The West today is facing a dangerous future. If Europe does not figure out a way to get Russia to turn the gas back on, the European economy will likely collapse this winter. If this happens, expect serious political instability. Yet at this very moment, our leaders are engaged in absurd power fantasies where they dictate terms to Russia about the sale of energy.

Consider the price cap on Russian oil. The idea is simple enough: buyers of Russian oil join a big club which makes a commitment not to buy any Russian oil that is priced above a certain level. Clubbing together has long been a feature of global oil markets. OPEC – and now OPEC+ – is a club of sellers. They effectively set the price of oil by meeting and agreeing on production targets for oil. So why haven’t buyers of oil clubbed together until now? Probably because the idea is ridiculous and, until very recently, Western leaders were not willing to look so unserious on the world stage.

It is not hard to explain why the idea makes no sense. Let us say the countries currently signed on to the madcap scheme – the United States, Canada, Japan, Germany, France, Italy, and Britain – turn to Russia on December 5th (the planned date of the action) and say they will not buy a single barrel of oil priced over, say, $90. The likely answer from the Russians will be: “Sorry, the market price of oil is higher than that. If you do not want our oil at the market price you are free to look elsewhere.”

What happens next? Assuming these countries place a ban on buying Russian oil over $90 a barrel, consumers and distributors will have to start bidding for oil in countries other than Russia. This will greatly increase the price they pay in these countries. This, in turn, will drive up the global price of oil – certainly for all the countries signed up to the policy.

What about Russia? They may lose out on some oil revenue, or they may not. It depends on two things. First, on how much the rise in the price of oil cancels out the loss in quantity being sold. Second, on how much of their oil can be shipped to alternative markets. Considering all this, who is more adversely affected by the oil price cap? Obviously, the countries trying to impose the cap. And those countries are not just slightly more adversely affected, they are far more adversely affected.

This is why no countries have tried a price cap before. It is an absurd policy. It is deeply unserious. It does not even pass the smell test of being an idea worth considering. If such ‘magic beans’ tactics worked, they would have been used by oil consumers against OPEC long ago.

It is sad to say, but the credibility of our elites is crumbling. They are becoming very difficult to take seriously. One can only imagine how their statements and actions are viewed across the world. Without putting too fine a point on it, the Chinese, Russians and Indians must be having a good laugh. And when that laughter dies down, it will have very real effects. Global partners will take us less seriously. We will not be accorded the respect we have been hitherto.

Meanwhile, inflation surges at home. Living standards fall, and there is reason to think the decline may not be reversed. This does not feel like a normal inflation. Normal inflation occurs when the economy is running too hot and is reversed when the economy enters a recession – typically after central banks raise interest rates. But our current inflation feels more like an impairment in living standards caused by supply chain disruptions and a shake up in global trade relations, sparked by geopolitical realignment.

Let us run some simple models to get a sense of how bad this could get. In one scenario, let us imagine that inflation in Britain continues at the current rate and we do not get a recession (or at least, the recession is not that bad) – so nominal wage growth continues at its present rate. This is the ‘No Recession’ scenario. In the second scenario, let us imagine that inflation continues at its present rate, but we get a recession in the last three months of 2022 and nominal wage growth goes to zero. This is the ‘Recession’ scenario.

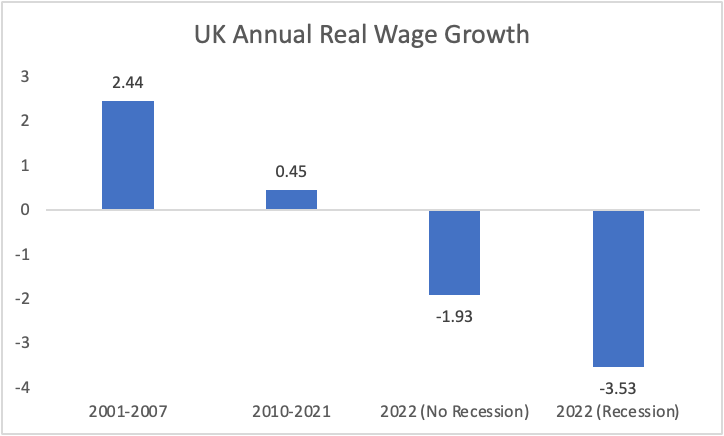

Here is what those two scenarios looked like and compared to real wage growth in the 2001-07 period and the 2010-2021 period.

