The wholesale price of natural gas in Europe started rising above its historical average in the summer of 2021, around the time that Russia began reducing gas pipeline exports. After reaching a level 2000% higher than its historical average in the summer of 2022, it then fell dramatically. The price is now only 30–60% higher.

Yet bills for households remain well above pre-crisis levels. As of July 2023, the typical U.K. household will pay around £2,074 per year for energy – almost double what they were paying in April of 2021. What’s more, the thinktank Cornwall Insights predicts that household energy bills will not return to their pre-crisis levels until the end of the decade “at the earliest”.

How can this be? Wholesale prices of natural gas are way down from their peak, and are now only slightly above the historical average. Why are energy bills set to remain elevated until at least 2030?

The main reason is that energy bills aren’t determined by current prices; they’re determined by the prices wholesalers paid in the recent past. And over the last two years, wholesalers have paid an absolutely huge amount for gas. Just how much?

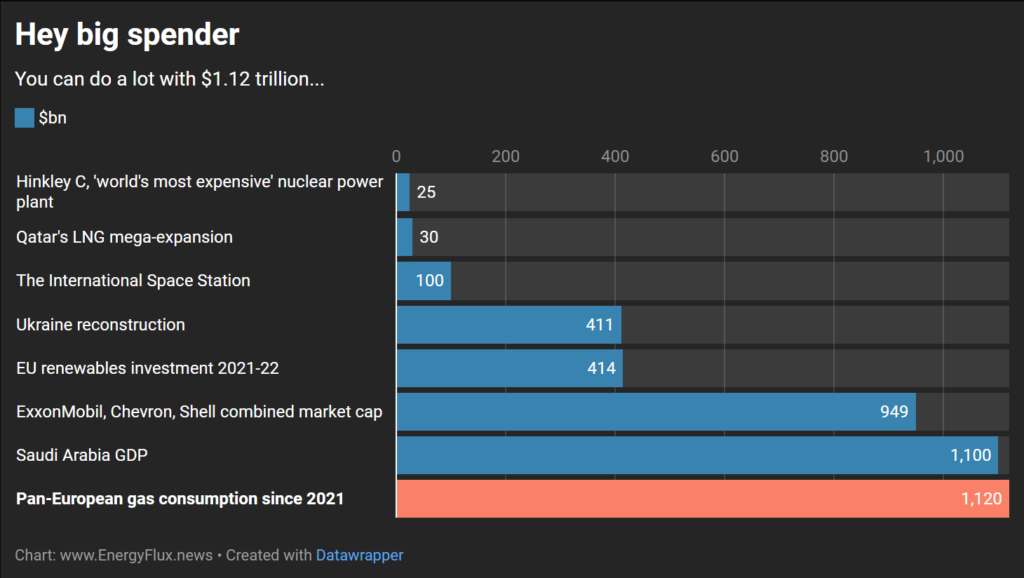

Seb Kennedy of Energy Flux estimates that since 2021, European energy firms have spent around $1.1 trillion on gas. This is about equal to the amount they spent over the ten years between 2010 and 2020. What’s more, gas consumption has actually fallen since 2021 (which helps to explain why the wholesale price has come down) so the rise in expenditure comes entirely from an increase in price.

Kennedy admits the figure is based on a “simple calculation” and therefore has a “high margin of error”. But he believes it’s “in the right ball park”. (Note that he includes the UK, Turkey and Ukraine as part of Europe.)

Here’s more or less what happened. When gas prices spiked in the summer of 2022, European policymakers panicked. Fearing there would be shortages in the upcoming winter, they told energy firms to buy up huge quantities of LNG – with the goal of refilling gas storage. And while they succeeded in refilling gas storage, the cost of doing so was enormous.

The chart above puts the figure of $1.1 trillion into perspective. As you can see: it’s bigger than the GDP of Saudi Arabia, more than twice as big as the estimated reconstruction costs for Ukraine, and more than 44 times bigger than the cost of Hinkley Point C – the world’s most expensive nuclear power plant.

“The rush to fill underground gas storage facilities at the height of the market was understandable,” he notes, “but the costs were apparent at the time, and governments put consumers on the hook”.

