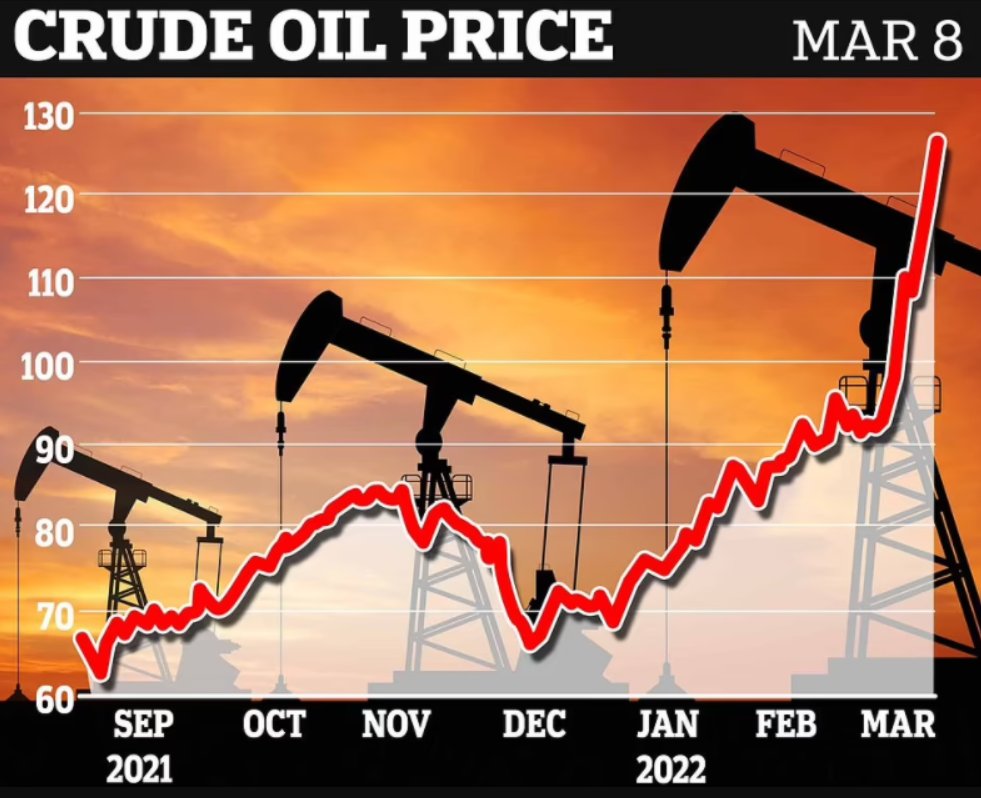

Britain has today followed the U.S. and banned Russian oil imports as drivers started queuing for fuel after being hit by the steepest weekly hike in fuel prices in more than 18 years due to Russia’s invasion of Ukraine – with prices expected to keep rising. The Mail has more.

Oil prices are rising at an alarming rate sparking warnings that petrol could soon hit £2 a litre – taking the cost of an average tank to more than £100 – an increase of around £17.

Unleaded hit an average record of £1.55 a litre yesterday, with industry sources saying it was likely to rise to £1.75 by next week as 5p is being added to the price every 24 hours in some areas. But prices at some forecourts are already pushing £1.80.

Motorists queued outside a Sainsbury’s petrol station in Cambridge today as they rushed to fill up cars and jerry cans before petrol prices increase even further. There were also long lines at the pumps at a Tesco in neighbouring Suffolk. On social media there were also reports of queues at supermarket pumps in Lancashire.

U.S. President Joe Biden has decided to ban Russian oil imports, toughening the toll on Russia’s economy in retaliation for its invasion of Ukraine, according to a person familiar with the matter, and the European Union this week will commit to phasing out its reliance on Russia for energy needs as soon as possible.

Filling the void without crippling EU economies will likely take some time – natural gas from Russia accounts for one-third of Europe’s consumption of the fossil fuel.

The White House said Biden would announce on Tuesday “actions to continue to hold Russia accountable for its unprovoked and unjustified war on Ukraine”.

The U.S. does not import Russian natural gas.

Boris Johnson has said the move to ban Russian oil and gas will punish Vladimir Putin’s regime but will be introduced in a way that “won’t affect” U.K. businesses.

Speaking to broadcasters, the Prime Minister said: “The U.K. is less exposed (than European allies) but clearly we do have diesel that comes from Russia and we can’t move overnight.

“But we can certainly do it and we can do it in a way that doesn’t disrupt supply, that ensures we have substitute supplies on stream in an orderly way and in a timetable that won’t affect U.K. business, won’t affect U.K. manufacturing, road haulage or other parts of our industry but will punish the regime of Vladimir Putin.”

Business and Energy Secretary Kwasi Kwarteng today revealed that the U.K. would “phase out the import of Russian oil and oil products by the end of 2022”.

He added: “This transition will give the market, businesses and supply chains more than enough time to replace Russian imports – which make up 8% of U.K. demand.

“Businesses should use this year to ensure a smooth transition so that consumers will not be affected. The Government will also work with companies through a new Taskforce on Oil to support them to make use of this period in finding alternative supplies.

“The U.K. is a significant producer of oil and oil products, plus we hold significant reserves.”

He added that the market has “already begun to ostracise Russian oil, with nearly 70% of it currently unable to find a buyer”.

