk factor for the development of many chronic conditions, including heart disease. However, research has shown that in a number of situations, being overweight may actually be of benefit. This phenomenon has been called the “obesity paradox.”

Our group from the departments of public health sciences and anesthesiology and perioperative medicine at Queen’s University investigated the relationship between body mass index (BMI, a commonly used ratio of weight to height) and outcomes after heart surgery. We analyzed a large database of health records of almost 80,000 patients having open coronary bypass surgery in Ontario over a 13-year period using data from ICES, a not-for-profit research institute in Ontario. We tracked five-year survival rates as well as complications occurring during the year after surgery.

We found that patients in the overweight and moderately obese categories made up two-thirds of all cardiac surgery patients. However, these patients actually had lower death rates and complications than patients in the normal weight, underweight and morbidly obese categories.”

So not only do the overweight live longer than the normal weight / underweight, thy also survive surgery more often.

As always the problem is that the goalposts were moved in the 70’s when categories were redefined for PC reasons and the NHS being notoriously bad at dietary recommendations.

https://theconversation.com/the-obesity-paradox-obese-patients-fare-better-than-others-after-heart-surgery-131637

But if the surgery is needed because of fat related conditions, then the obese intrinsically cost more in terms of health care. Medicine prolongs the life of the obese, basically facilitating poor choices and ill health.

Where is the evidence that those classed as overweight need surgery more often?

The survey above compares surgeries between different classes of people with no indication that those in the normal weight grouping need surgery less.

Medicine prolongs the life of all allegedly, the most expensive being those that live longest, because they need medical care for longer, it may prolong the life of the terminally dim as well.

Poor choices – choosing an NHS instead of a 1st world system?

From: https://www.webmd.com/diet/news/20090625/study-overweight-people-live-longer

“There is more evidence that people who are overweight tend to live longer than people who are underweight, normal weight, or obese.

In a newly published study, people who were underweight and those who were extremely obese died the earliest.

People who were overweight, but not obese, actually lived longer than people whose weight was considered normal, based on body mass index (BMI).

The research is not the first to suggest that those who carry a little, but not too much, extra weight tend to survive longer than people who don’t.

CDC researchers found the same thing in a widely reported study published in 2005, and last month a separate group of investigators reported that overweight heart patients live longer than lean ones.

Rather, the studies generally suggest that people with a BMI of 25 to 29.9 — which is considered overweight but not obese — have a survival advantage over people with higher or lower BMIs.”

Gastric bypass/banding for obesity costs a minim of £5K per patient, often much more. Hip and knee replacements are often linked to obesity are in the tens of thousands, (https://digital.nhs.uk/data-and-information/supplementary-information/2020/obesity-related-hip-and-knee-operations-2014-15-to-2019-20). Gall stones, complicated labour and delivery, etc etc. There isn’t the space to run through the whole list of figures.

Cost of replacement knees for all the joggers out the cost of all the surgery and accident care for all the MAMILs falling off their bikes.

Hip and knee replacements are often linked to lifetime wear exacerbated by manual work and participating in sports that impact the joints.

There is also the lifetime costs of all the brain injuries suffered by the young taking part in sports.

The majority of obese people are public sector employees, especially health sector, the private sector tends to be a bit leaner.

Gastric band surgery is more self indulgent vanity spending.

Gallstones and complicated labour can occur in people of any weight so not sure why you are throwing that one in.

Again, the arrogance is in assuming we’ve got a right to decide who gets healthcare when those who aren’t politically correct don’t meet the currently fashionable criteria.

They have all paid their taxes, didn’t have an option to opt out, so unless we move to a social insurance system we have no right to refuse.

We already know the overweight live longer, are generally healthier and have better surgical outcomes than those classified as normal weight, it is the underweight and the grossly obese who have the major issues with health, as they have worse life expectancy, they cost the health system less over their lifetime.

Is this not because a lot of old and poorly people who are hospitalised essentially starve to death? For example, people with dementia. Yes fat people who’ve lost their marbles and/or mobility might technically live longer but simply existing on your fat stores isn’t living is it.

The ones who starve to death are routinely offed by the NHS.

Evidence that dementia can be substantially reduced with g high intakes of Vit D & zinc, which is against NHS guidelines.

Indeed, by how many and are you willing to set yourself up as Lord High Executioner who decides that Person A isn’t really living so they don’t get healthcare.

The consequences are not as immediately obvious but nhs resources are finite, spending billions treating people for obesity related disease takes money that could be better spent. This is similar to the impending cancer crisis being overshadowed by Covid, focusing only on immediate risk…

The NHS could absorb every penny in the country until the heat death of the universe and still be short of funds.

Maybe if we copied a 1stvworld system as seen in continental Europe which isn’t continually making excuses we’d be better off

We must end the NHS’ sacred cow status but alas, I don’t see it happening. We’ve just seen the ultimate politicisation and manipulation of a health care system.

True, we will eventually need to move to 1st world Social Insurance system like most European countries, Japan, Oz etc instead of the 2nd world NI system we have now.

I think we should shift to it now rather than waiting 100 years just to be sure the NHS really is crap.

No system is perfect but many countries have mixed health care models which function satisfactorily and there’s no reason that we shouldn’t. Public sector workers will not easily relinquish the benefits. As a retired ex-NHS worker I am very aware that the reliable, index linked pension I now have is a privilege that many private sector workers don’t have.

Virtually all 1st world countries operate some variation of Social or Bismarkian Insurance for Healthcare.

The one tbing none of them so.is operate an NHS, you’d probably be lynched by the public if you

suggested it.

They all have much less bureaucracy, better health outcomes and the GP cannot act as a blocking gatekeeper.

Germany, Holland, Austria, Switzerland, Denmark, Japan, Singapore Australia etc etc etc.

We need to look at those countries, see which system we like best and copy it, no reinventing the wheel, just copy something that works.

Many are fat, salad-dodging, pie-eating parents and they pass their unhealthy habits on their fat, podgy, under-exercised children. Starve a child and you can expect a call from Social Services; fatten one to ensure a future of health problems and folk like you will defend them.

I agree. There are no pluses to being fat, you’re doing no one any favours by indulging it.

There might well be be pluses when the contrived food shortages arrive.

Fat is greed.

Perhaps physical punishment would help?

What a miserable git you are.

I should see if SPI-B has a vacancy – bit of mind control should be up your street.

Not really equivalent, as getting slim takes considerable effort and time, while refraining from drink-driving doesn’t.

Addiction may be a factor in both.

Sorry, but a lot of seriously overweight people really do not think they are unhealthy.

Sure. But nevertheless one of the big early clues that Toad n Sage had an agenda other than health was that they ignored linked issues. I expected a campaign last summer to catch Diabetes and pre Diabetes earlier – free easy testing stations at supermarkets – advice, support on reversal of pre and early Type 2 Diabetes, free and non judgemental, given how big a risk factor it was.

Sponsoring with the magic money of outside exercise tracks for all those interested. Especial help for overweight children, perhaps now stuck at home with overweight and anxious parents eating to deal with depression. I suspect one obese child at least died of Covid.

But no. The Psy Spy ops was: “Stay home, be very very afraid, vans will arrive to help you Comfort Eat – wait for The Vaccines, which are all that can save you from death.”

Maybe this GP could ask the Government why it didn’t do the prediabetes campaign?

True, however the best way to prevent Type 2 diabetes is to remove carbs from.the diet and move to a high fat / veg or paleolithic diet.

