Much has been made of Pfizer reaching the extraordinary mark of $100 billion in revenues in 2022, in large part undoubtedly thanks to the COVID-19 pandemic and its famous COVID-19 “vaccine”. Indeed, Pfizer’s year-end earnings report shows that COVID-19 vaccine sales alone account for nearly 38% of those $100 billion in revenues (p.30).

But revenues are revenues. What counts, of course, are profits. And half of the profits on its COVID-19 vaccine sales are not in fact profits for Pfizer, but rather costs. How could that be?

Well, it is because “Pfizer’s” COVID-19 vaccine is not in fact Pfizer’s. Legally, Pfizer is not even the manufacturer. Pfizer is rather a contract manufacturer that produces and markets the vaccine on behalf of its actual owner, the German company BioNTech. It says so right on the product’s label!

And per the terms of the collaboration agreement between the two firms, Pfizer pays BioNTech gets a 50% share of its gross profits for the privilege of so doing. (See my article “50/50 Split: BioNTech and The Pfizer Illusion” or section 4.9.1 of the collaboration agreement here.)

After deduction of this 50% BioNTech share as “cost of sale”, Pfizer has estimated that its own remaining profit margin on COVID-19 vaccine sales is in the “high-20s as a percentage of revenues”. (See, for instance, the quarterly earnings report here, p.4.)

Let us split the difference and assume a 27.5% Pfizer profit margin. Applying this margin to Pfizer’s $37.8 billion in 2022 COVID-19 vaccine revenues gives around $10.4 billion in profits.

So, BioNTech earned the same amount? Well, no. BioNTech earned more.

Among other possible reasons, this is because whereas the companies split profits 50-50 on sales in the Pfizer sales territory, BioNTech also has its own reserved sales markets (Germany and Turkey) and sells the product in partnership with the Chinese company Fosun Pharma on still other markets (Taiwan, Hong Kong and Macau, but still not mainland China where the drug has never been authorized).

So, how much did BioNTech earn? It would seem that hardly anyone wanted to know – or, at any rate, not in the Twittersphere. Thus, while Pfizer’s hefty 2022 earnings were the subject of many a viral tweet, with Elon Musk himself even helping out to amplify one with a couple of exclamation points (see below), BioNTech’s late March release of its own 2022 earnings report passed virtually unnoticed on Twitter and elsewhere.

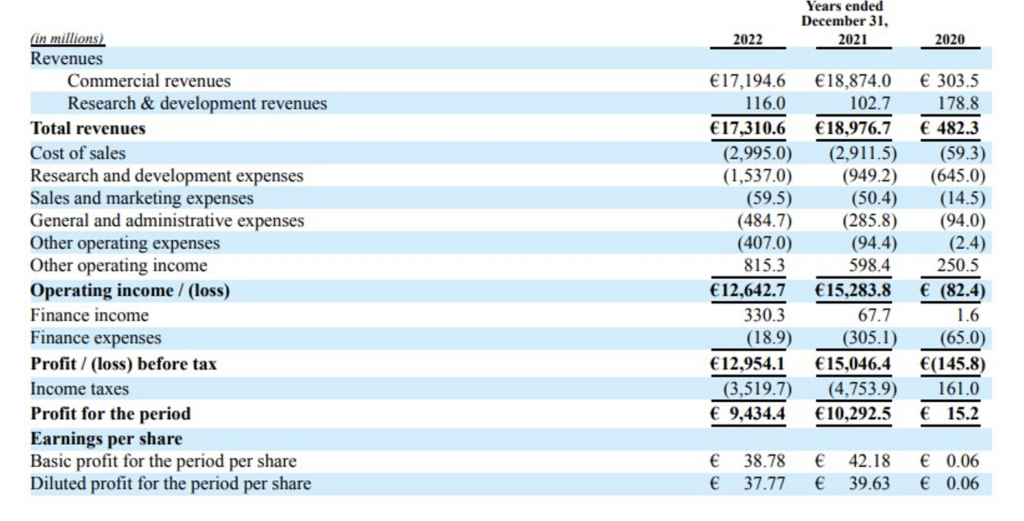

Nonetheless, the company’s 2022 COVID-19 vaccine profit figure is right there: namely, on p.161 under “Operating Results”. See below. No need to worry about profits on sales of any other products – since BioNTech does not have any other products. €12.95 billion. Or, at the average 2022 rate of exchange, $13.6 billion. So, roughly $3 billion and 30% more than Pfizer.

And if the difference in profits is significant, consider the difference in profit margin. BioNTech made €12.95 billion in profits on €17.3 billion in revenues for a whopping 75% profit margin! This as compared to Pfizer’s “high 20s” on C-19 vaccine revenues and 34.6% on all revenues. (See p.20 of the Pfizer earnings report for the company’s total pre-tax income.)

BioNTech’s astronomic profit margin reflects the fact that it bears very little of the costs associated with producing the drug. BioNTech does undertake some production activities for some markets: namely, producing synthetic mRNA, which it manufactures at its production facilities in Marburg.

But the costs involved in this are evidently minor compared to the costs borne by Pfizer. And remember that all the costs borne by Pfizer flow into and thus inflate the widely-cited revenue figures. This is why BioNTech’s profit margin on vaccine sales is so much higher than Pfizer’s.

In 2021, the difference between the BioNTech and Pfizer hauls was even greater, largely due to substantial milestone payments that Pfizer owed BioNTech per the terms of the collaboration agreement. Thus, BioNTech earned €15 billion on an even higher 79% profit margin! (See the second column above.)

At the average 2021 rate of exchange, €15 billion is equivalent to roughly $17.75 billion. Pfizer, by comparison, made roughly $10 billion in COVID-19 vaccine profits in 2021. (For Pfizer’s 2021 earnings and the calculation of this figure, see “50/50 Split”.)

