The Daily Sceptic‘s top article on September 2nd was about Ireland’s racist SPHE1 schoolbook, a story broken by Gript.

Days later the Telegraph reported national outrage at the way Edco’s book pilloried traditional Irish families and values. And sure enough, the book’s been withdrawn and can no longer be ordered on Edco’s website.

I’m trying to get hold of a copy before they’re all pulped – a prime exhibit for the Museum of Woke one day. What lay behind this crude indoctrination of children, so repellent to Irish parents and teachers anywhere beyond the Dublin echo-chamber?

Some see the long arm of the EU’s Erasmus project, which started innocuously enough as a university exchange programme. Now, its 2021-27 budget is €26 billion and its pro-EU, anti-nation state propaganda even reaches down to Irish primary schools. Primary school parents, forced by slashed school budgets to pay for far more than just uniforms, notice this spending priority. Did Edco’s authors Anne Potts and Nodlaig O’Grady perhaps get a bit of help from Erasmus?

In their book, Family A (boo, hiss) is busy farming. Multi-racial Family B (yay!) seems too busy to do much work, with all its flying around swapping homes with foreign families and supporting foreign football teams. Curiously, no-one’s remarked, in the furore over the SPHE1 book, that Family A is doing its best to feed people and look after the land, while family B is burning up the planet: perhaps the authors found that too complicated, too mixed a message for children of 14 and 15?

So what, apart from meat and dairy goods, does Ireland produce? Visitors enjoy Ireland’s EU-funded motorways, with late-model cars buzzing around, coaches in plenty (the rail network is negligible) but hardly any trucks. Apart from distribution to shops, where are the goods? What supports this prosperity, now that last century’s waterfall of EU cash goes to later-joined and poorer countries?

Fintan O’Toole’s 2009 book Ship of Fools described the boondoggles and corruption of the Celtic Tiger years – his anecdotes are hilarious.

Much has not changed, though O’Toole’s writing has – for employment in Irish media only a particular point of view is allowed these days. But the Corporation Tax (CT) scam he described motors on.

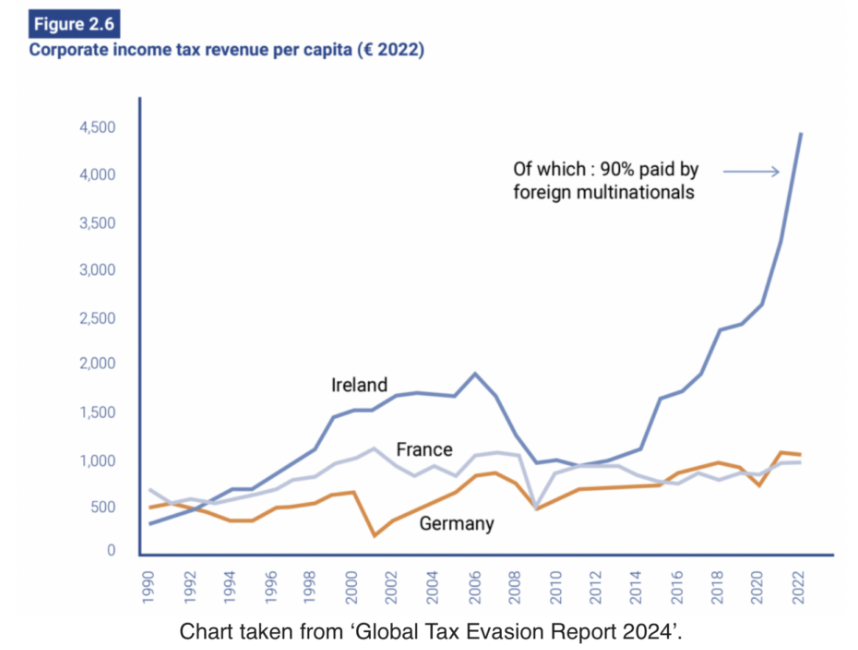

CT accounted for 27% of Ireland’s tax receipts in 2023, with net CT worth €23.84 billion, up 5.3% on 2022. The U.K.’s proportion was 8.7% for onshore CT, with oil and gas taxed separately. In Ireland, 90% of CT is paid by foreign multinationals, and over four times as much CT is collected per head than in Germany or France.

