Each year, the Government publishes international energy price comparisons. The data is sourced from the IEA and covers industrial and domestic gas and electricity prices. The latest data for 2023 was published a few weeks ago.

The data covers 28 of the countries that are part of the IEA. The data for some countries, such as Italy and Japan, is patchy and charts containing so many lines are difficult to decipher, so the chart analysis focuses on France, Germany, U.K, Korea and the USA as well as the median IEA price. The commentary does discuss other countries when appropriate. All prices quoted include taxes.

Time to dig in to find out where the U.K. stands in the international league tables.

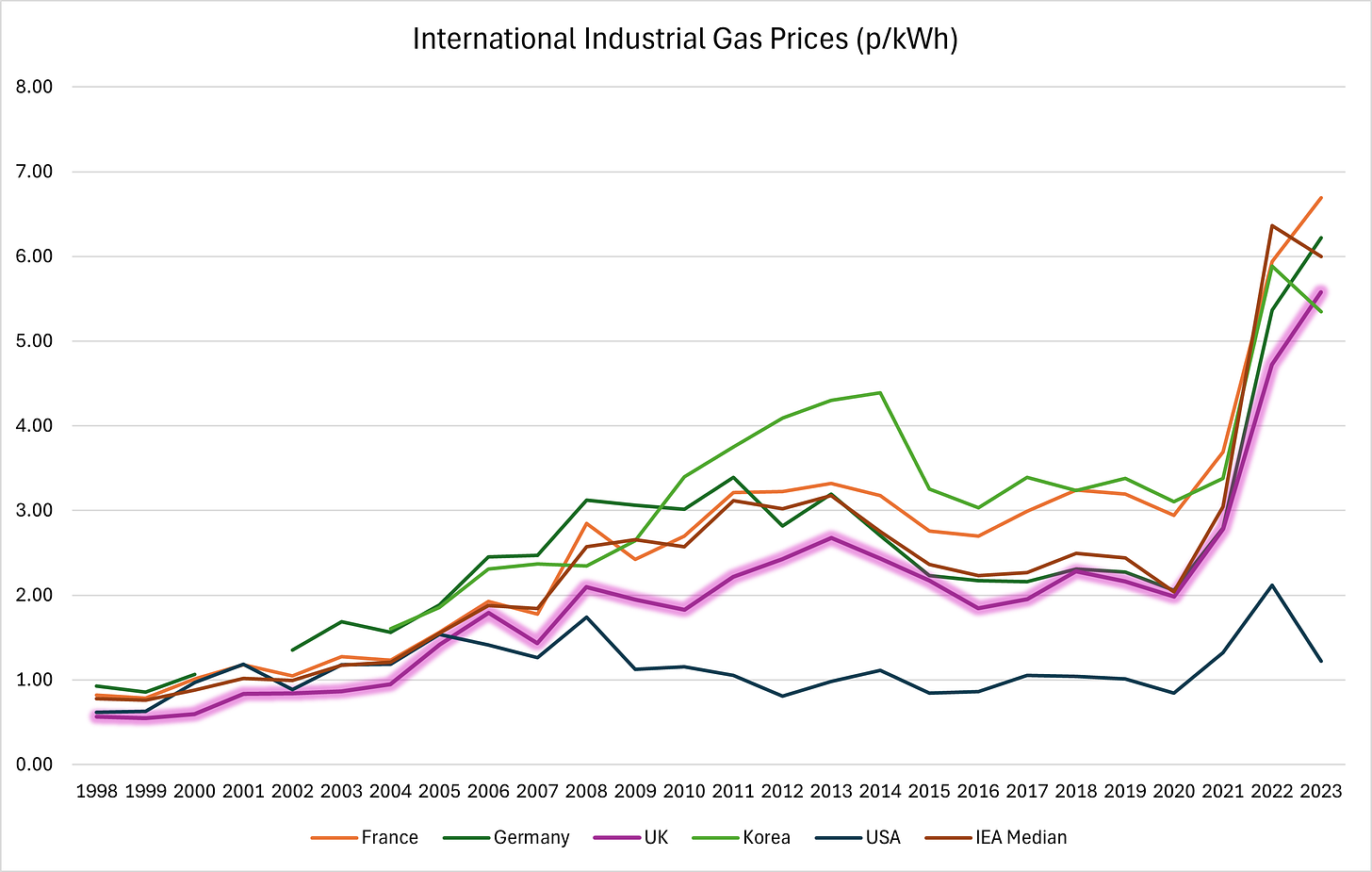

International Industrial Gas Prices

Starting with industrial gas prices (Table 5.7.1) as shown in Figure 1.

