The Government recently announced the results of the International Investment Summit held earlier in October with much fanfare. It claims the summit has secured £63bn of investment and nearly 38,000 jobs. But how much of this investment is really new, and what will be the impact on consumers?

International Investment Summit Sector Breakdown

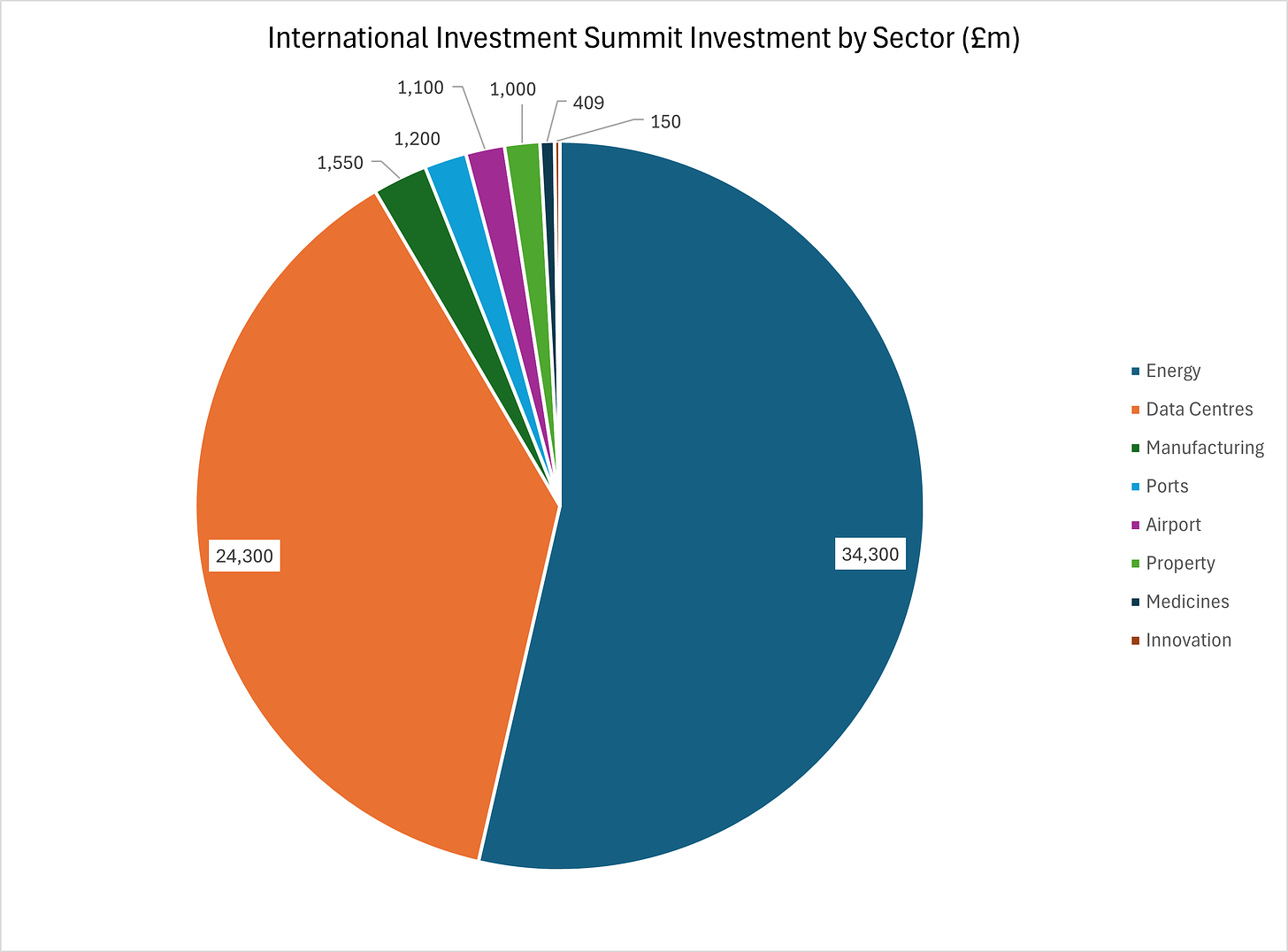

The Government announcement lists 23 different items of investment across several industrial sectors as shown in Figure 1.

