The stock market may be waking up to the possibility that Pfizer may go bankrupt due to the upcoming Covid vaccine legal claims. Many parallels can be drawn between the corporate behaviours of Pfizer and Purdue Pharma, a pharmaceutical concern that dishonestly and aggressively marketed harmful products. Purdue Pharma went bankrupt due to the greed and depravity of its leaders, as its ‘legal protections’ evaporated. Might the same happen to Pfizer?

Old, experienced vaccine companies like GSK refused to participate in ‘Covid vaccines’ – and we now see why they may have made the right choice.

Take a look at this chart: Pfizer’s stock (PFE) is valued at 25% less than it was five years ago, despite the billions of dollars it received from the sales of Covid vaccines, and the wider stock market and the pharmaceuticals index having gone up:

At first sight, Pfizer, a worldwide pharmaceutical juggernaut, should not be worth less than before the pandemic. Pfizer’s Covid vaccine made it billions and should have added value to the company, even if future sales of COVID-19-specific products cannot be assured. And yet, PFE has inexorably fallen since last November and is worth 25% less than five years ago, defying the general upside tendencies seen for other pharmaceuticals and the stock market.

Since November of 2022, Pfizer has deviated from the trend of the pharmaceuticals index, underperforming by 35%.

This can only be explained by the capital markets seeing something uniquely troublesome for Pfizer. This post will explore what it may be.

I am far from the first person suggesting that Pfizer, which aggressively marketed its Covid vaccines and underwrote a worldwide influence operation to mandate its product, may face ruinous liabilities.

Ed Dowd, a former asset manager, was one of the first people to realise that. He explained that legal protection granted to Pfizer by the PREP act will cease to protect it if significant fraud on the part of Pfizer is discovered.

Purdue Pharma as a Blueprint to the Future of Pfizer

Purdue Pharma was a company making opioid-based pain relief medications. They were very addictive. Purdue was owned by the ‘Sackler family’, with the entire company leadership obsessed with maximising sales of opioids and minimizing ethical concerns.