As we can see, in those halcyon days before the financial crisis, Britain saw its real wages rise around 2.4% a year. In the wake of the financial crisis, British living standards have been basically flat. That has been pretty unpleasant, but it has been tolerable – sort of. Now look at the two models. They show that we should probably expect real wages to fall by anything from 1.9% to 3.5% this year.

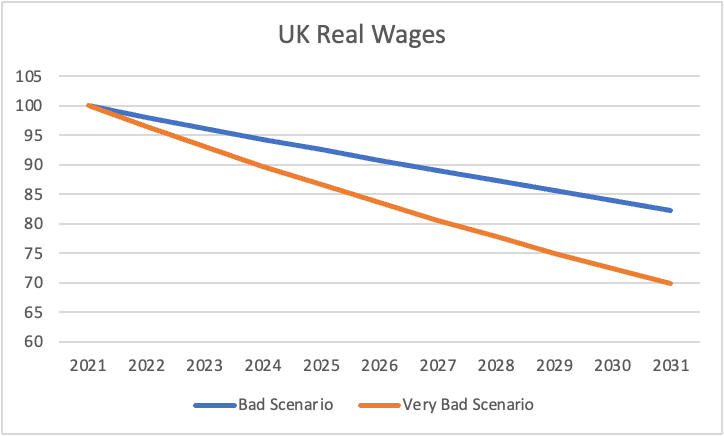

Now let us imagine that we are in for a decade of this. Let us say that due to shifting trade patterns, geopolitical chaos, continued supply disruptions (from lockdowns, net zero policies and various other interventions) and the decline of Western reserve currencies, we continue to see high inflation and low nominal wage growth. Here we will just label our ‘No Recession’ and ‘Recession’ scenarios ‘Bad’ and ‘Very bad’.

The erosion of purchasing power builds on itself. By the end of the decade, living standards – what you can purchase with your paycheck – have fallen by somewhere between 18% and 30%.

Of course, I do not have a crystal ball. Maybe after a few more months of turbulence, the economy will right itself and inflation will subside. My point is that you can make a credible case that this will not happen. In other words, I can argue with some justification that living standards in Britain will fall 18–30% in the next decade. Prior to the lockdowns, if you had tried to make that case to me, I would have dismissed you as crazy. But the world has changed drastically.

As these new realities assert themselves, our leaders engage in fantasy and playacting. And the rest of us risk, as Peter Cook once quipped, are sinking giggling into the sea.

Philip Pilkington is a macroeconomist and investment professional. You can subscribe to his Substack newsletter here.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Surely by their own description, given the reported number of “cases” and “deaths” we should be at level two at least.

So much for data not dates.

Agree, by their own definition we should be in level 2, I cannot see how we can be in level 1 EVER.

You can’t expect them ever to declare that we’ve reached level 1 – that’d be too much like Turkeys voting for Christmas!

Precisely. Anyone but a dimwit would recognize ‘Level 2’ as the most accurate factual description, even if you don’t succumb to the general idiocy of the ‘Levels’ for a virus that – even at worst – actually never reached the level of an ‘epidemic’ as defined by the GP monitoring system.

Conclusion : those making the statement are ‘dimwits’, even if slightly less so than the government.

They’re not dim. This is deliberate.

It’s so clear Rick, how can you not see it?

They know zero Whu-flu is impossible.

Don’t worry, the conniving evil b’s will bend the ‘rules’ and move the goalposts again and again to suit themselves. “Scary” new variants is one such tactic, to convince enough of the spineless public that we all must remain cautious. So be very wary of who you choose to hug ( But not before the 17th, mind!), because the Great Plague lurks everywhere, waiting to pounce on the unbelievers. “Data” is a flexible commodity, just like lies, damned lies and statistics.