By far the largest sector is energy, taking £34.3 billion of the total £64 billion investment. The second largest sector is data centres with £24.3 billion. The remaining 8.5% of investment is spread across ports, airports, property, medicines and what I have loosely termed innovation.

How Much is New Investment?

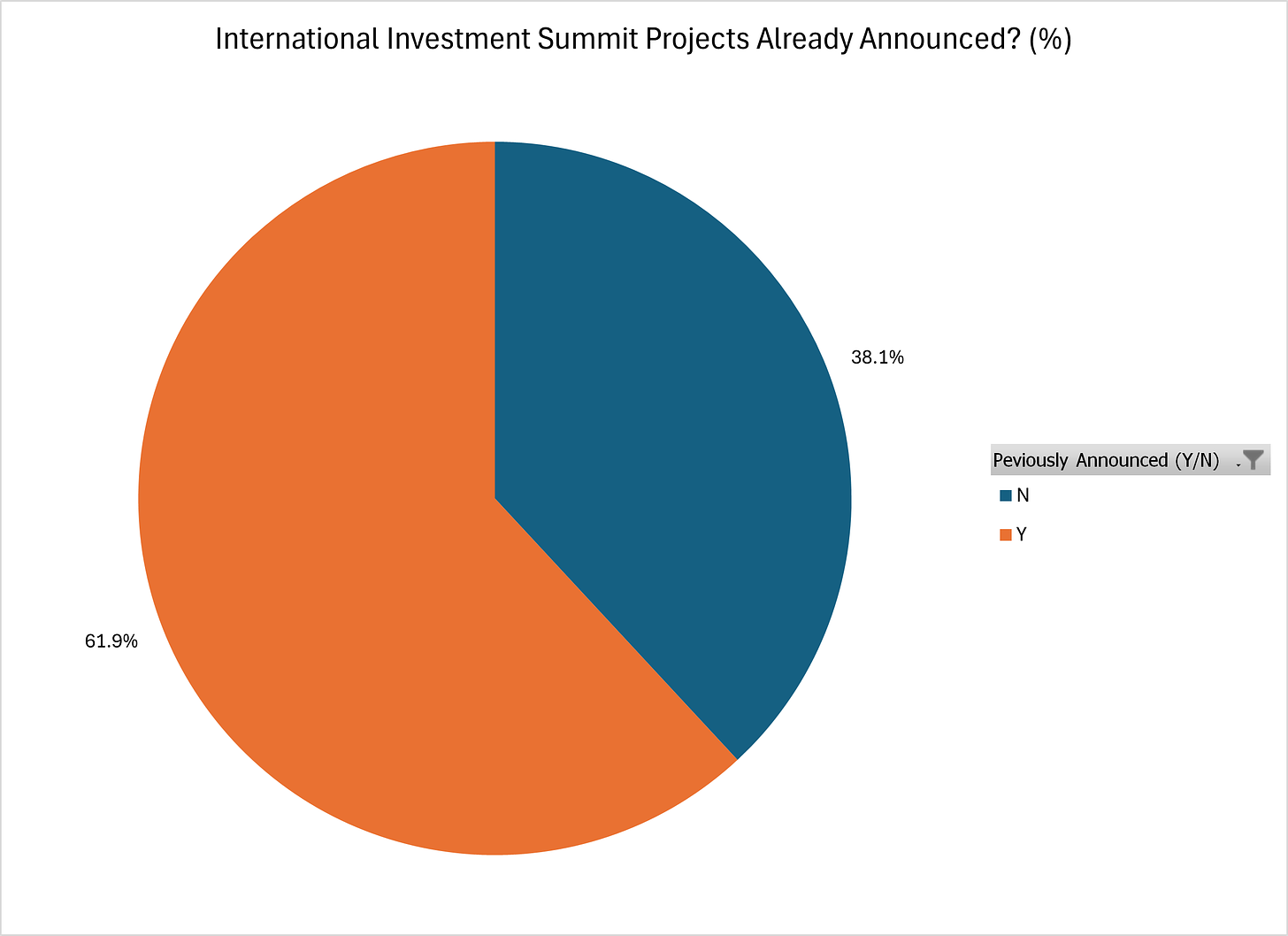

However, the headline announcement is not quite what it seems. Many of the projects have been announced before. At least £39.6bn or 61.9% of the investment has been announced before as shown in Figure 2.