Since the winter of 2022/23 passed largely without incident, it might appear that European policymakers “solved” the energy crisis. But what they really did was hide the costs. You can’t a spent a trillion dollars in two-and-a-half years and expect there not to be consequences. European citizens will be paying off the debt for years into the future.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

Since when has it been “shameful” to call upon people – any people – to stop killing?

Obviously never, but it is a bit silly to ask either protagonist in this instance, as Mr Harris explains in his article.

Thanks Ian.

There was a ceasefire, Hamas broke it with rockets and mass slaughter. Fuck around, find out.

“There was a ceasefire”…..there have been literally hundreds, and Israel, on average, has broken more of them than Hammas…so that doesn’t fly….

You certainly are Green. What you’re not, is there.

It isn’t to the vast majority of people in the world..that’s why people who think it is are on the wrong-side.

Everytime the right people are killing the wrong people. Which people are precisely the right and the wrong ones entirely depends on where you’re getting your news from.

True I guess but perhaps what is “shameful” in this case is not the call per se but the possibly self-serving and dishonest motives.

And Andy Burnham and the rest?

Andy Burnham? What has he said?

AB called for a ceasefire.

I don’t like Khan. But I’m alarmed Will Jones – a Christian – can add such a misleading title. A ceasefire would be humane after 3 weeks of carpet bombing.

Ah I see

I don’t know much about Andy Burnham

Let’s say there’s a ceasefire. What should Israel’s next move be?

Since asking folk to stop killing other folk gets in the way of the plans of a billionaire family….??

Interesting read from Mike Yeadon on his Telegram – the information is presented as screenshots so you best you read the post for yourself: https://t.me/robinmg/31312

Was he calling on Hamas not to kill? Always with these virtuous ones the timing of their call to ceasefire is after the aggressor has done some killing, never before it. A ceasefire always benefits the aggressor or instigator never the victim of the aggression who are supposed to take it on the chin each time and never respond. ——–If the allies have had this approach, we would never had bombed Dresden after the Germans had bombed Coventry because we should have “stopped killing”.

Coventry suffered a single, fairly small-scale (the Germans had no heavy bombers at that time and never had any in large numbers) bombing raid in 1940 which was really targetted at various factories producing military goods. Dresden was targetted by a series of large bomber attacks by English planes at night and American ones during the day from 13th – 15th of February 1945(!), when both the facts that the Germans had lost the war and that mass-killing of civilans by nightly firebombing hadn’t had any effect on that were amply clear. Dresden was an open city without any military useful factores and stuffed with refugees from the east by that time. One of the official motivations for the attack was reportedly Show the Russians what bomber command can do. As usual, the inofficial motivations where English bloodlust and the mad desire to burn down irreplacable cultural monuments. That’s why they were rightfully called the Huns … waitasec, that was what they called others because of this.

But judging from the news so far, you can at least pride yourself that both your allies during the first world war and the foreign invaders you deposited in their country to thank them for that are worthy disciples of your teachings as they also interpret warfare mainly as an opportunity to massacre non-combantants, these being easier targets then soldiers, anyway.

PS: The Frauenkriche in Dresden has meanwhile been re-erected and it has a golden cross on its top paid for by money collected in Coventry.

I respect your knowledge about everything German, and I have told you that before, but Coventry did suffer the most concentrated attack of the second world war on 14/11/1940. —-However that is not really the point here and I kind of guessed you would spend time on the German aspect of my comment rather than how my comment pertains to the current situation in the middle east.

We weren’t occupying Germany though were we.

You are supporting terrorists rather than a democracy. I would watch that bowl of cornflakes your munching on this morning as they might be bit tainted. But then again it’s all down to personal taste isn’t it?

Only when you’ve lost all humanity.

Why does this man have huge bags under his eyes?

It clearly isn’t from hard work……….

He has cried too many tears of righteousness and virtue.

It’s because he’s an egregious little creep who is a bad excuse for a human being. Human excrement made flesh!

Shoe other foot and the Israelis were underdogs Khan wouldn’t say a word if every last Israeli were slaughtered. On the other hand, the Hamas attack was allowed to rage for 7 hours before an appropriate response was mounted, stinks to high heaven.