Gas prices for most of the world are at elevated levels and U.K. prices at 5.58p/kWh are some 7% below the IEA median. U.K. prices are about 17% lower than France and 10% less than Germany. The outlier in this analysis is the USA, with gas prices some five times lower than those in the U.K. Canada’s industrial gas prices are even lower than the U.S. and New Zealand’s prices are also very low.

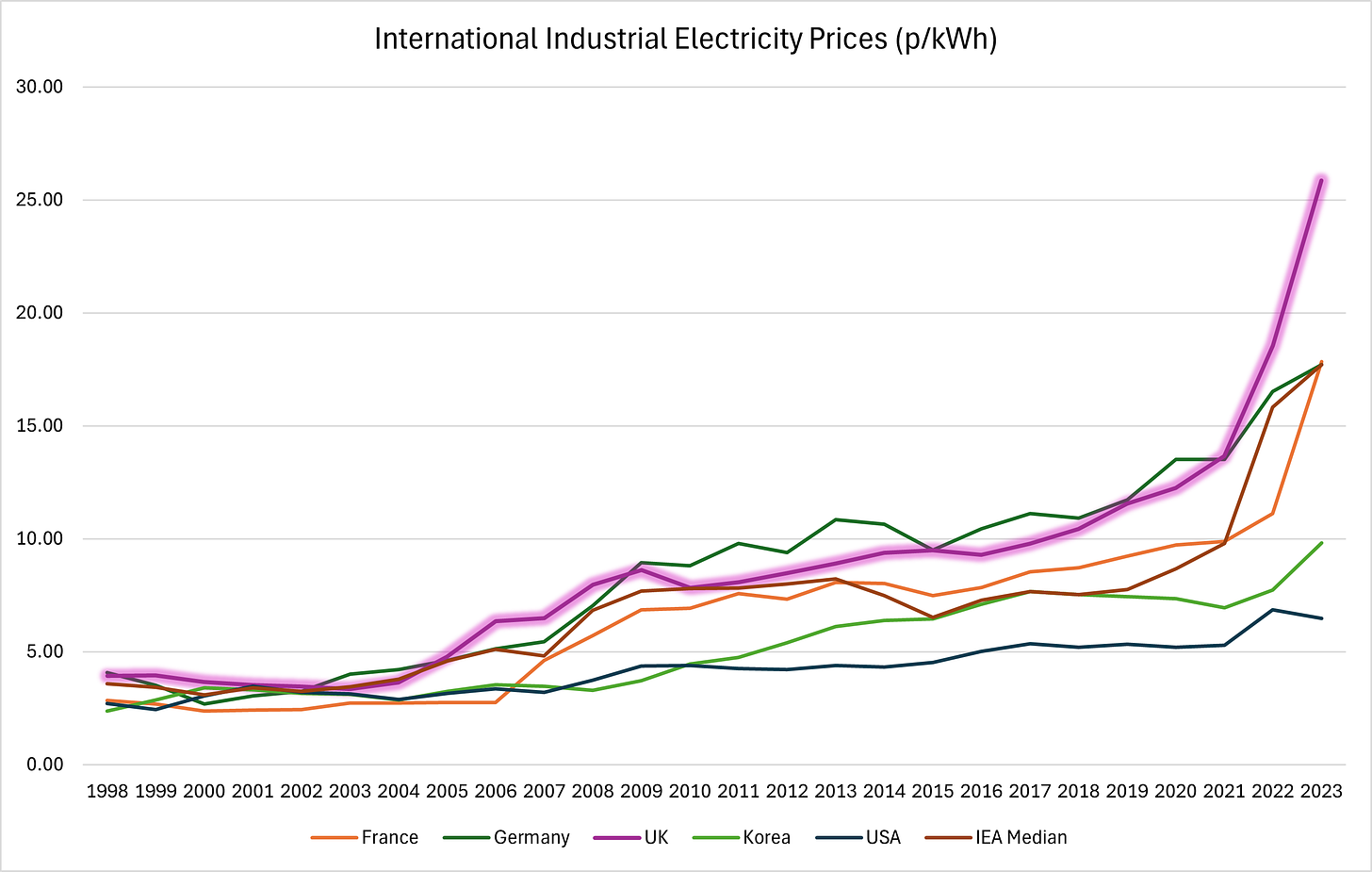

International Industrial Electricity Prices

The international industrial electricity price comparison (Table 5.3.1) is shown in Figure 2.

U.K. industrial electricity prices at 25.85p/kWh are the highest of the 28 countries covered by the IEA report. U.K. prices are some four times those in the U.S., 2.6 times those of Korea and 46% higher than the IEA median. Given that U.K. gas prices are below the IEA median and those of France and Germany, it cannot be gas prices that are driving U.K. electricity prices so much higher than elsewhere. Canada, Norway, Finland, Sweden, New Zealand and Portugal all have industrial electricity prices less than 10p/kWh.

We cannot hope to compete in traditional energy intensive industries, or industries of the future like making batteries or AI, with such extortionate electricity prices.