Its worked all over the world, it just means admitting that OURNHS dietary advice has been wrong and the cause of much of the diabetes going around.

Exactly. Last year, I was near 25 BMI (yes I know that’s a flawed measure) and my waistline was really not good. During the first lockdown, I stopped eating processed foods and cut back on carbs. I lost 14 kg and now have a BMI around 19. It’s called taking responsibility for your own health. During that same period, my now ex-landlord sat in the lounge eating biscuits and watching TV while complaining about other people not wearing masks properly or getting the jab. She’s gained at least 10 kg and still expects other people to be responsible for her health.

Does anyone NOT know it’s unhealthy to be overweight? It’s much like covid though, the government shouldn’t be treating people like children – basic information is enough then it’s up to the individual what, if anything, they do about it.

That’s just preaching and virtue signalling.

Bet it’s the Jews fault.

You should see a psychiatrist with that sort of twisted mind problem and lack of grasp. Sorry that Covid’s got too you that badly.

Actually, the people in the “overweight” category are the healthiest and have the longest life expectancy.

It’s the underweight who are the least healthy.

For me it’s the cause of being underweight that makes me unhealthy. Got suicidal during lockdown and stopped eating. Drinking and smoking too much won’t help. I don’t do that when I’m happy.

Unhappiness is mostly the cause of overeating.

Very, very sorry to hear that, Laicey.

Bollox

There is a big difference between a little overweight and obesity.

Is it underweight or undernourished?

Incorrect, NHS stats show those classified as “Overweight” both live longer and have a greater chance of surviving an encounter with OURNHS than those classified as Normal weight and those classed as Obese.

Which stats are you referring to? It’s an implausible claim. http://obesityhealthalliance.org.uk/wp-content/uploads/2017/10/OHA-briefing-paper-Costs-of-Obesity-.pdf

This point is made in Malcolm Kendrick’s excellent book ‘Doctoring Data’ page 118.

The point he was making was that the NHS BMI guidelines were not fact-based – BMI of 25-30 ‘overweight’ was statistically healthier than BMI of 20-25 ‘normal weight’. Over 30 ‘obese’ and under 20 ‘underweight’ were far less healthy.

I can only find an Indy link to this – sorry:

https://www.independent.co.uk/life-style/health-and-families/features/why-being-overweight-means-you-live-longer-way-scientists-twist-facts-10158229.html

Why is it implausible?

There are nultiple studies from.round the world showing the same thing.

(Maybe if the goalposts hadn’t been moved in the 70’s to redefine overweight it wouldn’t be the case)

“According to a four-decades-long study of over 100,000 adults in Denmark.

There’s a growing body of evidence that suggests we might want to reevaluate the way we measure an individual’s health — a lower weight doesn’t necessarily equate to better overall health.

According to a new study of over 100,000 adults in Denmark, researchers from the Copenhagen University Hospital have found that those with an “overweight” body mass index (BMI) were more likely to live longer than those in all of the other BMI categories — “normal,” “underweight,” and “obese.”

Through nearly four decades of analysis, from 1976 to 2013, the BMI associated with the lowest risk of death actually shifted from the “normal” weight category to the “overweight” category.”

http://thescienceexplorer.com/brain-and-body/overweight-people-actually-tend-live-longer-normal-weight-individuals

A significant number of research suggests the obesity paradox is a myth. https://healthcare-in-europe.com/en/news/too-good-to-be-true-new-study-challenges-obesity-paradox.html

They’d do better by putting everyone on rations than they would coercing mass vaccination

Just sayin’.

… but the two are parallel totalitarian models.

No more so than the campaign against drink-driving. This should not be about the use of force, but of regular reasoning. Those who choose to ignore such campaigning should not be coerced or punished, but they should be enlightened.

Sorry – but that’s an absolutely stupid parallel.

Rationing is on the way.

No it’s not because they know that would fuck them, that’s why Tesco has remained open without everybody croaking.

Or perhaps we all choose what balance of quantity and quality of life we’d like, and ignore the imbecilic focus on length of existence.

Who was it who said “no pleasure is worth giving up for an extra two years in a nursing home”, or something like that?

Kingsley Amis.

Fuck both

Oh I agree. But if you (1) really care about health of your population and (2) were willing to become a totalitarian state in order to achieve it, then rationing would work better than half assed dangerous vaccines for not very dangerous viruses.

Plus it would be better for the planet. Bonus Bill Gates points!

China has demonstrated that a totalitarian state doesn’t need vaccines to get rid of Covid.

On it’s way.

So? What do you propose in terms of regulation of /constraints on peddling addictive food? What are the underlying psychological mechanisms that encourage/promote obesity (note the parallel with engendering fear in the population)?

And, given that increased population obesity correlates with a longer average life span – does it matter?

I’ve no pat answers – just questioning. It’s easy preaching.

I wouldn’t propose any regulation, just admit to young people that being fit & healthy looks better than indulging sloth.

“I wouldn’t propose any regulation …”

That’s fair enough. Doing f. all is indeed one option.

(Preaching at the young is done constantly – that’ also doing f. all in reality. As is wider virtue signalling)

Just sayin’

If only the government had access to behavioural experts who know how to influence the behaviour of the population… Hmmm?!

The problem though is that if they were to use the same level of brutality that we’ve been subjected to and deploy it against obesity, then ‘fat shaming’ is exactly what they’d have to do.

“Look them in the eyes and tell them you didn’t eat that last donut”

“Stay off cakes; walk regularly; protect the NHS”

“1 in 3 fat people are weak willed and cannot resist a plate of éclairs”

“Don’t kill granny, make her exercise more”

“Look them in the eyes and tell them you didn’t eat that last donut”

Best comment

Good point. We’ve given everyone paranoia, OCD, depression and agoraphobia over the last year. But eating disorders have been sadly overlooked. We need to get SPI-B on the job asap.

The article exaggerates the impact of weight on covid (a young person could be massively obese and yet still have a risk much lower than a lean person in their 50s) and continues the public health narrative that BMIs over 25 are unhealthy. A BMI of 26 is associated with the longest life expectancy and the risk above that increases quite slowly (unlike being underweight where the gradient of mortality is steep). The message that most people need is that exercise is beneficial even if you don’t lose weight, and that maintaining your current weight can be a good goal for a diet program. Keep your blood sugar, cholesterol, and blood pressure down and body fat is irrelevant. Instead we apply a cosmetic goal and many people give up because they don’t think it’s achievable.

I’m not saying that those with BMIs over 30 shouldn’t try to lose weight, but why does the public health community insist on a simplistic (and false) message that groups in a lot of people that are not at any significant risk. Also, the idea that people are being lured into being fat by greedy manufacturers and advertisers is ridiculous. People overeat because it becomes a primary source of enjoyment or a self-medication for depression. If that’s a reason for banning products then we are going to have to ban alcohol, sex, and pretty much anything pleasurable that could be harmful in excess.

Is sex harmful in excess? I beg to differ.

It might result in the creation of new people who will then die. An unacceptable risk.

I wonder if that’s really what you meant but it’s patently wrong. The average life span has increased, particularly in the west, for multiple reasons and obesity has also increased (again, particularly in the west) but there is no correlation. If anything, the latter has severely impaired the former and average lifespan would be even greater were it not for the causes of obesity.

It does seem like another case of mistaking correlation for causation.

Great. I don’t drink, I don’t smoke, I don’t fuck around.