So, for 2021 and 2022 combined, BioNTech made over $31 billion in COVID-19 vaccine profits on a 77% profit margin as compared to Pfizer’s just over $20 billion on the estimated 27.5% profit margin. So, BioNTech made 50% more profits on a nearly three times higher profit margin.

Not bad for a company that had never turned any profit before 2021.

Can I get a “!!” from Elon Musk?

Robert Kogon is a pen name for a widely-published financial journalist, translator and researcher working in Europe. Subscribe to his Substack and follow him on Twitter.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

“By the time you read this, the $110 billion behemoth may be a smoking ruin – the biggest casualty yet of ‘Go woke, go broke’.”

Now that would put a smile on my face.

Anyway, congratulations on all you have done Toby. Even if you haven’t helped to kill them they are certainly severely wounded. Let this be a warning to others.

Well done and thank you.

I’ve taken steps to remove paypal from my financial life.

They were already stepping on civil liberties, but their threat to steal customers’ cash because they offended paypal in some unspecified manner is just too much.

Am I . . . Spartacus?!?

Looks like paypal are running scared….

https://summit.news/2022/10/13/paypal-appears-to-be-desperately-offering-bribes-of-15-to-stop-droves-of-people-cancelling-accounts/

Expose have just released the same news.

Wonderful.

Turned out I hadn’t used Paypal for ages anyway. Should have cancelled it years ago.

“Dan Schulman, the president and CEO of PayPal, gave an interview earlier this year entitled: ‘The thing that separates good companies from great ones: trust.’”

No it isn’t, it’s reputation – ask Jeremy Ratner. Reputation keeps existing customers, attracts others by recommendation, and keeps and attracts investors.

Getting a reputation for not being a reliable provider of a service which can be withdrawn instantly for spurious and subjective reasons will neither keep nor attract customers.

Spending shareholders’ money on ideology that loses customers, reduces shareholder value will neither keep nor attract investors as the pompous Mr Schulman has now found out.

This also shows the best company/market regulator is not Government nor bureaucracies, but the consumer.

I love the title of this article, I certainly don’t think it’s ‘too vainglorious’, and at the same time all of us who closed our PayPal accounts in protest can share in taking the credit. (I had to get a password reminder before I could close my account, which I had rarely ever used.)

In the Spectator article Toby Young said: “On the one hand, PayPal’s demise would send a message to the financial services sector that trying to police your customers’ speech is a terrible idea. But on the other, lots of small depositors would lose their money.”

I think small depositors should withdraw their money from their PayPal accounts before they lose it. It’s not Toby Young’s fault that PayPal cannot be trusted.

Not a penny left in mine.

It was amazing to me, when in the process of shutting down my PayPal account at just how many standing payments I’d set up went via PayPal! Even The Spectator…

I look forward to seeing Paypal’s scalp dangling from your belt, Toby.

I have a grand total of 50p in my PayPal account, and rarely use it.

Am I more of an embuggerance to them if I keep this account open?

I don’t think PayPal would notice that you have only 50p in your account, but they have definitely noticed how many people have closed their accounts since Paypal started to attack people’s freedom in the last few weeks.

Count me sceptical. They are far too entrenched now in the online shopping world and without real competition there- merchants and customers just love its ease of use and reach.

MasterCard folded its competitive effort because of that, not that they’d been more trustworthy.

I love your line on whether they’ll now fine themselves for that misinformation…

You may well be correct JB but they will have had a good kicking.

Cancelled my 25 year old PayPal account after they cancelled Toby and others. Hope they go under if they don’t learn their lesson.

I find it really upsetting that I can only cancel my PayPal account once …. and I’ve done it.

I’m consoling myself by googling “boycott PayPal” several times a day

Surely the AUP breaches human rights and in the EU/UK would be illegal and hence null and void. Making themselves judge, jury and executioner even for goings most of us disagree with and are criminal, e.g. money laundering or fraud means that they are subjecting people to arbitrary justice. Actually just looked article 12 UNDOHR. no one shall be subject to arbitrary interference…?

The Daily Sceptic isn’t the only journalism and “skeptic” site that’s been de-platformed or demonetized by PayPal. The conservative investigative journalism site UncoverDC.com also had this happen to them …. almost three years ago! PayPal or Twitter have never un-suspended this site and its founder, Tracy Beanz.

Apparently I’m the only journalist who thought to do a story on this. In my recent Substack dispatch, I interview Tracy Beanz, who talks about some of the ‘workarounds” she employed to get around this brazen censorship.

Her site is also called a “Covid conspiracy” site. This piece of disinformation is of interest to me as I have written many of the Covid stories UncoverDC.com published. Nobody else would publish many of these stories. And I can’t think of a sentence I would change in any of them.

https://billricejr.substack.com/p/shes-still-standing

Hats off to you and Tracy Bill. Not many of your type remaining.

I sent 2 mails to PayPal’s CEO & to corporate affairs asking clear questions about their policies & impact for me as an account holder. Response? NOTHING. The arrogance of these Bit Tech companies is breathtaking.

So I closed my account directly. In the process I applied another Daily Sceptic commenter’s advice to “..select the option to have them delete all your data too then you can leave a comment.”

My departing comment was this:

“I’m thoroughly disgusted by PayPal’s anti-free speech policy. Why would you use a financial service provider which can block your account at any time without providing any reasons, and then steal $2500- from you as a “fine” for your supposed transgression. My decision has been confirmed by ZERO response to my several emails to PayPal asking them if there was a reasonable explanation for recent actions. So much for customer service. Not to mention transparency. From now on, I shall be telling everyone I know to close their PayPal account.“