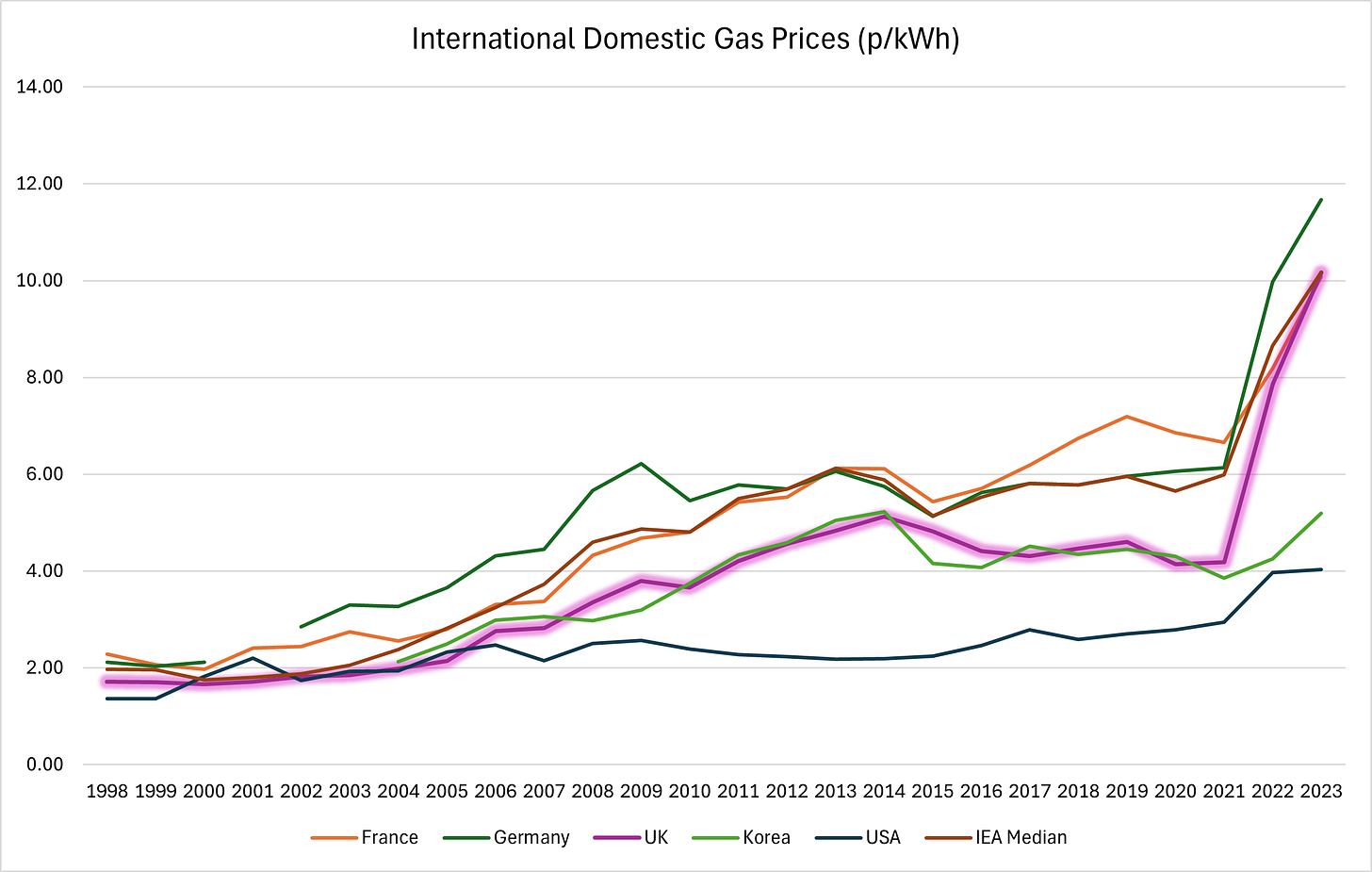

International Domestic Gas Prices

Domestic gas prices (Table 5.9.1) paint a similar picture to industrial gas prices as shown in Figure 3.

U.K. prices are at the IEA median of 10.17p/kWh, slightly above those in France and a bit below those in Germany. The price differential compared to the U.S. is less pronounced, but domestic gas prices in the U.K. are still 2.5 times those in the U.S. and roughly double those in Korea.