I might as well just fucking kill myself now. If it is seen as acceptable to openly insult people their faces about your weight, with full protection of an encouraging establishment, then I have no possibility of joy in life. This is despite having been a useful member of society for my entire life and hardly ever seeing a doctor.

It’s bad enough having to read the hate filled views of the fucking bigot, typing from behind the anonymity of their keyboards all day long. Now we have doctors saying that everyone should be telling me how to life my fucking life, which is none of their business.

Noone should be telling you how to do anything, but that doesn’t stop regular advice – which you must be free to ignore if you so choose.

What, advice like “avoid animal fats and base your diet on carbs”?

Actually the opposite: https://meatrx.com/

No fat Masai, they only eat meat & milk.

No fat eskimos, only ate blubber before westerners got there.

No fat Aborigines, only ate meat & roots

The list goes on.

I’d have thought it was obvious from my comment that I know that.

Sugar and a carb rich diet have done us no favours that’s for sure. And still they are trying to blame meat eaters for fuelling climate change. Of course Gates is in there, investing in non-animal lab developed meat which he believes one day will replace all other meat for sale to humans. What could possibly go wrong?

Excessive (highly refined) carbs are the killer. 0 nutrients. You should be eating plenty of nutrient rich food and you won’t go hungry or be fat. Ivor Cummins on the Fat Emperor blog is an eye-opener on this…

Love Ivor Cummins. If only he was our Health Secretary!

I recommend getting pissed it’s brilliant

It’s only really brilliant when combined with access to a dancefloor. Which we are STILL denied access to.

You,re missing the point.

If a single group us to be singled out, attacked, vilified, coerced and deprived of citizenship rights because it is making itself vulnerable to Covid, that group should be not the anti-vaxxers but the fatties.

That isn’t to say that either group should be attacked. It just means that if it makes sense to attack any one group, it should be the fatties.

HUMANS are vulnerable to Covid.

Therefore we should attack them….

Get your fascism brand here!!!

Your risk of dying of Covid is probably higher if you’re obese and “fully vaccinated” than slightly overweight and not (using official vax efficacy figures).

Yep. What the f. is all this crap doing here? I don’t see much point in working against Covid fascism only to be reading alternative health fascism.

Just ban food advertising (brainwashing) and then see what happens.

Two of the fattest folk I know also happen to be the most ardent covidians.. always masked up, home deliveries for grocery shopping, one vows never to use public transport ever again and both think everyone should be vaccinated and adhere to strict social distancing.

What’s also striking is that both have also put on more weight over the past 14 months. Not surprising really being stuck at home, stressed out they might catch covid and end up in ICU. It’s a sure fire recipe for comfort eating and binge drinking whilst sitting watching Netflix night after night!

Show them this video

Secrets of Influenza – YouTube

Doctors tried to infect healthy “volunteers” with the Spanish Flu

They’re probably ardent covidians because they know full well how vulnerable their obesity makes them.

I know someone similar. Drove me so crazy I had to move to get away from her. Inability to take personal responsibility.

Being very overweight is probably not the ideal life choice and I think people would be happier if they were healthier and fitter throughout their lives, from childhood on, and remained physically active.

Given the insane lengths to which governments now go in the name of “public health”, do I think the government should play a role in promoting healthy lifestyles? No, I don’t. They can no longer be trusted.

Let’s get back to treating people as adults, and the government’s role OUT of people’s private choices.

… and also get pressure from big money out of people’s lives in the form of the PR/SPI-B industry actoss the board.

It’s a very sensitive subject, and political too, but I believe Boris could tackle it. He somehow has the ear of the nation and he could use his own attempts to get his fitness back to lead on this. I know some would see him doing this as patronising and it opens areas for political attacks about poverty and food policy.

Perhaps people may not know how excess weight stored around the body as fat deposits is very toxic and responsible for an inflammatory response in the body, which is what in turn leads to all the associated illnesses from hypertension, heart disease, strokes, cancer, diabetes, bone and joint stress and on and on.

No amount of magic vaccination is going to fix obesity. It’s very complex but very glad this doctor has raised it. Not sure how LS could take it forward though.

Probably the wrong man for the job, given the nature of it (not just him – the whole lot due to the structure of government). No one in that role is competent to advise people on a healthy work/exercise balance; it’s a built in risk they all accept, unfortunately.

It’s worse than that, he is relying on the likes of Susan Jebb who were in charge during the “epidemics” of obesity, diabetes and other metabolic problems, so obviously nothing will change.

When my mother was young, “everyone knew” that if you wanted to lose wieght you cut back on starch and sugar. Some people still caslled dieting “Banting” ( see William Banting Letter on Corpulence).

There weren’t many fat children, and this was often blamed on “glands” ie. hormones.

Obesity etc. exploded in the eighties following the imposition of high carb low fat diets where the only permitted fat was industrially produced omega 6 seed oils.

Farmers feed pigs grains and skimmed milk to make then fat. Dieticians feed people grains and skimmed milk to make then thin. No wonder it doesn’t work. In future it will be high carb low fat vegan diets. That won’t work either. It isn’t meant to, fat people eat more food by definition and are therefore more profitable. Diabetics take more drugs and are profitable (as long as they are kept from controlling the insulin and insulin resistance using a low carb diet).

Insulin and insulin resistance is key to most modern problems. Who knew? Well lots of people actually but none in Public Health.

I view Johnson as a lying, stammering, sweating mound of blubber. I don’t see that any of that qualifies him as the man for the job.

Ivor Cummins has some good points about this. He points out that much of the information we have been fed about diet is plain wrong. He’s made a lot of good points about lockdowns too.

Perhaps we would all be healthier if they fired all the public health people.

Correct. The NHS promotes the food pyramid that is carbohydrate heavy with too little good quality fats – many people get fat and unhealthy on such diets

Got a cute for that?

I thought the food pyramid was an American thing, and is sub-optimal health wise because it originated with the US Department of Agriculture rather than from health experts.

Here it’s a plate but same problem. If you eat how we evolved to eat our bodies work how they evolved to work.

I’d like to see nurses settting an example.

A very good point

And dieticians

Just took the dog down the road. Two encounters within ten minutes. First, narrow bit of pavement with youngish bloke approaching, holding a toddler by the hand. He started hesitating and looked ready to veer into the road. “Come on through pal you’ll be hit by a bus otherwise” says I. He grinned and stopped to pet the dog. “This pavement dancing is just ridiculous” I said and he immediately, fully agreed in loud terms.

On the way back I came across a fella I know by sight from the local pubs. He’d obviously had a few scoops so I asked him if he’d been down my local, telling him I won’t go in while all the mask/app/distancing continues. He told me to go to the club a bit further on, and said: “Once you’re through the door they don’t give a shit, no phone numbers no masks, sit where you like and you can smoke in the back room as well.” So I’ve found a place I can drink in peace.

We are making ground. We are going to win.

Enjoy it while it lasts. We are not making ground. We are losing it faster now than ever.

I have to believe or I’d give up. I can’t give up. Believe me I despair sometimes but I have to keep fighting mentally.

There’s the attitude that the Fascists like best. Go and kiss Wankok’s toe. Or travel a bit higher if you prefer.

Is the club round here by any chance? ( South Wilts since you ask )

Sorry mate, West Midlands.

I should explain that I am Jo Starlin but can’t log in under that name on my phone for some reason!