I too am simply unable to wrap my head around the apparent fact that the most technologically advanced, most heavily guarded, militarised and monitored border in the world could not have seen it coming. Just wondering, you know. Something is not right… I agree.

Reminds me of the US air defences failing completely on 9/11.

I think a lot of “US air defences” were quite lax prior to that. As a tourist over there, I can remember lots of of occasions which left the door open. Literally so, on many domestic flights, with the pilot’s cabin door being left wide open. I can also remember being a passenger on a helicopter trip in New York on which we did a a trip around Manhattan – below the top of the old World Trade Center . That was in 1994. They probably don’t allow things like that now (around other buildings).

That said, the current practice of locking the pilots inside did have a side effect, in the Alps a few years ago, when the co-pilot deliberately crashed the whole lot in the mountains. So that was a side effect.

The US sir defences were lax indeed. I remember flying out of Newark airport in ’97 or ’98. As my carry on was going through the machine, the girl who was supposed to be looking at the monitor was chatting to someone next to her, head turned completely away from the screen, and at no point did either of them look at the screen. I remember thinking at the time that I could easily have had a gun in the bag and would have been able to carry it on board with no one knowing. I was not surprised when I heard the 9/11 planes left from Newark.

Also, back then there had been hijackings of planes, but these never involved using planes as missiles but rather going to Cuba or getting hostages.

US commercial aviation passenger security checking before 9/11 was the same as getting on a bus or train in the UK, non- existent. The plane hijacks by the Palestinian gangs did ensure luggage was checked across Europe, especially by El Al.

I’m talking about the USAF.

How quickly do you think the US air defences should have been able to respond?

The two flights that hit the Twin Towers took off from Boston at 7:59am and 8:14 am and they hit the Twin Towers at 8:46 and 9:03. Ground staff were first notified of a hijack at 8:19.

Mainstream media and the authorities are very down on conspiracy theories (that’s to be left to think tanks and intelligence services) so go for a simple explanation keeping in mind the well observed fact that governments do not care for the people they govern.

Agree. In this case the sitting on hands is all too obvious Vs the normal speed of Israeli response. So I don’t see it as a conspiracy just “war entrepreneurship” on the part of the Israeli leadership, IE if we let this blow up we can actually deal properly with Hamas.

whether we believe it’s true or a conspiracy theory, there are certainly dozens of former soldiers in the IDF saying similar things on different platforms…

This one was on a few different sites then ‘disappeared’ someone found and sent me this copy today…

https://www.reddit.com/r/conspiracy/comments/17e1rv0/hamas_massacre_was_an_inside_job_as_explained_by/?rdt=46988

Indeed. It’s incredulous that there was not a single mole inside Gaza or the West Bank that, at the very least, had a whiff of something afoot. And all those ‘coincidences’ to explain the security failures? Astonishing.

Former Shin Bet chief Gideon Ezra’s comment made years ago in relation to the Hamas leaders son turned informant who has appeared on the news recently:

There is the possibility all the collaboration stopped in the intervening years. Seems unlikely.

Yes, it’s almost as though someone wanted this to happen.

Can’t have Israel normalising relationships with Saudi.

Lots of money from arms sales to aid “defence”.

Takes the heat out of the ailing US hegemony – a chance for the US to rise from the ashes.

Reduces the chance of some in the west actually waking up to the fact that Russia will succeed in its Ukraine military exercise. ie US/NATO losing,

Enables the tentacles of the WEF/WHO to grow quietly.

The foreseeable death/injuries of thousands of innocents mainly in Gaza is a price worth paying it seems, especially those untouched by the horrors of this deliberately unleashed “war”.

The little people don’t matter. Not in Gaza, not in Ukraine and not here if push comes to shove.

As someone noted here recently, it’s good for BAE Systems – look at the share price. Not much risk of unemployment for those in the MoD as well.

Like Pearl Harbour or 9/11?

FDR knew about the pending attack but let it happen to get the US into the war with Germany, 9/11 was a CIA/Mossad/Klingon conspiracy so the US could attack Afghanistan and Iraq.

Clear?

It does seem strange, however it appears that Hamas went to extreme lengths to keep their plans hidden from from electronic eavesdropping which the Israelis have relied on previously. The Israeli intelligence people have admitted that this led to them failing to identify the imminent threat. Much the same as the Yom Kippur situation 50 years ago, they misread the signs and then had to change the way they operated in the years following.

