On 5th December 2022 Western countries imposed a price cap of $60 per barrel on Russian crude oil. This was followed on 5th February 2023 with a price cap of $100 per barrel on premium-to-crude products (such as diesel) and a price cap of $45 per barrel on discount-to-crude products (such as fuel oil). One year on from its initial implementation, has the oil price cap been a success?

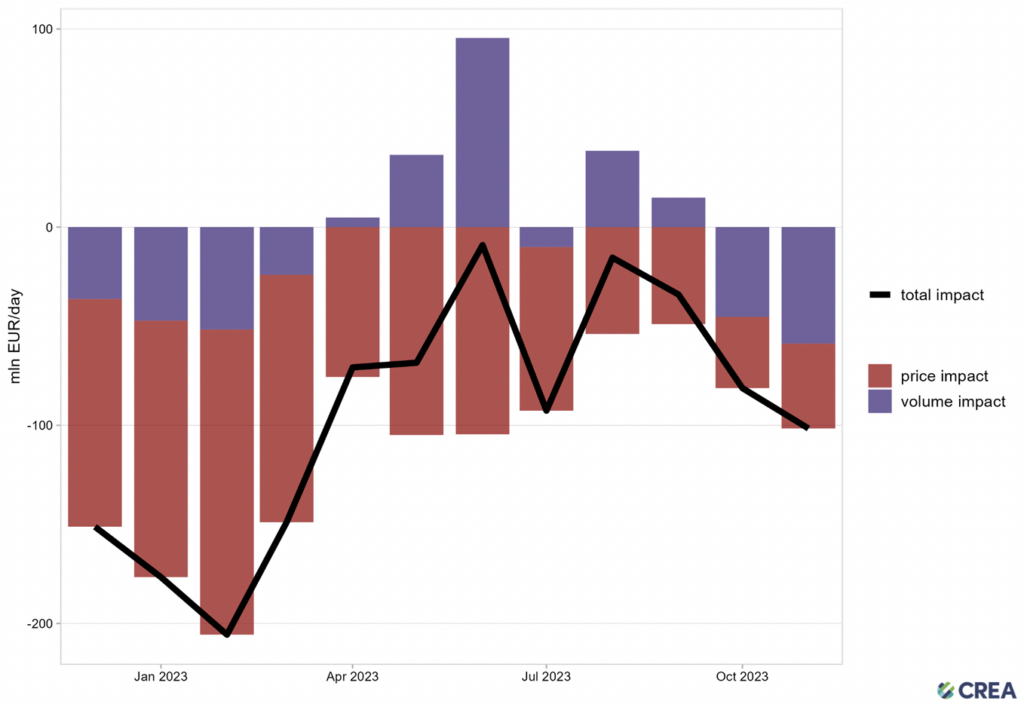

It appears not. According to a new report by Finnish thinktank CREA, the price cap has “failed to live up to its potential”. The report’s main finding is shown below:

The y-axis shows the change in Russia’s oil export revenues by month. As you can see, the price cap initially dented revenues quite considerably, up to a maximum of €200 million per day. However, the impact subsequently lessened, averaging around €80 million per day over the last six months.

Overall, the researchers calculate that Russia’s oil export revenues over the last year were 15% lower thanks to the price cap – not nothing but not enough to fundamentally shift the Kremlin’s calculus. In fact, from July to December, Russian Urals crude oil was consistently trading above $60 per barrel. And at the end September, it was trading above $80 per barrel.

Why has the price cap largely failed? For three main reasons, the researchers say.

The first is insufficient monitoring and enforcement. Recall that the price cap was meant to work by denying Western shipping and insurance services for any sale where the agreed price was above the price cap. Yet in October, when Urals was trading well above $60 per barrel, almost half of Russian oil shipments were carried on tankers owned or insured by Western countries – in clear violation of the price cap.

The second reason is the ‘refining loophole’, which I’ve discussed before. Countries like India, Turkey and Singapore have been buying up large quantities of discounted Russian crude, refining it, and then selling it on to Western countries at a profit.

The third reason is Russia’s increased use of ‘shadow’ tankers (those owned and insured in countries not imposing the price cap). Before the invasion of Ukraine, 13% of Russian oil was transported on such tankers. As of October 2023, the figure was more than half.