I had been wearing an mask exemption badge for quite a while now – just to stop people from bothering me and I must say it has worked a treat – but most of the places I visit now know me so well that I know that they are not going to bother asking me about a mask and so I’ve stopped wearing the exemption badge and just go in maskless. Been doing this for a few weeks now and no one has bothered me at all – I’ve even stopped with the hand sanitizer at the entrance too.

I take my hat off to you, sir! I wish I had your courage. As it is, I’m a yellow bellied coward and, as much as I hate it, put on a face nappy to go in shops etc. Consequently, I hate myself for doing it and hate the government even more for putting me in this position. A negative spiral of hate that’s very unhealthy. My solution is – as far as I’m able – to avoid going anywhere that requires me to wear a mask.

It’s how I might react if confronted by some jobsworth that’s been daunting me; the fear of all the rage coming out and the consequences. However, I have just bought a lanyard for an exemption card and if questioned I can politely point out that my medical history is confidential. The masking in a pub whilst standing but not sitting, and in a gym when not exercising is making the silliness all the more silly-obvious. It’s time to break the hate-spiral and ditch the muzzles. We can do this.

Was contemplating joining a gym a month from now (when I’m hopefully completing Bridge to 10k) but not if there’s still any mask requirements…

Try a CrossFit gym! The brand is owned by libertarians so you’re highly unlikely to have to deal with any woke BS.

Get a lanyard – works a treat, and you won’t be required to hate yourself any more!

Me too but I’ve never used sanitiser.

“lifestyle which includes regular exercise”

But last spring government guidance -which they wanted us to think was law – was to keep our time exercising in the fresh air and the sunshine to an hour a day at most.

I actually had a cretinous cowardly covid cultist express displeasure when he realised I was on a walk that took 90 minutes.

They, along with their European counterparts, did exactly what would ensure more deaths – denying people both exercise and sunshine. Well done, Boris.

Wasn’t it half an hour a day to start with? And Wankok threatened to deprive us even of that.

I think our Wise Leader in Wales “allowed” us out twice a day last year! Less virus in Wales so safer I assume. Perfectly logical use of TheScience(tm). Just don’t cross the border! ….the Un-united Kingdom of Once Great Britain.

I got the most bronzed ever by ignoring this guidance while furloughed.

Lockdown has made so many people gain weight which seems to be so ironic given the increased risks….. I could not understand why the government embraced the stay at home message and have created the ideal situation (for a lot of people working from home long hours and increase in eating take aways can only mean one thing) for weight gain.

It is nothing like drink driving. Being obese only kills the obese person. Drink driving often kills other people too.

Eating excessively and eating “the wrong food” is a lifestyle choice; so is drinking which often leads to excessive consumption. The dangers of smoking have been clear for decades, but still people choose to do it.

As for those who claim that obese people should not have NHS treatment, well, I think the same way about people who take part in extreme sports who do it for the equally selfish reason of liking the “adrenalin rush” and who often imperil rescuers when their excitement goes wrong.

It would be so much more sensible to teach children from a young age the basics of good nutrition and healthy lifestyles through encouragement not preaching and scare tactics (are you listening Government?). Instead they waste valuable learning time explaining their “rights” to be whatever they choose (and never how to cope with the disappointment of being a failure through unrealistic expectations).

Fat parents have fat kids. Being fat has an r rate of about 3. It’s the same with anorexia, it’s highly infectious in schools.

Stupid parents have stupid kids

Do we trust governments to intervene there?

We try to intervene, it’s called education. Ironically social mobility worked rather better when we had grammar schools.

Well education is a sort of intervention, yes, but there are grey areas where school and parental responsibilities conflict. It’s very delicate. Children should not be abandoned to be raised by evil monsters, but neither should the state think it knows better than parents by default. I just think we’ve had enough “public health” for now. BTW I’m thin and a product of a grammar school so not personally offended by any of this. But I think we’ve seen enough of government overreach in the name of the public good to last us a while.

When I wrote “stupid parents” I was more thinking of people lacking emotional intelligence who may not do a good job raising their kids.

Post hoc ergo procter hoc — there was more social mobility then than now because of the nature of the economy (more jobs in non-metropolitan areas, less Home-Owner-Ism) rather than anything to do with education itself.

Incidentally, perhaps we’d be fitter as a nation if we had streaming in PE as well as in academic school subjects, so that the unfit could be helped more to get fitter. I guess the problem is that it’s too manpower-intensive compared to team sports…

“Are you listening government?” Are you serious?

The government don’t want us to spot their hypocrisy of forcibly closing the gyms, banning organised sport, ordering people to stay at home, and limiting going outside at all. Did it not occur to them that if they forcibly confine people in their homes, and stop them working or having any purpose in their lives, they are likely to comfort eat, and drink alcohol, out of total BOREDOM?!?!?!?! So of course they’re going to whisper about it.

Anyone heavier than me should be locked away for their own safety.

Just out of interest, what weight would that be ?

I don’t actually know, but it’s a ridiculous idea anyway, so I’m against it regardless!

I like my snap so fuck off telling me what I can eat, I’ve had 3 operations in my 55 years every one paid for by my parents or me because the nhs is fucking shit.

These are the charts from an article in the Lancet recently.

I think fat shaming would help. Telling people with fat guts hanging over their trousers that it looks awful rather than that they’re fat & proud would help.

Isn’t that replacing one strain of medico-fascism with another?

You obviously won’t mind me telling you that you are an ignorant bastard then. (I’m too polite to use tge C word to describe you, although I do feel like doing so). Another person’s appearence has no bearing on your life whatsoever, so what right have you, or anyone else to say anything to anyone.

How would you like it if strangers started approaching you in the stteet and telling you that you look fuck ugly and should stay indoors to avoid offending anyone.

I don’t mind in the least.

Have you ever met anyone overweight who didn’t want to lose weight? They may not be prepared to do anything about it & they may become abusive when it’s pointed out but that doesn’t mean they don’t want to be slimmer.

The people in the category “overweight” are the healthiest: it would make no sense for them to lose weight.

My BMI is 32 I’m perfectly happy about that. Yep, it’s slightly above the optimum range, but at 60 I’m really healthy: on no drugs and walking my dog for 2 hours a day.

Haven’t had a day off work since 2004, and that was because it took me so long to get an appointment with a GP that the infected scratch on my elbow required intravenous antibiotics.

Excellent! So Covid-19 tells me the optimal BMI is 23 to avoid hospitalisation.

Yet once hospitalised your BMI must be much lower to avoid ICU admittance. Strangely the risk of dying is lessened if your BMI is a bit higher at around 26. Is it that people in ICU are most poorly so most at risk of dying? Multiplying the hazard ratios for ICU and dying it looks to me that you get an approximate constant hazard ratio of unity for BMI up to about 26.

Rather than coercing people to slim or not, is it not sufficient to simply advise people? If someone knows that high BMI is bad and chooses to do nothing about that, so be it. I personally have no desire to tackle the north face of the Eiger (though the romantic in me wishes I would, or at least tackle one of the easier faces!), but I don’t think we should prevent people from marching to the base of the mountain and setting off up.

The problem with fat-shaming is (that by making fat people more depressed) it may encourage them to comfort eat all the more.

The problem is that the wokesters just won’t have anyone calling out anybody they perceive as ‘different.’ Personally, I would employ people in call centres to make continual calls to the fatties and call them names. I hate the way we pander to salad dodgers. We’re catching up with the Americans who, when they get too fat to walk more than 5 steps without sweating and wheezing, get an industrial strength mobility scooter. You can’t move for them in Florida.

