The U.S. Society of Actuaries Research Institute has issued a report on mortality during the COVID-19 pandemic which includes around 90% of all Group Term Life insurance, thus providing quite a broad picture of excess mortality among the insured during the period up to and including Q1 2022.

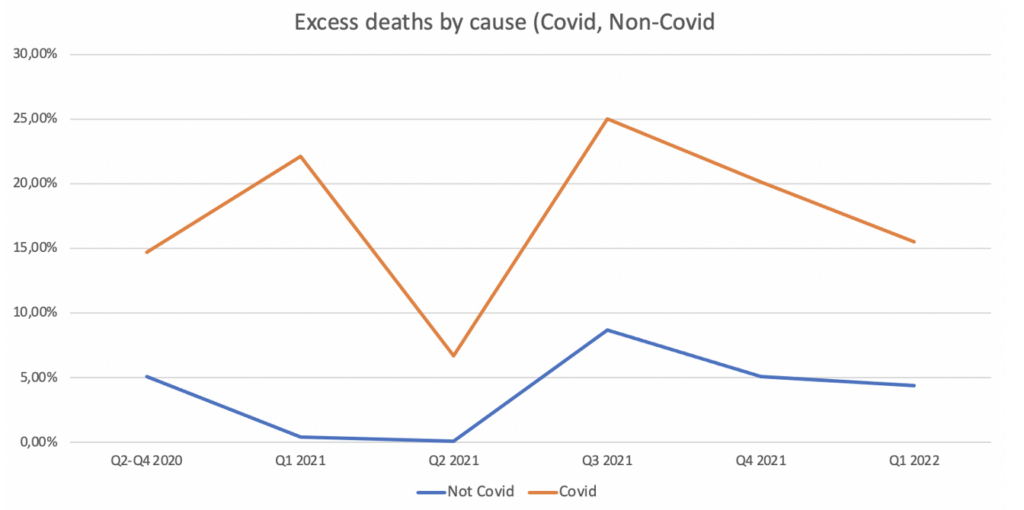

As might be expected, 80% of the excess claims over the period are related to COVID-19. In 2020, after the pandemic struck, but before vaccines were available, we see a surge in COVID-19 related excess mortality, but interestingly around a quarter of all the excess mortality is not COVID-19 related. This suggests that lockdowns and restrictions were already having a strong impact on mortality. The vaccination programme started in December 2020 but really took of in Q1 2021 when 172 million doses were administered. The cumulative growth in COVID-19 cases was much slower in Q1 2021 than towards the end of 2020, but interestingly we see a large spike in COVID-19 related excess mortality during this period.

The most interesting period in 2021 however is Q3, where not only COVID-19-related but Non-COVID-19 excess mortality spikes up to almost 9%, then falls in Q4 and remains at around 5% throughout Q1 2022, which is an alarming figure.

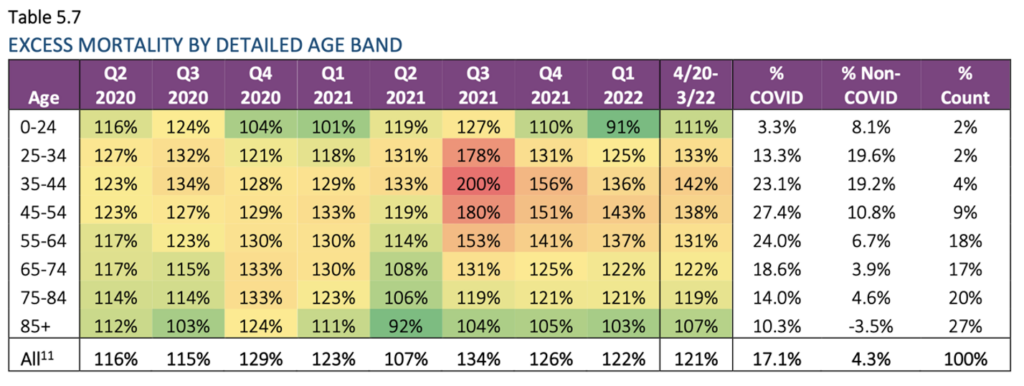

When those figures are broken down by age we see a staggering rise in excess mortality in younger age-groups, close to and even up to double the expected mortality for people between 25 and 55. The report does not provide a deeper analysis of this, such as breaking it down according to cause of death. So, what might cause the deaths of twice as many people in their prime of life compared with what might be expected in a normal situation? What was different?

First, the vaccine rollout in early 2021 was primarily focused on the older age groups while the vaccination rates for the younger ones started increasing in the latter part of the year, and this coincided with and was no doubt driven by increased pressure to get vaccinated, including mandates and relentless propaganda and ostracisation. So that could be a factor. Second, we must look to the harm done by lockdowns and restrictions, though this wouldn‘t explain this sudden spike in Q3 2021.

