Collapsing electric vehicle prices are leaving a growing number of drivers in negative equity, a top dealership chain has warned. The Telegraph has more.

Vertu Motors said on Wednesday that car retailers were coming under pressure as EVs coming off financing agreements were found to be worth less than the loan they are attached to.

In most car finance deals, this is not a problem for drivers as – provided they have kept up with their payments – they can hand back the keys and walk away.

The lender that funded the leasing deal then typically takes the financial hit.

However, the issue creates a headache for dealers that often allow customers to “roll over” positive or negative equity into new financing deals to win repeat business.

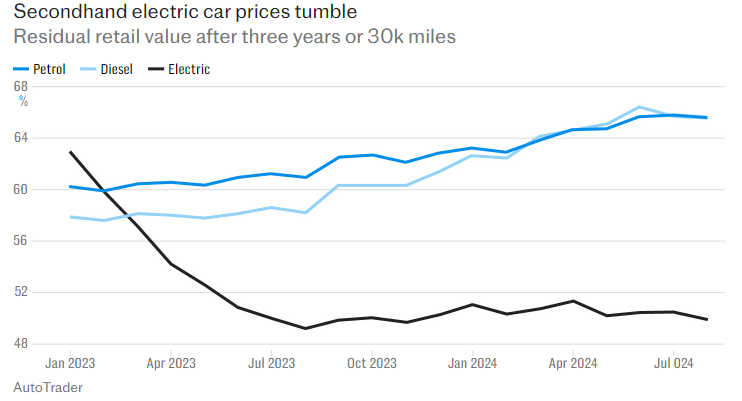

The steep drop in electric cars’ value is being partly fuelled by the discounts offered on new vehicles, as manufacturers attempt to boost sales to hit legally-binding government targets.

Rob Forrester, Vertu’s Chief Executive, said: “We all know that battery electric vehicles have depreciated at a significant rate, and that tends to feed into the creation of negative equity.

“If you think about when many cars were bought two to three years ago, new car prices were quite high because of supply constraints, but since then there’s been a reduction in used car value.”

It follows warnings last month that so-called fleet operators, such as car leasing firms and rental companies, were having to swallow large losses when reselling EVs because of “accelerated, exceptional depreciation”.

In the past two years, the British Vehicle Rental and Leasing Association (BVRLA) said the average amount of “residual value” left over at the end of a car’s lease period had plunged from 60% to 35%.

Worth reading in full.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Note that Shapps is only claiming to have been against lockdown for Omicron owing to its reduced virulence. He is not rowing back on earlier lockdowns, adding it “wasn’t a decision that ministers would have been able to make earlier in the coronavirus crisis”.

…Pity you didn’t have a trade union to represent the cabinet’s views, Grant. It might have saved us the lunacy of the last 3 years since there seems to be so many scaredy-cat ministers unwilling to speak out. Shapps just has no credibility for telling the truth. He always blames someone else for his decisions … It’s the French, it’s Covid, it’s the unions fault … It’s the scientists, it’s the spreadsheets! Grow a backbone Shapps. You’ve been in government 12 years!

It’s only a matter of time before Boris writes in The Telegraph (that newspaper that did so much to report the truth and give dissenters a platform during the Fakedemic) that he was totally against lockdowns, fought hard to prevent them, but was overruled in Cabinet and by SAGE.

Soon it will be a wonder how lockdowns actually happened since everybody was against them and nobody for.

Maybe we just imagined them.

I’m sorry? The Telegraph? Global Health Security ‘sponsored’ by the Bill & Melinda Gates Foundation? with their ‘Editor’ Paul Nuki? These are the current headlines on the GHS page

The Telegraph, a ‘paper’ I used to be subscribed to is as culpable as the rest, they just did it with a more small ‘c’ Conservative tone but the fear was ramped up by their furnding partners and they played the tune.

Ever notice how comments are disabled on all GHS reports.

..and they are still at it right now, see above, fear, fear, fear.

You should have stopped reading or listening to any msm media two years ago. Fearmongering, lead to mass formation psychosis. MSM had a major role in this. So many other sources for well researched data and covid findings, by scientists and researchers who MSM did their best to suppress and censor.

Nobody expected The Inquisition, but that’s what we got or at least a taste of it.

I’m still surprised we didn’t see any actual burnings of non-believers.

Thankfully the Javid vax mandate for the NHS was stopped just prior to implementation by brave doctors telling Javid publicly, he’s an idiot – unlike these people in the cabinet rubber stamping the scientists plans. Many people resigned and threatened to resign, but it was actually law people could be sacked if they weren’t vaccinated!

We had the Shapps inspired Covid passports and ludicrous transport restrictions (while letting over all and sundry on small boats) like masks on public transport and supermarkets.

We had government appealing to people to snitch on their neighbours. Police and drones following people on their walks. We had police regularly raiding people’s homes without a warrant. Incredible what was allowed in the name of ‘public health’.