Given the Saudi/Israeli discussions one would have thought that there would have been much greater analysis of likely actions to derail it, but living in a permanent state of paranoia is not good for the health of the nation and to some extent Israel has come to think it had emerged from the worst of the journey. Just goes to show.

Given that Hamas are firing hundreds of rockets that can reach Tel Aviv and even Jerusalem they clearly aren’t homemade. How did Israel allow so many, presumably from Iran, to be smuggled into Gaza presumably via Egypt? There’s only one crossing point, have they given the Gaza authorities, Hamas, complete control of the crossing? Maybe a lot of Israeli’s don’t want large numbers of boots on the ground in/near Gaza as this would mean young people doing national service being placed in actual danger and maybe the length of service being extended.

It’s incredible to me that the DS would use a headline like this. Shameful to call for a ceasefire? I’m embarrassed for Will Jones. I’ve enjoyed the content of this website since it started and have total respect for Toby Young for starting it, it was a lifeline during lockdown. But regurgitating content from the Daily Telegraph which conforms to the utterly ludicrous notion that what is happening in Gaza is a ‘war’ is hardly sceptical. So much of the news roundup is more of the same. Regrettably, I just don’t think I can continue to support the DS any longer.

Agree. Ukraine issue had balance, this issue is bringing out some disgusting bias and no context.

Ukraine had zero balance in western media. DS even had a pic of Putin as Hitler. And all those godawful Ian Rons Zelensky fanboy pieces….should have stuck to lockdown sceptics.

Agreed. Will Jones is one funny kind of ‘Christian’.

The terrorist apartheid state of Israel want to ethnically cleanse with a genocide all Arabs from Palestine so that the artificial state of Israel have it all to themselves.

Unfortunately, for other Arab countries nearby, they won’t stop there as they try to create their Greater Israel.

“artificial state of Israel”

Aren’t all states artificial? Other than the fact that this is in living memory and the passage of time hasn’t been sufficient for the situation to reach an equilibrium, what is so different about Israel?

Have some of the commenters lost the capacity for debate? I’m putting a point of view here but also asking a question. Would the downvoters like to explain to thick old me what the difference is, or is that beneath you?

I didn’t downvote you – and you surely must be aware that probably 95% of downvoters can’t comment because they can’t claim the cost on expenses – but I’m not aware of any other state being created in anything like the way Israel was.

People who had lived in Europe for 2,000 years and were of majority European ancestry took somebody elses land and became the majority in only a few decades in the 20th century.(According to the 1922 census that we carried out Palestine was only 10% Jewish.)

I agree the way it was created is artificial, but weren’t a lot of borders re-drawn after wars and people who lived in places were pushed out by incomers?

You’re basically saying that a lot of people who claim to be Jews are not, really. I don’t have the data so I cannot really comment, but for example didn’t the Germans think they had a way to tell if someone was Jewish or not, regardless of where they were born?

ToF I see a lot of bias and polarisation in the comments on both sides; anti-Zionism is not scepticism and too many seem very emotionally invested in this topic to take the dispassionate or inquiring approach to this as they have with other topics. Very few are doing that in the comments; you are amongst those few and all I see is you asking questions in good faith. Most others have their stance and are on broadcast mode. I’d like to know just how pervasive Hamas is in the Gazan community. How much of that is imposed, how much of that is embraced? Yes more than 50% of the Gazan community is under 18 but their education has been in the hands of Hamas since 2005. Hamas seizes aid, commanders key infrastructure, has the resources to engineer a mammoth network of tunnels, some big enough to drive trucks through. Just how much of a terrorist hot-bed is Gaza? How dangerous is it? Is that why other Arab nations are not rushing to open their borders to Gazan refugees? A bit less heat and more light would be welcome but there is too much propaganda and bias on both sides to get reliable info.

Because it was imposed on the indigenous population with no thought for their future well being from an influx of millions of people who have no connection to the area other than biblical fairy tales.

Deleted

Tbf the Arabs are expert at cleansing the ME of Christians and Jews.

When did that happen?

Ottoman Empire.

