Whenever discussing renewables subsidies on the internet, there is a form of Godwin’s Law that means it is inevitable that someone will come along and say: “Ackshually, fossil fuels are subsidised more than renewables,” or words to that effect, as shown in this example. I have often thought the claim to be bogus, but until now had never dug into the detail to prove the case one way or the other.

Energy is one of the elementary foundations of modern society. Almost any activity you can think of requires energy input of some type or other. Factories need energy to make things. Offices need energy for heating, lighting, cooling and running computers, as do our homes. Hospitals need energy to run operating theatres. We need energy to go to work or visit friends and family, whether we travel by car or train. We need energy to do the family shopping, cook, to travel to the gym, cinema, or restaurant. Energy is fundamental to every economic and social interaction, so it would not be surprising if energy were subsidised. Expensive energy is like a tax on our very existence, so taxes on energy act as a drag on society.

It is therefore vital that we get to the bottom of the claimed fossil fuel subsidies in the U.K.

What is a Subsidy?

In simple terms, a subsidy is when the Government pays (or mandates consumers to pay) for an activity to occur that otherwise would not happen if the market were left to its own devices. Examples might include grants to theatre companies or awarding CfD contracts to offshore wind.

A tax is where the Government levies an extra charge on a transaction or activity. For instance there is Value Added Tax, levied at 20% for sales of most goods and services. There are also special taxes such as levies on alcohol and tobacco and of course income tax. Reduced rates of tax are still taxes, quite the opposite of subsidies. No taxes and no subsidies represent a neutral position.

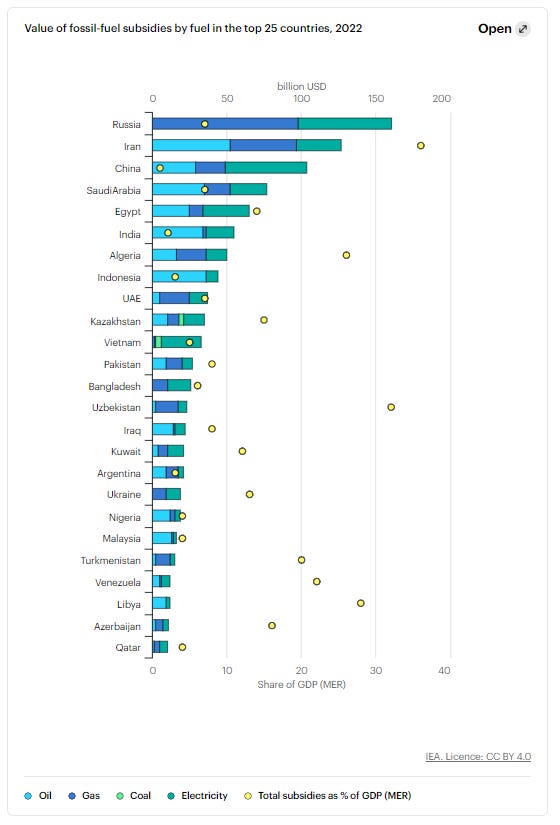

When it comes to oil and gas, the definition of a subsidy becomes a little controversial. The International Energy Agency (IEA) defines fossil fuel subsidies as “measures that reduce the effective price of fossil fuels below world market prices”. It is certainly true that some countries, such as Russia and Iran, do subsidise hydrocarbons according to the IEA’s definition. Interestingly, the Government said in 2021 the “U.K. does not give any subsidies to fossil fuels” and the U.K. does not appear on the IEA’s Top-25 list from 2022 of countries that subsidise fossil fuels (see Figure 1).

However, it should be noted that in the database buried in the IEA’s website it does claim that the U.K. offered fossil fuel subsidies of around £6 billion in 2022, but none in any other year. There must be something about its definition that omits the U.K. from its Top-25 graphic.

Where do the Claims of U.K. Fossil Fuel Subsidies Come From?

