Banks face losing their licence if they discriminate against customers based on their lawful political beliefs under plans being drawn up by the Government, according to the Telegraph. Louisa Clarence-Smith has more.

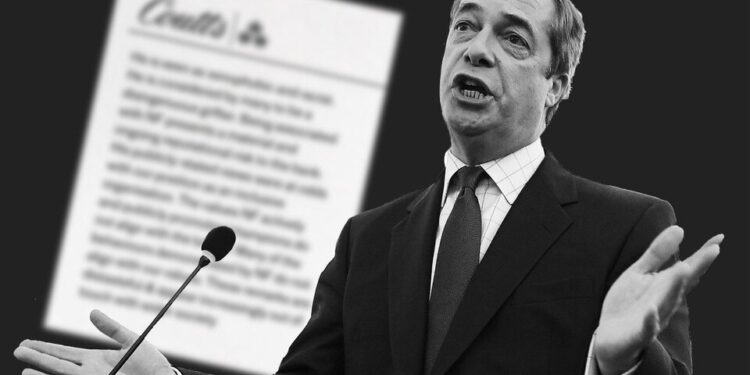

Ministers have ordered officials to start drafting legislation to give banks new free speech duties after it emerged that Coutts bank had closed Nigel Farage’s accounts because his views did not “align” with its “values”.

Andrew Griffith, the Economic Secretary to the Treasury, has asked civil servants to explore adding free speech protections to banking licences, according to Whitehall sources.

The move would mean that any bank which discriminates against a customer because of their political beliefs could have its banking licence revoked.

Separately, payment service providers will be told as soon as Thursday that they must not discriminate against customers on the basis of belief, the Telegraph understands.

The Treasury is preparing to enforce it by strengthening the Financial Conduct Authority’s ‘Principles for Business’. Principle Six, which states that “a firm must pay due regard to the interests of its customers and treat them fairly”, will be updated to refer to political beliefs, insiders said.

It will also say that banks must give three months’ notice of services being terminated and due notice must be given to enable appeals.

The changes are expected to be announced as early as Thursday as part of the Treasury’s response to its payment services regulations review.

It comes after Rishi Sunak vowed to “crack down” on banks removing customers for non-commercial reasons on Wednesday amid a growing backlash against Coutts and its parent company NatWest.

David Davis, Conservative MP for Haltemprice and Howden, branded Coutts’ decision to de-bank Mr Farage as “a thinly veiled political discrimination, a vindictive, irresponsible and undemocratic action”.

He told the Prime Minister in the House of Commons that the banking licence of NatWest should be in jeopardy over its handling of the scandal. He asked Mr. Sunak to order banks to disclose to the Treasury all of the accounts they have shut down for non-commercial reasons.

In response, Mr. Sunak said: “In the short term, having consulted on the payment service regulations, we do intend to crack down on this practice by tightening the rules around account closures.”

The Government began working on reforms for payment service providers earlier this year, after the Telegraph revealed that PayPal, the U.S. payments company, had been accused of shutting down accounts for political motives.

PayPal temporarily shut down the accounts of UsForThem, the parents’ group that fought to keep schools open during the pandemic, and the Free Speech Union and its founder Toby Young without any clear explanation.

It later reinstated the accounts following a backlash from MPs.

The company said it was a “strong supporter of freedom of expression and open dialogue”.

Other groups which had their accounts shut down by PayPal last year included Left Lockdown Sceptics, which describes itself as a “socialist collective” opposed to Government lockdown measures.

Worth reading in full.

Stop Press: Nigel Farage is demanding an apology from the BBC for reporting he lost his Coutts account because he didn’t meet the bank’s financial thresholds.

Stop Press 2: Watch me interrupt my family holiday in Majorca to tell people about this important victory for the Free Speech Union, which has been lobbying the Government to do something about ‘de-banking’ for nearly a year.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Majorca. Wow! According to UK reports on MSM you must be on fire. The temperatures in southern Europe are being reported in terms of catastrophe.

Looks like nice weather to me.

HEATWAVE ARMAGEDDON! CLIMATE CATASTROPHE! GRETA THE GREAT WARNED US! HOW VERY DARE YOU ENJOY THE SUNSHINE!

That’s being worked on: Local authorities in Germany have started warning people that temperatures of 30 centigrade or even more are lethal and that they must stay out the sun in such situations (I’m not kidding). These people are as determined to manufacture an emergency out of nothing as they were with COVID.

I normally operate at 37c.

If I were to try to operate under 30c the pathologist examining me would be able to tell how recently I had died.

All should note that the Gov is a major shareholder in NatWest, thus Coutts, although they have recently sold off a chunk of shares.

If banks are shutting accounts because the account holder’s views are at odds with those of Fink and Schwab it could be a touch difficult to force CBDC on to the population. Not that I’m a conspiracy theorist or anything. Heaven forbid.

Yes. The best thing about this is that it has shown us what a set of Coutts they all are and how bad CBDC would be.

CBDCs would mean those people who are debanked and are unable to get new accounts basically have no funds. If their ‘money’ is merely data, it can be effectively be deleted if it can’t be transferred to another bank and the victim ends up with nothing. It’s a terrifying situation.

Check out the list of reprobates who now control NatWest Group plc…

HM Treasury 41.05%

Norges Bank Investment Management 3.596%

The Vanguard Group, Inc 2.097%

BlackRock Investment Management (UK) Ltd.1.676%

Massachusetts Financial Services Co.1.548%

FIL Investment Advisors (UK) Ltd. 1.363%

Artemis Investment Management LLP 1.269%

Compagnia Investimenti e Sviluppo SpA 1.109%

Fidelity Management & Research Co. LLC 1.067%

Fisher Funds Management Ltd. 1.003%

The usual lowlives (and I include HM Treasury in that!!) The proxy voting rights held by these investment funds need to be revoked.