Isn’t that replacing one strain of medico-fascism with another?

And I am betting most could still lay you out cold if you actually came out from behind your keyboard and said it to their faces. Of course, it will never happen because, as you say, you like to preach to others from the protection of anonymity.

Florida, where Covid doesn’t rule?

Would be interesting to know how many of Florida’s Covid victims were fatties.

Great article. The cynic in me would say that the pharmaceutical companies make more money from fat people (many in the government have shares in big pharma), so there is not much motivation for them to encourage people to slim down.Sick people are more dependent on the state, something our government seems to like.

But it’s the underweight who are the least healthy.

There are very few underweight, but many overweight and those are the ones filling ICUs.

But it isn’t people with BMIs of 33, is it?

It’s people with BMIs of 55 or 60.

i agree it’s the very obese who are at most risk.

Muscle mass is a confounding factor. Slightly overweight is beneficial if the weight is mainly from muscle.

We know those classified as overweight both live longer and have the best odds of surviving an encounter with OURNHS.

, whether muscle or fat isn’t specified.

It’s almost as if animals that have laid down a fat reserve to carry them through bad times / times of no food live longer, but Nah!.

Back in the day, when children were skinny through lack of food, the government did try and feed them (school milk, school dinners, child benefit) to make the population healthier.

And to be fair, there is no shortage of information out there from PHE and elsewhere telling people now to eat more healthily and move more. In my experience though, none of it works unless you really really want to lose weight. And it’s hard work. And people don’t want it that much and aren’t prepared to put the work in.

The problem is the advice is WRONG!

I was sent to a dietician “for my cholesterol”. She made me rapidly gain 15 kilos all round my gut and then told me I was “failing to comply” with the diet.

When I ACTUALLY stopped complying with the diet, I lost all the weight just as rapidly (and improved my lipids)

This is so commonplace as to be unremarkable

I agree. I think I read the article differently to many. I took from it that with so many people scared witless about catching ‘it’ and dying, the best advice from a GP would be to tell them how they can minimise their own risk factors (weight for many) – a world away from what has actually happened where the terminally scared have been told that they can expect everyone else to give up their lives and liberty to make them feel safe, and maybe bleach their shopping to be sure. That doesn’t mean people have to follow the advice, or that they should be shamed or harrassed, but it would be more honest than continuing to pretend that everyone but them is responsible for their health. Someone is more at risk of a worse outcome if they are considerably overweight – that seems to be true. Persecuting people for any reason is appalling – speaking the truth is not.

Well said, Charlie.

If medical ‘science’, and I use the term advisorily, had spoken out a few decades earlier about the absurdity of ‘ no fat’ diets, the use of sugar substitutes, and carbohydrates, the problem would not exist.

People in the 50s and 60s were not overweight or obese. The fad encouraged by the ‘health’ industry of taking natural fats and sugars out of diets and replacing them with carbohydrates and corn syrup has caused this problem.

So its a bit rich to get lectured by ‘health’ experts on this topic.

As it does about salt, which has also been the subject of intense and totally misleading propoganda.

I agree up to a point, but we were kind of set up for this by the way civilisation has been built on grain-based agriculture for its storage rather than nutritional qualities. The more industrialised we have become, the more processed it has become. So we have this perverse situation where the poorest in some of poorest parts of the world are malnourished whilst the poorest in the richer parts overloaded with carbohydrate in the form of stack-’em-high-sell-’em-cheap long shelf life products. The food industry has lobbying power and is a big part of supressing more a more evidence-based understanding of nutrition and health.

The influence of the Seventh Day Adventists is huge too. God told Ellen G White we should eat a grain-based vegetarian diet because meat causes lust and worse masturbation. Strange that He never meantioned that to Jesus when he did that thing with loaves and fishes

“Should have used the tofu, son”

Corn flakes were invented by the Kellogg brothers to prevent masturbation. They work – if you eat them enough you get diabetic neuropathy and arterial damage

I think she’s confusing the Fat Controller and his entourage with people who actually care about the populace. They couldn’t give a flying fuck.

I wish Boris would stuff his fat face more. Might get rid of the fucker.

It’s for sure the nation is fat and unhealthy but it’s hardly surprising given the way his business chums promote eating. It’s impossible to get away from. Fast food, snacks and sweet drinks are everywhere and ruthlessly adverstised. Drink a can of coke and you’ll feel so happy that you’ll want to play bingo on your phone and get into gambling debt.

?

Don’t know about fat shaming; I’d like to see a bit more GP shaming. Other than politicians, I can’t think of a group who’ve let down people more over the last 14 months.

Journalists?

Clergy.

Unionised teachers

Yet again, you’ll find this has been mentioned many, many times BTL. As always, BTL “has the story”.

We must also stop people smoking and drinking alcohol, playing sports and everyone should live in bungalows the risk to the nhs is just too great in a post pandemic world for people to do anything that’s risks the capacity of the health service to combat the new variants. We can easily identify obese people by their appearance but we can’t identify these other resource drains as easily before they become a use of the service. We must judge everyone not just the visually apparent.

Unfortunately for this GP, the medical profession has lied so much about various illnesses, treatments and statistics in the past that I no longer believe a word that they say….

I am not in favour of shaming anyone but I find it perverse that those of us who keep ourselves fit and healthy and therefore see no need to the the vaccine are slanderef and threatened with second class citizenship while nothing is said about those who threaten their own health and burden the health service with their obesity.

They burden it for fewer years.

The ones that cost the health service the most are the healthy ones that go on for decades.

The cheapest are those that peg it early, logically.

Reminded me of the script for one of the old ‘yes, minister’ comedies, in which the civil servants were trying to educate him along the lines of why smoking was good. Essentially, it makes them die earlier, saving the NHS money, and brings in excise duty at the same time!

You can go on for decades without going anywhere near the ‘health’ service. It’s an illness management service.

Hear hear!

Greta Thunberg accuses Chinese state mrdia of fat shaming her. https://www.rt.com/news/524557-greta-thunberg-chinese-fatshaming/

I don’t think our illustrious government would ever even consider trying to tackle the obesity problem, in the same way they’ll never do anything meaningful about stress/mental health, cancer, dementia, heart disease… Many of these are the outflow from requirement for everyone to spend every spare moment at work. Parents working 40+hrs per week means they have no time to cook for, or play with, their kids so they get dumped in childcare or in front of a screen, and food becomes a ‘treat’ not fuel. No time to build those all-important relationships with family and friends, or exercise either, and stress levels go through the roof along with alcoholism and drug taking just to feel a bit normal. Kids end up going to bed later and everyone gets less sleep. They learn this is the way life goes, so they pass it onto their own children, and the cycle goes on. Woe betide the PM that tells employers to back off and lets people have a personal life even though we’d all be happier and healthier (and thinner). Sigh.

Bow did they manage before doing 50+ hr weeks 100 years ago?

This is, I think, to do with the way that productivity is measured. Assuming an office worker is salaried and not paid overtime then if one office worker can now do the same work as was done by two in the ’70s (say) that is more productive, from an economist’s perspective. You’re getting twice the work out of one person. There is, of course, no regard to the impact on that person’s health or the detrimental effect on society as a whole.

So following the OURNHS Doctors logic that the high death rate is all down to Weight categories, the logical conclusion is that there are no fat people in the following countries:

Taiwan.