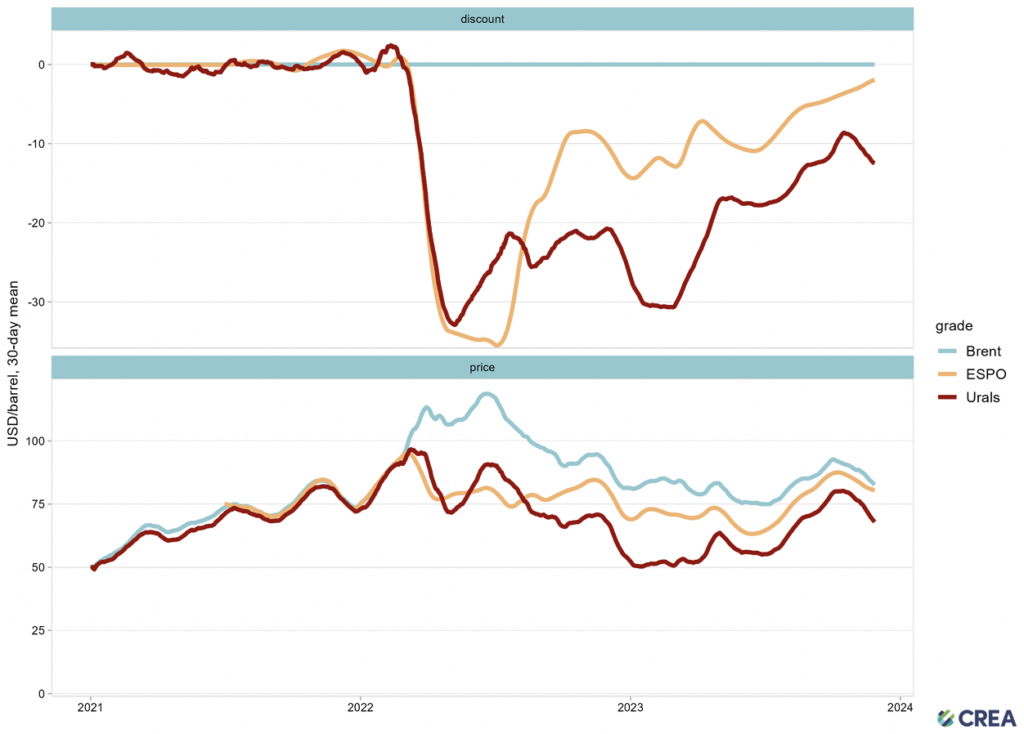

CREA’s report contains another interesting graphic, comparing the prices of Russian Urals and Russian ESPO crude oil to the price of Brent crude oil. (The top chart shows the difference between the blue line and the red and orange lines on the bottom chart.)

Interestingly, by far the largest fall in the relative price of Russian crude occurs around the time of Russia’s invasion and the announcement of Western sanctions. The impact of the oil price cap (the second dip in the red line on the top chart) is comparatively small. In fact, both Urals and ESPO have been increasing in price relative to Brent since February/March of 2022.

This suggests that the main reason Russia’s oil export revenues have suffered since the invasion began is loss of bargaining power due to the Western embargo, with the price cap itself having had relatively little effect.

Of course, just as Russia’s bargaining power fell when it lost its biggest buyer, Europe’s bargaining power fell when it lost its biggest seller. In the oil market, Russia has to sell at a discount because buyers know it has fewer outside options. And by the same logic, Europe has to buy at a premium.

Although Western sanctions have hurt Russia’s oil sector, the oil price cap has not had a major effect above and beyond the measures that were announced back in February/March of 2022. This may change if Western countries decide to increase monitoring and enforcement – at the risk of spiking oil prices.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Censor away, YouTube. All you’re doing is helping alternative platforms to grow and, anyway, the vaccine side effect horse has long since bolted.

The problem is that on those alternative platforms you are preaching to the choir. On YouTube there is a chance people might come across this content and it may change their opinion. But if everyone moves to an alternate platform, no one will see any of that content.

Sure, you can then discuss these issues freely, but what is the point if the vast majority of people see nothing other than government propaganda?

