So, now that it has been established that the main profiteer in the COVID-19 ‘vaccine’ gold rush of the last two years is not Pfizer, but rather the still astonishingly little-known and previously tiny German firm BioNTech, it would appear that something needs to be said about who owns BioNTech.

As shown in my earlier article here, for 2021 and 2022 combined, BioNTech earned over $31 billion in Covid-19 “vaccine” profits on a whopping 77% profit margin as compared to Pfizer’s roughly $20 billion on an estimated 27.5% profit margin.

This revelation, however, has led many commentators on social media to suggest that none other than Bill Gates was somehow the main beneficiary of – and presumably éminence grise behind – BioNTech’s astronomic rise or even that BioNTech is a “Gates company.”

While it is true that the Gates Foundation – not Gates personally – invested in BioNTech in a deal that, as will be seen below, was likely brokered by the German government, and while that deal is indeed curious for its timing and some of its details, its purely economic significance has been wildly exaggerated.

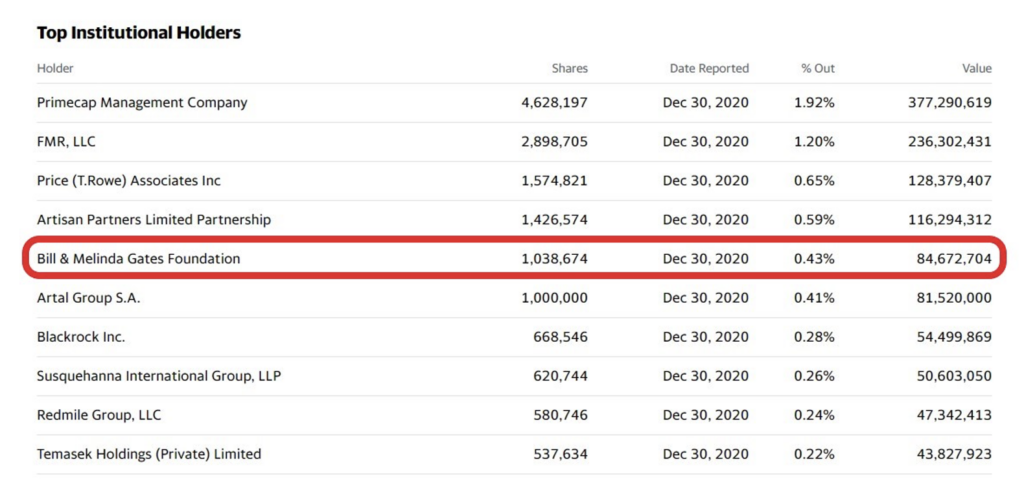

As of December 30, 2020, the Gates Foundation’s initial holdings of 1,038,674 BioNTech shares represented a mere 0.43% of the company’s total stock, as the below Yahoo Finance chart makes clear.

This placed the Gates Foundation among the top institutional investors in BioNTech at the time. But that such relatively paltry holdings could qualify an organisation as a top institutional holder is itself indicative of a far lesser-known fact about BioNTech: namely, that it is a very closely held company, the great majority of whose shares are owned by just three people.

Consequently, only a very limited portion of BioNTech shares have ever been available for purchase by the Gates Foundation or anyone else.