“Finally, while the U.K. is not dependent on Russian natural gas – 4% of our supply – I am exploring options to end this altogether,” he wrote.

The U.K. is planning to buy more oil from the U.S., Saudi Arabia and the Middle East instead, but wants nine months to sort out the deals.

The move is expected to be announced this afternoon and will lay out the ban and its phase-in period, which is expected to last about a year to try to stop people panic-buying fuel at a time when energy prices are rocketing.

There will not be a ban on Russian gas – but this is still under discussion within the Government. U.S. President Joe Biden has decided he will ban Russian oil and gas immediately.

It came as Rishi Sunak was urged to put the City of London on a ‘semi-wartime setting’ amid fears the Ukraine conflict could spill further into Europe. The Centre for Economics and Business Research has predicted that GDP growth this year will be slashed from 4.2% to 1.9% in 2022 and down to zero in 2023.

Are we absolutely sure this is a good idea and in line with our core strategic objectives? Drastically cutting oil and gas imports during an energy crisis and scrambling around for alternatives? Dropping GDP growth to zero in the wake of a very costly pandemic? Have we properly costed our interventions and assessed them against our strategic interests?

Worth reading in full.

To join in with the discussion please make a donation to The Daily Sceptic.

Profanity and abuse will be removed and may lead to a permanent ban.

So Toby thinks the 2020 U.S. election was definitely, absolutely NOT fraudulent. Pathetic. The 2020 election was stolen in just 6 swing states. It wasn’t stolen by high tech hacking of voting machines. It wasn’t stolen because of vote harvesting. It was stolen by good old fashioned fraud in the main counting centres in those 6 swing states. To cite just two as examples: In Atlanta, Georgia, Trump was well ahead on election night. Over the next few days the percentage of votes counted never seemed to rise but the number of votes counted did. In other words new ballots were added out of nowhere. Once Biden had overtaken Trump by a few thousand votes the counting miraculously ended. The very same thing happened in Pennsylvania except on a much larger scale. Trump ahead by 700,000 votes on election night, counting suddenly halted…over the next few days the percentage of votes counted hardly changed but the NUMBER of votes did.

A very low tech form of voter fraud but highly effective when you have a compliant and biased Mainstream Media unwilling to properly investigate and report and even more effective when the leader of the Free Speech Union decides to believe the “findings” of a one sided book.

Toby Young, you should take note of Mark Steyn’s take on what happened in 2020. The fraud was very low tech, very traditional, new votes appearing out of nowhere, a relatively low number of votes affected nationally but highly concentrated in just six swing states and enough to steal the election. It’s clear you didn’t follow the events of the 2020 election and the few days following it. Had you done so you would have seen the pattern.

Final nail in the coffin for Toby’s theory that this was a straight election: The Bellweather Counties list. https://www.wsj.com/articles/bellwether-counties-nearly-wiped-out-by-2020-election-11605272400

Toby has probably drunk the establishment press line that Trump lost all his court cases and so assumes there was no evidence supporting him. This is a typical and classic form of reshaping of the truth Toby should be aware by now that the establishment press indulges in on a wholesale basis. He should know by now they LIE ALL THE TIME. Trump didn’t lose his court cases, most of them were thrown out for a “lack of standing.” They were not heard.

To have standing it has to be shown that a plaintiff suffered an actual injury caused by the other party that can actually be addressed by the court. So the lawsuits were never heard and yes it was a technicality. The technicality being the courts didn’t have any power to do anything about it and other than that there is no measurable injury that could be recompensed to Trump. The lesson then is that there is no clear mechanism by which a stolen election can be redressed after the fact – at least not in the form of the legal route taken by Trump. It must not be allowed to happen at the time.

I would say both were used.

The vote fraud was 40 mn. Database votes are easy to flip – as an admin you erase all the logs. They were flipping votes in real time, even the fake news feeds were showing the flips. Mules were used pace DeSouza – 5 million in his movie, just in 5 states. They were used everywhere.

Biden the criminal won 600 out of 3000 counties. Max votes – 40 million or so. Vote fraud – 40 million. Old and New techniques.

The self-satisfied arrogance of Marianna Spring´s smug mugshot is fairly typical of most in education and communications (broadcasting) nowadays: young, without life-experience, ill-educated but opinionated – and a feeling of entitlement.

I’m not sure that’s entirely fair. It might just be an optical effect derived from the bottom half of her face (below the eyes) being from a head proportionately approximately twice the size of the top half of her face.

A 28 year old arseling who is the arbiter of reality?

Who TF is Sping? And Why TF would I care?

Bitter and twisted suits Nick. Hilarious, keep it up.

Toby’s TDS is a tad tedious. Instead of a straw-man like the Dominion voting machine contend with the evidence that 2020 was A/ indisputably RIGGED and B/ almost indisputably STOLEN.

That means to deal with the reasoned critiques in say Mollie Hemingway’s ‘Rigged’ or ‘2000 Mules’ or Navarro’s ‘6 key deceptions‘.

Still no time stamps aaargh

Toby needs to read better books about the US election system. Start with Margo Cleveland’s latest.

Why was US 2000, 2004, and 2016 elections all “rigged”, say the Democrats and their leaders very loudly and continuously, but with voting restrictions in states and counties across the country mostly removed by Democrats “because of the pandemic”, now suddenly “perfect”? How can so many institutions in USA now appear to be corrupt, yet the voting system is pristine?

Given opportunity to cheat, given the stakes, of course there will be cheating.