The algorithms are there to help prevent those less likely to ask questions from seeing this kind of content anyway.

Yes you’re absolutely right; however, at some point, you would think a tipping point is reached and the minority view becomes the majority one. And in the meantime, the alternative platforms need to up their game to meet the demands of massively increased user bases, which they must have gained over the past 18 months.

(although cynically, and defeating my own argument, I think they’ll have turned off the Internet as we know it by the time said tipping point is reached!)

Parler is the perfect example of this. It was killed off for becoming a free alternative to Twitter.

Those alternative platforms are at a major disadvantage when it comes to hosting infrastructure. When companies like Amazon, Google, Microsoft decide to boot them from their respective clouds, they have to basically build some very fundamental services themselves, which may be prohibitively expensive.

They dismiss us: irrelevant, misinformed losers.

Only if significant numbers from their MXM and YouTube start looking will they do anything.

We will learn more and more with nobody listening to us. Like talking to zn empty auditorium.

People will remember their censorship.

Unlikely. People have very short memories.

Well, what do you expect from a platform which encourages its channel owners to shadowban people for posting “wrong” comments – forever, with no recourse. Nobody expects to find any uncensored content on YouTube anyway.

unlikely most people get their information from the BBC and the MSM, they believe the NHS is good, and Politicians only have the people’s best interest at heart. Give them their weekly dose of strictly, a meal out in a pub and a 10 pounds value meal with wine from the supermarket and they will do anything.

We live in a free and open democracy. Isn’t it

wonderfuldoubleplusgood?Down the memoryhole it goes.

One could argue it’s a sign that the narrative is slipping away from them and they are having to double down

Youtube is likely to get totally banned very soon from Russia because it deleted its two RT channels in Germany. I suspect other countries are likely to follow – and good riddance too.

https://www.rt.com/russia/536133-zero-tolerance-youtube-censorship-rt/

Let’s hope so.

And there’s a fuckload of Republicans in the US who want to see the end of Google, Twitter and Facebook. They’ve made some very significant enemies!

Alphabet’s (agency) “advertising” tracking platform looks ever so like a spin off from internet surveillance.

It’s beyond me at this point why people aren’t mirroring all of their content to BitChute, Odysee & Rumble, providing links and encouraging the migration.

Dark Horse make a point of doing a short YouTube clip, like a trailer for the main show, which tells everyone where the full video is posted, eg on Odysee. A link can be found in the description and Bob’s your Uncle !

I’m pretty sure linking to other hosting platforms is against YouTube’s ToS.

I have abandoned youtube for exactly this.

If youtube wish to act as publishers pay the bloody taxes owed.

Utterly disgusting.

Nah. Why abandon it? Just get an adblocker.

I barely ever use it, having been a huge advocate for years. Full of ads anyway and sinister government sponsored messages it can fuck off!

These people took The jab and just look at how it improved their mental health:

https://twitter.com/i/status/1443216567118991368

https://twitter.com/i/status/1442968341048532994

That’s made my afternoon for all the wrong reasons!

Anyone remember a little known horror film from the 80s called “The Stuff”, and how the marketeers in it ran huge advertising campaigns to get people to take “the Stuff”? All this kind of reminds me of that!

I like it, trying to shove it down people’s arms in most ridiculous ways in combination with overreaching censorship will cause the most adverse reaction of rejecting all future pharma bs. It’s the same principle as with the crazy antivaxxers, all you need to do is let them scream loud and poke fun at them in order to gain public support for vaccination. Just in reverse.

High time a rival platform was set up.

“Bbbbbbbuuuuttttt MMR!!!”

Nice bit of whataboutery.

Matt Halprin… said vaccine misinformation was a global problem and had spilled over from the spreading of falsehoods about Covid jabs.

Hark, at them, they’re so threatened! What about the global problem of vaccine harm, injury and death, the highest of any vaccine programme ever??? Or the fact that these things DON’T stop transmission or infection??? This evil is being revealed to us more and more in all its vile colours. Go too far and even the normies will wake up – can’t have that now, can we?

THAT IS CLEARLY VACCINE MISINFORMATION YOU ARE BANNED!

As a normal person…just writing that gives me the shivers…these people have taken the money and lost their entire souls.

