Ofgem recently announced an increase in the energy price cap for the period April-June 2025. Overall bills went up 6.4% from £1,738 to £1,849 including VAT for dual fuel users paying by direct debit.

Various commentators were quick to blame rising gas prices for the increase. They were right to do so, because about £79 of the £111 increase in total energy bills can be attributed to the direct fuel component of our bills which is mainly gas. The increase in electricity bills was £33, of which £27 came from increases in direct fuel costs which is mostly gas.

Some of you may have seen my appearance on the Jacob Rees Mogg show on GB News debating this with Bob Ward. In that discussion, I urged viewers to zoom out and consider the longer-term drivers of higher bills, reeling off some statistics on the cost of renewables subsidies. That exchange prompted me to dig a little deeper into the changes in the Ofgem price cap since its introduction in 2019 and to peer into the crystal ball to see where electricity prices are heading.

Electricity Bill Components

Ofgem splits our bills into components, which we can further break down into smaller elements to determine how much of the increase in bills is due to gas and how much to renewables.

Direct Fuel Costs

Direct fuel costs are the largest component of electricity bills, and most of these costs are attributable to gas. The name is something of a misnomer because this component includes the cost of Contracts for Difference (CfD) subsidies. For the purposes of the analysis below, CfD costs have been stripped out of the direct fuel figure and attributed to the cost of renewables.

Capacity Market

The Capacity Market is primarily required to provide backup for intermittent renewables. Before we had renewables on the grid, we did not have a capacity market to speak of. For this analysis, the increase in capacity market costs has been solely attributed to renewables.

Adjustment Allowance

The Ofgem explanation for this cost is somewhat vague. It appears to be an allowance for suppliers to cover bad debts run up by customers struggling to pay their bills. This cost has been attributed to “Other Costs” in the analysis below.

Policy Costs

Policy costs comprise a myriad of elements, including the cost of the Renewables Obligation (RO) and Feed-in Tariff (FiT) subsidies. Other elements include the Warm Home Discount (WHD), which helps low-income households with their bills, and the Energy Company Obligation (ECO), which requires suppliers to deliver energy efficiency measures to homes. The total cost of this element is approximately £500 million per year for electricity and £217.5 million for gas bills (see Annex 4 Tab 3e ECO). There are additional components, such as assistance for those in areas with high electricity distribution costs, the Green Gas Levy and, new this period, Network Charging Compensation to offset the high electricity charges of energy-intensive users. For the purposes of this analysis, RO and FiT costs have been excluded from policy costs and attributed to renewables.

Network Costs

Network costs refer to the total expenses associated with operating the transmission system, the distribution network and grid balancing services. For the purposes of this analysis, the increase in network costs has been attributed to renewables, as the majority of the rise is due to additional balancing costs caused by the increase in intermittent renewables and the connection of remote wind and solar farms to the grid.

Operating Costs

These are an allowance for the operating costs of electricity suppliers and, for this analysis, have been classified as other costs.

Other Costs

There are several other cost elements that make up only a small proportion of the overall bills. These include an allowance for Smart Meters, an adjustment for paying by different payment methods (PAAC), another adjustment for those paying by prepayment meters (PAP) and Headroom for uncertain costs (HAP), which is supposed to act as an incentive for suppliers to compete in the marketplace.

Profit and VAT

There is another element called EBIT, which is supposed to represent a fair profit margin for suppliers. For electricity, this has increased from 1.88% in 2019 to 2.53% of the pre-VAT total as of April 2025.

The VAT rate has remained constant at 5% since 2019, but, of course, because bills have risen, the total amount of VAT paid has increased as well.

