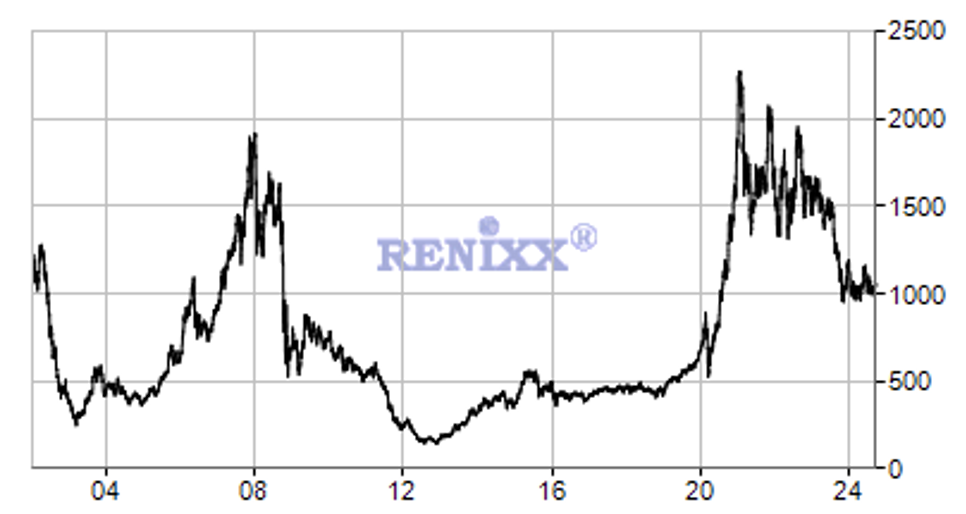

Many renewable energy stocks are dog shares to be avoided at all costs by investors seeking a reasonable rate of investment return. Perhaps not the advice you would receive in the advertising-compromised financial pages of mainstream media, and certainly not a message that resonates with promoters of the Net Zero fantasy. The Renewable Energy Industrial Index (RENIXX) is a widely-consulted global stock capitalisation index of the 30 largest renewable energy industrial companies in the world and it has shown near zero growth since it was started in 2006, along with a reverse projection back to 2002. Over the last three years alone it has lost almost half its value.

The retail exchange traded fund iShares Global Clean Energy aims to “target access to clean energy stocks around the world”. Last year its value fell by 26.1% and from its inception in 2008 it has more or less halved an initial investment of £10,000. Greencoat Renewable PLC is a U.K.-quoted investment trust and the owner and operator of renewable energy infrastructure assets in Europe. It is said to provide “attractive risk adjusted returns with a compelling growth opportunity; supported by a robust regulator regime and managed by a proven investment manager” – which is one imaginative way of explaining a loss in share value of 18.6% over the last five years.

Out in the real world where serious money talks, it is becoming obvious that the conclusion has been drawn that many green technologies, unless subsidised by the state, provide profit-free, second-rate solutions to problems invented around a politicised climate crisis.

This is the graph showing the real world performance of RENIXX. Consider also that an investment made over the same period in the U.S. Dow Jones Industrial Index would have quadrupled.

The RENIXX covers a broad spectrum of activities including wind power manufacture and supplies, along with producers of solar PV cells. Current members of the Index include Orsted, Tesla and Vestas Wind Systems. The stock of this latter company has risen only 7% over the last 16 years and it has fallen 58% from a high in 2021. Typical of the RENIXX dogs is the U.S. operation First Solar which has risen since 2021 but is below its all-time high price reached in 2008.

In fact many of the indexes such as RENIXX would look even worse if the performance of Tesla was removed from the charts. Over its lifetime, Elon Musk’s Tesla share price has risen an astonishing 18,000%, although in common with almost all green shares it has suffered in recent years. But Tesla is the value exception with Real Clear Energy noting that its worth by 2021 soared to over $1 trillion, making it more valuable than Toyota, Volkswagen, Mercedes-Benz, General Motors, Ford, BMW and Honda combined. Its stellar rise helps deflect from the dreadful performance of other green stocks including EV manufactures. Real Clear Energy notes that since 2020, 31 EV companies have gone public on U.S. stock exchanges, but only one, the Chinese Li Auto, has seen its price rise since an initial public offering. Most were real bow-wows, but standout disasters were recorded by Fisker (-99%), Nikola (-94%), NIO (-50%), Lucid group (-75%) and Rivian (-88%). Six other companies are already bankrupt.

One EV company, Plug Power, supplies hydrogen energy systems, and in its 27 years of existence has never turned a profit. In 2024 it lost $1.45 billion, up from a deficit in 2018 of $43.8 million. Even the big boys find renewable equipment a challenge. In 2023, Ford lost $4.7 billion on sales of 116,000 electric vehicles, or over $40,000 per vehicle. General Electric’s wind turbine business lost $1.1 billion in 2023.