Given the Government statement and the U.K. not appearing in the IEA’s list of top subsidisers, we need to look at where these claims of massive subsidies come from. Unfortunately, the idea that the U.K. heavily subsidises fossil fuels has a long history. This 2013 article from the Guardian claims the U.K. is “subsidising its coal, oil and gas industries by $4.2 billion (£2.6 billion) a year”. The Guardian has produced similar articles over the years such as this one from 2019 claiming “the U.K. leads the European Union in giving subsidies to fossil fuels” and this one from 2023 claiming “the U.K. Government has given £20 billion more in support to fossil fuel producers than those of renewables since 2015”. Note that they use the words “support” and “subsidy” almost interchangeably, eliding so called “tax-breaks” with subsidies. The Guardian is not the only publication making this type of claim. Politico also got in on the act in 2021 claiming that Britain “supports the fossil fuel industry through tax breaks and subsidies… to the tune of £10bn a year”.

When digging into the articles, you can see that their definition of subsidy includes consumers or producers paying less tax on fossil fuels than the authors believe appropriate. At the risk of repeating myself, paying less tax still means the activity is taxed, which is the direct opposite of a subsidy. Paying less tax than an arbitrary level is not a subsidy. Even paying zero tax is a neutral position and certainly not a subsidy.

How Big are Fossil Fuel “Subsidies”?

The Politico article linked above refers to data from the OECD to support its £10 billion (for 2020) claim. By digging into a more up to date version the data, we can evaluate the veracity of the claims. Broadly speaking the “subsidies” or support mechanisms are broken into two categories: producer subsidies and consumer subsidies.

Using the data for 2022, the total alleged support for oil and gas producers amounts to £3.1 billion. The largest component of this total is £2.25 billion of tax relief for decommissioning. This arrangement allows companies to claim capital expenditure connected to decommissioning old fields against corporation tax. For oil and gas companies, decommissioning their fields is a normal business expense. In normal company taxation, business expenses are deducted before calculating taxable profits. There is nothing to suggest that deducting decommissioning expenses before calculating taxable profits is anything other than normal business practice and is certainly not a subsidy. A further £0.85 billion of “support” is alleged because companies can treat investment in new fields as a business expense to set against the Supplementary Charge that oil and gas companies are subject to on their profits. Again, this is not very different to the investment allowances made to companies in other industries and does not amount to a subsidy.

Using 2022 data again, there is about £12.9 billion of claimed routine consumer support for fossil fuels. £7.8 billion of the total comes from consumers being charged 5% VAT on their domestic energy bills and not the normal 20% rate. It should go without saying that 5% VAT is still a tax, quite the opposite of a subsidy. A further £3.5 billion of the alleged support comes from fuel duty relief where some types of fuel pay less fuel duty for some uses than others. Again, some fuel duty applies, just not the full rate. This is not a subsidy; it is just paying less tax. Another £1.4 billion of “support” comes from reductions in the Climate Change Levy. Ironically, much of this support is granted to organisations with Climate Change Agreements to reduce energy use or CO2 emissions. In the crazy world of climate activists, paying a lower Climate Change Levy by agreeing to reduce emissions amounts to a fossil fuel subsidy. Finally, a further £0.2 billion of consumer support comes through the Warm Home Discount. This is a reduction in energy bills for older pensioners and other vulnerable people and it is probably justified to term this a subsidy, although it applies to gas and electricity from all sources including renewables, not just fossil fuels. Out of a total £16 billion of supposed subsidies, only £0.2 billion could be reasonably termed a subsidy and an indirect one at that.