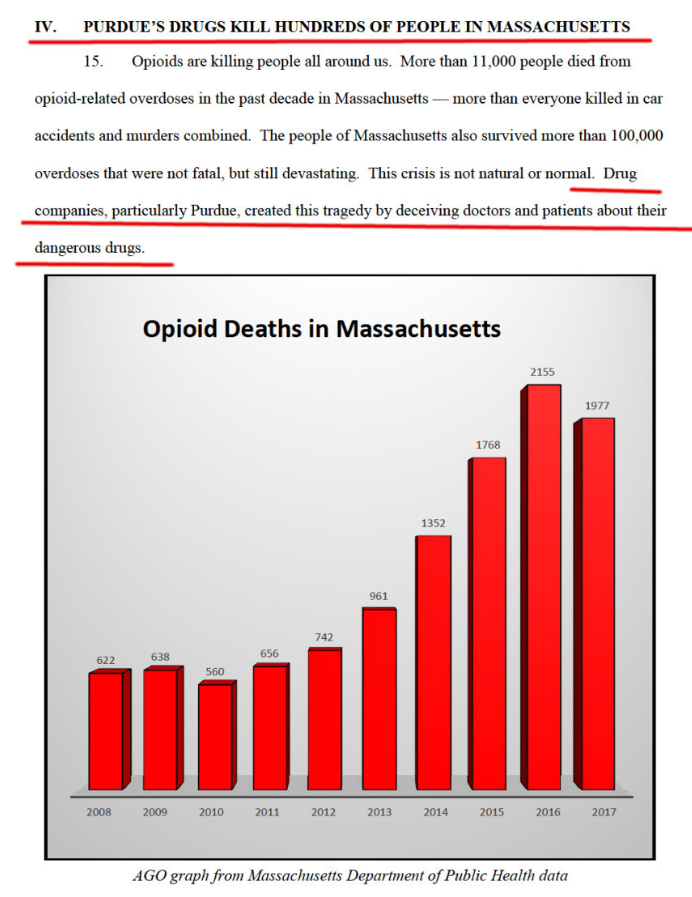

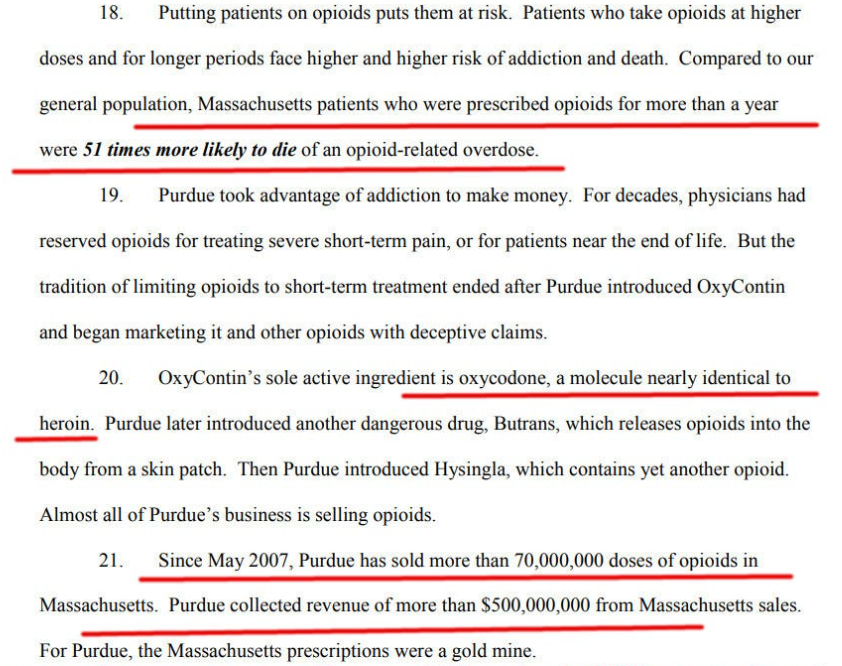

The story of Purdue Pharma – its relentless push towards higher doses of opioids given to patients to get them addicted – is much longer than the story of the Covid vaccines. This post is not the best place for a comprehensive history. The best quick introduction to the malfeasance of the Sackler family that owned Purdue Pharma is to read the PDF of the Massachusetts legal complaint.

The complaint reads like a detective story, full of sordid details about malfeasance in Purdue Pharma and the deaths that it caused.

Interestingly, the above page could be rewritten, almost word-for-word, to cover the Covid vaccines, which are technically not addictive but require endless repeat injections, do not prevent COVID-19 and appear to cause excess deaths.

