Dear Baroness Hallett,

You have invited submissions to your U.K. COVID-19 inquiry that contain information or insights that might otherwise be overlooked.

We’ve got one for you.

We submit that you should look into the payments that the U.K. Government handed over to domestic violence agencies during Covid lockdowns. In our view, those hand-outs are among the most unwarranted of that period. We urge you to bring a sceptical, impartial mind to bear on the reasons that were given for those payments. We invite you to bring the same forensic rigour to the uses to which that money was put as you will no doubt apply to other Government hand-outs supposed to mitigate the harmful impact of the Covid restrictions.

We can be sure, for example, that you will want to hear, in detail, about the £29 million plus which Michelle Mone is alleged to have made from contracts to supply PPE equipment. At the same time, your inquiry’s learned counsel will assuredly dig into the evidence that Bounce Back loans totalling more than £10 million were blithely handed out to Russian and Lithuanian businessmen. Similarly, discussion is bound to be aired about the £34.5 million purloined in a host of internet frauds.

Add all those amounts together, however, and the total comes nowhere near the £125 million plus which the U.K. Government handed over between April-June 2020 to domestic violence agencies on the grounds that they were facing unprecedented calls for their services.

Everybody, without question, regards that money as having been spent in a good and deserving cause. Nobody doubted it at the time and we would bet good money your Covid inquiry will not question it for a second unless (even if) we press the case.

However, the domestic violence agencies obtained that money on the strength of un-evidenced claims about an increase in domestic violence resulting from stay-at-home orders. We submit that those agencies ought to be asked to account for that money and, if they cannot, to give it back.

Here’s the background:

As soon as the Government announced its COVID-19 restrictions in March 2020, the domestic violence agencies began to say that demands for their services were turning into a ‘tsunami’ and that they were confronting ‘a perfect storm’.

In April 2020, Refuge reported a “120% increase in calls to its helplines since the crisis began”. The National Domestic Abuse Helpline reported a 49% increase in calls. The Counting Dead Women Project said 16 women had been killed in domestic incidents in merely three weeks – the highest number for 11 years.

The Victims’ Commissioner, Dame Vera Baird, relayed that murder figure to the House of Commons committee which was considering the effects of lockdown, telling it that the number represented a doubling of the normal rate. The Chair of that Committee, Yvette Cooper, solemnly thanked Dame Vera for her “grave and serious evidence”.

The former Prime Minister Theresa May assured the House of Commons that “clear evidence” proved that abuse was increasing because victims were locked up with their abusers 24/7 and had no chance of getting away.

Without exception, the mainstream media uncritically relayed the same picture. Panorama transmitted an entire edition devoted to the subject, tearfully fronted by Victoria Derbyshire, who drew upon her own experience of living with a father who hit his wife, her mother.

In emotional terms, the picture everybody was seeing seemed completely logical and it naturally tugged the heartstrings of society’s instinctive wish to protect defenceless women and children.

The response of the U.K. Government was prompt and unstinting. Before the end of May 2020 more than £125 million had been handed over to domestic abuse agencies in extra subsidies to deal with the coronavirus crisis. One of the first to shell out public money was Nicola Sturgeon, then First Minister of Scotland, who announced as early as March 30th that she would be giving more than £1.5 million to Scottish Women’s Aid and Rape Crisis Scotland. She explained, “There is a real risk that women and children already subject to domestic abuse will feel even more isolated and vulnerable during this crisis, so this funding will ensure they have access to support services.”

Not a single official or elected representative appears to have asked at any point whether independent verification existed to support the claims of the domestic violence agencies. Not one journalist asked to see the evidence. As is the established custom with these agencies, they shake the begging bowl and find it filled to the brim by the state and by well-meaning patrons and donors. The experience of more than half a century has taught them that nobody is going to check their claims, doubt their probity or scrutinise their expenditure.

In the case of the Covid lockdowns, however, it looks doubtful that a tsunami of domestic abuse occurred. No perfect storm was over the horizon.