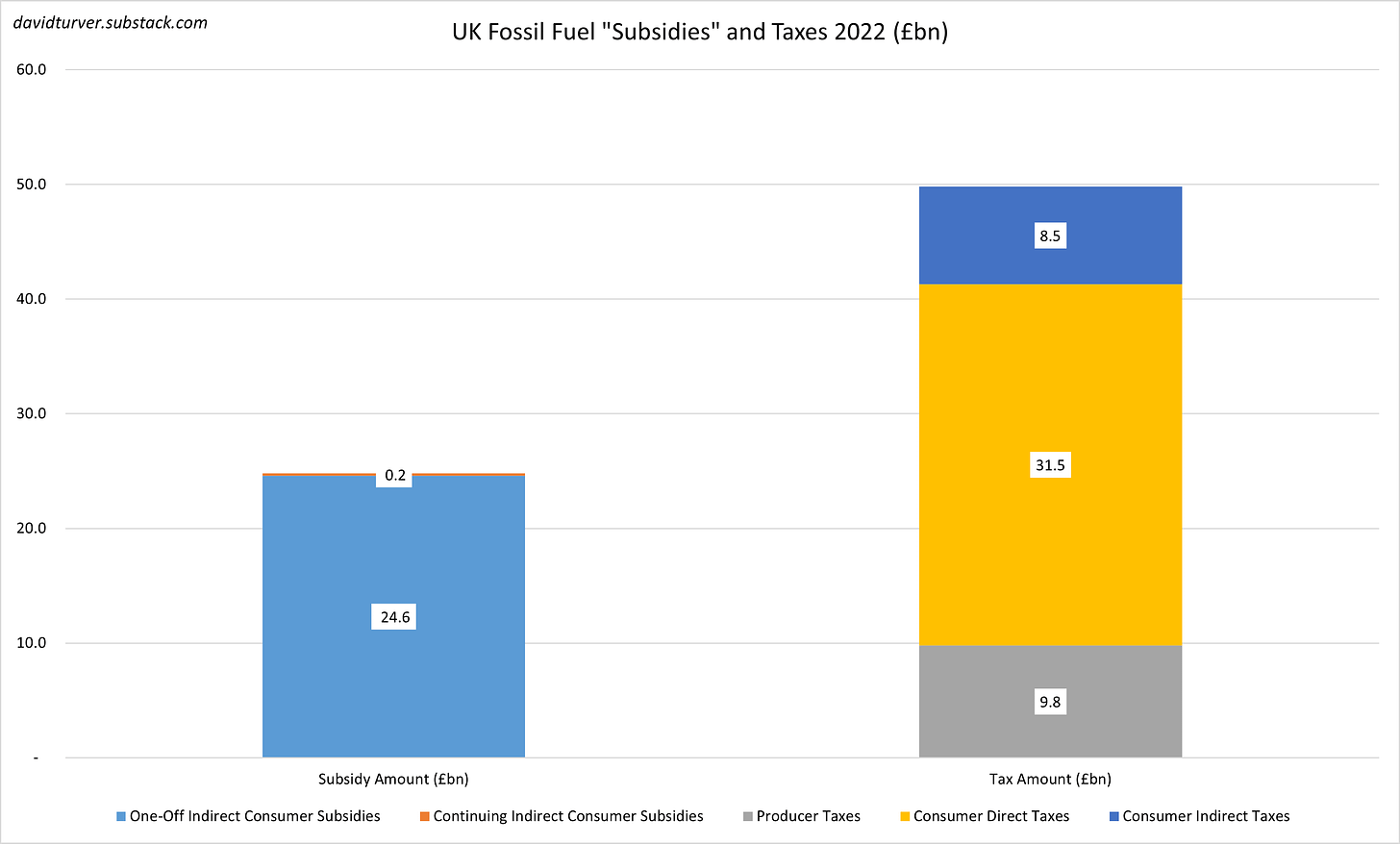

However, there is a ‘but’ and it is quite a big but because we also need to consider one-off consumer support schemes. There was £19.4 billion on the Energy Price Guarantee for domestic consumers, £2.6 billion on the Energy Bill Relief Scheme for non-domestic consumers and a further £2.6 billion on the Energy Bill Support Scheme. These schemes amount to a total of £24.6 billion and there is a case to classify this money as some sort of subsidy. However, these schemes should probably be referred to as indirect subsidies because they covered all forms of generation, not just fossil fuels. Note that as Figure 1 shows, this support did not meet the IEA definition of a subsidy, or the U.K. would have appeared in about 12th place. We should also bear in mind these schemes were one-off responses to a crisis and are no longer in operation.