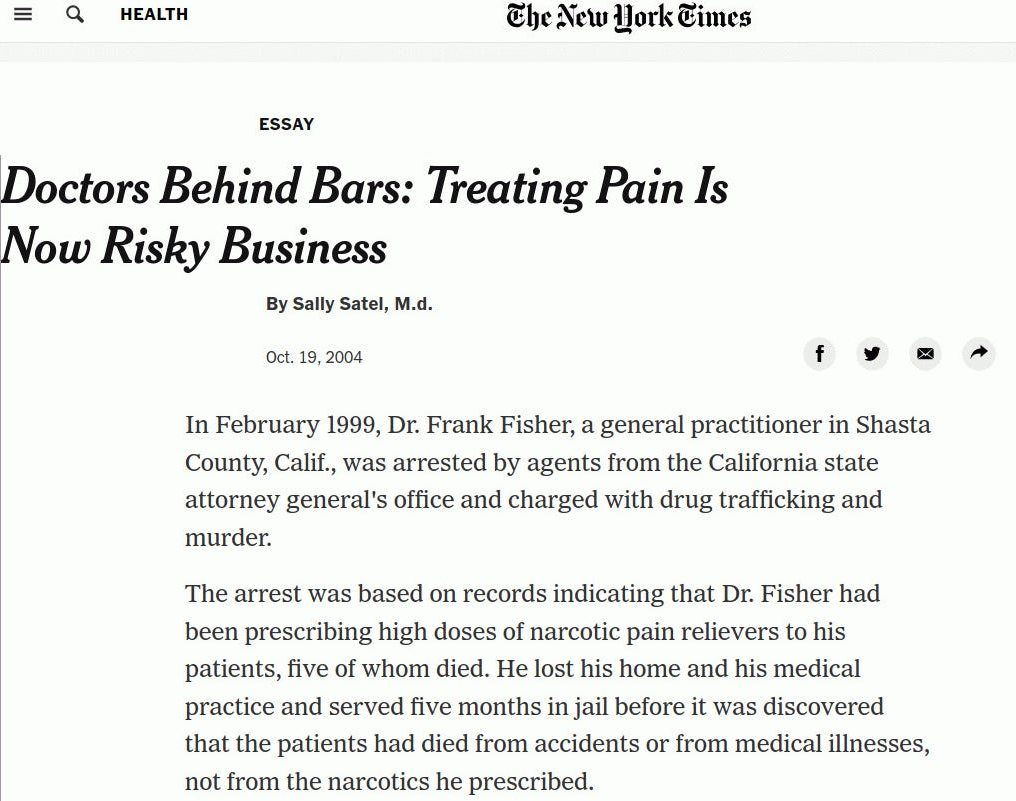

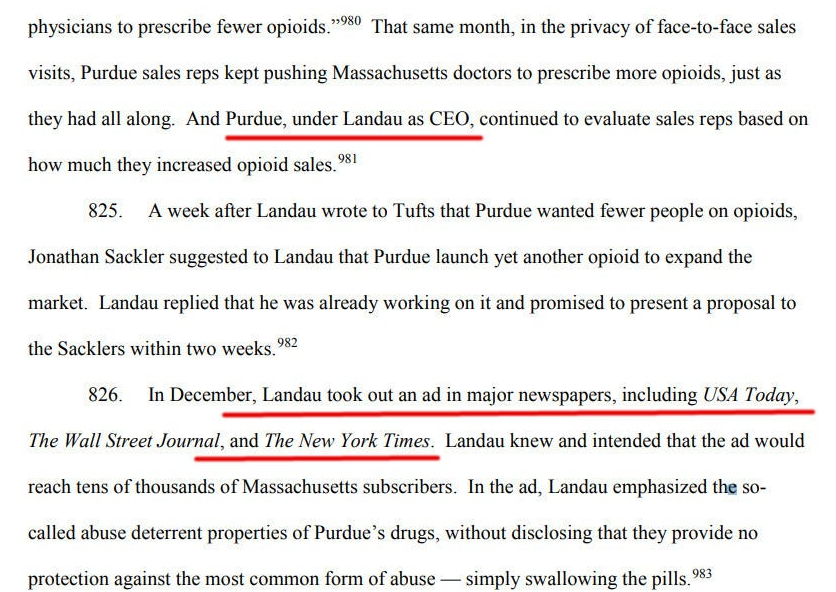

The Sacklers and Purdue Pharma used the same playbook as Pfizer is accused of doing by buying off the corrupt press to place favourable publications. Take a look at just one example: a paid article from the New York Times.

As Massachusetts’s legal complaint explains, Purdue Pharma was paying the New York Times for advertising:

Greedy and Reckless Management

Our friend Geert Vanden Bossche, a vaccine expert, has detailed the reckless corporate behaviour of Pfizer regarding Covid vaccines.

Let us compare Pfizer, an aggressive entrant into the vaccine business, to GSK, an established and more careful player. GSK refused to play the Covid vaccine game. It realised that nothing good could come out in the long run. GSK declined to expose itself to the potential liability of endangering millions with a vaccine that was extremely unlikely even to work.

The maternal RSV vaccine story further highlights how reckless Pfizer is.

The NIH gave the blueprint for the RSV vaccine to both Pfizer and GSK. Both companies tested essentially the same product. Clinical trials revealed that giving pregnant women the RSV vaccine increased premature births and infant mortality.

GSK, the established and conservative vaccine company, wisely heeded the alarm signal and abandoned the maternal RSV vaccine development. Instead of honestly terminating the program, Pfizer purposely selected small vaccine and placebo groups to make the premature birth signal statistically insignificant and lobbied the corrupt FDA to approve its vaccine.

The following are potential similarities between Pfizer and Purdue Pharma:

- Reckless disregard for the dangers to recipients of their products. For instance, Pfizer tested its recent vaccines on several mice only – just one example.

- Corporate greed is exemplified by risky decisions to chase billions in immediate profits at the risk of bankruptcy in the long run.