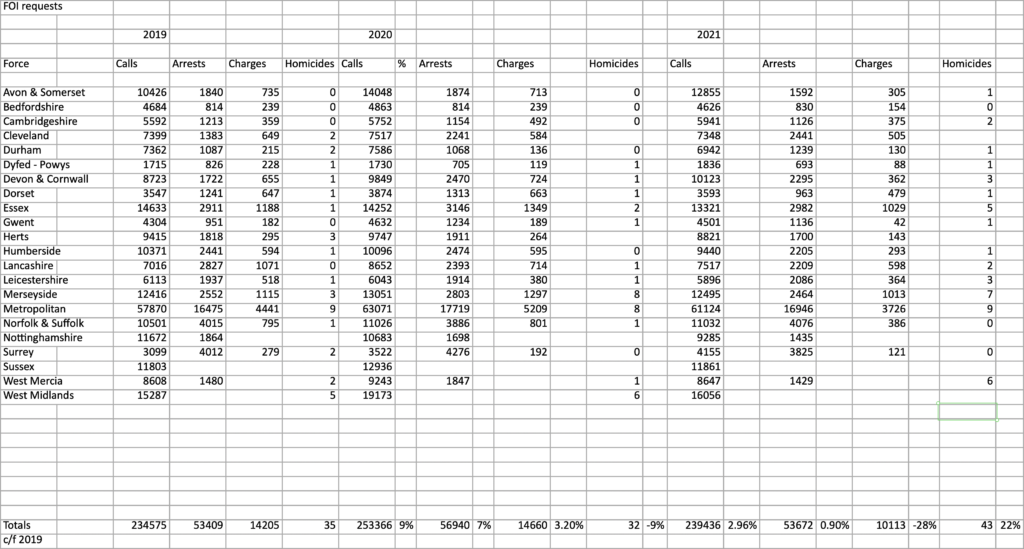

I made FoI applications to every police force in the U.K., asking for their records for January-May 2019, 2020 and 2021, showing figures for numbers of reported incidents of domestic abuse, arrests, charges and homicides.

More than half of those forces did not reply or withheld the information but 21 police forces delivered their figures – a more than adequate sample.

The spreadsheet tabulating those figures is below. It makes amazing reading. In many areas, the number of recorded incidents of domestic abuse actually fell in the lockdown months of 2020, compared with 2019. Overall, the number of calls reporting incidents did rise by 9% in 2020 compared with 2019 and the number of charges rose by 3.25%. If the domestic violence agencies received a similar increase in calls, it would be understandable that they might have needed to augment their services. But a 9% rise does not a tsunami make; and did they really need to spend £125m to cope with that increase in calls?

With a sleight of hand that is never called out, the agencies habitually conflate calls to their helplines with actual incidents of violence, as if the first invariably connotes or leads to the second. However, that 9% increase in the number of calls to the police is not reflected in a commensurate rise in charges (3.25%). Police Scotland explained – on the record – that in 2020 the gradual rise in the number of reports they received throughout lockdown was largely attributable to disputes about custody and access to children – incidents which did not necessarily lead to criminal charges.

In fact, as the spreadsheet shows, charges were lower in 2021 than in 2019 (although marginally higher in 2020). More tellingly (and contrary to the claims of the Victims Commissioner and Counting Dead Women Project), the number of murders in the areas for which we have figures actually fell between January-May from 26 in 2019 to 23 in 2021, and the number fell from 35 in 2019 to 32 in 2020, at least in the 21 areas that responded to my FOIs.

Our partial survey is not the only source on this subject. The ONS reports on Homicide in England and Wales for the years ending March 2021 and 2022 show that there were 114 domestic homicides in the year ending March 2021 and 134 in the year ending March 2022 when, as the ONS observed:

Homicide returned to pre-coronavirus (COVID-19) pandemic levels [compared with] the year ending March 2021 when Government restrictions meant there was less social contact.

Why the fall? The answer is contained in that ONS observation that “Government restrictions meant there was less social contact”. So far as domestic violence is concerned, this means that fewer people killed each other at home, mostly because they hadn’t first gone out and got mad.

Going out has always proved one of the flashpoints for domestic violence. Suspicions of infidelity – whether of flirting or going further – are dynamite between couples, especially when they are themselves lit up by drink and/or drugs and they burst into flame most frequently when people are at the pub, the club or at parties. Even if they were drinking while they were confined at home during lockdown, couples who were isolated from the temptations of company had one major thing less to fight about.

Murder, as recorded by the police, is the most reliable of all indices of domestic violence. Dead bodies don’t lie. If, therefore, the number of domestic murders fell during lockdown, it can be reliably assumed that the number of domestic violence incidents will also have fallen.

So, Baroness, if the domestic violence agencies were faced with only a small increase in calls to their helplines and, at the same time, incidents of domestic violence between 2020-21 were likely falling in locked-down homes, what did they do with all that money they received? We urge you to ask that question. We respectfully suggest you should press it very hard.

But, of course, we realise that’s never going to happen. You won’t be calling anybody to account over this scandal. The domestic violence agencies operate on holy ground which is sacrosanct. It would be an unthinkable heresy to question their probity.

We can be certain that the domestic violence gravy train will roll on unhindered. No awkward questions will be asked in your inquiry – even though it was appointed specifically to ask such questions.

They know they are immune.

Neil Lyndon is a British journalist and writer. He has written for the Sunday Times, the Times, the Independent, the Evening Standard, the Daily Mail and the Telegraph.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

So essentially, she turned the bank into a vehicle for her own vanity, and to counter personal perceived grievances against society. Splendid work.

You would have to have a heart of stone not to laugh.