Taxes on Fossil Fuels

If we are to get a complete picture we should also consider the taxes the U.K. levies on fossil fuels. These can be split into two categories: producer taxes and consumer taxes.

Oil and gas producer taxes comprise ring fence corporation tax, the supplementary charge (extra corporation tax), petroleum revenue tax and the energy profits levy (also known as the windfall tax). According to the OBR, the total receipts for these taxes rose sharply from £2.6 billion in 2021-22 to £9.8 billion in 2022-23 (the most comparable year to calendar 2022). Those who claim we subsidise fossil fuels are effectively saying we should increase these taxes by the £3.1 billion “support” identified by the OECD above. Once again, paying less tax than some arbitrarily defined level is not a subsidy.

The ONS publishes the cost of environmental taxes, many of which can be characterised as consumer taxes on fossil fuels. These include direct taxes on fossil fuels that raised the following amounts in 2022:

- Fuel duty, £24.8 billion. Those who say we subsidise fossil fuels would add the £3.5 billion of fuel duty relief identified by the OECD to this already massive tax, making it much more expensive to move around.

- Emissions Trading Scheme which raised £4.6 billion including U.K. and EU schemes.

- Climate Change Levy (CCL), £2.1 billion. Those claiming massive fossil fuel subsidies would add the £1.4 billion CCL reductions identified above to this already significant tax, effectively cutting incentives to reduce emissions.

In addition, there are indirect taxes on fossil fuels that raised even more money in 2022:

- Road Fund Licence, £5.2 billion (remember this tax does not apply to electric vehicles yet).

- Air Passenger Duty, £3 billion.

- The Plastic Packaging Tax brought in £0.3 billion. Plastic is made from fossil fuels, so this is effectively another tax on fossil fuels.

This gives a total of £31.5 billion of direct taxes and a further £8.5 billion of indirect consumer taxes on fossil fuels.

Finally, VAT is levied on domestic energy, petrol and diesel which is another direct tax that falls on fossil fuels. However, I cannot find a reliable data source that gives an analysis of VAT receipts arising from hydrocarbons so we should simply note VAT raises about £160 billion in total each year and fossil fuels will contribute a significant portion of that total.

Conclusions

This analysis is summarised in Figure 2 below.

First, we can dismiss the so-called subsidies for producers as normal business expenses deducted from taxable profits. We can also dismiss all but the £0.2 billion Warm Home Discount ongoing consumer “subsidies” as simply lower taxes for some uses of fuel. Tax is still tax and lower tax is not a subsidy. If we are generous to those who claim we subsidise fossil fuels, we could note that in 2022 there was about £24.6 billion of one-off indirect subsidies. However, these schemes are now no longer in operation.

On the tax side of the ledger, we have £9.8 billion in producer taxes, £31.5 billion of direct consumer taxes and a further £8.5 billion in indirect consumer taxes, plus an unknown amount of VAT. Even in an exceptional year when the various energy bill support schemes were in place, taxes exceeded the alleged subsidies by a wide margin.