- Buying off the press and regulators to obtain support for their products.

- Hiding deaths and adverse effects from the public.

Purdue Pharma was able to play its game for years. Finally, the deaths were too many, and the lawsuits took it down.

If the stock price of Pfizer is any guide, the capital markets may now see that the same may eventually happen to it.

Hopefully, the people who suffered various ills from Covid vaccines would be entitled to compensation.

Pfizer may also be the perfect player to throw under the bus to save other Covid pandemic players.

Pfizer, however, does not have enough money to compensate every victim fairly.

Are Google and Facebook also Liable?

A year ago, I wrote a post explaining that Google and Facebook can also be liable to Covid vaccine victims because they intentionally conspired to hide the dangers of Covid vaccines from the public.

These internet giants, which profited mightily from the pandemic, are bigger fish than Pfizer: each victim could receive up to $15,000 in value if Google and Facebook are found liable.

Purdue Pharma owners thought, for years, that they could hide wrongdoing and avoid liability due to corporate shields. However, when malfeasance was discovered and the victims could no longer be hidden, legal theories caught up with them. The legal claims bankrupted that company and cost its owners, the Sacklers, billions.

Hopefully, the same will eventually happen to Pfizer, Google and Facebook, the three companies arguably most instrumental in what happened during the last three years.

I realise it is a long shot, but I have hope for a measure of eventual justice. My hope is supported by the realisation that monetary compensation may incentivise broad groups of people to ask for legal redress.

The stock market, it seems, sees the same thing now, with the Pfizer stock declining relentlessly.

Do you think that one day, Pfizer will go bankrupt due to Covid claims?

This article was first published on Igor’s Substack page. Subscribe here.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

The law suits will rain down in the home of uncle Sam in short order.

If it goes bankrupt, it will have been a controlled demolition.

No chance Pfizer goes teats up. None.

2022 Revenues, $100 bn US – a record with $22 bn in profits….

2023 Revenues – forecast is $71 Bn – hence the stock battering

Marburg virus is being cooked up, Disease X is in the pipeline.

The only certainty is not that Pfizer – a criminal mafia – goes teats up, it is that another scamdemic is being baked into our future.

https://off-guardian.org/2023/10/15/this-week-in-the-new-normal-75/

“This week in the New Normal” from Off-G.

Euthanasia is to be trialled in the Isle of Man, doubtless prior to roll-out across the UK.

And Kneel is chilling with Billy – well, well, well.

It’s difficult to see how Pfizer get their comeuppance if i’m honest. The current head of the CDC and the various regulators in both the US and Europe are similarly up to their necks in complicity. It will take a generation at least for the tide to turn. By then of course m, the guilty will be long gone with their pockets suitably lined with taxpayers cash.

The current share price merely reflects investor sentiment that there is no obvious near term cash cow coming out of the mRNA development. Paxlovid was a similar bust.

I read Empire of Pain, about Purdue pharma, and if I recall correctly the Sacklers made $10bn out of which they had to pay $1bn in fines.

The pharma industry treat the fines as a cost of doing business. What we need is criminal convictions and associated punishments.

The pharma execs are no doubt very careful to ensure that there isn’t sufficient hard evidence to make a criminal conviction likely, and to, through their fraud, make enough money to pay any fines they might receive in a civil judgement.

That is exactly right. Lawsuits are generally baked in. This is true of all major corporations.

And even when the hit is huge and extraordinary, barring colossal fraud on the scale of Worldcom or Enron, viable businesses survive. E.g. BP after Deep-water Horizon.

Corporate misbehaviour will exist as long as there are no serious personal consequences for the directors.

Imagine how the world would be if a very rich person could murder someone and just pay some money as a punishment. There would be a lot of murders.

RIP Ex President of Tanzania!

‘Punishable by fines’ is equivalent to ‘legal for a price’

“Are Google and Facebook also Liable?….How about media and Radio pundits too?

So pathetic when GB News does its disclaimer that “vaccine has saved millions” etc.

I pray so.

The list of those liable due to being accessories, is long: nearly every politician, civil servants, ‘experts’, celebrities, media outlets and their presenters, medical and nursing personnel, large swathes of the population.