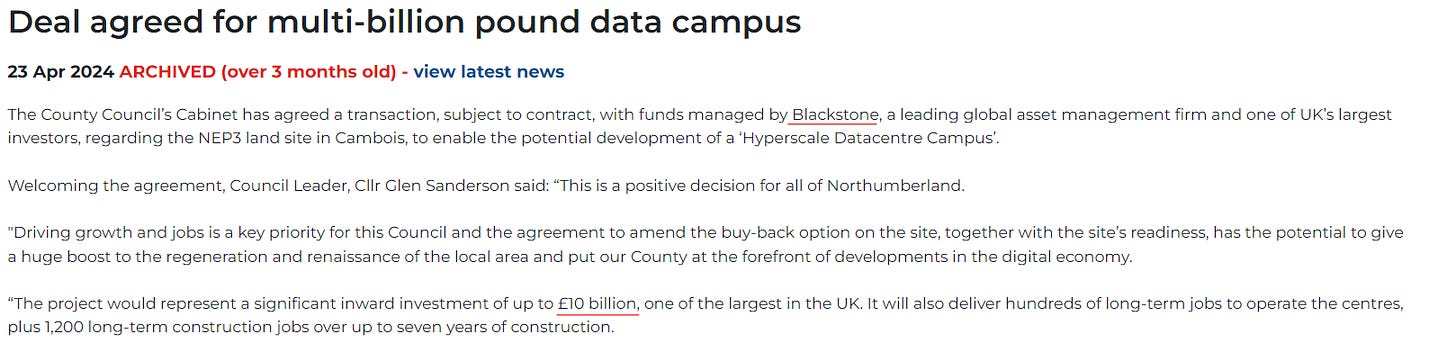

For instance, one of the largest project re-announcements is Blackstone’s £10bn data centre investment in Blyth was agreed in April 2024, under the last Government (see Figure 3).

Similarly, Ørsted’s £8 billion offshore wind investments were announced as part of the AR6 auction results last month and the AR6 process was initiated under the Tory administration, as was Greenvolt’s £2.5 billion floating offshore wind farm. Moreover, the £8 billion of carbon capture projects were announced by the then Tory Energy Minister, Claire Coutinho in October 2023.

Amazon’s £8 billion data centre investment was announced last month, seemingly totally unrelated to the investment summit. It also appears that not all the £8 billion will be “investment” because the press release says the money will be spent on “building, operating and maintaining” the data centres. The operating costs of large data centres are considerable because of the amount of electricity they consume. The claim of supporting 14,000 jobs also appears dubious because it seems to include tech jobs at clients that might utilise Amazon’s cloud services.

Planning permission for the £1.1 billion investment in expanding Stansted was granted in October last year, and Stansted is owned by Manchester Airports Group which is in turn owned by a consortium of Manchester local authorities so should not count as international investment. Finally, the Holtec SMR factory was announced in May 2024, it’s just the final site selection that was announced last month.

That leaves us with the remaining £24.4 billion of investment that might be termed new, but £2 billion of that is from U.K. business Octopus Energy. A further £1 billion is from a new property company set up by publicly owned Network Rail and London and Continental Railways; again, hardly international investment. It is also likely that many of these transactions would have happened without the lavish summit.