Lots of horror stories being reported at this website (restricted to medical professionals apparently, this is no “anti-vaxxer” site it’s owned by webmd):

“How concerned are you about adverse events related to the vaccines?”

https://www.medscape.com/sites/public/covid-19/vaccine-insights/how-concerned-are-you-about-vaccine-related-adverse-events

Actually it looks as if non-medical people may be able to post there, so I have some doubt, unfortunately I can’t now delete my comment. That’s not to say these reports aren’t mostly genuine however, and from the wording it does seem as if they are mostly reports from people with at least some medical knowledge.

Odysee, Rumble and telegram (which now offers live streaming) gain every time the deep state become more desperate.

For those wishing to host their own video’s on their own server – Peertube is an open piece of software. I’m running one myself on a virtual server ($5 a month job). This allows me to embed video on my blog.

Dear YouTube,

I hope you and your loved ones survive the experimental gene therapy.

That’s more charity than they deserve.

True. I ‘d just woken from a dream where Keir Starmer was an anti Vax leader of the Labour Party, and then I woke up.

Scared, aren’t tney?

They are not the only source of information, only a leading source of lies.

As a thought, for people who get a serious adverse reaction to the vaccine, why would they not sue Google as with this release it is clear they are consciously stopping them from getting potential warnings which may have influenced their decision?

I am not I’m law so not sure that would stand up but if you cannot go after the manufacturer due to government liability waivers may as well go after YouTube! Isn’t that the American way of law chuck lawsuits at everyone who can be linked at all and see what sticks?

Fair point.

Will they be blocking the videos of those who have suffered severe adverse reaction from the poison too?

THERE IS NO SUCH THING! THAT IS VACCINE MISINFORMATION, YOU ARE BANNED!

Nope…still gives me the willys to write that, even in jest! We are now in the time of the New Nazis.

So……if you were in any doubt about whether or not the Covid issue was a joint government-corporate stitch-up……

…..look no further than this extension of this egregious and fatuous censorship.

Do they think we won’t notice?

“My heart is broken.

I now have had confirmation of two U.K. teenage deaths post Pfizer.

A sixth form student in Solihull received the jab last week, suffered blood clots, a cardiac arrest and died on Monday.

A 17 year old girl from Braintree died in her sleep with no underlying health conditions just 24 hours after the jab.

I knew this day would come. I did everything I could to stop it and we all must continue to do everything we can. The best we can hope for now is to limit the deaths these weapons will cause

Our children deserve so much better. ”

”

On telegram, No idea if this is true, but if it is……

If only Toby Young would make some basic enquiries.

In reality, he appears to be a bit more of a mate of Boris and Gove than the people of Britain.

A 17 year old girl has died in France some days after getting the Pfizer jab. Here’s the sad story. Sofia Benharira: 17-Year-Old Student Dies 7 Days After Receiving The Pfizer COVID-19 Vaccine, Family Seeks Answers : The COVID World

Also Alderbrook School, Solihull, Birmingham

https://twitter.com/Mandy90375141/status/1442877019499294737

https://insideeko.com/adam-ali-death-obituary/

Although no evidence it was the vaccine wotdunnit.

By now I’ve read several of these reports of young people dying suddenly of basically nothing. It’s maddening that the press won’t ask the one question everyone is thinking: Was this person vaccinated? Is it possible the vaccination caused this death? The press won’t do its job – asking questions and obtaining relevant information – so really are these people really journalists? I don’t think so.

How many healthy 17-year-olds simply die in their sleep? If you are healthy and die at 17, you typically died in an accident, a drug overdose, suicide or had cancer. Most of these more common causes of death have been ruled out, which leaves …

Investigation: Deaths among Teenagers have increased by 47% in the UK since they started getting the Covid-19 Vaccine according to official ONS data

https://theexpose.uk/2021/09/30/deaths-among-teenagers-have-increased-by-47-percent-since-covid-vaccination-began/

19-Year-Old Ukrainian Student Gets Pfizer Vaccine Behind his Family’s Back, Dies Seven Hours Later

https://theexpose.uk/2021/09/29/19-year-old-ukrainian-student-gets-pfizer-vaccine-behind-his-familys-back-dies-seven-hours-later/

The policeman who murdered Sarah Everard got life imprisonment (and rightly so).