Change in Electricity Bills

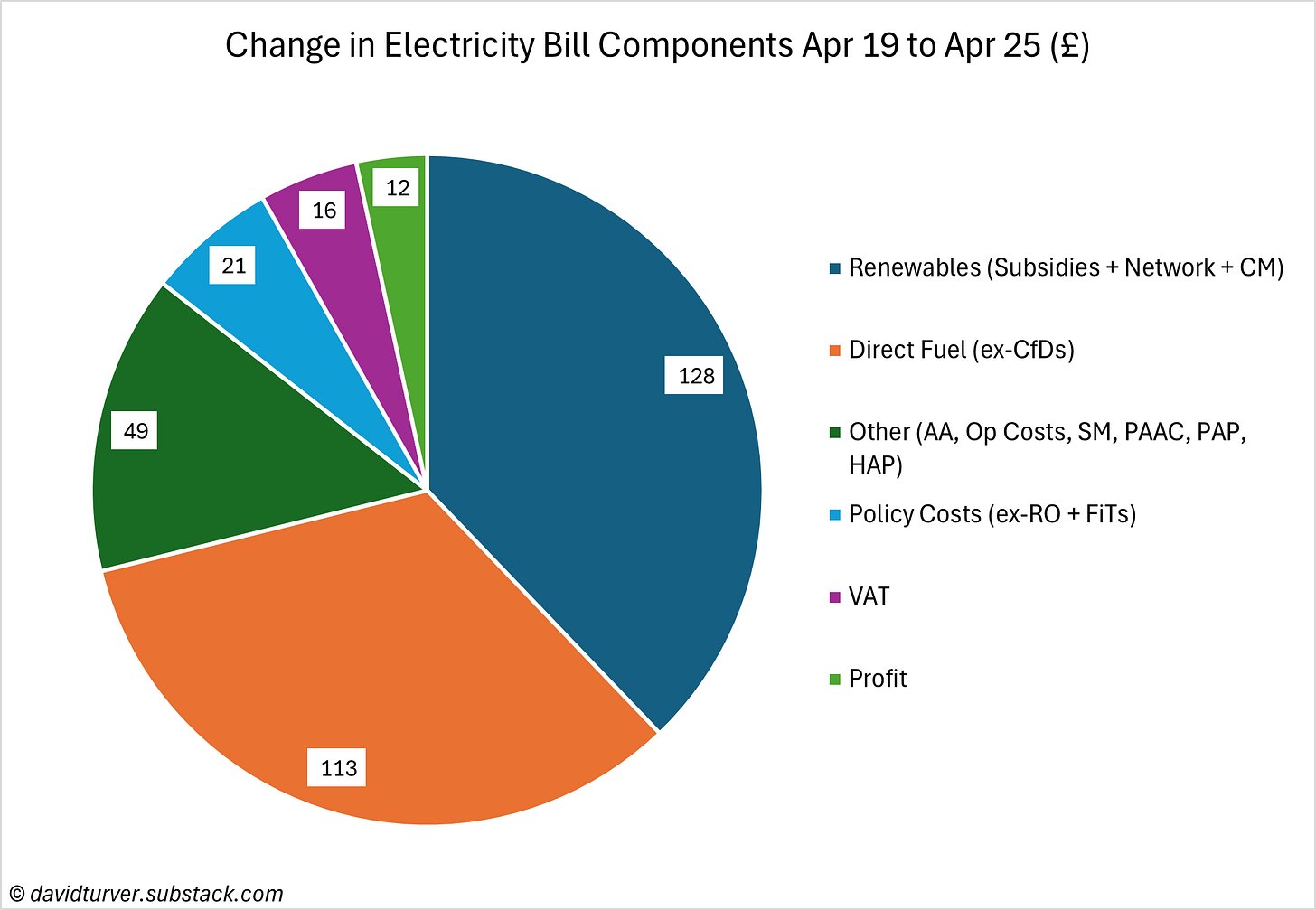

Now we have the definitions out of the way, we can look at which parts of our electricity bill have changed the most since April 2019. All data is from Ofgem Annexes 2, 4 and 9, using Tab 1c, where the figures are for constant consumption of 2,700kWh per year (see Figure 1).

Overall, electricity bills have gone up by £339, from £587 to £894 including VAT. The biggest component increase is in renewables-related items, which have risen by £128. Of this, network costs are up £75, the Capacity Market by £12 and the three subsidies have increased by £40, split into a £25 rise for RO’s, £11 for CfDs and £4 for FiTs.

Direct fuel costs are up £113, largely reflecting the 50% increase in wholesale electricity prices, from £61.90/MWh to £93.07/MWh. In the same period, gas prices have risen more steeply, by 77%, from £21.75/MWh to £41.45/MWh. The gas price they have used equates to about 121p/therm, which was the gas price in mid-January. It rose to a peak of over 140p in mid-February but has since fallen to around 100p/therm. Gas futures prices have also fallen as global tensions have eased, with the ceasefire in the Israel/Gaza conflict and the prospect of peace in Ukraine. Of course, gas prices would fall further and faster if we lifted the ban on onshore and offshore drilling, increasing our own domestic supply of gas. We might hope that both gas and electricity bills will fall below the price cap if suppliers can take advantage of the latest lower prices. Of course, the renewables-related costs will not fall with gas prices – in fact, CfD subsidies will rise – so we will not feel the full effect of falling gas prices in our bills.