Impact of Energy Investments

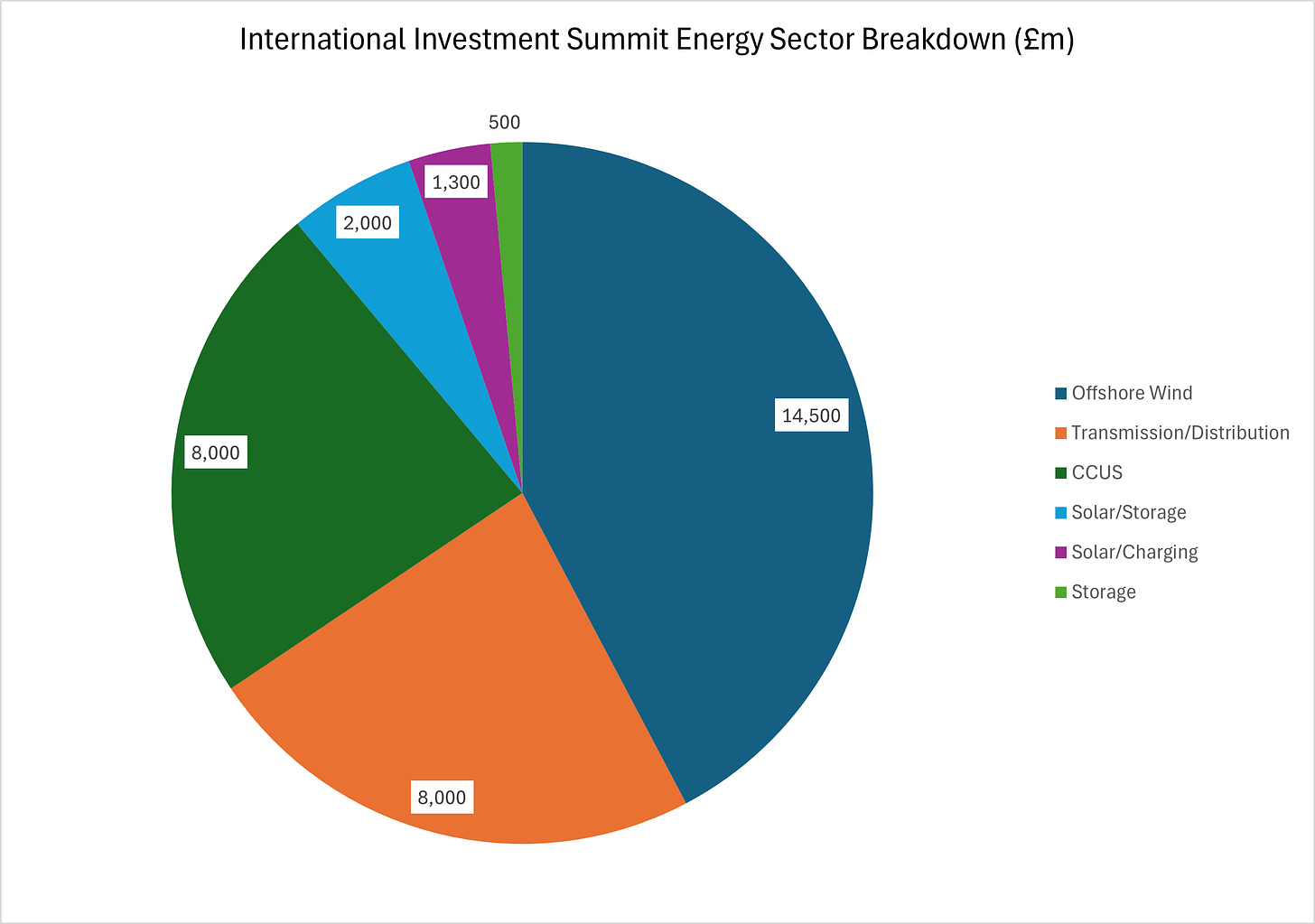

The Chancellor, Rachel Reeves made a speech at the summit and claimed that the “Government’s number one mission is to grow the economy by being the most pro-business this country has ever seen”. It is interesting that she chose the words “pro-business” and not “pro-market”. We can perhaps see why if we dig into the announcements related to energy (see Figure 4).

The offshore wind projects were announced last month as part of the AR6 renewables auction results. As I covered then, the strike price for fixed offshore wind was in the range £76-£82/MWh (in 2024 prices), both of which are above the average reference price so far this financial year of around £61/MWh, largely set by gas. The generators are guaranteed subsidies that will be paid by consumers. The capital expenditure for the Ørsted projects is £8 billion to deliver 3.48GW of generating capacity, or £2.3 billion per GW. Moreover, the Greenvolt floating offshore wind project has a strike price of £195/MWh, more than three times the recent reference price. The capital expenditure for this project is £2.5 billion for a 400MW generator or £6.25 billion per GW. Both projects are spending far more than £1.4 billion per GW the Government estimated for offshore wind deliverable in 2030. These staggering costs will be paid by consumers through their bills.

The investment in Carbon Capture and Storage (CCUS) is estimated at £8 billion. However, in return for the £8 billion investment, the Government has confirmed that £21.7 billion of funding has been made available over 25 years for these projects. This means that consumers or taxpayers will be on the hook to pay back nearly three times the initial investment in subsidies to make these projects work.