No, I’m not buying this. There is something else going on here. First Spineless Sino comes out bleating “I told them not to do it but they wouldn’t listen” and now Shameless Shapps tries to pretend he spent his lockdown evenings under a study light laboriously putting together his own spread sheets like a pre finals student.

Do me a favour.

What exactly is motivating the volte faces I’m not sure but the stories Shapps and Sino are telling are simply lies.

Is there some early backside covering going on so that when it become socially acceptable to talk about the abject failure (and danger) of the ‘vaccines’, they will have got in early, and positioned themselves to be viewed as sceptics from the off? I am keeping my fingers crossed btw, because six months ago you would be pilloried for suggesting lockdowns were a bad idea, I am hoping that narrative creep re clot shots will appear.

“Is there some early backside covering?”

No, I don’t believe there is. The story is being changed but I suspect the apparent arse covering is part of the new story. Arse covering is too obvious.

Quite. Why didn’t these senior Cabinet members actually speak out against the lockdown fanatics and do something about it at the time? It’s rather reminiscent of post-War Germany where it was virtually impossible to find anyone who had actually been a Nazi!

Yep, they all voted for the measures, and the stab mandates.

No way back in my book. Never forgive. Never Forget.

Seconded.

MPs who:

Voted for lockdowns,

Voted for Net Zero

Clapped Zelensky

Deserve to spend the rest of their lives their lives in prison.

Now We Know What Insulate Britain Really Meanthttps://www.atangledweb.org/now-we-know-what-insulate-britain-really-meant/

by Niall McCrae

Yellow Boards By The Road …. for the love of humanity …

Tuesday 30th August 11am to 12pm

Yellow Boards

Junction Broad Lane &

A3095/A322 Bagshot Road

Bracknell RG12 9NW

Wednesday 31st August 11am to 12pm

Yellow Boards

Loddon Bridge, A329 Reading Rd,

Winnersh (Outside Showcase)

Wokingham RG41 5HG

(1 year, 1 week, 1 day from our first appearance there)

Stand in the Park Sundays 10.30am to 11.30am – make friends & keep sane

Wokingham

Howard Palmer Gardens Sturges Rd RG40 2HD

Bracknell

South Hill Park, Rear Lawn, RG12 7PA

Telegram http://t.me/astandintheparkbracknell

Ok, so there is the beginnings of an attempt to try to pin it all on SAGE.

It will be interesting to see if it results in a pile on or not

I’m so angry about what has been done to us over since March 2020 that I would very much like to see some of the people responsible for it mauled in a very bad way.

But I also keep reminding myself that scapegoating means many of those responsible get away with it and lessons aren’t fully learned.

I suppose if the choice is between SAGE getting all the blame, their careers, lives and credibility completely destroyed or nobody facing any consequences (like Iraq, or the financial crisis of 2007) then I guess I reluctantly chose the former. But very reluctantly.

Baby steps

When Johnson kept insisting he was “following the science”, it was obvious he was covering himself not his Sage handlers

Johnson wouldn’t know ‘science’ from a horoscope. Never underestimate how dumb he is. Not that that’s an excuse.

“there was of course no instruction manual for dealing with the first pandemic of modern times”,

Yes there was, at least there was a well established plan, which got chucked out the window on Day 3. I wonder what changed..?

Schapps never lets a day go by without finding a way into the news. Perhaps if he had time he could sort out the DVLA. No publicity in that? Oh, well, don’t bother.

Little squirt!

For normal industrial product development we’ve also got ‘scientists’ doing really clever stuff.

We filter them through a layer of engineers who are really good at risk assessment. “This proton stream powered car is brilliant but what if someone crosses the road behind it?”

The pandemic was completely lacking the engineer layer that protects the population. Instead we had scientists giving advice to Classicists who wouldn’t have a clue how to interpret or question the information.

“Classicists who wouldn’t have a clue how to interpret or question the information”

Not sure about that – I never got beyond O Level maths and I worked out this was all nonsense in March 2020.

Ditto.

same here.

As an enigeering-scientist, ‘hear hear’ Thing is with engineers, it has to work. That’s a pretty stubborn task master at times, at least one which can’t be ignored.

Absolutely perfect analysis. Thank you

Shapps with his traffic lights that hobbled the transport industry is a See You Next Tuesday.

“There was of course no instruction manual for dealing with the first pandemic of modern times.”

BS[1]

And several other similar documents that are hidden in plain sight.

The trick was to rename Covid as an unprecedented, unknown alien life form, and hence to assert that traditional management along the lines of influenza could not work. Coincidentally, or not, the WHO declared influenza to be extinct[2] when they launched the new Covid product.

[1] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/213717/dh_131040.pdf (2011) (especially section 4.15)

[2]

Funny how there were so many lockdowns when every politician was against it.

Funny how they kept completely silent in public about their opposition as well.

Sorry grant, too little too late. I was doing as I told is no longer a defense in court.

Just to be clear, this is the same Shapps who barely a year ago threatened people with 10 year jail sentences if they failed to declare having been in a COVID ‘red list’ country.