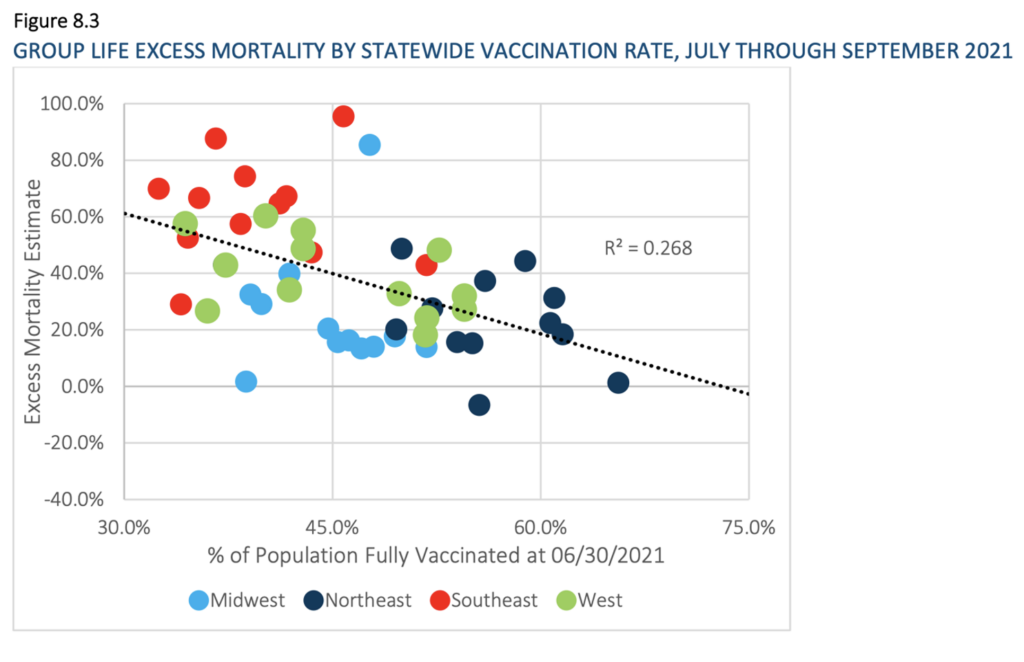

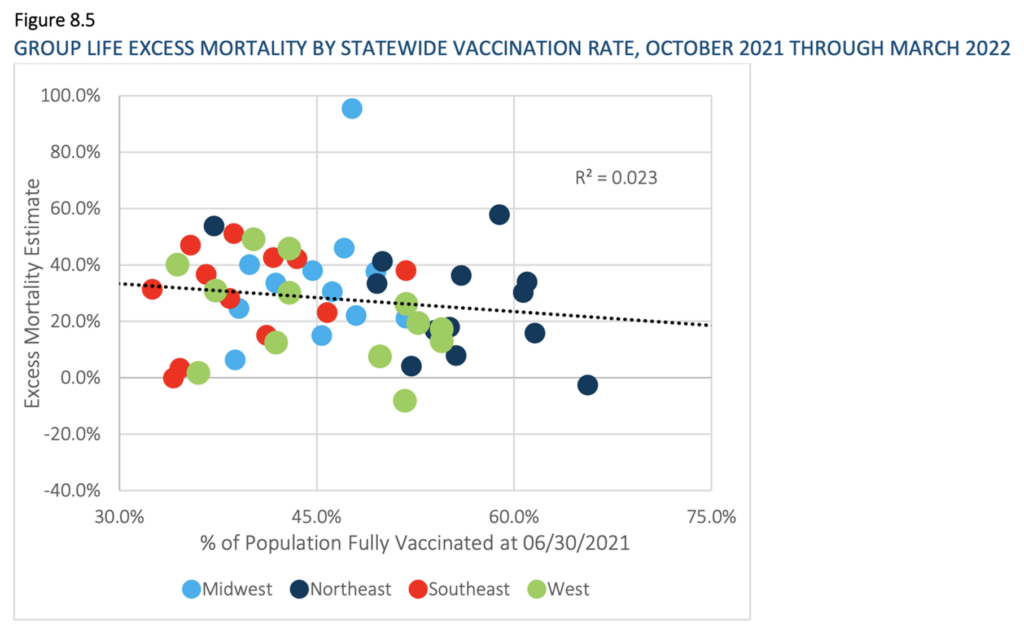

The report provides a useful comparison of the relationship between excess mortality and vaccination rates by state in two different periods. In July-September 2021, we see quite a strong inverse correlation between the two factors. But in the period October 2021 to March 2022, this relationship has almost disappeared. This result fits well with figures from other parts of the world which in January of this year showed how after the emergence of the Omicron variant the protective effect of the vaccines disappeared or even became negative.