S Korea.

Japan.

Vietnam.

Really ???

Sumo wrestlers?

Not as many as there are over here, especially in the elderly, especially in Vietnam. Probably not as many insulin/leptin resistant and hypertensive people. And that probably is a factor, yes. BMI-based categories are arbitrary, but excess visceral fat can be a sign of a problem. That said, cross-immunity gained from previous exposure to SARs & MERs in those parts of the world may well be more of a factor.

Fascinating. A bit of alternative bossing about attracts more comments than most topics here

Stop talking about obesity. We need to talk about Klaus Shwab and Bill Gates.

I agree, I think they’re both overweight.

Fat people doing funny shit and cats dong funny shit is my favourite shit on YouTube. If it is a fat cat or a fat cat in a hat or a fat cat in a hat on a mat I can barely contain myself.

In all seriousness.. perhaps this GP should focus on something more important i.e. something that isn’t the sniffles aka covid 19. I don’t know.. MS, ME, Lupus, cancer, …

Apparently we all consume massive amounts of sugar nowadays compared to a few decades ago. Back in the 1970s and 1980s, the supermarkets used to display the sugar and flour on the shop floor on the pallets they arrived on. So much was sold it simply wasn’t possible to display on the shelves. Housewives (dare one use the term) bought these items weekly. All meals were home cooked from scratch. Pies, dumplings, cakes, puddings cooked from basic ingredients. People were not, generally, overweight, as can be seen in old tv footage, news etc.

Nowadays there is a tiny section of supermarket shelving dedicated to sugar and flour. Hardly any seems sold in its basic form, compared to the pallet loads that used to be put out daily. Yet apparently we are consuming loads more sugar than a few decades ago. It must all be hidden in partially prepared foodstuffs and ready meals, and soft drinks. People are unwittingly consuming vast quantities of sugar, which is down to the food industry. The supermarket shelves are now full of partially prepared meals, not raw ingredients. The meat counters are tiny compared to when I was a kid, but the sections with stuff covered in sauce in a foil tray have expanded. So even meat is sold with a sugar laden coating.

So neither the medical industry and the food industry have our best interests at heart. Seems corporate sized organisations are deadly to human life, what do we do about it.

This was the part when I realised this is just trolling. As if the Pig Dictator hectoring us about our weight as part of his “irritating lectures” (which I haven’t tuned in to watch for over a year) would be effective, after he’s locked up everyone at home periodically, banned people from socialising with friends & family, destroyed jobs and scared the shit of many people. Sitting at home with booze & food is about the only joy left in life for many people.

Unless of course you reject all this and put your energy towards exiting the controlled system. Healthy mind leads to a healthier body.

Strange to give space to an article that goes against the general anti-government-interference that is the raison d’etre of this site. My body, my choice.

BMI is pretty much meaningless, it has units of kg m-2 (body weight divided by height squared). For people of Asian ethnicity the “ideal” maximum is 23.9. If the BMI drops towards the minimum then menstruation becomes erratic or stops particularly in teenagers.

True! Most competing sports people’s BMIs are in the grossly obese range because muscle is heavy.

Bio impedance machines (not even that expensive) properly measures fat, water, bone – why is the NHS not using this?

That’s interesting. I didn’t know that. I look mildly chubby if my BMI goes up to 24ish. There must be a better measure.

Almost the entire medical and government advice on diet is wrong. Putting carbs as the foundation of the food pyramid and demonising fat is probably the single most destructive public health measure ever. Millions of life years ruined or lost to pad their pockets.

Great post! True!

Yeah, focus on the meat in the burger, rather than all the crap that goes with.

The food pyramid came from the US Department of Agriculture, not any health-related organization.

Odd this article came up, after watching Wall-e last night. The human race has become obese, trapped in their constantly connected to the web chairs, where they spend all day consuming goods from the mega corporation.

The issue always circles around diet and body size/shape, but the reality is you can eat mountains of food, as long as you burn off the excess. Lack of activity is the real problem and lockdowns have exacerbated that issue massively.

Precisely. You need around 1 Calorie per minute just to stay alive, for cell respiration, so approx 1400 calories a day. If you stand rather than sit, another Cal per min. If you walk, that takes maybe 2 – 4 Cal per min. So most people, if they only waddle to and from the car park, and walk around the supermarket, need maybe 1700 Cal per day. That is a tiny amount of food on a plate if it mainly consists of carbs.

I reckon humans were designed to consume more like 4000 Cals per day, hunting and grazing for food and raw materials. Farm labourers, coal miners, etc needed wedges of carbs for energy needs. Before the 1990s nurses were generally slim, they spent all day running round servicing the needs

of patients. Now the majority are overweight bloaters sitting in front of computers serving the needs of computer databases and processes “to manage patient care”.

Modern work in front of a computer will kill us, modern food production kills us, and the medical industry also wants to harm us. All due to corporate vested interests. People en masse need to understand basic biology and nutrition.

Good point. The low carb diet has become popular, as lifestyles have become less active.

We evolved as long range hunter/gatherers. I imagine our ancestors were a range of sizes and shapes, but most would have needed to eat a reasonable amount, in order to survive their environment.

School food prior to 1980s consisted of a slice of meat, veg and potatoes. Then proper food was replaced with slurry meat (sausage rolls, burgers) and carbs (pasta). The so called healthy menu at my child’s school consists largely of pasta, never roast meats. Yet they don’t permit salt on the table. They excuse the inexcusable by quoting NHS recommended diets. That genocidal organisation needs disbanding.

But although you can burn off mountains of energy, if a large proportion of the energy is in the form of carbohydrate you can still be insulin/leptin resistant and hypertensive without necessarily being overweight (however that’s defined and it’s pretty arbitrary).

The vast majority of patients who end up in ITU with Covid have a BMI of >25 and it often does’t end well for them.

Ok, but what’s the proportion of BMI>25 in the population as a whole? How does this compare with the covid figures? Same for BMI>30.

Again and again, we see stuff like this put forward without context. And is it actual BMI that matters? Or is it general metabolic health instead?

It should hardly need stating that BMI is a crude and very often misleading measure. Some of the fittest people I know will have BMIs > 25. But they’re all muscle.

For any BMI ‘overweight’ or ‘obese’ person, is the weight around the waist or in the shoulders?

How does susceptibility to covid, and other respiratory illnesses, vary with weight and metabolic health? There’s a very interesting serious of questions here, which cry out for answers. But scarcely any of the commentary I’ve read so far, both in articles and in BTL comments, scratches the surface.

Perhaps Will J. should get on the case.

Meanwhile, the concept of ‘fat shaming’ is a horrible, horrible thing.

I’m frankly astonished at the criticism of this article with which I agree 100%. I’m 68 this week, and although an active professional equestrian trainer, since 60 years of age, weight had crept on despite a largely very healthy diet. Last year after lockdown, I saw some photos from a magazine photoshoot I’d been asked to take part in. I was horrified at how fat I looked on a horse. I had been unhappy with my weight and I know had contributed to self loathing whilst going through business worries and a very difficult house sale.

I had been on various diets but nothing seemed to work. I had my thyroid checked as several close family members had thyroid problems. But all ok.

But I resolved to lose weight – 13 st and 5ft 8″, having stayed down to 10st or under, with considerable self restraint – for my whole life until late 50s – and I have done it successfully,

but slowly. I never weighed myself but had a recent doctors appointment and was weighed. Down to just over 11 stone. I still want to lose another 5lbs, but will stay permanently on this diet, just adding enough to maintain, not gain weight again.

