Liz Truss’s efforts to divert the blame for her downfall from her mini-Budget to the Bank of England has received support from some unlikely quarters in the past few days.

If you want a refresher on the role of the Bank of England in creating the market turmoil that followed the min-Budget, this piece by Jon Moynihan, published yesterday in CapX, is well worth a read. It includes a crash course in Liability-Driven Investment funds, which were at the root of the precipitous rise in bond yields that ultimately did for Truss.

So, who are Liz’s unlikely allies? Robert Peston, for one. On Sunday, he tweeted: “Liz Truss is completely right about one thing. It is astonishing that the Bank of England, the Pension Regulator and HM Treasury were so wrong footed by pension funds’ fire sale of government bonds and other assets as a result of their massive over-use of LDI hedging…”

Then, there’s Patrick Hosking, the Economics Editor of the Times. He has written a piece this morning in which, while he doesn’t entirely exculpate Truss, nevertheless accepts that she’s essentially right about the role of LDIs in her downfall. Here’s an extract:

Economic historians no doubt will argue about that, but no one would dispute that the crash of government bond prices and the surge in their yields, which move inversely to prices, did for her personally. The ensuing slump in the pound and the jump in new mortgage rates were seen by her own backbenchers as a damning verdict.

How much was down to the liability-driven investment “tinderbox”, as she calls it, is harder to say. The House of Lords industry and regulators committee, a cross-party group chaired by Labour’s Lord Hollick, largely sides with her on this narrow point. It says today that while the mini-budget was “the trigger” for the gilts market dive, “we believe that the downward spiral was caused by the presence of leverage in LDI funds”.

It was a complicated moment in markets and politics. Three big themes were playing out in late September. The first was a significant worsening of inflation and therefore rising interest rate expectations both worldwide and in Britain. The second was the uncertainty of the Truss era and how that might affect the UK’s appeal to international investors. The third was the gradually growing stresses in pension funds’ LDI positions. There was also a fourth element at work — the death of the Queen. This led to a near-paralysis in policymaking for more than a fortnight and persuaded the Bank of England to postpone its monetary decision-making by a week.

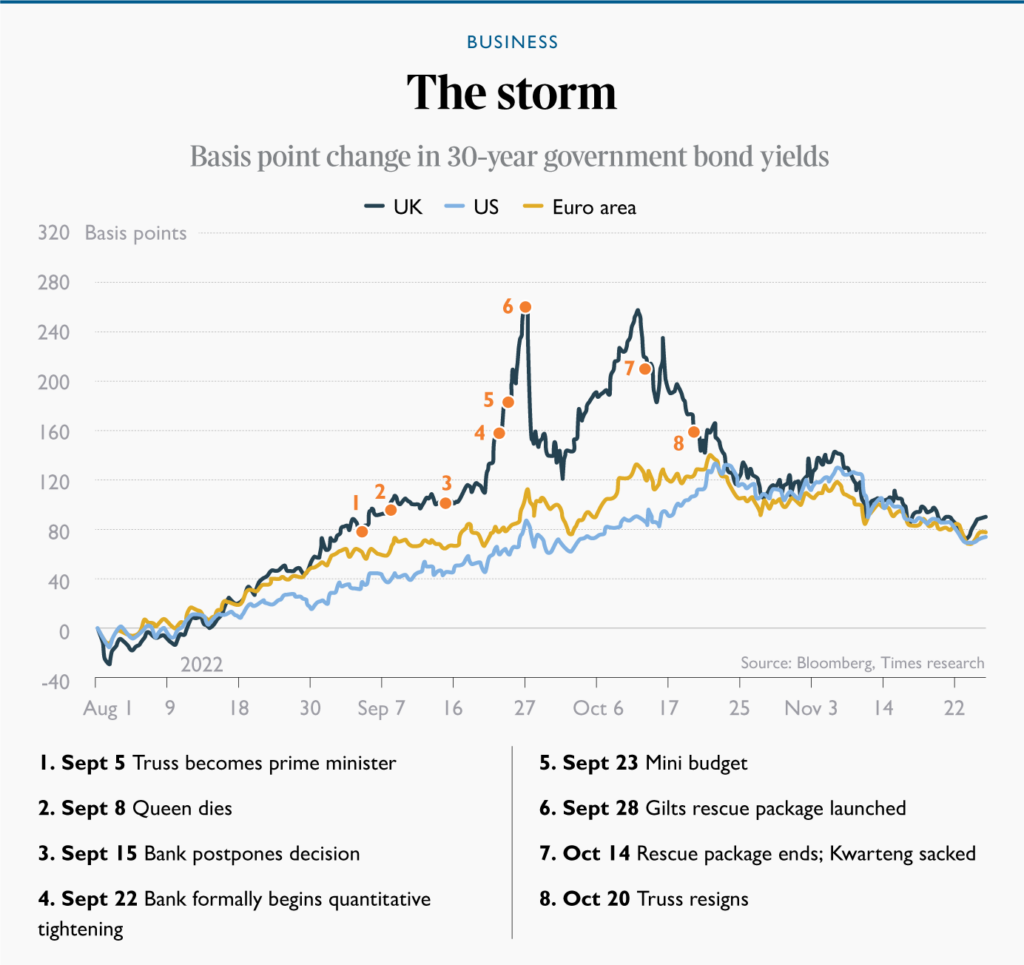

Disentangling these forces is nigh-on impossible, but it is important to try, not only to understand Truss’s downfall but also for deciding how Britain should reset policy to minimise the chances of a repeat of the LDI debacle. The chart above sets out the sequence of events. There are several immediate observations.

The first is that the trajectory of UK yields started to diverge from European and American yields pretty much from the moment in late August that it became clear Truss would win the Tory leadership election. Anxious investors started to demand a premium to hold UK government bonds. The second is that yields started to accelerate sharply not from the day of the mini-budget but the day before, when the Bank raised base rate and officially pressed the button on quantitative tightening. It has always insisted that its tightening plans were well telegraphed, but formally announcing that it would start to sell £80 billion of its stockpiled bonds certainly didn’t help.

The third is that, but for the period of mourning, the official monetary tightening would have taken place a week earlier. Arguably, it might have led to a flatter, more gradual slope in rising yields. Might that have made a difference? The liability-driven investment squeeze was mostly down to the rate of change in yields. It was not the rise in yields, but the speed at which they rose that wrong-footed pension funds and left them scrambling to find cash for margin calls quickly enough. That led to more gilt sales and the terrible self-feeding selling spiral that followed.

Truss’s suggestion that she was undermined by a left-leaning economics establishment sounds borderline paranoid. The Treasury and Office for Budget Responsibility were merely reflecting the, yes, orthodox way bond investors think. But she is right to believe the turmoil was enormously amplified by the fatal flaw in liability-driven investment.

It remains to be seen what the Government or the Bank of England or the pensions regulator does about LDIs. But as Peston goes on to say in the same Tweet thread, “This was the most serious regulatory failure since the 2007/8 banking crisis.“

Patrick Hosking’s piece is worth reading in full.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.