On 26th August, EU natural gas prices reached an all-time high of €343 per MWh. This was due to a combination of factors: ongoing problems in the French nuclear sector; the rapid reduction of flows through the Nord Stream pipeline; and an unusually hot summer, which made coal difficult to transport and power plants difficult to cool.

Since then, however, the price has come down considerably; as of this writing, it is less than €140 per MWh. For this we can thank an unusually warm autumn and the filling of gas storage facilities (at which point buying gas became temporarily impractical).

Buoyed by the rapidly falling line on the chart, commentators began to herald the end of Europe’s energy crisis. “Vladimir Putin is now losing the energy war”, declared The Telegraph. “The end of Europe’s energy crisis is in sight”, announced the FT.

Unfortunately, these good tidings now look premature. Natural gas prices have been on the rise again since mid-November. In fact, if you ignore the massive swings in the series, they’ve been rising at a steady clip since Russia first started reducing gas supplies in the middle of last year:

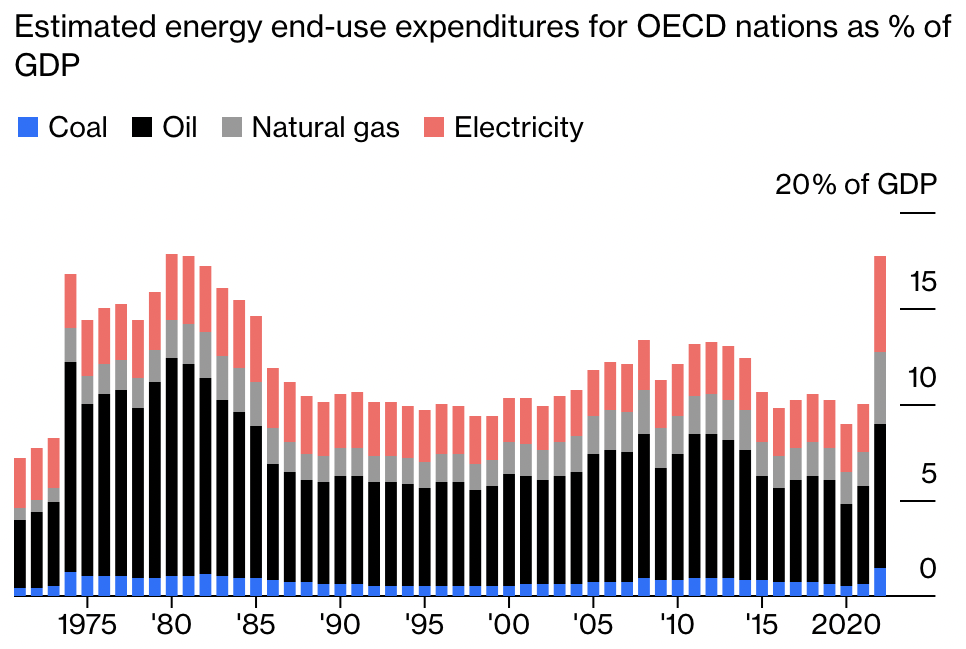

Of course, changes in the price of “Dutch TTF gas futures” are hard for most people to interpret (including myself). A more digestible – and more comprehensive – statistic is the percentage of GDP that we spend on energy. This is shown in the chart below, taken from Bloomberg’s energy man Javier Blas.

As you can see, OECD countries (of which Europe comprises the lion’s share) are forecast to spend 18% of GDP on energy this year, compared to only 10% last year. That’s 8 percentage points of GDP that we could have spent on things like healthcare, infrastructure or tax-cuts. 8% of GDP is four times what we spend on defence.

Putin may be “losing the energy war” insofar as his pipelines have been sabotaged and he’s been forced to sell oil at a discount. But here’s the rub: Europe is losing it too. The winners here are China, the U.S. and Saudi Arabia.

“We should all be skeptical of the emerging narrative that says the worst is over,” says Blas. Likewise, the economist Robin Brooks believes a “deep Euro zone recession is coming”. Both of these pundits are hawkish on Russia, so neither has an incentive to make overly pessimistic forecasts.

I certainly can’t predict the markets; with a relatively mild winter, natural gas prices may start trending down again. But we’re not out of the woods yet – not by a long shot.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.