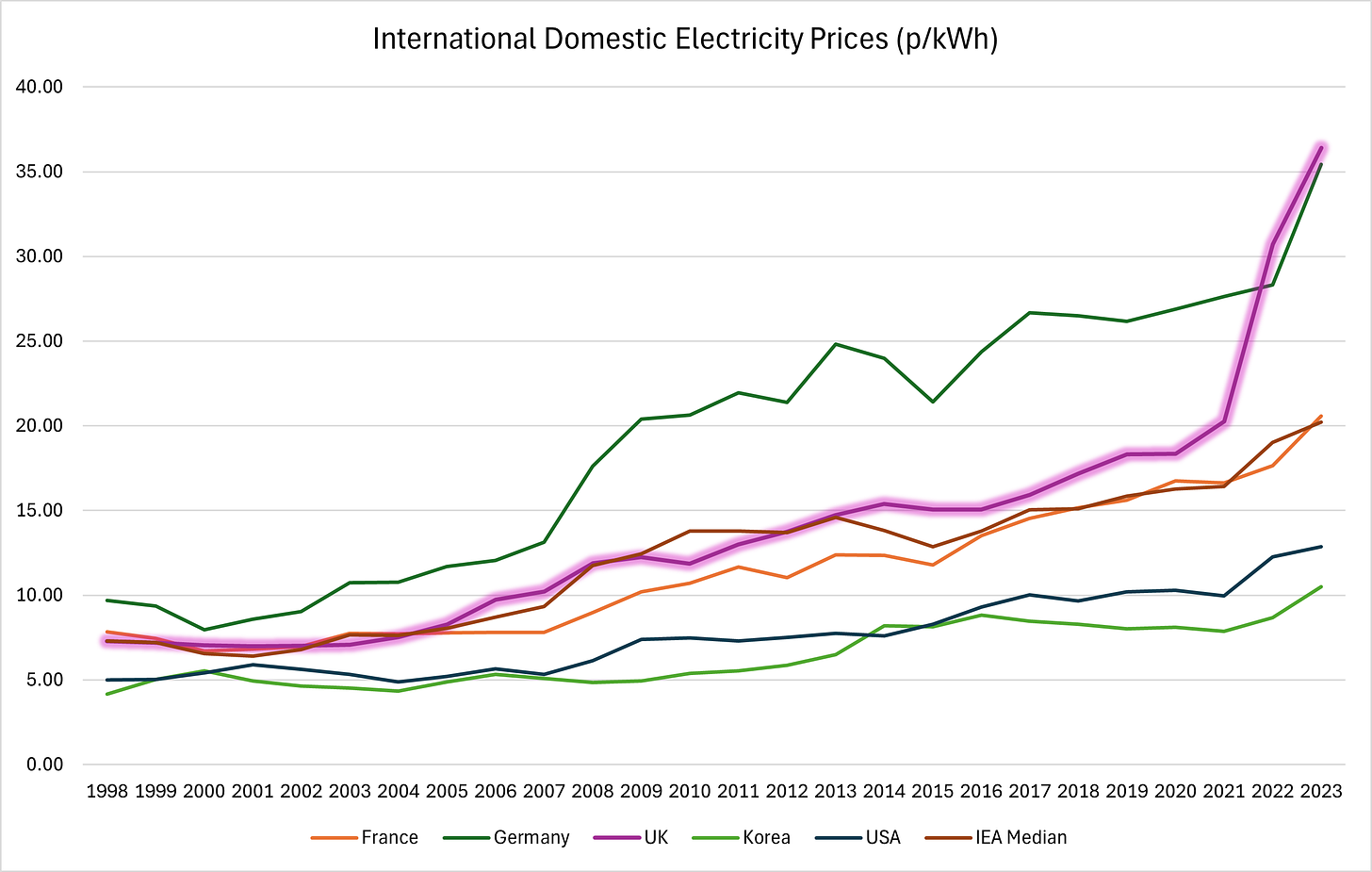

International Domestic Electricity Prices

Sadly, U.K. domestic electricity prices (Table 5.5.1) are even worse than industrial prices when compared to the IEA median, as seen in Figure 4.

At 36.39p/kWh the U.K. has the highest domestic electricity prices in the IEA, some 80% above the median of 20.22p/kWh. U.K. prices are 2.8 times those of the U.S. and 3.5 times prices in Korea. Prices in Germany are slightly lower than the U.K., with France’s prices just above the IEA median at 20.57p/kWh.

Conclusions

What are we to make of all this? When it comes to gas prices, the U.K. is reasonably competitive compared to the IEA median. However, there are many countries with much lower industrial gas prices, notably the U.S. and Korea.

However, when we turn to electricity prices, the U.K. is woefully uncompetitive in both industrial and domestic markets with the highest prices among the 28 countries covered by the IEA. This level of price differential is an existential threat to the economy. Moreover, with gas prices around the median level, it cannot be gas that is driving the U.K.’s electricity prices well above those of international competitors.

As discussed previously (here and here), it is the ~£11 billion of renewables subsidies, £4.6 billion of carbon taxes in the form of the Emissions Trading Scheme, £2.5 billion of grid balancing costs and £1 billion of capacity market costs that are driving electricity prices skywards. There is an extra £112 billion of transmission network costs in the pipeline to connect remote, intermittent renewables to the grid that will continue to push up prices.

Sadly, the Government has made a decarbonised grid by 2030 one of its five missions. Pushing even more renewables on to the grid is bound to increase electricity costs even further, crushing our competitiveness. This is in direct contradiction to Labour’s number one mission of increasing economic growth. As discussed earlier, these two missions are incompatible; we cannot have top tier growth with the highest electricity prices in the developed world.

Having the highest electricity prices in the world ought to trigger a national emergency response. The Government’s primary mission should be to cut energy prices because cheap energy is the key to unlocking growth. They should focus first on ending subsidies for renewables and cancelling any further auction rounds. This would stop the rot at source. Second, they should abolish the Emissions Trading Scheme to bring down the cost of gas-fired generation. The Government would then need to invest in new sources of gas supply by encouraging more North Sea drilling and lifting the moratorium on fracking. In the longer term, there should be a renewed focus on nuclear in the form of conventional reactors, small modular reactors (SMRs) and advanced reactors. These will need to be supplemented by gas-fired generation for the time being, until nuclear is able to respond effectively to rapid changes in demand.