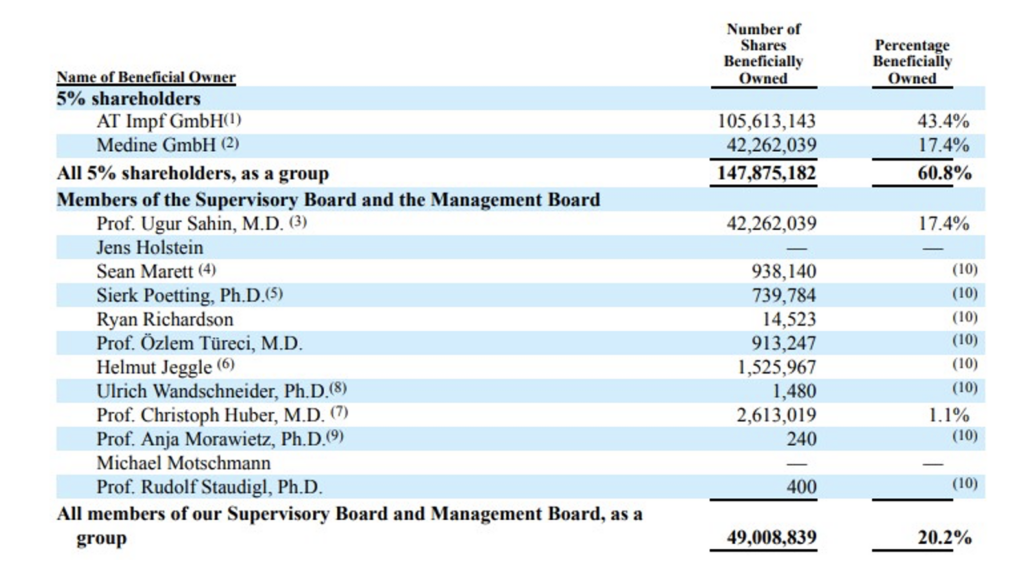

The three principal shareholders are CEO Ugur Sahin and Germany’s Strüngmann twins, Andreas and Thomas, who provided much of the initial seed capital for the company’s founding in 2008.

According to BioNTech’s latest annual report to the SEC (p.192), the Strüngmanns own 105,613,143 shares representing 43.4% of BioNTech’s total stock: i.e., literally 100 times more than the Gates Foundation held! Sahin owns 42,262,039 shares representing 17.4% of the company’s stock. Together, Sahin and the Strüngmanns thus control nearly 61% of BioNTech stock.

The Strüngmanns are AT Impf in the below table. AT Impf is a fully-owned subsidiary of the twins’ ATHOS KG family office. Sahin is the sole shareholder of Medine.

Furthermore, as footnote 1 to the table specifies, “ATHOS KG via AT Impf GmbH has de facto control over BioNTech based on its substantial shareholding, which practically enabled it to exercise the majority of voting rights to pass resolutions at our Annual General Meeting.”

So, in short, BioNTech is not a “Gates company”, but rather literally a Strüngmann company, the Gates Foundation’s stake having always been extremely minor.

As discussed in a much-cited Substack post by Jordan Schachtel, the Gates Foundation has since sold off 890,000 shares in BioNTech, representing 86% of its previous holdings. Based on timing and the evolution of the BioNTech share price, Schachtel estimates that the foundation made $260 million on the sale or a whopping 1500% return on its initial investment.

It is this windfall that makes Gates appear like the main beneficiary of BioNTech’s sudden success in the often fact-deprived atmosphere of social media. But, needless to say, the Strüngmanns are the main beneficiaries of BioNTech’s success.

Indeed, as was widely reported in the German media at the time, the precipitous rise in BioNTech’s share price briefly catapulted the twins into the position of the richest people in Germany, with an estimated net worth of €52 billion or $62 billion, when the share price was at its highest in late 2021. Their BioNTech holdings alone were reported to be worth over €42 billion. (See, for example, the report in the German weekly Stern here.)

Of course, the BioNTech share price has since fallen back down somewhat closer to earth. But the twins do not appear to have been averse to getting some cold hard cash out of their investment while the share price was high either.

Thus, circa December 2020, when the Gates Foundation still held all of its initial holdings and 0.43% of BioNTech stock, the twins in fact held 114,410,338 shares or nearly 47.4% of BioNTech stock. (See page 201 of BioNTech’s 2020 annual report here.) This means that the twins have in the meanwhile divested themselves not of nearly 900,000 shares, like the Gates Foundation, but of nearly 9 million.

We know, moreover, from other SEC filings that they sold the great bulk of the shares (over 8 million) precisely in 2021, the year in which the BioNTech share price reached its peak. Depending then on the exact timing, they presumably made roughly ten times more than Gates – i.e., a haul of over $2 billion as opposed to the Gates Foundation’s $260 million – and not for the benefit of any non-profit organisation, but strictly for their own.

Furthermore, the Gates Foundation was not the only BioNTech partner to have apparently thought better about having too substantial a tie-up with BioNTech in the longer term. So too did none other than the Chinese pharmaceutical company Fosun Pharma.