I feel so much better, I’m happy in my own skin, this dreadful world situation has made me live for the moment, for the first time in my life. I take the recommended high doses of Vit C, D and also zinc, eat plenty of fruit, veg and salad, and home cook, no junk food.

It is a well known fact that obese people are far more prone to Covid complications and many other serious illnesses. Wear and tear on joints especially is far more common in the obese.

If you want to ‘Save the NHS’, then start concentrating on general health and fitness. This is what the government should be concentrating on, not the propaganda of fear and vaccine promotion that is all we hear on radio and tv.

I don’t think the hesitancy is about fat shaming. I think that people know fully well that their lifestyles and bodies are unhealthy! but that people are prepared to accept this extra risk in exchange for the benefits – ie cake and being lazy etc.

But this is how it should be! If someone’s actions don’t cause others harm then they should be allowed to do whatever they want to themselves.

The reason that this is now an elephant in the room is that the new covid hysteria is completely opposite to that – we are no longer allowed to make individual choices about what is right for own health and crucially what is an acceptable level of risk. Plus our own Gov would have to put their hands up to all the extreme lengths they’ve gone to to make everyone’s health worse!

For decades, people have heard their Doctors say, “You need to lose weight”. Yeah, good advice, but HOW?

For decades we were told that a low-fat diet is optimal. Doctors have been spreading that particular agenda based on what? Evidence? Piss-poor “research” paid for by commercial interests. The notoriously biased work of Ancel Keys.

So, in adopting the USDA Food Pyramid, the medical profession has been a very large part of the problem. You study medicine for years, but gloss over the subject of nutrition and once you are qualified, you are basically drug dealers with a degree in medicine.

The standard treatment for Type-2 diabetes is Metformin followed by insulin when it inevitably fails. The more aggressively that Doctors treat T2D the worse it gets.

Thankfully, there have been some brave individuals like Tim Noakes who took on the Medical Establishment and won. He was ruthlessly persecuted for opposing the “accepted wisdom” about low-fat diets. There are still many Doctors who really believe the dogma and insist that cholesterol causes heart disease so they hand out Statins which reduce the cholesterol numbers but do nothing to reduce the risk of death or morbidity.

So, you’re right about obesity being the root cause of many health problems. What are you doing about correcting decades of bad nutritional advice promoted by the medical profession and educating GPs and Diabetes Nurse Practitioners about the low-carb diet and other non-pharmaceutical interventions that actually DO lead to lasting remission of T2D and obesity.

It does not help to point out the problem, obesity, unless you can offer fat people a strategy to fix the problem that actually works.

I’ve been struggling with stomach issues for years now, after ruling out a few things my Dr wants to give me antidepressants (but he’s giving me them for ‘anxiety’ not depression after I raised concerns about going back down that road). I mentioned that when I juice fasted for a week the symptoms went away, crickets. “well do you want the prescription or not?”

Try giving up wheat. It may not work but it’s worth trying. I gave up wheat when I discovered how badly it spiked my blood glucose and found the chronic heartburn and farting went away.

I can get away with small quantities of wheat such as the rusk in sausages. More than that and my guts start to grumble. More still and the heartburn and farting comes back.

Wheat has been bred to yield more but seems to have become more toxic for more people.

Obesity and type 2 diabetes are the top co-morbidities.

The immune systems of obese people are already under stress even before they are infected with covid. The infection then bombards their immune systems thus triggering a huge, life threatening overreaction.

This is yet another example of lack of plain speaking regarding anything to do with covid.

Maybe we should stop talking about obesity completely. Maybe we should stop talking about weight and dress sizes too for that matter. I spent ALL my 20s and 30s trying to keep a BMI of 26.5. I ate very little and all healthy whole foods. I finally stopped worrying about food as I was becoming very miserable with the struggle to maintain an unsustainable weight for me.

Once I realised that as a 5ft 10in woman who did not have the frame of a bird and could not maintain a healthy so called BMI weight of 11.5 stone I also stopped worrying about dress. I still eat sensibly with just two meals per day. I don’t eat much fruit but do eat loads of vegetables. I also have fat in my diet. Fish, animal and vegetable. I have been a size 16 easily maintained 12.5 stone for 25 years. According to BMI I am overweight. I am comfortable with my body for the first time in my life. It has taken me 50 years to stop listening to the ‘experts’ and make my own choices.

I suspect much overweight is due to a complex number of issues. Much to do with women never sustaining the weight the experts tell them to sustain and much to do with dress sizes never going above a skimpy cut size 14 if you want to look fashionable. Hence the trainer/legging monstrosities you see walking around. I also think for the population as a whole it links into low levels of depresdion and anxiety caused by Government interference and policy in our lives. Taking away aspiration and opportunity, high taxation and breaking down the traditional family.

After the birth of my son thirty years ago, I could not lose the extra weight I had gained; I remained at between ten and half and eleven stone for many years. I finally came down more to the ten and a half; but I’m a short individual and even I had to admit I didn’t feel comfortable. However….all the diets, low-fat, low carb, don’t eat this that and the other, they all failed. I also had a blood sugar reading that was kind of ok but still a bit high; battled that as well, but again couldn’t break the problem.

Finally….a couple of years ago I read an article about problems people were having with dairy, especially milk. Many seniors (I am one) had given up milk entirely and were using other milk-type products.

I changed to goats’ milk, dropped cows’ milk entirely and within two weeks had cleared a lot of bloat and lost a couple of pounds weight. Months later I was below ten stone; when covid started I eventually couldnt get so much goats’ milk, so went over to one of those fortified types in cartons. A year later I am now nine stone.

COWS’ MILK. For many, this is possibly the real, hidden cause of bloat and weight gain.

Just a suggestion.

Oh yes, good point. Milk from Friesians and the later derivative Holsteins has significantly different protein than old breeds like Jerseys and of course goats. It doesn’t bother me like wheat but many people have problems with modern milk

Fat shaming, though horrible in the moment,may well be the trigger people need to do something about it….

The big unanswered question is – why are obese people more at risk? The risk is not in getting infected, but getting very sick if they are infected. For several months, indeed since the excess risk became evident, I have been suggesting that the leptin status should be investigated. Leptin is a hormone produced in fat cells. The bigger the cells the more they will produce. Leptin is what’s known as a pro-inflammatory substance. Covid-19 is a hyperimmune state induced by infection with SARS-CoV-2 infection. It is highly like that leptin may accentuate the development of immune overreactivity. But as far as I am aware no-one has investigated this. It’s time they did.

Ron Rosedale explains this quite well.

https://thefatemperor.com/ep67-ronrosedale-md-crucial-explanation-on-how-to-avoid-serious-viral-impacts/

I doubt very much that the virus is short sighted and can only see very fat people.

There’s an every growing body of evidence showing the causal links between over consumption of highly processed “foods”, gut health and the immune system. I don’t know so much about Leptin specifically but by the time someone has an excess of adipose tissue the damage is already being done to the immune system.

I agree with the comments that the government response to covid has made most of us much more unhealthy. Apart from the initial restrictions on exercise, there is the quarantine confinement (I emailed Whitty about the detrimental effects on my mental and physical health – no reply), the closure of restaurants where “proper” food is available whilst fast food remained available etc etc. Also, happy people are healthier and healthier people are less likely to be ill or to be less ill if they do catch something. The government had an opportunity to encourage people to take more exercise and change their lifestyle for the better while on furlough. Instead we are banged up and it is hard to know how the policies inflicted on us could have been bettered if they wanted us to suffer detrimental effects. How Whitty, Valance etc haven’t been struck off for gross damage to public health beats me. Does nobody making these policies have any common sense?