Of course, the billions to be spent on storage will not generate a single extra MWh of electricity. Indeed, after taking account of losses during charging and discharging, the batteries will consume energy. Adding extra expenditure to the system without increasing output can only increase system costs and thus push up our bills even further. The £8 billion to be spent on transmission and distribution will also have to be paid back through higher network charges on our bills.

Data Centre Challenges

The second biggest investment category is in data centres. However, there are significant challenges ahead for these projects.

First, there is the problem of obtaining grid connections, with the system already operating at capacity across many areas of the country, including the area with most datacentres – the “Slough Availability Zone”. Second, even if connections can be delivered there has to be significant doubt that we are capable of generating sufficient electricity to power the hyper-scale 1 GW or higher behemoths that are under consideration to support the AI revolution. Third, as previously discussed, we are not cost competitive because the U.K. has the highest industrial electricity prices among the 28 developed countries covered by the IEA.

There must be grave doubts, despite the investment summit fanfare, whether these projects will be delivered on time or ever.

Conclusions

Overall, the investment summit was a damp squib, mostly re-announcing projects that were already in existence. Not only that, the energy projects that were declared will only increase our already extortionate electricity costs, making the country less competitive and act as a drag on growth.

However, it is revealing that the Chancellor declared her Government to be “pro-business”. We can see this means distorting the market to give corporations guaranteed returns at the expense of the consumer and taxpayer. It is astonishing that the Labour Party, supposedly the party of working people, is actively encouraging corporatism. Labour has become a kind of reverse Robin Hood, robbing the poor to give even more to the already rich.

David Turver writes the Eigen Values Substack, where this article first appeared.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

“imagine if we could have our savings confiscated by the state…”

Oh, I don’t find that too difficult to imagine.

I certainly think private pensions are going to be raided at some point. For noble reasons of course. Supporting our NHS, the envy of the world.

Look at the last weeks so-called “Far Right” riots which, so far as I can tell, involved The Plod hitting people with big sticks who then reacted.

“Took part in the Far Right Riots did you Mrs Smith? Right, take her kids away, destroy her dog, confiscate her Pension and Saving, sell her home”

I do not understand the eagerness to rob the paedo of his salary and pension.

He earned them fair and square under the system that exists in the BBC.

That has nothing whatsoever to do with the disgusting crimes he has admitted and is being and will be punished for. He cannot after all show his face in public anywhere.

To follow the argument to its logical conclusion he should be made to repay every penny he has ever earned from the BBC over the period of his career and have everything he has ever bought with that money confiscated to pay the debt.

Complete tosh. I am bored hearing about it. Knee-jerks from jerks.

There is no line to be drawn under this argument.

Laws exist to punish people from their crimes. It seems some people are not satisfied with that. What kind of lawless country is this?

I agree, but he needs a jail term so he can’t enjoy all of that moolah. And I would withdraw the 40k raise he was given.

He should go to prison and get the very small amount of cash allowed to everyone else. 10 years should just about finish him, because he will need to be in solitary for his own protection. Just deserts!

Probably a reward for services rendered in the broadest possible sense of the term. You will get a bit fat pension just keep your mouth shut about the rest of the network. These are the people that rule you. Those that get their jollies from watching a child being raped. You might want to consider the news they present you with in the light of these facts just sayin’.

”You don’t need to be a pervert to work here but it helps.” BBC.

They all knew about Max Clifford they all knew about Savile. But if it is poor working class children or children in a home then who cares they can easily be expended to satisfy the lusts of the priviliged. Perhaps it will always be thus but then you listen to the BBC and they attempt to deliver some moral mesage. I know it is hard for boomers but you need to disabuse yourself of the idea that someone is respectable just because they wear a suit and speak on the BBC. They have been raping your children for generations.

The Algerian beat the Hungarian woman. Through to the semis. Evidently the definition of a woman nowadays, according to the IOC, includes those with XY chromosomes. At this rate it’ll be a women’s final involving two intersex athletes, or not women, basically;

”Under-fire Algerian boxer Imane Khelif beat Hungary’s Anna Luca Hamori in the women’s welterweight boxing quarterfinal of the 2024 Olympics on Saturday, as a gender eligibility row continued to rage in the backdrop.

Khelif, who was born and raised as a woman, identifies as a woman and is registered as woman on her passport, has been competing at the Olympics in the face of a backlash over her participation due to suggestions that she is genetically a man.