This is also relevant to our topic, since Fosun – or allegedly even, via Fosun, the Chinese Communist Party! – is likewise often identified in social media posts and by certain commentators as somehow the “real” owner of BioNTech.

It is not and has never been anything of the sort. Rather, as part of its 2020 agreement with BioNTech to commercialise that latter’s COVID-19 vaccine on the Chinese market, it, like the Gates Foundation, acquired a minor equity stake in the German company.

That agreement, however, has largely remained a dead letter, since Chinese authorities have never even approved the vaccine for use on the mainland. This might have something to do with the fact that late last year the Chinese company sold off more than two-thirds of the 1,576,000 BioNTech shares it originally held. Per the calculation of the Chinese market specialists at Bamboo Works, this left Fosun with a mere 0.2% stake in BioNTech. So much for Chinese “control” of the company…

What, then, of the famous September 2019, pre-IPO equity deal in which the Gates Foundation acquired its holdings in BioNTech? How did Gates know to invest in a company that had never even gotten close to bringing a product to market, had only ever run losses – and was focused on developing cancer treatments, not vaccines against infectious diseases, to boot! Hardly anyone had ever even heard of BioNTech.

Well, the below image provides a clue.

It comes from the closing plenary session of the October 2018 World Health Summit: a German-government-sponsored event, which is held every year in Berlin. (See the World Health Summit ‘highlight’ video here.) The host institution is Germany’s premier university teaching hospital, the Charité, the chair of whose virology department is none other than Christian Drosten. It is Drosten, of course, who devised the famous PCR protocol that the WHO would adopt as the “gold standard” for detecting COVID-19 infections.

In addition to then German Chancellor Angela Merkel at centre stage, you will, of course, notice Bill Gates (whose Grand Challenges network co-hosted the session) directly to her right and WHO Director-General Tedros, a bit further away to her left.

But it is the man without a tie directly to Tedros’s left who is of particular interest to us here. For that is none other than BioNTech CEO Ugur Sahin.

It was the 2018 World Health Summit under the patronage of Chancellor Merkel that brought together Gates and Sahin. It is unlikely that Gates had ever heard of Sahin or his company before then either.

The German Government, on the other hand, knew Sahin and BioNTech very well. For, as touched upon in my November 2021 article here, the German government was the company’s state sponsor, both sponsoring its very founding and helping to keep it afloat with subsidies during the many years when BioNTech produced nothing.

Robert Kogon is a pen name for a widely-published financial journalist, translator and researcher working in Europe. Subscribe to his Substack and follow him on Twitter.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Brilliant idea!

I know what…..why don’t we set up an R&D establishment and call it: ‘The Common Cold Unit’

‘It is therefore arguable that in the case of infections like coronavirus or rhinovirus colds, which are normally quickly self-limited, the best approach would be to relieve the patient’s discomfort and disability and leave their immune system to take care of the virus.’

A view from the common cold unit, D.A.J. Tyrrell June 1992

Thank you for mentioning the Common Cold Unit and the impossibility of stopping the spread of these viruses. Any real scientist would know this.

“It seems that even Private Eye’s MD shares this view.

There was no pandemic.

Yes and all of the data support that assertion, therefore now it is irrefutable fact, which just further confirms this Covid Inquiry is just purely farcical. I’ve got a link about that, and it’s also safe to say that Joel Smalley really hates Piers Morgan, so I’m in good company there;

”In March 2020, the erstwhile PM, bumbling buffoon, Boris “BoJo” Johnson, ignorantly and foolishly declared that COVID was the “biggest threat this country has faced for decades”…

…without checking the mortality records of the last few decades.

A few months in, gullible, ignorant, virtue-signalling, fools like Piers Morgan (chief Dunning-Kruger Effect) got upset when you stated that COVID was “just a bad flu”, dogmatically impotent to justify his spleen, reverting to name calling, transference and hand waving away of data and analysis.

But guess what you see when you do check the evidence!

A novel, deadly pathogen wreaking havoc across all demographics of society, resulting in “unprecedented” excess death as Matt Hancock would pitifully mutter?

