The crisis at NatWest has deepened after a profit warning sent shares in the taxpayer-owned lender plunging and the City watchdog launched a review into its handling of the Nigel Farage debanking fiasco. The Telegraph has more.

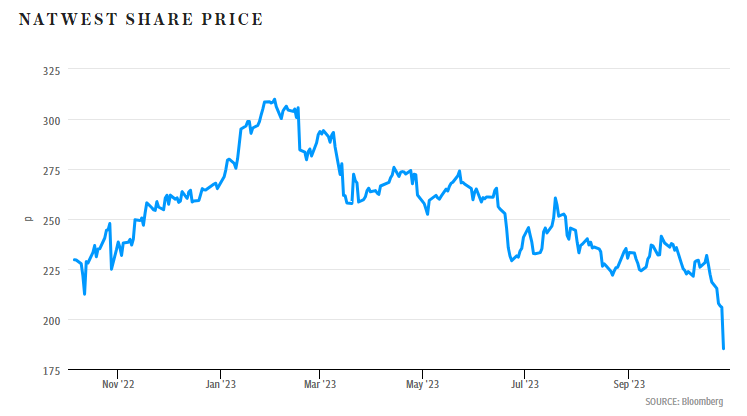

Shares in the high street bank fell by as much as 18% in early trading on Friday – their biggest same-day drop since the result of the Brexit referendum was revealed in June 2016.

It came as NatWest reels from a row over its decision to close bank accounts held at Coutts by Mr. Farage, the Brexit campaigner turned GB News presenter.

On Friday, the pressure ramped up further as the bank slashed its profit margin guidance and the Financial Conduct Authority said it was opening an investigation into the handling of the Farage scandal.

Richard Hunter, of Interactive Investor, said: “The market is taking no prisoners in this reporting season and NatWest shares have again been pounded in opening exchanges.”

Once again: go woke, go broke.

Worth reading in full.

Stop Press: Gordon Rayner sets out the “laughable” discrepancies in the Farage debanking “whitewash” review by law firm Travers Smith.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

40 % owned by the taxpayer. I hope they go teats up and that people move their money elsewhere. Their actions are criminal, immoral, if not illegal. Nigel for PM.

People just need to take their money out. That will do everything that’s needed. Don’t need any stupid “investigations”.

Might end up being a lot more than 40% if it goes bust after a bank run, along the lines of the Northern Rock one in 2008.

Share price drops, taxpayers are ripped off for millions. How so bloody predictable. Insider dealing? Oh, it couldn’t possibly be so.

Given the utter necessity of having a bank account unless you are very enterprising or belong to a subculture (certain ethnic groups prefer cash transactions as well they should) I think you could very easily make a legal argument to say that a bank account is a protected right and should be protected by law and that ‘debanking’ as it is called should be ruled completely illegal without the writ of a judge and a criminal conviction.

Contagion is affecting all banking shares…Time to buy, but NOT NatWest, on principle!

Is it just me or does Alison Rose look like Heather Hallett’s sister……

All part of the same British establishment self gratification fest.

Get those tumbrils warmed up……

Write to your MP and demand that Rose’s outrageous golden handshake of £11.3M is revoked. Crime doesn’t pay, or does it?

I don’t have a personal Nat West account to close.

I am, however, Treasurer for a Not-for-Profit ….. and am in the process of switching our bank to Lloyds.

The arrogant lefties at Nat West need to be punished. Every little helps.

Didn’t the FCA already conduct an investigation by asking Coutts/NatWest whether they believed there had been any improprieties (and then taking the answer as the truth)? Are they now saying that they will conduct a real investigation?

Directors have a duty to enhance shareholder value. 40% taxpayer owned. Why isn’t the Government suing NatWest directors on behalf of we stockholding taxpayers, for breach of fiduciary duty in that it has failed to enhance shareholder value and done the reverse?

As the tax payer was forced to prop them up the last time their shares took a dive how is this time good as surely we will be stuck with the bill again?

So in this case it’s “go woke go running to the treasury for more of a bung, again” unless our PM gabs it by the neck and says no more and I doubt that he will.