Banks face losing their licence if they discriminate against customers based on their lawful political beliefs under plans being drawn up by the Government, according to the Telegraph. Louisa Clarence-Smith has more.

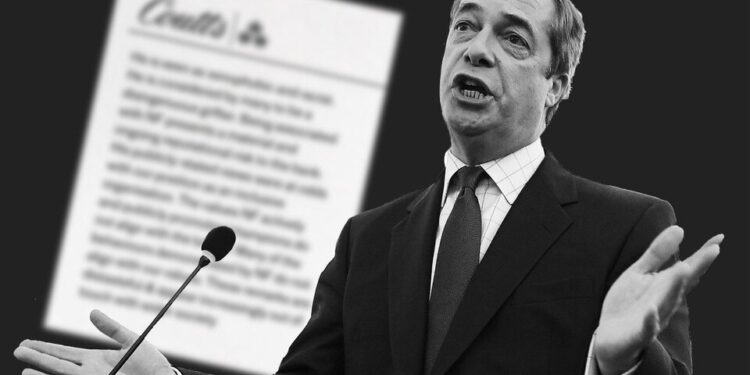

Ministers have ordered officials to start drafting legislation to give banks new free speech duties after it emerged that Coutts bank had closed Nigel Farage’s accounts because his views did not “align” with its “values”.

Andrew Griffith, the Economic Secretary to the Treasury, has asked civil servants to explore adding free speech protections to banking licences, according to Whitehall sources.

The move would mean that any bank which discriminates against a customer because of their political beliefs could have its banking licence revoked.

Separately, payment service providers will be told as soon as Thursday that they must not discriminate against customers on the basis of belief, the Telegraph understands.

The Treasury is preparing to enforce it by strengthening the Financial Conduct Authority’s ‘Principles for Business’. Principle Six, which states that “a firm must pay due regard to the interests of its customers and treat them fairly”, will be updated to refer to political beliefs, insiders said.

It will also say that banks must give three months’ notice of services being terminated and due notice must be given to enable appeals.

The changes are expected to be announced as early as Thursday as part of the Treasury’s response to its payment services regulations review.

It comes after Rishi Sunak vowed to “crack down” on banks removing customers for non-commercial reasons on Wednesday amid a growing backlash against Coutts and its parent company NatWest.

David Davis, Conservative MP for Haltemprice and Howden, branded Coutts’ decision to de-bank Mr Farage as “a thinly veiled political discrimination, a vindictive, irresponsible and undemocratic action”.

He told the Prime Minister in the House of Commons that the banking licence of NatWest should be in jeopardy over its handling of the scandal. He asked Mr. Sunak to order banks to disclose to the Treasury all of the accounts they have shut down for non-commercial reasons.

In response, Mr. Sunak said: “In the short term, having consulted on the payment service regulations, we do intend to crack down on this practice by tightening the rules around account closures.”

The Government began working on reforms for payment service providers earlier this year, after the Telegraph revealed that PayPal, the U.S. payments company, had been accused of shutting down accounts for political motives.

PayPal temporarily shut down the accounts of UsForThem, the parents’ group that fought to keep schools open during the pandemic, and the Free Speech Union and its founder Toby Young without any clear explanation.

It later reinstated the accounts following a backlash from MPs.

The company said it was a “strong supporter of freedom of expression and open dialogue”.

Other groups which had their accounts shut down by PayPal last year included Left Lockdown Sceptics, which describes itself as a “socialist collective” opposed to Government lockdown measures.

Worth reading in full.

Stop Press: Nigel Farage is demanding an apology from the BBC for reporting he lost his Coutts account because he didn’t meet the bank’s financial thresholds.

Stop Press 2: Watch me interrupt my family holiday in Majorca to tell people about this important victory for the Free Speech Union, which has been lobbying the Government to do something about ‘de-banking’ for nearly a year.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Are Saudis still the good guys to do business with after Russia is sanctioned? confused

With “allies” like those, who needs enemies?

Saudis be like: ‘what is the west going to do, ban our oil after it already banned Russian supply? Let’s just sentence this woman to million years in jail’

I don’t understand why anyone wants anything to do with the place.

I don’t even know why any Westerner would want to holiday or live in Dubai. It’s bad enough being exposed to the stark contrast in cultures at Dubai Airport! Seeing women in black with not even their eyes or hands exposed being towed along by their keepers on an invisible leash doesn’t exactly make me all warm and fuzzy towards such places or the culture.

Seeing women in black with not even their eyes or hands exposed being towed along by their keepers on an invisible leash doesn’t exactly make me all warm and fuzzy towards such places or the culture.

Saudi is just next level misogyny in my opinion.

Indeed

Neither do I. I visited Bahrain, UAE, Qatar and Saudi often in the 1990s. Why we want anything to do with these people is beyond me. Oh yes, oil and gas. The sooner we can wean ourselves off THEIR oil and gas the better.

At this rate Saudi will become just as bad as the UK and USA.

I feel very sorry for this young woman but having got out of Saudia she should have stayed out. This is the medieval society which will be our future unless we stop the damned Reset.

Indeed, that is where the Great Reset will ultimately lead. Which interestingly makes them rather strange bedfellows with the neoreactionary nutters as well.

It is euphemistically called “archaeofuturism”. The worst of medievalism and technocracy rolled into one, basically.

Behold, our “ally” from hell, Saudi Arabia.

Recently, some woman from Germany twittered about the German idiom Schwein gehabt haben (literally to have had a pig, meaning is You were really lucky here). According to her opinion, this saying ought to be outlawed because would clearly be a microaggression targetting muslims who were a progressive force in society.

It’s nice to experience this progressive force in action.

If that’s what they consider “progressive”, I’d really hate to see what they consider regressive!

I generally take the view that regardless of what we think, the laws of the land are the laws of the land. If you take them on then you know you risk a substantial penalty. I’m no fan of Saudi, but at a time when our freedoms are being taken away, I feel that we should put our efforts here. We should sort out the authoritarian mess in our borders and on our doorstep before lecturing others on how to live.

34 years old and a student??

Why on earth would you go back to Saudi for a holiday?

Looking forward to hearing the hypocritical “guardians of free speech” in our Parliament condemning the silencing of dissent by Saudi officials.

There’s nothing quite like a bit of Parliamentary Hypocrisy to start the day …..