Net Zero policies are pushing up inflation and hitting economic growth, a top Bank of England policymaker has warned – though she does not see that as a reason to oppose them. The Telegraph has more.

Climate change policies including carbon taxes and emissions trading schemes risk raising costs for families as companies pass the extra costs on to their customers, said Catherine Mann, a member of the interest rate-setting Monetary Policy Committee.

Economists have found “that carbon taxes, public investments, and subsidies are all inflationary”, she told an audience at the University of Oxford.

Ms. Mann added: “Evidence has suggested upward pressure on inflation [and] downward effects on output.”

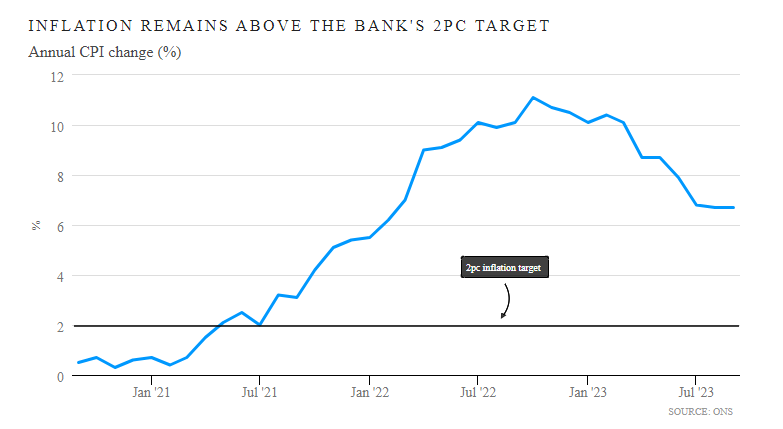

The warning comes at a tough time for the Bank of England and for British households, with inflation still running at 6.7%. This is more than three times the Bank’s 2% target. At the same time the economy is flatlining.

It comes after the Government rowed back on some of its Net Zero policies, delaying a ban on the sale of new petrol and diesel cars from 2030 to 2035. In September the Prime Minister also said he would delay the ban on new oil-fired boilers from 2026 to 2035 and increase grants for heat pumps.

The Bank of England itself has faced criticism for its focus on climate change, a move promoted by former Governor Mark Carney in departure from its traditional role of concentrating on interest rates and the state of the banking system.

But Ms. Mann hit back at this criticism on Monday, arguing the Bank’s interest in climate change and Net Zero policies is critical because they affect inflation.

“Not only is it within my remit to respond to the macroeconomic effects of climate change, but, in my view, my remit requires me to do so,” she said.

“When climate change has macroeconomic effects – whether physical impacts from extreme weather events and higher average temperatures or transition effects associated with transforming to a Net Zero economy, including explicit implications for inflation – it becomes a concern for monetary policymakers, directly within a price stability mandate.

“That applies whether the monetary policymaker’s remit includes a reference to climate change or not.”

Ms. Mann, who has consistently voted for higher interest rates than the majority of the nine-strong MPC, said Net Zero policies affect inflation as governments seek to push businesses away from established, but polluting production methods and into new greener methods.

But this means piling extra costs onto polluting businesses “presumably to be passed on fully or in part to consumers, which prompts the behavioural change needed to reduce emissions”.

Even if consumers themselves choose to buy less polluting products, the extra demand will push up prices until companies can boost the supply of the greener goods and services, Ms. Mann added.

Worth reading in full.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Wow so forcing ppl to use more expensive technology that works much less well than existing tech like ice cars and gas boilers is inflationary, who’d have thought. No one needs to go to school or even be on the MPC to understand something so utterly obvious. She might be on the MPC but she sounds a total NPC.

All the people pushing green crap are rich and won’t be much/at all affected by the damage caused by it.

We’ll all be affected when the financial system collapses. The greater one’s wealth, the greater one’s losses when it does so. Plus these wealthy folk have always bought in basic needs skills such as chefs, cleaners, gardeners etc & have no self survival skills.

These are the folk who need to be informed & opinions changed if more folk are to wake up to the real & present dangers which are coming. These folk will have influence.

At the moment they believe that their wealth will save them. It won’t. It didn’t in the Great Depression.

The history lessons are there if we choose to look at them.

Buy gold and plant some potatoes.

Land & seeds for food production will be worth more than physical gold.

And doesn’t Billy-boy know it. Land-hoarding on a huge scale.

Even the Daily Mail are reporting on that. Don’t over do it boys, people will call you conspiracy theorists!

Maybe, though my fear is it’ll end up looking more like some 3rd world country – rich people in 3rd world countries seem to get by OK.

Depends if they can hide their loot, depending on how bad things get.

A Crossbow, Tarpaulin, gas canisters and dried food etc might save them. With a Crossbow, you can reuse the bolts even if you have to yank then out of someone’s skull.

As long as they have somewhere to hide, what a thought!

At the same time it is surely de-inflationary to have people spending much more on energy meaning they have less money to spend on other things.

Nominative determinism.

Another ‘transwoman’.

Cheap shot; but we have little else to use at the mo’.

At least Ms Mann is being honest about the financial implications of going green. I could not accuse Mr Mann of being honest in any way.

Which is to say: the policies are doing exactly what they are designed to do, to impoverish and immiserate the populations of the industrialised West because “global equity” or “social justice”, or something. ‘Saving the planet’ was always just the cover story to return us (not “them”, with their private jets and Zil lanes) to lives of feudal servitude: nasty, brutish and short, as the man said. What do they imagine will happen when mass populations grasp that they no longer have anything left to lose?

Carbon taxes on all stages of manufacture, transportation, retail and use, trebling electricity costs via subsidies to wind/solar, is driving inflation?

Who would have thunk it?

Well since we don’t have a Government we have Play School, certainly not the goons in it.

Net Zero great leap backwards

leaflet to print at home and deliver to neighbours or forward to politicians, media, friends online.

Obviously more inflation means fewer souls in the short term and in the long term it will induce health deterioration amongst most people especially in climates such as ours. They kill you instantly or they shorten your life. If that isn’t cause for action then I don’t know what is,.

Buy stocks in Guillotine manufacture. There’ll be a huge demand in 20 years. Are you listening Parliament?