Hungary’s boxing federation and Bulgaria’s Olympic Committee lodged objections with the IOC on Friday over its decision to allow Khelif to compete. Hamori has also posted message against on her social media handles, which have since been deleted.

IOC president Thomas Bach reiterated the body’s support for Khelif in the daily press briefing in Paris on Saturday.

“We have two boxers who are born as a woman, who have been raised as a woman, who have a passport as a woman and who have competed for many years as a woman.

“This is the clear definition of a woman. There was never any doubt about them being a woman.”

https://deadline.com/2024/08/algerian-boxer-imane-khelif-wins-olympic-womens-boxing-quarterfinal-gender-row-rage-1236030947/

Not sure what “born as a woman” means – maybe no willy? But how you were raised and what your passport says is sod all to do with the matter at hand. I don’t know much about XY people but my gut feel tells me that if female-only competitions are to

mean anything then XY people should be excluded.

Yes I would agree as there has to be some standardized cut-off point and I’d say the sex chromosomes are a reasonable thing on which to call it. Otherwise there’s no point having a female category if they’re going to allow XY people in there who benefit from a performance advantage. There’s various types of DSDs ( Difference/Disorders of Sex Development ) and it’s only the 5-ARD one which apparently conveys this advantage in sports, which happens to be the same DSD that the S. African runner, Caster Semenya, has. It hasn’t been confirmed that this is what the boxers have but it’s said to be the most likely by experts. I shared a good post which gives a better explainer than I can do under one of the boxing articles. I’d say these boxers, or anyone else proven to have XY sex chromosomes, should go in the men’s categories. I don’t think there’s enough of them in any one sport to warrant their own category.

They would almost certainly not be competitive at an elite level against completely male athletes and that’s unfortunate for them but life isn’t always fair

Maybe you watched this 800m final at the Olympics in 2016, where basically these ‘intersex’ biologically male athletes stole gold, silver and bronze from the women;

https://www.youtube.com/watch?v=psxr58zKi6g&ab_channel=Olympics

You can see how devastated Britain’s Lynsey Sharp was to have lost out on getting her bronze. She was 6th over the line but the 3rd woman to finish. I can only imagine how frustrating that must’ve been for the woman who should’ve got gold;

https://x.com/salltweets/status/1816299187652399455

Interesting- I wasn’t aware of that

Is he not already a pensioner, if he is 62 and his normal retirement age under the scheme was 60? Could have deferred it, I suppose, if not drawing his income as soon as he resigned. Looking on the bright side, he’ll be paying a fair bit of tax once it pays out. Likely to be one of the wealthiest inmates somewhere soon, depending on what the judge decides.

I’m sure he can afford financial planners who will have worked out how he can minimise his tax exposure

They don’t lock up their own because then he would have no disincentive to start singing like a canary. Consider their perspective in terms of how they view you. If they are happy that they get their jollies from raping children do you really think that they look at you in a tender-hearted fashion. There is nothing difficult to understand. They have laid their own character bare for you. You contiue to respect this man just because he is an establishment figure. Surely you can see the problem here.

Would have to see the terms and conditions of the BBC pension plan to make comment or rule on legality of denying him a pension based on conviction of anything, some of which he surely funded partially.

He will get no prison time and will be busy putting together further child abuse videos. If he lived on my street then I will be dealt with accordingly.

I wonder if he also got private medical cover from the BBC? If so, I can imagine the insurers clawing back the payments, if it can be shown he had a history of this behaviour before he suffered his collapse.

I’m getting the word “nonce”

Quite frankly talk of denying a person their Pension is an absurd argument. It is also an extremely dangerous path to tread.

“Do something we deem wrong and your Pension as well as your savings will be confiscated”.

Is that really what we want to tell Starmer to do? Which crimes do not count, which do and who decides?

Hi Will. Talking up the confiscation of private property rights, is not a good position to be in. They will come for yours next.

Headline: “…free to retire on…”

Text: “…could still retire on…”

Daily Sceptic or Daily Mail?

My understanding is that they were far more serious and depraved than ‘Indecent images’. He made and shared images of children being violated. I have heard it speculated that because the prosecut or is already saying there are “extenuating circumstances” -( when we all know that ‘mental health issues’ does not excuse this), he may not even be jailed. But this has to happen – even if it is a short sentence – as then real justice will take place at the hands of inmates.