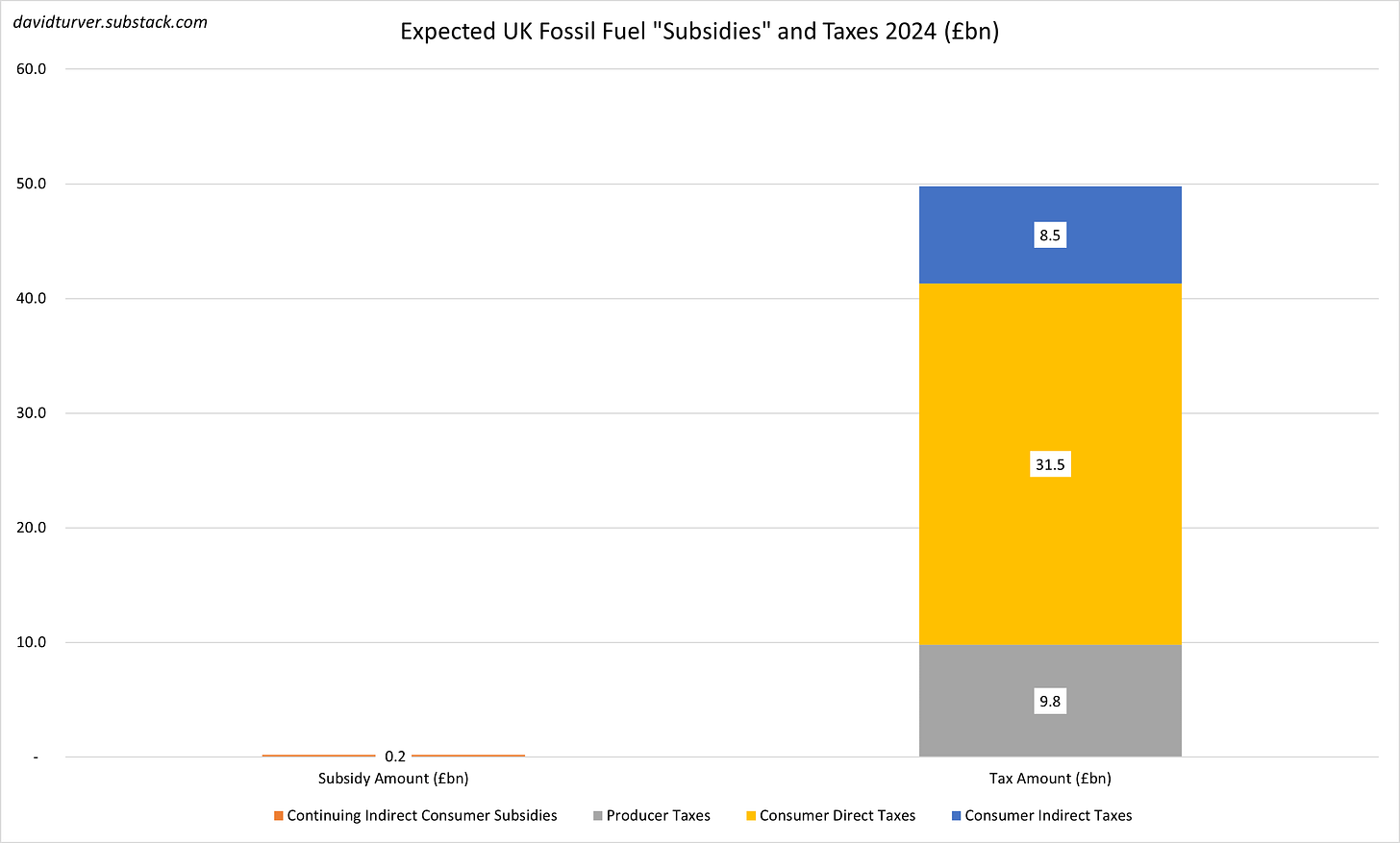

Now the energy crisis has subsided we are left with just £200 million of indirect subsidy to help the elderly and most vulnerable with their energy bills offset by close to £50 billion of direct and indirect taxes as shown in Figure 3.

However, we should note it is likely the fossil fuel tax take will fall with lower oil and gas prices. Production will likely decline due to a lack of investment driven by the 78% marginal tax rate on profits, leading to a bigger fall in producer taxes. On the other hand, it is rumoured that the Chancellor will increase Fuel Duty in the Budget. High taxes mean high prices which in turn function as a tax on the rest of the economy leading to steady, inexorable decline. If we want a thriving economy, we should be cutting taxes on energy, not increasing them. Note again, lowering taxes is not a subsidy. Zero tax is not a subsidy, it is a neutral position. Remember this when some activist claims we subsidise fossil fuels.

David Turver writes the Eigen Values Substack, where this article first appeared.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Beautifully put.

And an article that mirrors my thoughts and sentiments almost perfectly.

Yep totally nails it.

I’ve got to second that.