The SOA report provides good data on mortality during the pandemic and it will be interesting to see how Q2 this year plays out, given that we see indications of worrying excess mortality not explained by COVID-19 in many countries. Further analysis, especially of the staggering mortality figures among younger people, is urgently needed. It is high time to recognise and honestly start focusing on the potentially devastating effect of the mass-vaccination drive.

Thorsteinn Siglaugsson is an economist, consultant and writer based in Iceland. You can subscribe to his Substack newsletter here.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

More delusional reporting about how the UK Chancellor of the Exchequer’s policies have a significant bearing on the cost of UK debt.

The UK is already bankrupt. Like most countries with a bloated overbearing state.

I’m not defending Rachel Reeves or any politician, but some minor policies which represent a drop in our ocean of debt is what wrecked our economy.

That should be “isn’t what wrecked our economy”

My take on the matter:

1.) Any reasonable market analyst or investor must have had strong suspicions about a Labour government anyway, as historically every single Labour government left the economy in worse shape than is had been before they took over.

2.) But they gave Starmer’s government the benefit of doubt. Maybe this time it will be different. You never know.

3.) By now they have realized that their suspicions were well founded, Labour haven’t got a clue and Rachel from Accounts is indeed incompetent.

4.) Borrowing cost up, pound devalued as a result.

Liz Truss may have been a careless driver but was never given a chance to improve. Whereas Rachel Reeves is totally reckless behind the wheel. Her licence to kill our economy should be immediately withdrawn with a life ban.

Rubbish.

Reeves is deliberately trashing the economy, targeting those who Labour hates.

Truss would have been the best Tory PM in 14 years, except she went too fast, too soon and was mugged by the blob. They couldn’t have her fracking, ending ECHR, moving our embassy to Jerusalem, lowering taxes.

Listen to her recent interviews and she, for my money, is leading the charge against the blob that is the real enemy within. She understands and explains how we need a people’s movement, properly led and focused on the 5th Column.

This naive reporting angers me, to be honest.

I agree. In fact this is typical pseudo-journalism. Kate Andrews seeks to make a thesis out of a very straightforward bit of politics, not economics just vicious politics.

Rachel from accounts is acting under orders and those orders are to destroy the British economy and its people. Andrews hasn’t worked this out yet and has sought a hi-brow explanation. The reality is she hasn’t got a scooby and is talking nonsense.

She works for Gove. That’s all you need to know.

Good point.

What was unknown at the time of the Truss budget was that the pensions industry had decided to play casino games with the money in the pension schemes by using LDIs. The Bank of England also neglected to inform Truss or Kwarteng that they selling off a tranche of QE bonds when the budget was announced in what could be seen as a deliberate act of sabotage.

Rachel from Accounts had fucked up all on her own and delivered mortgage rates higher than Truss did.

Let’s not forget that the “necessary intervention” to shore up the LDI pension scheme included the Bank of England’s own pension scheme.

I’m sure the “intervention” was completely necessary and nothing to do with that

That’s more like it.

Interesting (to me) that the thesis in the article alleges that ‘Rachel Reeves is Making the Same Mistake as Liz Truss‘

Surely a more valid comparison would be between Truss and Starmer – what with them both being PM? Or between Kwarteng and Reeves.

I think Starmer is being let off too lightly on the fiscal incompetence argument.

I do not believe there is “fiscal incompetence.” It is inconceivable that so many ministers and civil servants could be acting in a manner so patently fiscally incontinent. They are acting under orders and those orders are to destroy the economy and thus the nation. Nothing these days is as it seems.

I stopped my Spectator subscription because of this person. Needless to say I did not waste my time reading the article.

I suspect that the exchange rate plays more of a role than is discussed here. The govt wants to repay loans in pounds, but why would an investor want to have pounds? The govt is trashing the productive part of the economy, via unnecessary increases in energy prices, taxes, and regulations.

What use will a pound be in 5 years time?

Why would they want to “finance the transition” when “the transition£ is clearly going to destroy our economy since it’s intended to outsource all manufacturing and ensure we have the most expensive energy on the planet?

If the markets (in 22) were mainly reacting to the government’s plan to subsidise energy costs, why didn’t they react two weeks earlier when the announcement was actually made and why didn’t the enormous cost of lockdowns create any panic?

A very simplistic assessment.

Truss’ budget was a lukewarm centrist plan with a strong empirical basis. The energy subsidy was ill advised but despite her plan being thrown out the energy subsidy continued as did money printing and currency devaluation. Furthermore the continuing vast green energy subsidies still continue despite the high debt and low productivity of the UK. The article fails to grasp deeper problems.