Government borrowing costs surged to their highest level in nearly a year after the largest tax raising Budget in history. The Telegraph has more.

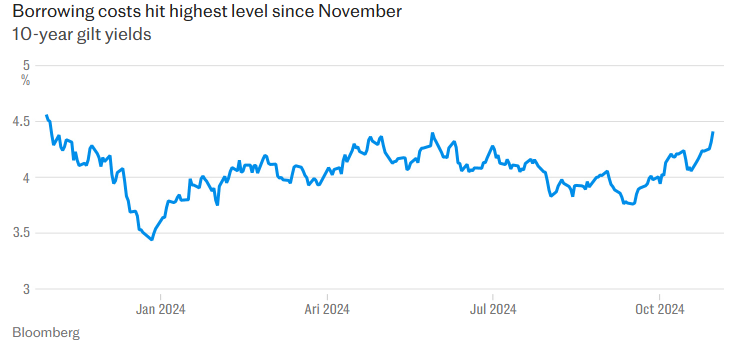

Bond markets took fright to the Chancellor’s proposed debt-fuelled spending binge by pushing up the yield on the main type of Government by nine basis points to 4.41% — putting it on track for its highest close since November.

Meanwhile, two-year debt surged as much as 12 basis points to 4.38% after the Budget.

The move was prompted by a larger-than-expected bond sale plan by the Government, with the Treasury planning to increase sales by £19 billion more than expected.

In April, markets were told that Britain would issue £278 billion of debt through the Debt Management Office, which issues U.K. debt.

The Government has now ramped this up and plans to sell £297 billion of bonds this year, higher than expected.

The sale is the largest ever put forward by a U.K. Government, excluding the huge debt raise during the COVID-19 pandemic.

Nigel Farage compared the market reaction to Liz Truss’s infamous mini-budget of 2022. Speaking in the Commons, the Reform leader said:

I sat listening to the numbers. This budget is illiterate. I don’t know who’s doing the sums, whether perhaps it’s the Rt Hon Member for Hackney North [Diane Abbott], but the sums do not work.

And the markets now agree with me, because just in the last couple of hours, we’ve seen a very substantial spike in gilt yields.

We’re not quite yet back to 2022 with that mini budget. But clearly, clearly, people are saying this isn’t going to work.

Contrary to Labour’s claim that it is honouring its manifesto commitment not to raise taxes on working people, the Office for Budget Responsibility said that workers will shoulder 80% of the increase in employer National Insurance long term through lost wage increases and lower income.

The official watchdog also warned that homeowners face a hike in mortgage rates as Labour’s borrowing binge will drive up inflation and mean higher interest rates for longer.

Downgrading its growth forecasts for years three to five, the OBR gave the Government just a 54% chance of achieving its aim of a budget surplus by 2029.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

She makes Liz Truss look like a bloody genius. Funny in a grotesque sort of way just how stupid she is. And appraently dishonest as well given the fictitious nature of her previous career. But she will remove all the pictures of men and replace them with pictures of women so it’s all good.

I would suggest she puts up a picture of Wendolene from Wallace & Grommit.

I posted that picture a few days ago.

Who exactly do we and all other nations owe this money to?

I wonder what would happen if all just refused to pay and instead issued their own currencies, backed with say gold or silver thus freeing their and future generations from debt?

I’ll give you a clue –

What/who have all the following got in common :(apart from being dead, save Putin thank God)-

Hitler

Lincoln

Garfield

Kennedy

McKinlay

Gaddifi

Castro.

Putin.

And the winners of this farago are, drum roll – Banking Familes.

Would you lend money in the future if that were to be done. How would pensioners be paid (by law the bulk of the pension scheme assets for funded DB schemes are invested in government debt).

Something is coming to upset the applecart you can see that in the npanic of the more canny among them. Of course a rocky road but I think it will offer hope. I don’t see this as the endpoint of the entirety of western humanity quite the contrary in that those who survive will have had to renew the integrity of their being.

Workers are also to bear the unexpected IHT on the residue of personal pensions. This is a new tax on pension savings which are regarded as deferred income.

for those who don’t know, such pension residue does not escape tax as it incurs income tax even withdrawn by descendants. Now it also suffers 40% IHT.

Also, for the record, annuity rates have been very low because of artificially low interest rates. Income from personal pensions are depress thereby whereas public sector retirees have no such reduction, they bear no risk, it continues inflation protected for the rest of their lives.

Personal pension holders have a much poorer and more complex life and now lose 40% at death. Another tax on workers.

no additional tax on the public sector.

The money in the pension also gets tax relief as it goes in. So if the descendants pay tax at the same rate getting it out (and they pay no income tax at all if the death was before age 75 so that’s a major win scenario) then it just cancels out the tax relief when it goes in, and with the 25% cash there is still a tax advantage before considering inheritance tax.

So all the change is doing is stopping pensions being used as a vehicle to avoid inheritance tax.

Whatever rate you think inheritance tax should be set at I’m not sure why pensions should be available for use as an inheritance tax avoidance vehicle when their real purpose should be to provide an income in retirement.