He also said this about the dangers of a Mass Psychosis outbreak:

Bang on

I still can’t get my head round what happened- more specifically how people went along with it all

That people went along with it is no surprise. The majority of people always goes along with everything those in power throw at them while trying to continue living their lives as good as they can. The really noteworthy thing was that our political and social elites who are totally awash with human rights everywhere really absolutely don’t give a shit about them. Insofar we’re allowed any freedoms, that’s not because of our inalienable rights but solely, because those in power can’t be arsed to care about us for as long as they believe we don’t really matter.

That’s again quoted in the The Lockdown, Stupid! article: It was our inalienable human rights which made them do it, specifically, the right to life. That was redefined as right to live in the most germ-free environment a government is capable of creating to avoid endangering one’s life by potentially contacting a disease and inevitable natural side-effects of the fact that this planet is decidedly not germ free and that some germs are invisible and incontrollable parasites of our bodies was redefined as us consciously spreading death and disease by virtue of maliciously being alive.

This as dishonest as murderous sophistry paints a picture of our ruling class I really had preferred not to look at.

Yeah I had preferred not to look at it too.

I know people are dozy (including me) but honestly the lockdown stuff was such patent bollocks and went on for so long and was such an outrageous assault on liberty I was sure they wouldn’t get away with it.

I agree it was patent bollocks, but we have to remember that the full force of the state’s power was deployed on a relentless and aggressive propaganda campaign of fear, which in Halfwit’s own words, was intended to scare the pants off people, coupled with the promise of safety provided everyone complied with the rules. These were powerful forces and to resist them required both a sceptical mindset and a willingness to risk social opprobrium by stepping out of line which, it seems, is a relatively rare combination. It was like living under a totalitarian government, where the people were controlled by fear and governed by fools.

Well maybe the first few weeks, but then it just got silly – scotch eggs etc. Beats me how anyone could still take it seriously at that point.

Then there’s Charles mackay who wrote the best book on Covid 19, way back in 1841, “Extraordinary Popular Delusions and the Madness of Crowds”:

And if you have not read it, now’s the time.

So cock up then? I wholeheartedly disagree, and I know most others on here do too, but why has this been overlooked in the comments so far?

Well-said. You hit the nail on the head.

This “enantiodromia” as you describe it, is common. It happens in industries particularly where pure reasoning plays a significant part in the understanding and where sons inherit from fathers. It happens in families and various forms of government. It happens to leaders or, the ruling classes regularly. Our times continually go in and out of joint. A dangerous but interesting phenomenon.

“Fair is foul and foul is fair”

https://nosweatshakespeare.com/quotes/famous/fair-is-foul-and-foul-is-fair/

Mr. Jung also notes what we have and are witnessing. Not sure there is a vaccine for such an epidemic

We must all speak out, and all times speak the truth, regardless of the cost.

“The supreme danger which threatens individuals as well as whole nations is a psychic danger. Reason has proved itself completely powerless, precisely because its arguments have an effect only on the conscious mind and not on the unconscious.

The greatest danger of all comes from the masses, in whom the effects of the unconscious pile up cumulatively and the reasonableness of the conscious mind is stifled. Every mass organization is a latent danger just as much as a heap of dynamite is. It lets loose effects which no man wants and no man can stop.”

Hugh – have just ordered your book. Looks just up my street!

I was a defiant sceptic from the outset. Most of my wider family, friends and associates weren’t (although some were fairly tolerant), but the last few years haven’t been easy.

I have, however, found in recent months that some people who were fully on-board with the nonsense are now sheepishly admitting that it was “a bit over the top” and one or two agree with me that it was nonsense.

I do believe the tide is turning – but very slowly – now the damage of the lockdown years is only too apparent. Whether any of them would have the fortitude to stand up to a future tyranny is unlikely: they are conformists and conformists conform.

“The internet, for all its benefits, has proved to be a remarkable tool of oppression.”

I appear not to be Internetoppressed. What are the signs & symptoms?

The Internet is a fantastic tool for enlightenment, information, learning and freedom. If it were not so, Govts would not be trying their hardest to control it, restrict it.