But it’s the rates of tax which really matter to multinationals, with their brass-plate “headquarters” in Dublin Quays (see Ship of Fools again).

For non-trading income (investments only) CT is 25%; normal CT is 12.5% (it’s 25% in the U.K.); and there was a special 6.25% rate under the Knowledge Development Box (KDB) for intellectual property. International pressure is squeezing the KDB loophole, so as Brian O’Doyle described in May for Jacobin.com, companies can use this impenetrable wheeze:

Instead of moving profits through Ireland, CAIA [capital allowances for intangible assets] encourages companies to move their intellectual property (IP) into the country. The value of intangible assets is more difficult to measure than traditional investment, particularly as companies normally produce those assets in one arm of their business and sell them to another arm through a nonmarket (transfer) price.

The core advantage of this scheme is that it allows tax deductions against the cost of IP [which] is extremely difficult to evaluate correctly. Indeed, as the accounting firm KPMG told some of its investors in 2017, the benefits are almost limitless:

A hypothetical company with an equity market capitalisation of €1,000 million, but tangible assets of €100 million can argue that the gap of €900 million represents its intangible asset base, which can be legally created and appropriately located . . . Ireland’s CAIA Programme enables these intangible assets to be turned into tax deductible charges.

Ever wondered how Starbucks U.K., to take one of many examples “paid a ‘derisorily low’ £7.2m in U.K. corporation tax last year despite making a gross profit of £149m on sales of £548m in Britain”? (Guardian, April 5th 2024).

A multinational’s brass-plate “headquarters” in Dublin, charging royalties and licence fees to “subsidiaries” in other countries as intellectual property, can take care of inconvenient profits and pay helpfully little tax. That’s if it hasn’t managed to negotiate an even better deal than 6.25%, as many multinationals are said to do.

Pundits on RTE were worrying last month about the USA’s move to “onshore” jobs. One of the principal things Ireland actually manufactures – so, real jobs – is pharmaceuticals. Now Americans of both parties are asking why tax-dodging Big Pharma pays Irish people to produce pills of which three-quarters go down American throats: bring the jobs home, and the taxes. No wonder Dublin’s worried. But the EU will likely go on turning a blind eye to the CT boondoggle, remembering how onside Ireland was in Brexit-wrecking negotiations, and now by taking in refugees. Though as a result of the latter, public services are badly stressed and the housing market’s going crazy again (see O’Toole for the last occasion) – serious trouble brewing there.

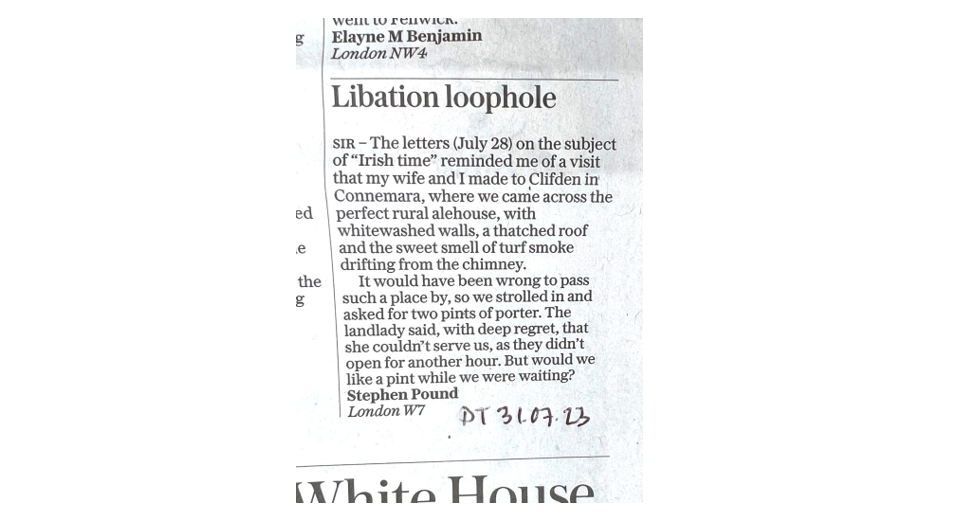

The old Ireland, with its famous welcome and scenery, is still there for visitors to enjoy (though perhaps not quite as in this Telegraph reader’s fond recollection).