You’ve got to hope the health establishment don’t latch on to obesity with anything like the same zeal as SARS-Cov-2. No doubt they will fix on and mandate the wrong solutions like low fat diets. You can imagine weighing scales on entry to restaurants. Mask wearing to prevent snacking. And expect to be coerced into taking an obesity vaccine https://pubmed.ncbi.nlm.nih.gov/24365968/

Blimey! I thought you were joking, but if that paper is real, obesity vaccines are part of an “exciting research area”.

The point about why certain health matters haven’t been ‘shouted from the rooftops’ is one of the many dogs that haven’t barked during this long night.

If the government and SAGE (if it is still possible to treat them as separate entities) were really actuated by a concern for public health (and if, therefore, this were a genuine public health emergency), they would have spent the multi-million-pound advertising budget they cooked up with the media bosses on sober and sensible advice and guidance on, inter alia, the importance of fresh air, exercise, vitamins, good food, sunshine, company, intellectual stimulation and productive work.

Spring 2020 was the most beautiful in memory but most people were indoors, with the windows shut.

Confining people to their homes, bombarding them with relentlessly negative and mendacious ‘news’ and prohibitive injunctions, enforcing mask-wearing, destroying local community networks, weakening family connections, increasing dependence on digital devices, rigging the market in favour of retail distribution corporations and fast-food delivery franchises, deliberately fostering a climate of hostility and fear – all of this (and there is much more), was not the handiwork of a government concerned about the well-being of its citizens, and neither was it the regrettable outcome of a tough but well-intentioned protective programme; all of this was the purpose of the programme.

Yes, as I just posted in another thread. The real elephants are in the room with the most vulnerable, namely..

Stress

Lack of activity

Lack of sunlight

Poor infection control in healthcare settings

Great article. Frontline doctors have had the opportunity to tell us what they observed in COVID patients. Hopefully, more will be willing to have this conversation with their patients without feeling squeamish about it. Then, it is the patient’s choice, to take responsibility for their health. A thank you to this doctor for discussing his/her observation.

But this isn’t a ‘frontline’ doctor. It’s a GP, who’s probably spent most of the past 14 months hiding behind his/her receptionists, imagining that the ocasional phone conversation counts as a consultation and is ok for patients.

And anonymous; so not THAT prepared to have the difficult conversations, eh?

The trouble is that much of the education around losing weight is wrong. I have struggled with my weight all my life. I’ve yoyo dieted and even developed two eating disorders in my teens following strict diets. I finally discovered ketogenic diets late in life and for the first time the weight dropped off. It was confirmed by a genetic test that my body gains weight quickly and lets go of it reluctantly and that I am profoundly carb sensitive. Therefore the ‘everything in moderation’ or carb heavy diets recommended in government guidelines will never work for me. I suspect that there are more people with metabolisms like me and as long as they are being told lies about the ideal diet for their particular bodies, they will be locked in a never-ending struggle with excess weight.

Everyone is like you, the guidance is completely misguided, everyone will become carb sensitive eventually. Not to mention the accelerated Alzheimer’s, inflammation related illnesses and diabetes we get to endure along the way. 100 years ago dropping carbs to lose weight wasn’t even considered controversial, every housewife knew it.

I have at least one patient a day come in and laugh about how much weight they have gained over the past year. Usually also jabbed and terrified of Covid…

BMI is a very poor indicator of health and far too simplistic.

When I was 50 I went to a Wellman clinic and the nurse took my height and weight and age and consulted a chart which said I was close to being clinically obese! She looked at me (my shirt was off for other tests), looked at my defined chest, shoulders, plus reasonable six-pack and said “well that chart is a load of nonsense! Doesn’t take account of bodybuilder types”

At 64, and a stone or so lighter, I am still supposedly obese at BMI of 26. I am nowhere near obese as anyone who has seen me in the gym would agree on. Muscle is heavier than fat so it makes a nonsense of the indicator. Okay to use it to frighten the genuinely obese perhaps?

BMI has never worked for those with an athletic physique, it never has an was never intended to be used as such; the same with any general height/weight tables. It’s a guide for the masses who aren’t athletes.

Thanks for your comment.

I agree with you that BMI doesn’t work for an athletic physique (when is a physique athletic or non-athletic?) but doctors and nurses should be made aware of that.

I have to admit that I can’t think of any other simple way except, perhaps, using fat calipers or similar.

Obese would be over 30,

At 26, that is slightly overweight. For you, with muscle, that may not be fat at all. If I had a BMI of 26 though, I’d look like a proper lard arse.

The problem is that our state-run healthcare system has little incentive to work out the reason why people struggle to stay a healthy and lose weight, ending up on ever more useless drugs (including for depression) and an early death. Most GPs are ignorant about the root causes of many Metabolic Syndrome symptoms, including hypertension, weight gain, type2 diabetes etc. The NHS guidelines on treatment are useless and out of date. A big problem is undiagnosed Insulin Resistance and “secret diabetes”, compounded by gut problems such as IBS. There are initiatives such as the NHS approved “low carb programme” that are starting to tackle the problem but NHS inertia and vested interests prevail. Also, by the time people are diagnosed as Type2 or have had a heart attack it’s much more difficult to restore their health – and YES for many people Type 2 is reversible.

Sadly, most practising medics that are aware of the solution seem unwilling to speak out, or are very muted about it and us patients have become too reliant on the “all-knowing” NHS. The evidence is there, e.g. not all fats are bad for you. Mostly it’s highly-processed foods that do the damage. For many “fatties” that can’t lose weight by “eating less” a test for “insulin resistance” and a blood glucose monitor is the way to start finding the out what diet works. If you’re already on drugs for hypertension, etc. you’re on a slippery slope and probably need to do your own research. It’s not difficult, eg start with Dr Malcolm Kendrick’s “Doctoring Data”, or perhaps Prof Tim Spector’s “Spoon-Fed”. There’s plenty of good information out there, you just have to suspend your faith in the “NHS” and any ideas of a black-and-white “one solution fits all” answer.

Also the VERY poor testing of the thyroid. The routine testing is just the TSH – or Thyroid Stimulating Hormone – which being a Pituitary hormone tells you little about the thyroid and its production of T4 and T3.

Once diagnosed – often taking years – patients often remain under-treated needing other meds – statins, blood pressure meds, anti-depressants which of course are bigger earners for Big P h a r m a.

Weight gain is very common with low thyroid. http://www.thyroiduk.org

My ex was on antidepressants for 18 years (still is as far as I know) and I’m sure that influenced her attitude to her weight

I’m aware of patients, especially diabetics, being told they must not use low carb diets or they will have their treatment withdrawn. “We can tell if you’re complying because your triglycerides will go up” like that is a good thing.

Worse still a lot of doctors have been instructed not to encourage or even discuss other than low fat diets. I don’t know if this is still happening but it wouldn’t surprise me.

I’d love to stay and poke a sharp stick into some salad-dodgers, but I need to go and do an hour on the rowing machine.

The problem with obesity is that there are too many businesses making money from it. (I know all about it, my wife had a problem with it for years – we divorced in 2009!).