Other costs are up £49 since 2019, with operating costs (£20), the Adjustment Allowance (£14) and Smart Meters (£6) making up the bulk of the change. Policy costs (excluding ROCs and FiTs) are up £21, with ECO (£14) and WHD (£4) making up the bulk of the change. The increase in overall bills has pushed up VAT by £16. Increased bills, coupled with a bigger margin, have pushed up the profit element of bills by £12.

Where are Electricity Bills Going?

We should now look into our crystal ball and make some informed judgements about where electricity bills are going.

Cost of Subsidies

If we start with the biggest scheme, ROs, we can see from the OBR Outlook that the RO scheme cost £7.6 billion in 2023-24, and the cost is forecast to rise to £8.5 billion in 2026-27. This element of our bills will continue to increase.

The second scheme is Feed-in-Tariffs (FiT), and we can see from Ofgem’s latest report that it cost nearly £1.9 billion in 2023-24, or around £221/MWh. FiT contracts are index-linked, so we can expect the cost of the FiT scheme to continue to rise in line with inflation, meaning this element of our bills will also continue to increase.

Finally, we have the Contract for Difference (CfD) scheme, where data from the Low Carbon Contract Company shows the CfD scheme cost a record £2.4 billion in subsidies during the calendar year 2024. CfD contracts are index-linked as well, so we might expect the cost of subsidies to rise as the indexation of existing contracts outweighs the lower prices of some new developments.

We can expect the total cost of subsidies, about £12 billion – or the equivalent of £420 per household – to continue increasing over the next few years.

Grid Balancing and Backup

If we turn now to balancing and backup costs, the NESO report for 2023/24 shows grid balancing cost £2.54 billion. As the grid takes on more intermittent sources, we might expect the volume of grid balancing to increase, but the cost will largely depend on the price of gas.

According to the OBR, backup from the Capacity Market cost £1 billion in 2023/24, and they forecast these costs to rise to £4 billion per year in 2027/28. Even if balancing costs remain constant, we can expect the total costs of balancing and backup to rise by £3 billion by 2027/28, or the equivalent of over £100 per household.

Clean Power 2030

NESO estimated the Clean Power 2030 Plan (CP2030) would cost £44-48 billion per year to the end of 2030, or a total of £264-290 billion over the six-year period. Assuming a cost of capital of 8% and operations and maintenance costs of 2% for CP2030, this would result in an ongoing cost of £26-29 billion per year, or £900-1,000 per household. This could be offset to some extent by using less gas, with the maximum gas saving estimated at about £7 billion per year if gas prices remain at 120p/therm for the foreseeable future.

Taxes on Gas-Fired Electricity

Energy bills are also increased by the taxes placed on gas-fired electricity generation, which is subject to the Emissions Trading Scheme (ETS). The UK ETS Authority has set the carbon price for 2025 at £41.84 per tonne of carbon dioxide. Actual carbon prices vary somewhat, but this price can be used to estimate the extra costs of gas-fired generation. Modern gas turbines emit around 350kg CO2/MWh of generation, so gas-fired generation attracts a carbon tax of about £14.60/MWh. NESO’s CP2030 plan anticipates carbon prices rising substantially to around £147 per tonne, so even though the amount of gas-fired generation on the grid will fall, the cost of this generation per MWh will increase, with higher carbon taxes adding further upward pressure to energy bills.

Conclusions

We can see that the direct and indirect costs of renewables have been the biggest drivers of increased electricity bills since 2019. Increased gas prices have also played a part in this rise, but there is reason to believe gas prices will fall with easing global tensions, and even more reason if we were to lift the damaging bans on new gas drilling.

However, looking forward we can see that electricity bills are going to keep on rising because of increased subsidies and backup costs. The extra spending on new renewables and grid infrastructure contained in CP2030 plan means prices will continue to go up from their already high levels.

It is time to change course and abandon Net Zero, declare an energy emergency and go all out for cheap and abundant energy.

David Turver writes the Eigen Values Substack, where this article first appeared.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.