I do have a heart of stone, and I’m still laughing

It caused share prices to fall. So no, I’m not laughing.

Share prices go up and share prices go down.

Well, if you think the shares are now undervalued, then you should BUY BUY BUY, TonyRS!

Oh, wait, svb collapsed already.

Question is, was the share price fall cause or effect?

I think we can all agree it was an effect.

Except, once again, I expect “the little people” will have their pockets picked in order to bail out the Banksters and Regulators who failed to do their jobs.

Capitalise the profits; socialise the losses.

Point taken.

A useful reminder of the limit to compensation from the BoE if your bank folds; £85K, I think.

I believe that the FDIC will try to recover most if not all of depositors money

It is reported the losses on the fixed interest investments exceed the capital of the bank. The fact they have closed the doors suggests it has gone through their capital ratios. If that is so there is simply not enough there to pay off the depositors in full.

Besides, it will take months to unravel once the big law firms and accounting firms get involved and their fees will be eye watering.

Up to $250,000

Delusional. Completely detatched from reality.

Jay Ersapah…said I “feel privileged to help spread awareness of lived queer experiences, partner with charitable organizations, and above all create a sense of community for our LGBTQ+ employees and allies.”

A bit more attention to the job she was paid to do as opposed to her extracurricular activities might have paid dividends. Assuming of course that she was up to the job in the first place.

Sorry – but I would say rising interest rates and holding a lot of fixed income securities is what done it.

Failure to hedge for this risk shows poor financial accumen.

To paraphrase Warren Buffet.It’s only when the tide goes out that you see who’s not wearing a swimming costume.

Yes, and this “living queer” was more interested in the rainbow, signalling virtue and seeking attention.

So, maybe they should have picked someone who could run a large banking business sooner than someone whos best credential is just being gay!

Lefty idiots deserve all they get!

The FT has a sober analysis of what went wrong on the business side.

The age old banking nemesis: asset/liability mismatching.

Here by ‘Unnecessarily eating chicken but thereby risking to sh*t elephants’.

Should be accessible without Paywall through this link.

A bit of insider knowledge/trading on the large customers side also seems to be present. Plus ça change….

https://www.realclearpolitics.com/2023/03/12/the_spectacular_unravelling_of_silicon_valley_bank_593578.html?utm_source=rcp-today&utm_medium=email&utm_campaign=mailchimp-newsletter&mc_cid=673e4aec10

The FT article is not consistent with what has been reported. A temporary solvency problem would be supported by the authorities as that is one of their principal roles. Being a forced seller of that much government bonds would not have seriously upset the bond markets where daily traded volumes are enormous. Some commentators suggest that the losses realised on a sale are in some way different from losses booked when prices fall. That is not really true as bank solvency is a day to day hour to hour issue based on market values.

Management must have known they were bust quite a while ago.

Playing to the gallery of left wing friends is not what they are paid to do and their corporate and regulatory obligations make such activities secondary, to the extent their Directors permit it at all.

Their primary role is to run a compliant, financially secure business. They seem to have invested too much in fixed interest government bonds. I accept the rules do tend towards that but the over-riding obligation is to protect the depositors and the business.

It has been suggested elsewhere that the volume of deposits were so high they were unable to profitably lend (media wrongly calls this “investment”) so they stashed the funds in government securities. Any fool knows that excessive money causes inflation and the principal way of controlling that is for the central banks to raise interest rates. That they have done: too late and too little, I would say, but they did it.

Higher interest rates on all but short term bonds causes a fall in their value. Any bank employee should know that, especially the Risk Officer and whoever decides on investment and liquidity policy within the bank. To get caught out so badly and so suddenly is a disgrace for which heads should roll; disciplinary action should be taken and, I doubt not, litigation will ensue.

As central bank interest rates and guidance has been on a rising trend for so long, and inflation shows no sign of abatement (except in President Biden’s speaches), the falling value of bonds must have been apparent in the management reports at SVB for months. How come no one noticed and adjusted the book accordingly?

I expect that banks around the world will suffer share price drops tomorrow and the sorts of start-ups SVB lent to will also suffer. For most this ought to be short term but the mood of the market is to hammer any stock with any question marks and they generally do not recover quickly. Some VC investment funds and their invested businesses will not survive, no matter how good their underlying businesses. From interviews in California many of them apppear to have had all their surplus cash and all their credit lines with SVB which is unforgivable concentration of risk.

Maybe the FED and FDIC can induce commercial banks to take over SVB but with the likely litigation in prospect, I would be surprised if they thought it worthwhile. Maybe they will agree to take over the balances but not the buisiness; I doubt it.

No tears for Jay please. NHS Trusts will be queuing up to employ her/it/them/whatever

Halifax are you listening?. I withdrew my money because of insisting on pronouns for staff members. They’re the next domino. Get Woke, Go Broke.

It was an asset grab – nothing to do with wokery.