Well, if you’re still even remotely in that camp, I’m sorry to burst your bubble (yet again) – COVID was indeed just a “bad flu”. Although, to be completely frank, nowadays, I’m not even sure what that means or if it really has any material implication in terms of mortality.”

https://metatron.substack.com/p/covid-the-biggest-threat-faced-in

Thank you tof. 👍

So we have the civil servants working from home or the beach. we have MPs not in the chamber for significant discussion about totalitarian mandates for a non existent pandemic and now we find out perhaps they should have been doing some useful risk decease management because our sea and rivers are riddled with ecoli. !! Who plays in the sea, yes children who were not at risk from covid yes children. But anything else other than covid that really does threaten citizens is fine by them, as all they are doing in this inquiry is allowing a get out of jail free card “lockdown earlier charade” but useless at best parliamentarians and trusted sources were to blame for a long list, of which the covid inquiry should be exposing but it is colluding to point the gaze elsewhere,

I would not call it a panto it is a tragedy play in reality.

Few were at risk from the cold or flu – the aged and those with co-morbidities. Yet the fascists locked down an entire country over an IFR of 0.3% – engaged in outrageous data fraud, terror, propaganda, police fascism, coercion, murdered with midazolam, issued fake tests for fake cases, demanded no stabs no life, closed schools, made the sheep wear face anus wraps….and not a single politician, political party or this wretched fat Hammerhead-Hallett wants to acknowledge any of it. Not a single public figure outside of Bridgen says anything. Why is that? Pharma money, bribes, death threats? Occam’s razor to the rescue.

Just promote measures to boost the functioning of the immune system – diet, vitamins, minerals. Cheap, effective & simple.

Sorry! How foolish of me to think that the health & well-being of us all is the goal….

On another note, I’m dumping this thread reader post here to provoke critical thinking about how easy it is for folk to fall prey to propaganda on what ever subject, even those with critical thinking skills & intelligence which was on display during the covid lockdown saga, who have fallen prey to a different propaganda psyop which also threatens our freedoms.

Made me think.

https://threadreaderapp.com/thread/1726656619973693626.html

BB, I stopped reading at ”….the genocide being committed in Gaza…” Seems to me you’re attempting a not very subtle steering of the thread onto a wholly different topic. And when you hint at ”folk” with critical thinking skills and intelligence around particular subjects ( that’d be Covid, ‘climate change’ etc ) are you referring to the posters who are fully onboard in refuting all the pro-narrative garbage the MSM outlets, such as the Beeb, have been spreading non-stop but they suddenly 100% lap up and treat anything coming from the Hamas-run Gaza Ministry of Health as accurate and basically the Gospel? Or is your inference that people have fallen for propaganda only aimed at certain posters on here?

I do have to marvel at the mental gymnastics some on here use to justify the murder of 13,000 plus civiians and the carpet bombing of Gaza, not to mention the missing 6,500 or so, no doubt buried to death under the rubble.

Then there’s hundreds of thousands of Palestinians with no home to return to .

Anyone might think Israel wanted to eliminate them all.

Oh, but that’s only the figures from Hamas, maybe in reality there’s only about half a dozen or so dead.

But, anyone pointing out the bleeding obvious genocide is automatically a Jew hater and an embracer of Hamas.

one may be able to criticise the Israelis for several things but genocide is not one of them when the population of Gaza has increased from 200,000 in 1948 to 2.3 million now. I will not bother with describing the mentality of anyone who cannot be utterly shocked by the bestial behaviour of Hamas,which is quite beyond even the usual behaviour of terrorists targeting the defenceless

What on earth has the population of Gaza increasing since 1948 got anything to do with wether genocide is being carried out now??.. Absolute moronic post..

Heres the UN definition of Genocide….

The definition contained in Article II of the Convention describes genocide as a crime committed with the intent to destroy a national, ethnic, racial or religious group, in whole or in part.

I think you’ll find, if you care to think clearly, that what is occurring in the middle east right now fits the definition rarther accurately

What do you think the Palestinian chant of “from the river to the sea” means”???

Yawn yawn yawn….