Meanwhile over 1600 have been murdered by the “vaccines” and now as predicted children too.

The perpetartors will get knighthoods and peerages.

‘Censorship’ eh? Why can’t ordinary people look at the facts and make their own interpretation?

For example, NOBODY is really dying of C-19 in Australia (or NZ)……but those numbers are changing. Why? Possibly, because medicine that people don’t need is being put into their bodies.

A bit of basic data analysis of numbers is handy.

Data I refer to is from here.

Info on Australia’s vaccination programme is here.

Over TWO winters, Australia has seen 1,278 deaths……..[NZ 27 after months with no change……..HK 213 an increase of 1 in about 8 months].

The ‘worst’ day of the pandemic in Australia was 3rd September 2020, when 22 people were taken – or at least had their demise subscribed to C-19.

In 2020, 909 Australians died of C-19.

In 2021, from 1st January to 30th June, 1 Australian died of C-19.

From 1st July, 368 Australians have been added to the list.

It was in June/July 2021 that the jabbing programme accelerated – particularly that of the second doses.

Since then, certainly ‘cases’ have absolutely rocketed, and after a short lull, the C-19 deaths began to occur again…….second jabs appear to be responsible for a rise in cases and deaths.

So help solve the conundrum, we need to know the age profile and health condition of the first 909 who died……and compare it with the next 369……..AND then look at how many of the second 369 were jabbed……we know exactly how many one the first 909 who died were jabbed – NONE.

The 1,278 Aussie deaths are comprised;

Vic – 856……….0 since October 2020, then the majority of all deaths since July 2021

NSW – 385…….0 from December 2020, then the majority of all deaths since July 2021

Tas – 13…………0 since May 2020

WA – 9………….1 since May 2020

Qld – 7…………1 since May 2020

SA – 4…………..0 since April 2020

ACT – 5………..1 since April 2020

NT – 0

Why is there such a big difference in deaths between NSW and Vic and the rest of Australia? Big cities? Maybe. Needs looking at.

In any case, relative to the rest of the world, the numbers of Aussie deaths are very, very low. The question should be ‘who is doing the dying’?

After all, if it was that ‘infectious’ or ‘deadly’, then surely scores of thousands would be dropping like flies…….especially after all the protestors in Melbourne mingling closely.

Australia’s response is one of massive disproportionality – and it is clear that human freedoms have been abused to a degree that is way out of kilter with the problem.

What is it that they are not telling us? Why are Berejiklian, Andrews, Hazzard & co. making threats and using the kind of language last heard in 1930s Germany, 1950s USA or 1970s South Africa? They are bullying the people, it’s not a good luck, and is never successful.

Lastly, England cricket captain Joe Root says he and his players won’t commit to the Ashes tour because of ‘bubble’ issues………perhaps he should also add ‘concern add human rights issues’.

Hmm, looks like they will have to block all health authorities that provide statistics about those adverse reactions then.

I think it’s time they renamed YouTube to GoogleTube to match their policies and content. GovTube would be also ok.

I’ve been looking at brandnewtube this year. Sometimes there are gems to be found. Vernon Coleman I liked at first, but it’s just more of the same now, and I liked the Rex Colt videos – but, again, once he’s talked about what the Covid scam is all about, what more is there to add?

Problem the brandnewtube is that most of the comments below the videos are nonsensical, or spam (“I make $30,000 from working at home”) and this reflects badly on the owner of brandnewtube who should, I think, get rid of the rubbish contents.

Many of the videos on bnt are just re-hashed copies of copies over and over again, many are badly made 11-second clips of nothing very much, and there’s a whole bunch of nutty religious ‘Mark of the Beast’ tosh. I’m not one for censorship but I think in the case of bnt a lot of ‘pruning’ is needed to make it look less tawdry.

Also the video ‘slider’ doesn’t really work very well at all.

I do agree that Google has become too big – and too nosey. Now they claim, after some years of my presence (Google Photos / Youtube videos I’ve made) that I’m under 18 years of age and want to see my credit card details as proof of age… to which I say: “I don’t think so!!”