Level 1 is unattainable. So they can always justify some restrictions. Fucks sake.

For money’s sake. For dictatorship’s sake.

Unless or until we the UK gets its own DeSantis this will never be over.

The overall mindset of the rulers is to control and keep controlling as they have some very unpopular legislation about to be put in place to help ‘save the planet’.

And there is this: Who among our “public health officials” or political leaders will now admit they were wrong? Apparently, even when one knows the policies he endorsed caused more harm than benefit, he is not going to admit this. Instead, he will be much more likely to “double down” on his past prescriptions, and indeed try to censor any information that might show he was wrong.

It’s much worse than that.

You’re a nice person, like much of the country, and you wouldn’t risk known harm to the vulnerable.

That’s not how the NHS thinks. Remember the Liverpool “Care” Pathway? They are capable of ruthless action in ordinary times.

Remember the deliberate shunting of the old to nursing homes at the start? They knew that would kill. Remember the GPs writing round asking the frail to sign Do Not Resuscitate notices? Remember the nurses visiting and leaving such DNR notices on display against the wishes of the elderly? Remember the same happening to the disabled?

And the pharmaceutical companies hiding research showing their products led to death or addiction which led to death?

For them it’s part of the job.

We the concerned ordinary folk are all scrabbling round at the margins of incoherent systems like VAERS and Yellow Card, trying to work out the death rates and harm rates. But Pfizer and the rest, and the NHS, already have the full facts – on the short term effects. They know people are dying and being injured. A minority, sure, compares to the number jabbed, but deaths and injuries which could be prevented by careful recording, investigation and a precautionary approach.

And it’s very clear that they don’t care at all.

UKColumn is now presenting the govt’s Yellow Card stats in a much more accessible form so go there, understand the reality and share!

I’m married to a beautiful, tall, leggy blonde who’s 10 years younger than me. We have 5 model children. I retired at 40, 5 years ago and we live in a 200-acre vineyard in Tuscany. I own 10 sports cars, have my own private helicopter and a 400-foot yacht on Lago Maggiore, not to mention 500 million pounds in bitcoin. Oh yeah, and there’s a pandemic.

These people are either nuts or they mean us harm. How can it possibly be higher than level 2?

The could be nuts AND wish us harm.

In fact, no one sane and sensible would do what they’re doing.

I’d heard of the “irreversible” “road map” back to normality, with its estimated completion date of 21st June. However, I now see (perhaps rather belatedly) that the declared “data not dates” rider (which I’ve long appreciated doesn’t cut both ways) will poleaxe the midsummer watershed, since SARS-CoV-2 won’t be “not known to be present in the UK“.

How has Boris been able to get away with touting his road map to normality without attention being drawn to the insurmountable hurdle he’s built into it?

It has been pointed out on LS months ago.

Everyone else is studiously ignoring it.

Are the cmo’s being led down the same path as us mere mortals? For a minute, I thought they were being “supported” by the wef/gates/who gang. However, perhaps there is hope that they realise something is amiss, when it is as clear as a bell to the guy down at the pub, that all restrictions should be lifted weeks ago. Shame on them for not being more vocal.

It should be lowered to level 2 and the “pandemic” declared to be over.

Yes we should be in level 2 of course but the pandemic can not be classed as over until 2023 or the vaccines can no longer be given! They are on emergency use approval until then, so no emergency means no vaccines. Not going to happen.

How low has it got to go? Do they require dead covid people to be resurrected?

Keeping a permanent state of emergency gives the excuse to keep the v@x programme live indefinitely. (I know other posters have mentioned this, but it bears repeating). By these alert definitions, we’ll never be back to any recognisable “normal”. Adapt and survive, friends.

Why are we still listening to these idiots?

Ditch the masks and back to normal.

This guy is coming to the rescue apparently. Give him your support.

https://www.bitchute.com/video/mW6hK9j7wCRZ/