I could fill this page with a myriad of Zionist ideologies that make that look utterly insignificant.. But we can’t talk about that can we now…

Apply some historical context fgs

Again, there’s that giant elephant shaped Islamic death cult in the room you so conveniently ignore. You just carry on shovelling and swallowing the heaps of propaganda tumbling out of its backside.

Why are you unquestioningly taking the words of a gleefully mass murdering, burning, raping and torturing fanatical religious death cult at face value?

” Islamic death cult”….

Try carrying out some research on Zionism…

Thanks for the tip. Just doing that now. Yep, nowhere in the literature on Zionism does it mention wiping Muslims off the face of the Earth from the river to the sea or the instruction to kill all Muslims.

I also couldn’t find any evidence of Jews paragliding into surrounding Muslim countries then beheading, disembowelling, burning alive, torturing and raping thousands of men, women, children and babies whilst on the phone to their mothers gleefully bragging about it like they’ve just won the Bake Off.

Why don’t you buy a luxury mansion in Qatar and join Hamas?

Mogs,

I’m sorry that you stopped reading there. I posted it because we are all subjected to military grade propaganda on all political topics & to point out that this can happen to even the best of minds & folk. It’s aimed at all of us, to question, to challenge ourselves on all the battle fronts which are being waged against us.

As an example think about Ian Rons – great on covid, great on free speech, blind spot on Ukraine/Russia & called out on this by many BTL.

We’ve been stirred up about all of the threads which have come together in this latest horror of Gaza/Israel. The mass migrations, the divisions & hatreds fomented by the MSM, the war on terror which engendered a hatred of others have been used against us. Yes there are some abysmal situations happening in various countries & awful no go areas & crimes. These have been created by the politicians with there actions or inaction to cause trouble.

So knowing that the emotional responses to the Gaza/Israel situation have been stoked & long in the planning & that when an emotional response is elicited, neurologically there is no possibility of a cognitive response to that emotional response as the amygdala, where emotional responses are triggered, has no neural connection to the cerebral cortex where cognitive function occurs.

It’s exactly the same playbook as used during covid. That is the reason for posting the thread. That is the reason I addressed it to all of us as we’re all human, we all respond with our emotions to certain triggers which differ for each of us meaning that each & every one of us is susceptible to being played.

I was not directing this at any one individual or any one topic. Any of the events happening around the world currently will trigger a response. We need to be mindful that if we respond emotionally, then our critical thinking skills will not & cannot be engaged. It is a reminder to be cautious & aware that what happened to others during covid could happen to any one of us on another subject.

BB

I skimmed the rest, but when an article opens with that sentence about Israel committing genocide then you know the entire thing is starting from a specific bias, so you’re hardly likely to be getting a balanced and impartial take on things. Then the author goes on to state that Andrew Bridgen, Toby Young and Laura Dodsworth are “hacks”, “liars” and “opportunists”, which is highly inaccurate and disrespectful. Any coincidence they’ve come out in support of the Jewish community?

Then we get references to “the apartheid State of Israel”…the whole thing is one-sided from the outset. Anti-Zionist and pro-Muslim/Palestine. I’ll let people make up their own minds. No surprises though that there’s zero mention of the war crimes the Jihadists committed or that they kill their own civilian people, directly and indirectly.

The point was well made, about our vulnerability to political tactics. It often doesn’t really matter too much, but during the panic a few years ago, I thought that something like that probably occurred in places like Germany in the 1930s, with lots of people falling in to the wrong crowd, as it were.

Yup who’d have thought history can repeat itself in the age of social media.

The article was penned by Simon Elmer. Ordinarily I think Elmer is an interesting writer but this article is in my opinion off the mark.

I am not taking sides in the Gaza conflict because I don’t know where the truth lies. Israel has a lot of explaining to do and particularly regarding the security “lapses” – yeah right – on October 7th. Hamas strike me as barbarians. However, there is no doubt in my mind that islam is a serious threat to the people of this country. Muslims are being deliberately planted in towns and villages all across the UK and are a dangerous threat to Britain and its way of life. So I want an end to immigration and repatriation of those refusing to bow to England and St George.

There is little to commend in Elmer’s article.