People need to ask themselves what, exactly, it is that they are supporting. Are you supporting the apparent indiscriminate attacks on civilians in Gaza and the West Bank? Are you supporting the indiscriminate attacks by Hamas on civilians in Israel? Maybe you’re simply supporting Palestinians right to sovereignty, whilst also supporting the Wests values which most Muslims in this region find repulsive? It’s like raising an eyebrow at three plates of roast dinner being put in front of you, and being asked “what’s the matter, you like sprouts don’t you?”

Good point. I can’t see any kind of two-state solution working or being accepted by either side, at least not in my lifetime. It seems to me that you either believe in the “rightness” of Jews having an ethnically Jewish majority country of their own, somewhere near where their tribes evolved whenever it was, or you don’t.

…another story, another defender of the mass killing of Palestinian women and children….dressed up as something else….what’s new?

I pretty much knew what I was going to get with..’an unapologetic supporter of Israel’..

….they can do anything they want, they can kill as many people as they want, and I’m going to dress it up in ‘self-defence’ ‘those terrorists must be stopped’….and all the rubbish excuses that have never, and would never be used to support any other country in any other situation….?

“As with all carefully tested public positions, this is aimed at sounding eminently reasonable. Who could possibly object to an end to the killing in Gaza? “

Well you do, you evil objectionable arsehole..as an “unapologetic supporter”…

What proof does this genocidal maniac have for saying ‘calls for ceasefires are often thinly-veiled demands for Hamas not to be pursued’..really, who is saying that?

..maybe he could go on to explain how killing two million people, over half of them innocent children, aids that agenda? I’d be interested to know…

According to this tw*t, the Good Friday Agreement would never have happened..as someone had to talk to people who were deemed ‘terrorists, didn’t they? I applaud Russia trying to do the same, if it stops the current violence….

The apologist’s for the serious War Crimes being witnessed by the whole world are truly out-doing themselves … sickening….

Call for ceasefire on June 6th 1944, and after the Japanese attack on Pearl Harbour?

Where was the call for ceasefire just before Palestinian terrorists crossed the Israeli border and slaughtered and butchered 1 400?

If you hit someone, you get hit back. If you hit someone then cry ‘Pax’ – good luck with that.

So…..because the Israeli Government spectacularly failed to protect their citizens against what we all agree was an horrific attack, you think those same people now have the right to visit even more, and worse ‘slaughter and butchery’ on other innocent people?

As we are now at over 7000 dead Palestinian civilians, over 3000 of them totally innocent children, can I genuinely ask you how many more deaths will be an acceptable ‘price’ ? Or is there no price until the last of them are dead?

The last of whom are dead? Do you mean Hamas, or Gazans in general?

Until Gaza is demilitarised what can happen? I can’t see Hamas giving up their weapons, I can’t see Israel allowing them to keep any significant weapons that can strike across the border. The problem is that fighting an enemy that is well dug in is always unpleasant and costly, until someone comes up with a formula to allow the creation of a new status quo without Hamas in charge of Gaza this situation isn’t going to change.

Moot point..are you saying they can kill everyone in Gaza to get to their end goal..if the answer is yes for you then you’ve answered it yourself…and I think this is acceptable ‘reasoning’ to the Israeli Governmentt…

If the answer is no then another way needs to be found to reach that goal

that doesn’t involve killing and displacing two million people.

I know which one I think is the reasonable choice, but that’s just my opinion.

For me, the moral question here is: does Israel’s right to self-defence allow it to “instruct” Palestinian civilians to leave their homes, if those homes are adjacent to rocket launchers used by Hamas to attack Israel? And what happens if those civilians then ignore that instruction?

There is a publication on the Laws of Warfare & any military action which knowingly affects civilians even if there is a military target next door, is unlawful. Ordering folk out of their homes so that they can be bombed & will be bombed even if the civilians can’t move is an unlawful act.

It doesn’t matter who is breaching the law or what the provocation was, directing military action towards civilians is unlawful. Full stop.

Please see my comment above..for me there can be no right here if it kills and displaces millions of innocent people…

What it shows is that they need to find a different way to their goal, or basically it seems to me you are giving them permission for wholesale slaughter…

Have you ant idea if any Hammas terrorists have been killed…? What proof do we have this bombardment has done anything?