Including quite lot of them that had minimal competence at assessing the validity of the product on offer to the general public. Today, I was doing some voluntary work on setting up a social event along with several others. One of them that I was working with was a vaccine administrator for one of the pharmacy firms during the “campaign”. I avoided arguing with him, but he was quite pleased with what he had done, and was open about the limited knowledge of any voluntary patients records etc. They were not provided with anything much about those who rocked up asking for a jab, by the sound of it.

In effect, he had the physical skills competence for injecting things into us, and that’s about it. No doubt there were thousands of volunteers working for £15 a head along those lines until recently.

Good.

It won’t stop them though. Another company will take up the slack. Remember they’ve got oodles of cash secreted away, nothing is too difficult for them if you’ve got a depopulation agenda in full swing. It’s another distraction, in my view, designed to take people’s eye off the ball and get relaxed.

Its gone a bit quiet about Moderna hasn’t it? Rishi and UK very keen to enlarge Moderna’s operations in the UK. Lots of human guinea pigs here they think.

Not surprising is it? Only the insane jab junkies and hardcore Kool-Aid and the Gang members would be rocking up for the toxic crud after all this time;

https://twitter.com/CartlandDavid/status/1713878568457908605

One of the things that should become apparent is whether to injectant reached the bloodstream due to incorrect administration.

In the old days when doing an intramuscular injection, when the needle has been inserted the plunger will be pulled back to see if any blood is withdrawn, and if so the injection is aborted.

The instructions issued at one point in the injection jamboree was just to stick and squeeze (for speed and so that less skilled practitioners could give jabs), so the injectant might go into the muscle but there would be a proportion of all the jabs where it was going into the bloodstream.

So instead of staying local to the injection site the MRNA got whizzed round the body visiting hearts, other major organs and foetuses.

If this is proven then the government or health authorities, or whoever gave the instruction would also be liable for damages.

Not only that, there is strong evidence that even when the injection is only done properly into the muscle, it is not actually limited to it. Rather, it can spread almost everywhere, given its structure. Look this up via the likes of John Campbell on his YT channel. In short, it was a blatant lie that it was like conventional ones.

I agree with JohnK above. My understanding is that the lipid nanoparticles injected by mRNA jabs are specifically designed to go all around the body, including across usual blood barriers (brain, placenta, etc). This is not at all reliant upon the injection being “incorrectly administered”.

Yeah. I wrote 9 months ago:

https://www.facebook.com/permalink.php?story_fbid=pfbid06Zjcu57igrKo63mLoWBzsiNJpnrf939xa1Yi4rx59tYfh2Qsy5ZbLhp1JGasMwKxl&id=519547237

I would happily go after the guilty with a pair of large pliers. There will be no need for fines and gaol time when I’m done.

https://www.conservativewoman.co.uk/how-uk-government-advisers-helped-pfizer-win-5-95billion-covid-vaccine-contract/

Covid “vaccines” were being planned and contracts negotiated in July 2020 way before anything had been manufactured….whoops, I mean brewed.

Shock, horror.

“There’s a final oddity. A document found via Pfizer’s website shows that Pfizer began drafting the clinical trial protocol on December 5, 2019, four months before it announced its collaboration agreement with BioNTech to develop their Covid vaccine and well before China alerted the World Health Organization (WHO) about the Wuhan pneumonias of ‘unknown cause’. “

Excellent work as usual by Paula Jardine at TCW.

They have demonstrated an opportunistic attitude, by the look of it. Too good to miss the open door granted by various politicians for the development of a novel product with reduced financial risk, and the prospect of future sales for a relatively novel technique.

Pfizer is circling the drain. We all know what they say about karma…

And how about Moderna – weren’t their ‘clinical trials’ that led to their ‘safe and effective’ official labelling also fraudulent?

No, I think the Global Wagons will be circled to protect “one of their own.”

My most fervent hope is that Mr Siri wins and these purveyors of damage are brought out into the open, along with the tech billionaires, the drug pushers, Gates, Valance, and politicial leaders, I hope that the damages they have to pay ruins them.

But I have seen to much and know that even if there is the smallest hope that Siri wins the case, it will not be retrospective, so all those injured and the families of those killed will never see justice, there are too many grubby fingers in this particular pie.