Yep, and despite homeless British people sleeping rough or stuck in moldy flats this is the sort of digs these incomers are scoring. No wonder they’re playing hell at the old RAF base in Wethersfield and they don’t want to get shifted onto a barge. Not when they’ve got this to look forward to, courtesy of their pals uploading footage like this. They’ll all have high hopes! We’d pay good money for accommodation like this;

https://twitter.com/Steve_Laws_/status/1725489342477468125

“I am not taking sides in the Gaza conflict because I don’t know where the truth lies. Israel has a lot of explaining to do and particularly regarding the security “lapses” – yeah right – on October 7th”

Were you not aware of world affairs and the Palestinian situation prior to the 7th???..as that would assist your decision making re the truth…

And anyone who believes the narrative that the IDF didn’t show up for 6 hrs after 29 breeches of the Gaza fence because they were all relaxing by the pool with their pants down with the understanding all was quiet on the Gaza border will believe absolutely anything and has been had hook line and sinker… Again

Provide the evidence for your assertion.

What “evidence” do you need… Anyone remotely capable of critical thinking skills can soon conclude..

29 breeches of the fence, hrs and hrs for the IDF to show up.. 1 year of planning, Warnings from Egypt, Mossad intelligence know absolutely everything, apart from what was going to happen on the 7th, yea right.. You must be either having a laugh or thick as..

Why don’t you provide evidence of the msm /Israel narrative that it was a “security failure”…. I bet you can’t dig up a shred of evidence supporting such….they are the very LAST outlet you’d believe… Well obviously not… People learnt nothing from the Covid scam and global lies.. Feking nothing

Suppose you still think Russia blew up Nord stream pipe line too..

And Santa’s coming down your chimney in 5 weeks time 😂

That was obviously suspicious but Netanyahu being a globalist happy to sacrifice a few hundred citizens to create an excuse for conflict doesn’t mean anything else but that. We can only guess at the globalist agenda in which he was playing his part. It doesn’t mean that Hamas are suddenly OK or that ordinary Israelis are genocidal.

Point to my post(s) and tell me where I’ve stated that “Hamas are OK or that ordinary Israelis are genocidal”..

What is it with you lot… You’ll be calling me “antisemitic” next..

Furthermore, the ordinary Israeli knows damn well what happened on the 7th and that their globalist war mongering leader has sold them out..

And this didn’t start on the 7th of October, I’m sick of the constant rhetoric that aligns with this utter moronic nonsense… As I replied to the post.. Are people unaware of the historical context.. Obviously they are.

As for “suspicious”…. If thars the most accurate term you think applies here then you’re deluded too

Why is now the time to contact my MP when he maintains the position that?

Despite being contrary to the available evidence and looking uninformed at best, at least he’s consistent which is more than can be said of the governments top advisers.

My own MP is still in total denial!

If you stop acting like a chump then they will stop feeding you the chump food. They pay a lot of attention to metrics and the sad reality is that their agenda picks up upon this.But we should be very encouraged by the fact that taken in aggregate, consumption of mainstream news across the western world has dropped by about fifty percent in the last five years. In terms of young people I remember reading that the average under 25 person doesn’t even expend five minutes a day reading or viewing the BBC. We shouldn’t assume that our victory will be in ten years time. We have already made remarkable progress.If you understand the battle you won’t care how long it takes.

There’s even less point in writing to my MP than usual – and I’ve written to him often. He normally parrots the Party line and now he is to stand down at the next election, so I can’t even threaten to not vote for him.

This is an awful situation – represented by a seat- warmer; a uniform carrier with no more skin in the game. I ventured in my last letter to suggest that as he was already a Sir, and was unlikely to seek preferment, he therefore had nothing to lose by voting against the government just this once but to no avail.

(It was about Net Zero and he still banged on about the need for decarbonisation)

Nadine Dorries’ book reinforces the understanding we have on here that British democracy is a nice notion that died long ago

Ditto. His initials wouldn’t be AB would they?

It needs a major MSM newspaper, e.g. Times, Sunday Times, Telegraph, Mail, to splash this biased farce of a pantomime across the front page, repeatedly to apply sustained pressure. Only when it’s right in front of their noses will Hallett, Sunak, Valance, MPs, Guardian, BBC, Ch4, Sky, etc. begin to understand. They can only deny and whitewash for so long.