Please understand that Vanguard does not belong in this list of reprobates.

Research its founder, Jack Bogle. Research the history of Vanguard. And learn the definition of mutual.

They own 2.097 per cent and they’ve been pushing the insanity that’s been wrecking businesses along with BlackRock and State Street. They’re part of the problem.

You modified that comment after I’d replied. Cheeky! Vanguard Group holds institutional and mutual stock.

Vanguard Group holds institutional and mutual stock.

Take Microsoft:

Vanguard Group Inc with 8.74% is the largest institutional stockholder

In mutual fundholders you’ll find:

Vanguard Total Stock Market Index Fund 3.04%

Vanguard 500 Index Fund 2.32%

Vanguard Growth Index Fund 0.85%

Vanguard Institutional Index Fund-Institutional Index Fund 0.70%

Vanguard have been part of the the clique pushing ESG behaviours as much as BlackRock and State Street. They have their defenders, but they’ve been allies to the other investment banks. They aren’t the good guys.

Doesn’t this all hinge on the interpretation of what is considered ‘political’? A few short years ago the term only applied to the affairs of government and the various shades of political parties so involved; nowadays it seems to encompass just about everything from biology, religion, race, creed and sexual preference. Will my bank still be able to ban me for being considered a Christian-leaning TERF (and thus by modern definition some sort of far right extremist) despite ‘protected rights’, for example, but not for being an actual political party refugee?

If they ever look at my subscriptions to Daily Sceptic, Daily Wire, Free Speech Union and my purchases of books by the likes of Ayn Rand, Roger Scruton and Aristotle, I’m screwed!

These rules aren’t enough for the banks: they’ll find a way around any rules. It’s fixing an issue, rather than attacking the underlying causes: the corruption of the businesses.

In essence, neo-liberalism and cultural Marxism have merged. Fiscal neo-liberalism requires the market to be kept stable. Cultural Marxism gives corporations control over entire populations, allowing companies to run their own legal systems (and intelligence agencies, if Coutts’s Stasi-like dossier is looked at) inside countries that already have their own laws with democratically elected officials.

Stakeholder capitalism, as pushed by the likes of Klaus Schwab and Larry Fink, needs to be repudiated and destroyed. Companies funding political organisations should face serious penalties. Ratings systems such as ESG should be declared illegal.

Never mind political beliefs, what about the debanking of businesses because of “excessive” use of cash?

There is a parliamentary petition with the subject “Require banks to give a specific, contestable reason before closing an account” at this link: https://petition.parliament.uk/petitions/640488

Signed.

You should have a hat on Toby.

We don’t want to lose you to sunstroke.

How can you have a debate of ideas unless people of all political persuations can access basic and necessary services such as banking, or will electricity etc. suppliers start to cut customers off if they don’t think their right way?

Since Coutts Bank started in 1692. I think it is inconceivable that none of their clients was involved in the slave trade.

Whilst many are trying to exploit the Daily Sceptic to undermine democracy, the main founder of the Daily Sceptic is tirelessly and courageously using democracy to undermine tyranny.

I am a firm advocate of Free Speech – rabidly so. But I am also a firm advocate of respecting property rights and an integral and essential part of property rights is for private entities (in this case, Coutts and Farage but also in the case of PayPal and Toby Young, previously) to have the right to voluntarily engage or not engage with each other. Whether you agree with the reasoning for it or not, Coutts has decided that it does not wish to engae with Farage as a client. Unless they are breaching a specific contractual agreement with Farage, by what moral right should Coutts be forced to keep Farage as a client? Think of it in the reverse. If Farage chose (for whatever reason) to not be a client of Coutts, should he be forced to keep his account there? Of course not – that would be absurd. So why should Coutts be obliged to keep Farage as a client?

This is not a Free Speech issue. This is a property rights issue and for the right of individual entities to voluntarily choose with whom they will engage / do business.

I am a firm advocate of Free Speech – rabidly so. But I am also a firm advocate of respecting property rights

In this case, the property involved is Farage’s, namely, his money, and the standpoint of the bank is We are gatekeepers of the electronic money transfer network and have decided that you must not be allowed to use your property! That’s a classic example of abusing an accidental position of power to interfere with other people’s property rights. Especially considering that everything the bank owns is something financed by exploiting other people’s property for its own benefit. The commerical leadership of the bank has not been authorized to make and enforce political decisions just because it happens to control a lot of property it doesn’t own.

If a business was behaving the way businesses did until recently, where they stayed apolitical and aimed to maximise shareholder value, I’d agree with you. The problem is so-called ‘stakeholder capitalism’.

Now, businesses are obliged to make moral value judgements, campaign politically, fund political organisations, run affirmative action schemes and, in effect, run their own legal system through company ‘values’ under duress from BlackRock, Vanguard, State Street and the other banks and hedge funds or have their ESG score affected, which risks their line of credit, because they’re all loaned up to the eyeballs. An employee or client can behave entirely legally in his own country in his own time, but fall foul of the company’s ‘values’, lose his job and be blacklisted from similar jobs. Even relatives can be kicked out of jobs because of his behaviour.

Unless stakeholder capitalism is repudiated and outlawed and ESG and similar ratings banned, this will continue to be an issue. It’s a free speech issue and an issue where companies are being allowed to interfere in areas where they have no right to go.

The trouble with banking is that it’s a very long way from being a free market. If banks could be opened at will, then the property rights argument would be a fair one. As it is, the industry is an oligopoly by legislation.

And the UK is particularly bad. I have family in the USA and they have huge numbers of banks there, many of which are small ones in effect run by families. The UK’s banks (including former building societies) is controlled by giant banking corporations.