Don’t like the current government with a passion, but this change seems reasonable to me.

IIHT on personal pension residues is nothing other than THEFT. The intention clearly is to reduce savings in to private pensions. That means reduced tax benefits for working people. The aim clearly is to impverish older people. Basically it will help to shorten lives – no jab, no pension. That sort of thing.

All IHT is theft. Why should the government be allowed to steal your money when you die?

I suspect those of us with public sector pensions look like we will be hard done by next year as I think September’s CPI will be a temporary low at 1.7% as energy bills rose this month and then we will probably see it rise again before we get to April.

I would caution against the use of the word ‘pandemic’ unless it is ironic. Because the very definition and notion suggests a transnational problem which requires a transnational solution which is obviously music to their ears. This idea of contagion and worldwide spread deserves closer and deeper scrutiny in my view.

Borrowing ”the road goes on forever and the party never ends”

I do not understand bonds or bond yields? but I do know that however many clever economic gymnastics you perform, eventually the bond party will run out of road.

“In every life, there comes a day of reckoning – a time when unsettled scores demand retribution, and our own lies and transgressions are finally laid bare.”

”Well, I told you once an’ I told you twice

That someone will have to pay the price”

My feeling is that this will not end with us all enjoying a new age of prosperity and economic rectitude.

Bond yields don’t appear to have surged to me.

https://markets.ft.com/data/bonds

Of course if expectations of higher borrowing costs from government policies are already priced in at the beginning of the day you wouldn’t expect to see much movement, but no suggestion to me that the budget measures themselves have shocked the markets. And not much movement in the FTSE all share today.

In reality it didn’t seem too bad a budget in relation to what I was expecting. Of course that’s against very low expectations, and there is all the wasted money on the climate change nonsense etc.

Same here – it does sound as though labour did a better job of signalling to all the powerful stakeholders what was on the agenda / options etc. Although much of what Truss wanted to do was correct, and time has proven the case, their stakeholder management was clearly shite… like it or not, you have to try and take some of these powerful factions along for the ride, or they’ll do you over…

There is no more room for more of the same. You have to go back to late 2019 when the system was about to go down. They kept it afloat a while longer and it gave exhausted workers something of a reprieve. There is no regeneration strategy now. You see twenty something women with good professional jobs complaining that they can barely afford their rent and will never be able to have a family,. This is not a sustainable situation.

The worst part of it is that we all know very well that all the extra tax revenue they raise will be wasted.

The NHS will be even worse.

The green energy schemes won’t work.

The potholes won’t be filled in.

The gradual decline of the country will carry on, probably at an accelerated pace.

I know – governments of all flavours are simply crap at the execution / doing phase… mostly because they don’t have to do it, they can blame someone else. I think I heard a suggestion they wanted a 10 year plan for the NHS, which should cross parliaments… that’s a step in the right direction

What really pisses me off in the headline picture is that all these bench wipes are wearing bloody poppies. How dare they! Not one of them gives a sh#t about this country.

Absolute Next Tuesdays!

https://x.com/vowalesofficial/status/1851714002646106290?s=48&t=tRZxiZS6XXOVoV2wE5Supw

An update from the good people at Voice of Wales.

The chunky governor at Belmarsh opened her computer this morning to 10,000 emails expressing concern for the welfare of Tommy Robinson.

An incompetent DEI hire, female Chancellor. What could possibly go wrong.

Britain’s poltical class are vacuous, dumbed down versions of those of the past. The decades of communist infiltration and degradation of the education system has roosted its chickens. When you have Diane Abbot and Angela Rayner, etc. in Parliament representing people, you know we have collapsed.

Their aim is not “a budget surplus by 2029”. Their aim is for government debt to be falling as a percentage of GDP by then. For example, if the economy grows by 2 percent that year, then government debt could grow by 1.9 percent. (To understand this, consider that with government debt approaching £3 trillion, this would allow government borrowing that year of £50 billion )

Furthermore, this target excludes “investment spending”. Private investment is designed to deliver future profits. Government investment is not like that. For example, building a new school counts as “investment”, but it incurs ongoing running costs.

So don’t be fooled. Labour are absolutely NOT planning to balance the budget.

“Contrary to Labour’s claim that it is honouring its manifesto commitment not to raise taxes on working people…”

The thing about taxes is don’t just look at who is handing over the money, look upon whom the taxes are incident.

Employers NIC increase will be incident on employees via wage freezes, removal of benefits, shorter hours, workforce reductions. It will be incident on the unemployed as employers freeze hiring.

Borrowing is a tax incident on everybody as they have to repay it and suffer the devaluation of currency through money printing.

It is a typical Labour budget those of us old enough recognise, tax, borrow, spend, put up cost of living, lower standard of living, throw a big spanner into the workings of the economy. And of course pizz more and more into that bottomless money-pit, the quite useless, irretrievable NHS.

Too many people are too young to understand Old Labour. They thought they were getting Tony Blair’s Socialism-lite New Labour, so voted Labour, Lib Dem, Tory or stayed home.

Wrong. It’s Marxist-Socialism variety. This medicine will do the people good – if medicine is not bitter it’s not working.