Here’s a snap I took in Connemara in June, our local paper loved it.

Happily, although scams trundle on, many of the worst of the old ways are only a memory (Catholic Church, anyone? In the old days it was the Jesuits who did the indoctrinating). One of Gript’s readers, commenting below its article on the preposterous SPHE1 textbook, said that 60 years ago the Educational Company of Ireland, today’s Edco, used to distribute leather straps for beating schoolchildren.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

First take ze migrants, zen take ze bugs, zen rip out ze gas boilers, zen get on ze bicycles. —Ve have vays of impoverishing you and making you feel zo happy about it.

It’s not Ireland but look at this. Nasty, callous, treacherous b’stards! Damn right they need named and shamed. Zero budget when it comes to migrants, though, as if we need any reminders as to where their loyalties lie;

”Yesterday Parliament voted 348 to 228 to end winter fuel payments to pensioners. They were all Labour MPs.

Here is a video of every MP who voted for the measure. They deserve to be famous.”

https://x.com/DaveAtherton20/status/1833924307379945690

Knock all the green sh*t off the bills, then no need to bump up the allowances.

You ain’t seen nuthin yet Ron——Despite Miliband’s bare faced lies, bills are only going in one direction————UP UP UP——-Hey Miliband you are a f….g LIAR

I seriously don’t know how this feckin lot sleep at night.

We can all see Starmer sleeps very soundly.

He is not in the least careworn despite all the adverse exposure of the past two months and more.

He is loving every minute.

Take a good look at his face.

No empathy.

Compare Yvette ‘Allo Allo’ Cooper who is looking care worn.

Did you see the cheering when they won the vote? It was like England had just scored against Germany. Cheering because they have won the right to kill pensioners as indicated by their own study back when the Tories were thinking about removing the allowance, that said up to 4000 pensioners might die if the allowance was removed. ——Meanwhile migrants refurbishments including satellite TV will make sure the illegal aliens are nice and cosy this winter. I hope they chuck in a Netflix subscription as well since the poor vulnerable aliens should not have to be going without the latest films and TV series.

To be honest, I watched that clip a couple times and couldn’t detect cheers, only people shouting ”shame!”. But I see that after that decision was declared Lammy announced Ukraine needed a ‘few’ more million quid. Priorities…Anyone would think these sociopaths don’t have elderly parents themselves, but I guess freezing to death from hypothermia is just a working class problem;

”Wow. David Lammy just gave another 600 Million to UKRAINE. We are living in a clown world . Do you believe any of these clowns when they say they are fixing the foundations and can’t give heating allowances to pensioners.”

https://x.com/LeilaniDowding/status/1833928932367954398

There’s nothing wrong with living in the stone age.

Stone age peoples managed so we should be fine.

Anyone saying different do not pass go and go straight to the Scrubs for 18 months for being a Far White racist thug.

One of Ireland’s great charms and strengths is the Irish people.

Soon to be no more.

Bye bye Irishness and Irish people.

Maybe they need some dog and cat munching Haitians?

LOL.

PS. I have read numerous reports and seen a number of online videos saying this has been happening in Springfield Ohio the population of which was overwhelmed by an influx of 20,000 Haitians.

Maybe we should house some in the UK in Keir Starmer’s street or Angela Rayner’s?

I have the ideal place for Haitian criminals. —-No not prison. The Lion enclosure at the London Zoo.

The Government in Ireland recently signed up to the EU’s ‘Pact for Migration’, which makes migration into the EU continuous and permanent. The EU says that all member states must sign up to this pact and those that refuse their quotas will be fined a large sum of money.

Ireland is already swamped with migrants but they seem to want more. As their society continues to disintegrate it is likely to become like France with criminal trafficking gangs transporting migrants across the border into Northern Ireland. The UK is invaded from two directions.

There needs to be an emergency debate in the HoC about this issue.

We are not in the EU, allegedly, so why can’t we simply make companies pay tax on what they make here? Rules are made to be changed after all.

Any chance that Starbucks will give a warm spot and free coffee etc. to pensioners? We live in a poor world indeed when Labour MP’s cheer the fact they have succeeded in murdering Pensioners but do nothing about major companies making obscene profits.

It all depends on what the double taxation treaties say for legal persons domiciled or resident in a different jurisdiction.