Google has provided a useful, free service – but now they have become too invasive, and it is riddled with ‘faults’ where you can’t, for example, get rid of people who have invited themselves onto your photos account/albums – and you can’t log out of Google on your mobile phone. I have read about these issues, and it appears it not just me. Google is spying on you, no doubt about it.

“There is still a lot of challenges around MMR and people arguing whether that causes autism. And as we know, the science is very stable that vaccines do not cause autism,” he said.

Not so fast.

Try reading this then come back and talk about your ‘stable science’:

How to end the Autism Epidemic by J.B. Handley

The full pathway has now been exposed. It’s the aluminium adjuvants.

It’s noticeable that the separate vaccines have a much better safety profile than the combined jab. Do they not have aluminium then?

Earlier vaccines had mercury as an adjuvant, also no bueno.

What’s that quote by Tyrion Lannister in Game of Thrones? “When you tear out a man’s tongue, you are not proving him a liar, you’re only telling the world that you fear what he might say.”

Censor away. All they are doing is proving that they fear the truth coming to light.

“The further a society drifts from the truth, the more it will hate those that speak it.”

For me, this George Orwell quote says everything anyone needs to know regarding big tech’s censorship of the

truthmisinformation.Someone confident of their case isn’t afraid to argue it.

The Globalists are scared.

What will they do when they’ve cancelled all but themselves? Continue to cancel or stop?

Great to hear that a sharing service that allows people to watch ISIS at work, people taking a dump etc has decided that it is medically qualified to censor open debate on the vaccines, I assume that the VAERS and the yellow card system will be banned from being shown too. By a bunch of jumped up computer nerds who believe because they invented an App it makes them qualified to tell the rest of us, including Nobel prize winning scientists what to think and say. I wonder who they tied that little deal up with

I suppose this means that Mike Graham will stop speaking to Mike Yardley (I think that’s his name) on Talk Radio about the terrible consequences he suffered after taking the vaccine.

I sense this has already happened as the spate of calls taken relaying similar testimony has dried up.

No doubt they are looking to being taken down from YouTube if too much is made of it.

(And as MG has obviously been jabbed in order to be able to fly to the USA, he’s lost interest in the topic; many of the jabbed appear to acquire a form of deafness, probably as a defensive mechanism).

Trust the experts folks

Better get this out there then before we’re all banned!!

https://childrenshealthdefense.org/defender/safety-signals-covid-vaccines-full-transparency-cdc-fda/

If they say mRna SPIKE PROTEINS work, then that’s that.

The vast group wouldn’t listen anyway. Being part of a vast group run by powerful people is important to these people.

Facts mean nothing, can be trashed.

I wonder why we’d have to learn more on ‘ain’t it awful if it goes nowhere and if their ears are closed?

Maybe it would be time to move on.

Alternatively, videos debunking what will be on YouTube likely helps us. And how to do that.

MMR? My little niece’s life changed dramatically and irrevocably the day after the MMR. A happy, lively, tottering 13-month-old became a screaming mess who was unable to lift her body or use any of her limbs. At the hospital a health-visitor exclaimed “what on earth has happened to this child? She was perfectly all right a few days ago!”

But that was the last and only comment; everybody clammed up after that. Several years later the NHS made her long sturdy leather boots to strengthen her legs to enable to hold her body weight so she could stand up. After years of treatment, physio etc., she’s almost perfectly mobile.

But this sweet child is forever damaged; she is in a remedial class, what we used to call ‘backward’. That she is vaccine-damaged there can be no doubt, but it became another of the growing list of things we mustn’t talk about.

If we don’t stop these monsters, damaged humanity will become the normal state, lives unsustainable without buckets full of drugs and Big Pharma the benevolent, philanthropic leader who controls all. The nightmare is not around the corner; it’s already here, it slipped in while our attention was diverted and we are living it here, now, today.

That’s a horrendous story and there are probably many thousands more. My heart goes out to you, Lorrinet. I hope your niece gets to live a fulfilling life as much as she can. We are truly up against a monster. There has to be a way to defeat it.

So we have private firms that are omnipotent enough to define “the truth”.

Sounds like they have ambition to be an equivalent to the Roman Catholic Church of the Late Middle Ages.

What an arrogant and evil bunch of characters.