I don’t know what you are watching to be honest, but it’s not what I am watching, which is wholesale bombing that mainly affects the innocent civilians…and the ‘safe areas’ as you call them are being targeted by Israel, and also bombed…..so that’s a nonsense..people can’t escape the terror being unleashed on them…

You mean not give up their land AGAIN?

Well if even Mossad didn’t know it was happening (ahem) then how could anyone call for a ceasefire. It lasted 7 hours. The Gaza bombardment has been 3 weeks. Apples and pears.

This is probably going to sound naive, because I’m not following events over there as closely as some, but why is the pressure only on Israel to cease firing? Hamas are still bombarding Israel with missiles so of course Israel react in kind. If Hamas gave a stuff about the citizens of Gaza then why carry on poking the bear? Their home is being destroyed, civilians are dying as ‘collateral damage’ as a result, but they’d rather this then cease their firing and give up the 200 hostages they still hold captive. I’m fairly confident if they agreed to do this then Israel would stop.

So isn’t the fact that Hamas appear to have no intention of stopping their assault on Israel or releasing the hostages proof enough that Israel have to proceed with their ground assault and take out the terrorists whilst simultaneously rescuing the hostages? Hamas are forcing Israel’s hand. Maybe they want to lure them into the rabbit warren of tunnels, which they will know like the back of their hands, because they’d have the advantage over the IDF.

Ceasefire would be both sides obvs, otherwise it wouldn’t be a ceasefire would it?

David Icke pointing out that the same hand is pulling the strings on both sides of the Israeli – Palestine situation. This is what we should be railing against – those parasitic perpetrators who use the innocents of the world as collateral to further their evil, satanic agenda

“We awaken to more scenes of horror in Gaza that melt your heart. Only when we awaken to the global demonic force that feeds off death, destruction and misery – and so creates it – will we see the insanity of fighting each other while the strings of all are held by the same hands”

https://davidicke.com/2023/10/28/we-awaken-to-more-scenes-of-horror-in-gaza-that-melt-your-heart-only-when-we-awaken-to-the-global-demonic-force-that-feeds-off-death-destruction-and-misery-and-so-creates-it-will-we-see-the-insa/

Hamas: genitally-mutilated pork-haters who kill children with lo-tech weapons.

The IDF: genitally-mutilated pork-haters who kill children with hi-tech weapons.

They couldn’t be more different.

Dear Toby,

I very much respect all that you’ve been doing with DS.

However, I’m flabbergasted with this piece. Please can you refrain from publishing such VILE content on the DS website or I will remove my recurring financial support.

Kind regards

And to be clear, the context for the above is that, as Sceptics, we ought to –

Stand with the CITIZENS on BOTH sides

Stand with PEACE

Stand with CEASEFIRE

See through the PROBLEM-REACTION-SOLUTION tactics of the sick psychopathic scum, who, as usual, fund BOTH SIDES of the conflict to create conflict and chaos.

https://t.me/robinmg/31306

HAPPENING NOW AT NYC’S GRAND CENTRAL STATION: HUNDREDS OF JEWS AND ALLIES ARE GETTING ARRESTED IN THE LARGEST MASS CIVIL DISOBEDIENCE NYC HAS SEEN IN TWO DECADES.

NO GENOCIDE IN OUR NAMES!

CEASEFIRE NOW TO SAVE LIVES!

NEVER AGAIN FOR ANYONE!

If I was a Londoner, which thank God I’m not, then I would be more impressed if this little git focused on clearing up the mess in his own backyard rather then virtue signalling about the Middle East.

So …. Khan is a disgusting specimen who, at the very least, sympathises with the terrorists of Hamas and is quite happy to see hundreds of thousands of their supporters intimidating the small Jewish community on the streets of London.

Is that news?

The marches are to support the Palestinians of Gaza who feel forgotten and are being carpet-bombed by a first world nuclear power who has sealed both end and stopped, food, water, electricity and internet (to briefly hide IDF deaths). They are not to support Hamas.

Hamas were “allowed” in by Israel to create carnage and give Netanyahu an excuse to take over Gaza it was a put up job. Hamas are sponsored by M16, the CIA and Mossad.

https://stopworldcontrol.com/israel/