We can but hope that reality dawns on the Government before the economy collapses under the weight of Net Zero.

David Turver writes the Eigen Values Substack page, where this article first appeared.

Stop Press: We’re going to have to wait a long time for reality to dawn because the Government announced on Friday plans to spend £22 billion of our money on carbon capture and storage which will reduce efficiency and push up the costs of gas-fired electricity even further. Will the last person to leave Britain please blow out the candles, because there won’t be any lights left to switch off.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

“Cheap energy is the key to unlocking growth”. Nailed it in one. Starmer’s net zero and growing the enconomy policies are bound to fail, and he is too stupid to realise it.

Why do so many people assume that bad things happen because of error, stupidity or ignorance.

I suspect the destruction of the UK economy is just what the current Labour government wants. With the ensuing poverty snd chaos they can more easily impose their authoritarian bell.

Exactly.

It’s essential for them to usher in CBDCs….

The final nail in our coffin…. Game over..

The complete control of one’s consumption and consumerism…

Good point

All communist countries had the same basic setup: impoverished population dependent on state handouts.

So why would Labour want wealth? It’s totally against their interests.

But on top of that ignorance and incompetence is also prevalent in these societies because party loyalty and ideological commitment is the essential quality of the cadre, not competence.

I agree, it is all part of a plan.

The detonation of our economy got underway with the lockdowns etc implemented by a mixture of treacherous and useful idiot tories – the unapologetic neo-maoist globalists that are now heading up the regime will be sure to finish the job of delivering the modern, western equivalents to China’s Great Leap Forward and Cultural Revolution that led to the deaths of some 40m people. Remember the mantra “build, back, better!”

Starmer is acting under orders from the Davos Deviants. He has been told to destroy this country and by God is he going to do just that.

Correct , nicely set up by Cameron’s continued new labour initiative with the traitorous baton handed by Sunak to Sir Kneel to finish us off !!

Pretty much —They don’t work for us. We are just a nuisance to the Davos Crew and we are to be fobbed off with wind and sun. Like it or lump it.

He’s doing as he’s told !

What chance that new electric arc furnace ever being built in South Wales while electric is 4 time the price here than in the US?

It will never be built. But Tata will still pocket our £500m

Tata has learned how to GRIFT

I wonder how much of the increase is down to massive inflation due to covid money printing – a fair chunk is surely? When you have to buy real things on the open market, like gas or oil that’s where the impact is felt. Looking at the charts a fair chunk must be, otherwise why is France so impacted as well with their very high nuclear base?

Buying oil or gas on the international market means a country will be at the mercy of global prices and speculators. However all fossil fuel extraction requires a licence so it must be possible for the government to attach conditions to the licence e.g. the oil/gas can only be sold to UK users/our grid at a maximum price that is fixed, and rises in line with inflation, for the duration of the licence. Unfortunately this type of licence may well be illegal under World Trade Organisation rules that exist to protect international trade regardless of the effect on a country’s economy or citizens as long as the multinational brokers make a killing.

Another piece of the China plan.

Kill off British industry.

Move what’s left of our manufacturing to China.

All faithfully enacted by Starmer and Milliband.

How is that Starmer, Miliband and the whole farce of a Labour Government can stand at press conferences and sit in TV studios claiming “renewables are now cheaper than fossil fuels” and go totally unchallenged? —-This is a bare faced lie. —–Renewables and fossil fuels do not perform the same task. It is like comparing a helicopter to a jumbo jet. —Renewables are part time diffuse energy that cannot provide base load. Fossil Fuels are full time concentrated energy that can. —–If Renewables are so cheap, why are we paying the highest electricity prices in the whole world? —–Whatever happened to all the FREE WIND?

We have to pay that much to subsidise it / back it up with something reliable… question is how can we get that message out in a clear and simple way? I agree the lack of challenge to their statements is downright scary

NET ZERO —–The Anti Capitalist witch hunt.

Might be worth energy-intensice industry in the UK buying the odd SMR.