Of course the excuses come rolling in. Same thing happened with the early dot.com revolution, it is argued. But the green revolution is not a free market gold rush. It peddles second-rate solutions and produces equipment such as cars that the market does not want to buy in bulk. Collecting the breezes and the beams is only viable with huge amounts of subsidies taken from trapped consumers. Nobody would build a windmill to supply power to the electric grid if their mouths were not first stuffed with taxpayer gold. In Britain, electricity prices are soaring and wind and solar power, which supplies barely 6% of total energy needs, requires an annual bung of £12 billion. In the U.S., the Biden Administration has thrown vast amounts of money around in a desperate attempt to boost a green economy that few people would be willing to start and support with their own hard-earned.

The supplicant nature of many green businesses perhaps explains their bombed-out share prices, along with the end of cheap interest rates and higher inflation. But provide a heady mixture of free money and subsidies designed to guarantee a profit and the chancers will initially beat a path to your door with any number of whacky schemes to save the planet. At the U.K. Energy department, Mad Ed Miliband and his band of weird wonks are currently entertaining any number of financial black holes including carbon capture, hydrogen manufacture and battery storage.

But the money – and borrowing capacity – is running out for luxury pet projects across Europe and the seemingly unlimited government spending will have to end in the near future. And fears are rising about the heavy environmental damage inflicted by EVs, the lack of national green jobs created, the further de-industrialisation of western economies and the horrific, mostly unreported, toll on wildlife caused by the countryside-blighting growth of monster wind turbines and overhead power cables.

It is said that if you want to predict how people will vote in an election, the prices offered by bookmakers are a more reliable guide than opinion polls, which are often distorted for the benefit of the paying customer. Next time someone is punting green stories, ask to see what their value is in the real commercial world where hard-won cash is not necessarily God, but it is a deeply religious experience. In these cases, past results are probably a very good guide to future performance.

Chris Morrison is the Daily Sceptic’s Environment Editor.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Green Technology = Subsidy Farming. —–Because no one in their right mind would ever build a wind turbine eg without the subsidy, as they are simply not economical. But as we all know if government want you to buy yellow trousers instead of red trousers then they will offer massive subsidy to yellow trouser manufacturers and heap massive costs onto red trouser manufacturers. In other words they will interfere in the market. Green technology only exists because government have interfered massively in the market. The question then becomes “Why are they doing this? Many people would say because we must “save the planet”. ——-Many others realise that “saving the planet” really means “ruling it”.

In order to be able to save something, one has to be in control of it first. But the reverse isn’t necessarily true: Our would-be planet savers use this as cudgel to bludgeon us into fearful submission to what they’re planning to do to us. But that’s happening because we’re ruled by these people we’ve ‘selected’ (sarcasm) in this particular, unsuitable way. The political system established in the so-called west after the second world war means to become our doom — end of history, not because we “won” over communism but because of revolutionary suicide (term used by Jim Jones) our leaders try to force us to “to save the planet.”

We don’t have to do that.

I like the subsidy farming analogy. I’ll use that, thank you.

The stock market is one of the best guides to what people actually do as opposed to what they may say.

In easy times, the stock market is a voting machine. In hard times, it is a weighing machine.

I’ve been following a ‘contra-ethical’ investment strategy for about 20 years. Tobacco, oil, water, armaments, pornography (if you can find a listed pornographer!).

There’s a simple rationale. These businesses are usually mature, highly cash generative. Many pay healthy dividends (in a growth stock dividends are bad, it means management can’t think of anything to do with the cash. In mature businesses they’re good because there isn’t anything to do with the cash). Lots of investors have adopted ESG rules that prevent them investing in such stocks, others avoid them to virtue signal, consequently they have to work hard to attract investment; essentially pay higher dividends.

The inverse of all these points apply to ‘green’ stocks, they’re a punt. Any business where profits rely on subsidy should be avoided, there’s no fundamental reason for it to exist.

I think if you look at the market as a whole, there are very few, if any, areas of economic activity not affected by subsidies or market interference in some way or another.

Even those few areas not directly regulated or subsidized are significantly affected by cross-interreference from other over-regulated or subsidized sectors.

I’m not saying it’s right mind you. I’m very much against any form of government tinkering. But in the present reality it’s practically impossible to avoid it.

I used to use a financial adviser that was recommending ESG investments and getting low single digit returns. I dumped him a year ago and started making my own investment choices on a low cost platform. Not only am I saving the FAs fees, for doing sweet FA,but getting returns close to 20%.

ESG investments have bombed and many funds are ditching them.